Invest in ETFs

Diversify your portfolio easily with top-performing ETFs on Groww

Why invest in ETFs?

Explore ETF categories

about Groww

“If you are one of those who would like to take control of how you save, use Groww. It’s ridiculously easy portal. It took me 5 mins to set up and 10 mins to find the funds that suited my need and invest.”

“Groww.in was the platform where I first got onboard to MF and I would have to say, even for a beginner like me it made things quite easier to explore and invest. Groww actually helped me make better-informed decisions.”

“The experience with Groww has been lovely. Investing sounds extremely simple and non-scary to me now. Really smooth.”

in a minute

What is an ETF?

An Exchange Traded Fund (ETF) is a type of investment fund that holds a collection of assets such as stocks, bonds, or commodities. ETFs trade on stock exchanges, just like individual shares, and their prices fluctuate throughout the trading day.

How does an ETF work?

ETFs track the performance of a specific index, sector, commodity, or asset class. When you invest in an ETF, you’re essentially investing in all the underlying assets that the ETF represents—providing instant diversification.

How are ETFs different from mutual funds?

While both offer diversification, ETFs trade on the stock exchange in real time like shares, whereas mutual funds are bought and sold only at the end of the trading day. ETFs also generally have lower expense ratios compared to mutual funds.

What are the benefits of investing in ETFs?

ETFs offer diversification, liquidity, lower costs, transparency, and flexibility. They’re an efficient way to invest in a basket of securities and manage risk through a single investment.

Are ETFs suitable for beginners?

Yes, ETFs are considered beginner-friendly because they provide exposure to a wide range of assets without requiring you to pick individual stocks. They’re also easy to buy and sell through your trading account.

What types of ETFs can I invest in?

There are various types of ETFs, including:

- Equity ETFs (track stock market indices)

- Bond ETFs (invest in fixed-income securities)

- Sector or Thematic ETFs (focus on industries like technology or healthcare)

- Commodity ETFs (track assets like gold or oil)

- International ETFs (provide exposure to global markets)

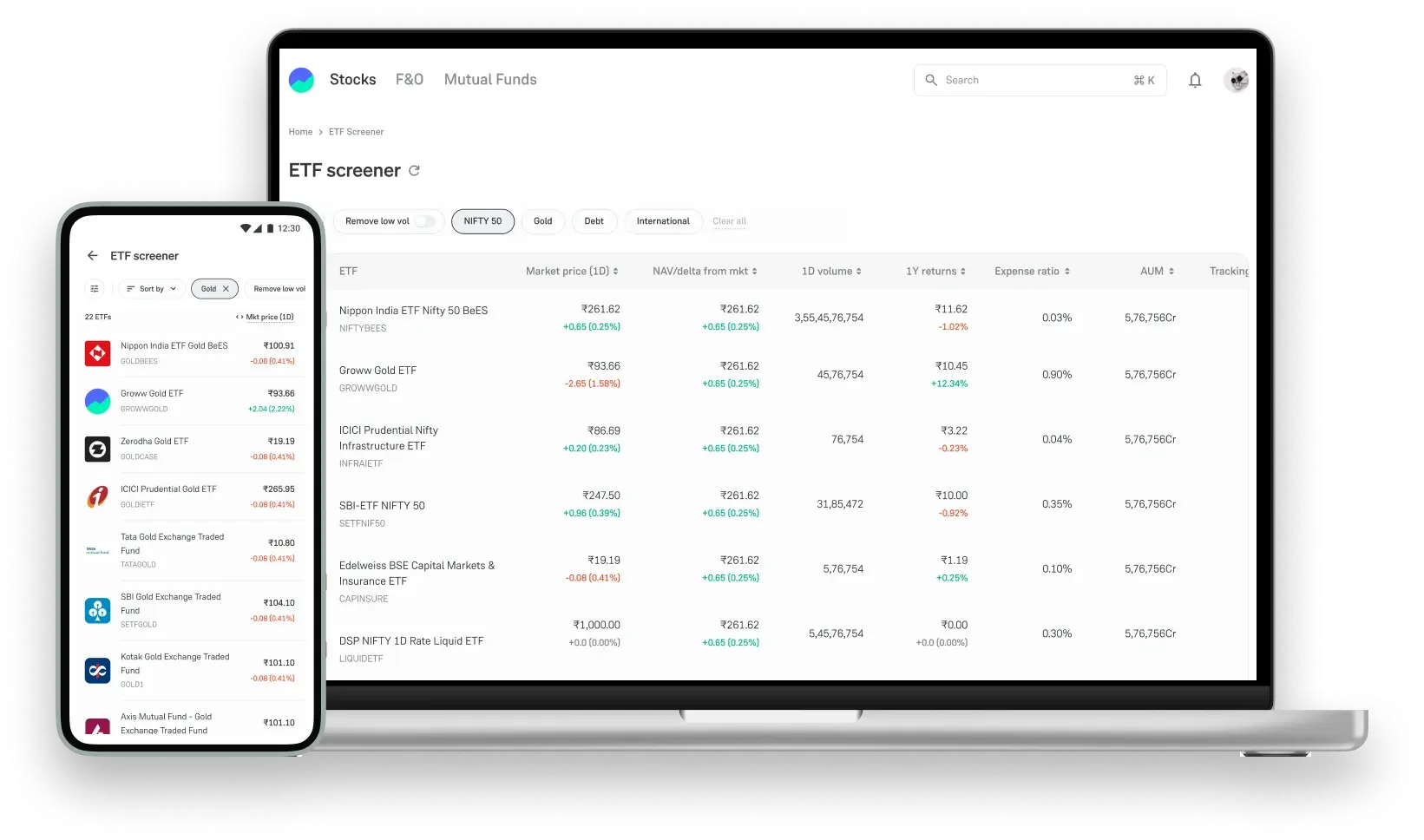

How can I invest in ETFs on Groww?

You can invest in ETFs on Groww by searching for your preferred ETF, reviewing its details such as past performance, expense ratio, and holdings, and then purchasing units directly—just like buying a stock.

What are the risks involved in ETF investing?

Like all investments, ETFs carry risks. Their value can fluctuate due to market volatility, sector performance, or tracking errors. It’s important to review the ETF’s objective, composition, and historical data before investing.