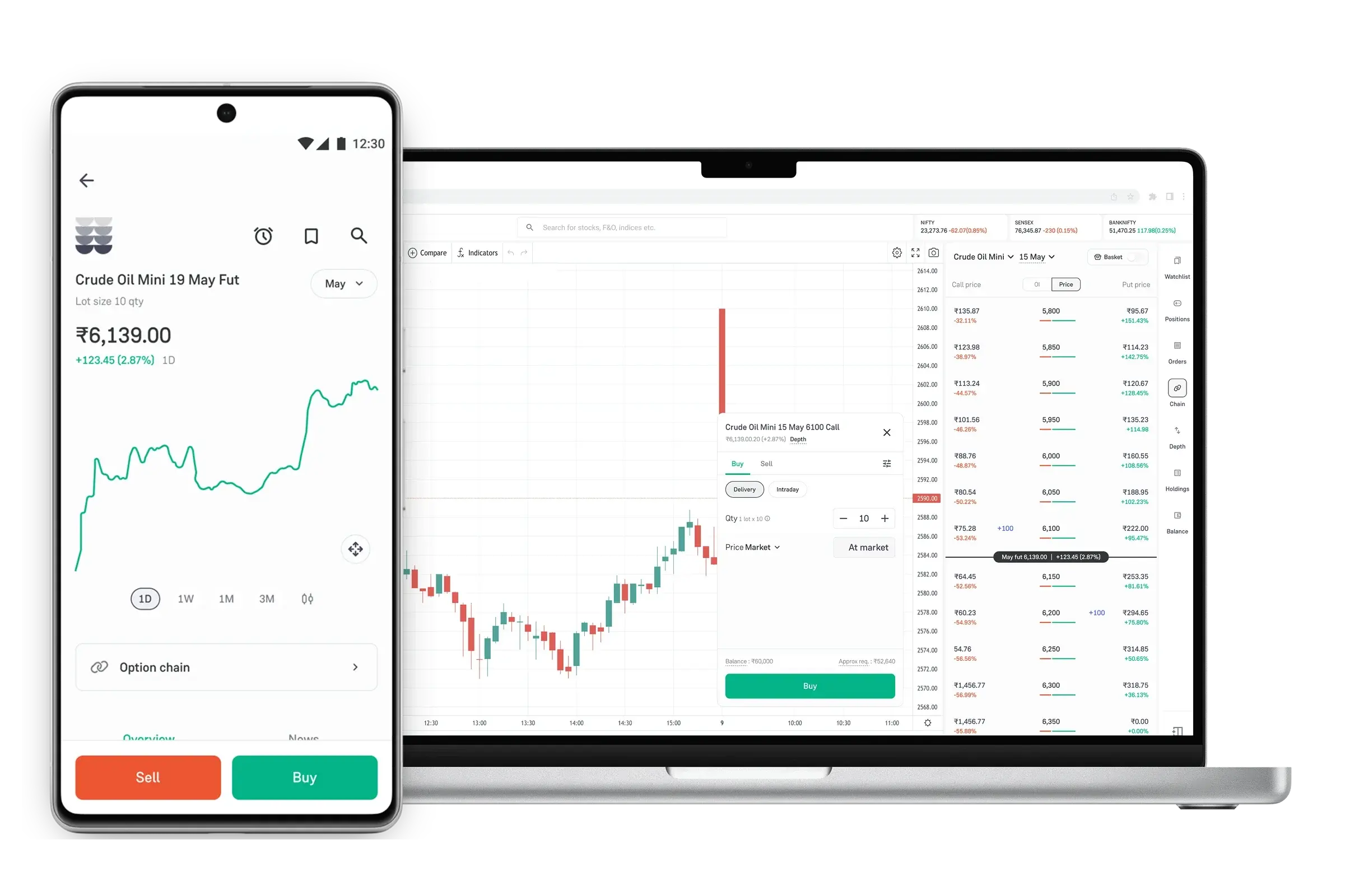

Everything you need and more

Why commodities?

Know more about commodities

Frequently asked questions

What is commodity trading?

Commodity trading refers to the buying and selling of futures and options contracts of tangible goods like Crude Oil and Gold. There are broadly 4 categories of Commodities:

- Precious Metals: Gold, Silver

- Energy: Crude Oil, Natural Gas

- Base Metals: Copper, Zinc, Nickel, Aluminium etc.

- Agriculture: Wheat, Cotton, Rice

Is Commodity Trading legal in India?

Yes, Commodity trading is legal in India. It is regulated by the Securities and Exchange Board of India. Major commodity exchanges in India -

- MCX (Multi Commodity Exchange): Metals, Energy products

- NCDEX (National Commodity and Derivatives Exchange): Agricultural products

Which commodities are available to trade on Groww?

Groww offers 4 commodities to trade on the platform viz. Crude Oil, Gold, Silver and Natural Gas. Each of these commodities have further lot size variants, for example, Gold has Gold, Gold Mini, Gold Ten, Gold Guinea and Gold Petal.

How is commodity trading different from equity trading?

The fundamental difference is that in equity trading the underlying of an option contract is an Index or a Stock whereas in commodity trading the underlying of an option contract is a future contract.

The price action in equity trading is based on the company performance, economic data and market sentiment while in commodity trading it is influenced by global supply-demand factors, geopolitical events and weather patterns.

Further, the equity markets are open from 9:15 am to 3:30 pm whereas the commodity markets are open from 9 am to 11:30 pm.

How can I start trading commodities on Groww?

Fill out your basic details in this form and we’ll get back to you with the next steps on how to start trading commodities. Currently, commodity trading on Groww is on invite-only basis.

Can I trade commodities without adding money to Groww Balance?

Yes, you can pledge your stock holdings on Groww to get a pledge balance which you can then use to buy/sell commodity futures or options. However, loss incurred in F&O trading is deducted from cash balance. So you need to add money to Groww balance to cover for losses (if any).

What is the minimum margin required to trade commodity futures and options?

The margin required to trade depends on both the commodity and the derivative (future or option) and it can range from a few hundreds to thousands of rupees.

What are the charges for trading commodities on Groww?

Groww charges the same brokerage for commodity trading as it is for equity futures and options i.e. Rs 20 per executed order. In addition to these, there are regulatory and statutory charges levied by exchange and the government. The details of all these charges can be found here

Does Groww allow physical settlement of commodities on its platform?

Groww does not support physical settlement of commodities on its platform. Fresh positions in the commodity futures are blocked a day prior to the start of the respective commodity’s tender period. Any open futures positions will also be squared-off one day prior to the start of the tender period.