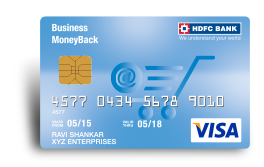

HDFC Business MoneyBack Credit Card

The HDFC Business Moneyback credit card has a low annual fee and is designed to provide rewards and cashback benefits to all types of businesses. Cardholders can earn extra rewards on online purchases and get cash back on their statements by redeeming the points.

Image Source: HDFC Official website

Highlights of the HDFC Bank Business Moneyback Credit Card

|

Suitability |

Rewards and Cash Back |

|

Joining Charges |

Rs. 500 |

|

HDFC Business Moneyback Credit Card Charges Annually |

Rs. 500 |

|

HDFC Business Moneyback Credit Card Reward Points |

5% Monthly Cashback |

HDFC Business Moneyback Credit Card Benefits and Features

The following are the key benefits and features of HDFC Business Moneyback credit card

a) Cashback

- The MoneyBack credit card, as the name suggests, offers a 5% payback on critical business spendings such as hotels, meals, cab service, telecom payments, electricity payments, railways, and government and tax-connected spending.

- On a minimum monthly spend of Rs.10,000, the maximum reward per month is Rs.250.

b) Spend Rewards

- Every anniversary year, you will get 2,500 reward points on annual purchases of Rs.1.8 lakh.

- You will be eligible for the benefits if you make at least four transactions of Rs.100 or more on your MoneyBack Credit Card in a calendar month.

- For free accident insurance coverage. Purchase protection against fire and burglary for things worth more than Rs.5,000 purchased with a credit card.

c) Balance Transfer

Move the outstanding balance on your previous credit card to the MoneyBack Credit Card and benefit from HDFC's low-interest rate. Balance transfers have a minimum transfer amount of Rs.2,500 and a maximum transfer amount of Rs.1 lakh.

d) No Liability on Lost Card

If you lose your Business MoneyBack card, you must notify the HDFC Bank credit card call center immediately. Upon the filing of the complaint, you will have no obligation for any fraudulent credit card transactions.

e) Interest-Free

Cardholders can enjoy up to 50 days of interest-free credit from the date of purchase.

f) Loan on Credit Card

You can also borrow money using this Credit Card.

g) Security

It is a chip-enabled card that may be swiped at any standard POS or used at any chip-enabled POS (non-chip POS).

HDFC Business Moneyback Credit Card Annual Fee and Other Charges

|

Annual Charges |

Rs. 500 |

|

Joining Charges |

Rs. 500 |

|

Interest Rate |

3.6% p.m |

|

Late Payment Charges |

|

Eligibility to Apply for the HDFC Business MoneyBack Credit Card

Corporate cards, like ordinary credit cards, have some special eligibility requirements that applicants must meet in order to be authorized for this credit card.

The HDFC Bank Business MoneyBack Credit Card has the following basic qualifying requirements-

|

Age |

21 Years to 65 Years |

|

Income |

Minimum Rs 6,00,000 per annum |

Documents Required to Apply for the HDFC Business MoneyBack Credit Card

- Aadhar Cards, Voter IDs, PAN cards, and other forms of identification are acceptable.

- A passport-sized photograph, permanent driving license, business registration certificate, Job card provided by NREGA officially signed by an officer of the State Government, and other papers may be required in addition to these.

- Aadhar Card, most recent utility bills, or a passport are acceptable forms of address proof.

HDFC Business Moneyback Credit Card Apply Procedure

You can apply for this Credit Card both online and in person. To apply offline, bring all essential documents to your closest HDFC Bank branch and apply for the card by filling out a physical application form.

To apply online, simply follow the steps outlined below-

Step 1: Visit the official website of HDFC Bank.

Step 2: Choose 'Cards' and then 'Credit Cards' from the 'Borrow' option.

Step 3: Choose the 'HDFC Business Moneyback Credit Card' from the 'Business Credit Cards’ category.

Step 4: Fill out the online application form by clicking Apply Now.

Other HDFC Bank Credit Cards