What Is the Dow Theory? Principles & Market Trends Explained

Dow Theory is a fundamental principle of technical analysis that interprets market trends as a function of the movement of leading stock indices.

- Based on Charles H. Dow's writings, it is inferred that markets trend in identifiable patterns based on the general investment psyche.

- Dow Theory specifies three types of trends, such as primary, secondary, and minor, and looks to agree among various indices (such as the Dow Jones Industrial and Transportation Averages) to confirm trends.

- Dow Theory emphasises volume, economic factors, and sentiment as fundamental to market movement.

- It embodies the rules for examining long-term trends and guides traders in terms of predicting probable reversals and market cycles.

Historical Background and Founders

The Dow Theory was developed by Charles H. Dow, co-founder of The Wall Street Journal and Dow Jones & Company, in the late 19th century. It was later extended by William P. Hamilton, Robert Rhea, and E. George Schaefer. They combined Dow's editorials into an analytical framework. Dow's interest was in describing how market indices reflected the broader business environment.

His successors improved upon the theory by making the trend classification precise and interpreting confirmation signals. Their combined effort provided the foundation for contemporary technical analysis and continues to impact trading approaches today.

Key Principles of the Dow Theory:

Here are some key principles worth noting in this regard.

Market Discounts Everything

- This premise suggests that all recognised and unrecognised information, economic indicators, news, earnings, and sentiment are already priced into stock prices.

- Price action reflects market participants' collective knowledge and psychology. Thus, examining price action in isolation can identify underlying market forces without any outside data.

- This belief aligns with the efficient market hypothesis and supports the use of charts and price patterns to forecast future movements.

- However, it also assumes that investors act rationally. However, this is not always realistic, as many investors lack control over their emotions and may overtrade out of fear or greed.

Primary, Secondary and Minor Trends

- Dow Theory categorises market movements into three trends: Primary trends (a year or longer), secondary trends, and minor trends.

- Primary trends are dominant bull or bear markets. Secondary trends take weeks to several months and are corrections or rallies within the primary trend. Minor trends can take days or weeks to unfold and reflect short-term fluctuations.

- This framework helps traders distinguish between noise and significant shifts. Primary trends are significant for long-term investors.

- Even if the traders focus on secondary and minor trends for shorter-term strategies, they tend to opt for primary trends in the long run. Investors have to recognise which trend is dominant to make informed decisions and avoid trades against the prevailing market direction.

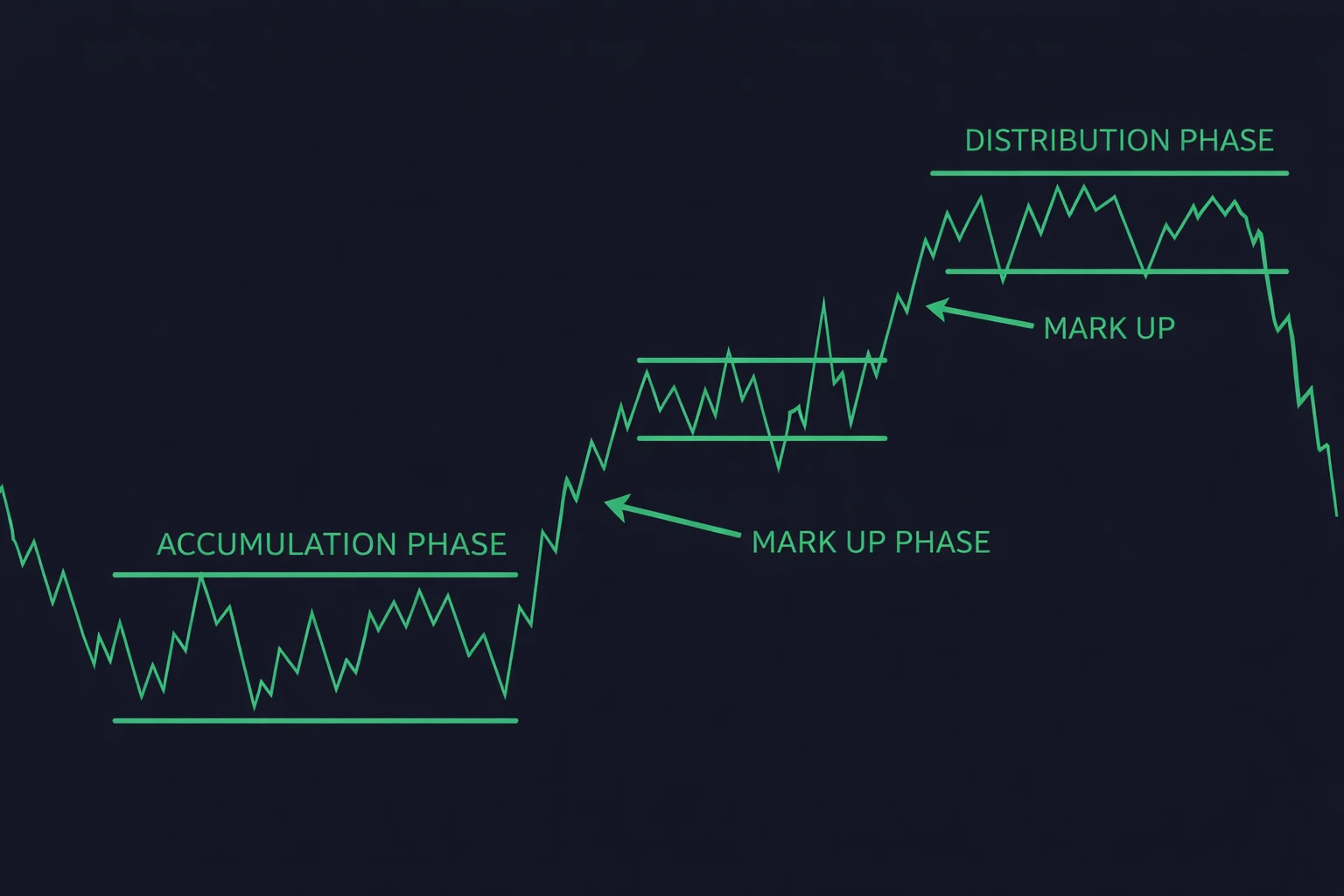

- Primary trends have three phases. In a bull market, they are the Accumulation Phase (where informed investors or smart money quietly buys assets since prices are low, absorbing the supply while the general public remains unaware), Public Participation Phase (the trend becomes more evident to the public, drawing technical and general traders, thereby leading to major increases in prices and higher volumes), and the Excess/Distribution Phase (the peak of the trend, with higher speculation and informed investors selling their holdings to late buyers, signaling the bull market’s end).

- In a bear market, the phases get reversed, i.e. Distribution Phase (informed investors sell their holdings to the general buying public and there is a sideways market movement), Public Participation Phase (acceleration of the downtrend with more investors joining the selling activity), and the Panic/Despair Phase (more capitulation on account of heavy selling, with public panic. It often marks the bottom of the trend).

Confirmations and Volume Importance

- Dow believed that no trend was valid unless confirmed by another major index. Historically, the Dow Jones Industrial Average and the Dow Jones Transportation Average have tended to move together to confirm a trend.

- Volume also has a supporting role in this. The increasing volume of trade needs to be accompanied by a trend to confirm its strength. Diverging or lagging volume can indicate a weakening trend or an upcoming reversal.

- This emphasis on confirmation provides more consistent signals and deters premature action. But, with the emergence of diversified industries and algorithmic trading, sceptics suggest that today's markets do not necessarily adhere to such binary confirmations.

Trends Persist until Reversal

- Dow Theory posits that a trend continues until conclusive evidence disaffirms it. This motivates speculators to "ride the trend" rather than get out too quickly.

- Reversals of trends are typically substantiated by a breakdown in index confirmation and by a breach of previously established highs or lows. This is based on the market concept of inertia.

- Trends are likely to persist because of momentum and market sentiment. The specific turning point may be challenging to identify, particularly when short-term trends temporarily oppose the dominant trend. Consequently, this rule frequently necessitates experience and judgment to utilise efficiently in live trading.

Application in Modern Markets

Despite being developed more than a century ago, Dow Theory is still applicable today. Its focus on trends, volume, and confirmation rules continues to form the basis of contemporary technical analysis.

- Many traders apply Dow Theory in combination with indicators such as moving averages and trend lines to confirm breakouts or reversals. In algorithmic and globalised markets, Dow Theory offers a human-oriented framework to discern sentiment and macro trends.

- Yet it's usually considered lagging because, by the time a trend is confirmed, a meaningful price move may already have occurred.

- Nevertheless, its conservative, confirmation-based strategy continues to deliver value in volatile markets where spurious breakouts are common.

Dow Theory vs Technical Indicators

Dow Theory is essentially a trend-oriented model, concentrating on price action and confirmation employing index analysis. However, technical indicators such as RSI, MACD, Bollinger Bands, and moving averages are mathematical analyses of momentum, volatility, or overbought/oversold status.

Dow Theory is qualitative and rule-based, whereas technical indicators are quantitative and frequently lagging. Dow Theory is good at grasping market psychology and long-term composition, but it can be imprecise. Then again, indicators provide definitive entry/exit signals but may make noise or false signals. Combining both may increase a trader's capacity to validate trends and control risk. It is vital to understand market patterns and movements carefully before you move ahead.

Limitations and Criticisms

Here are some limitations worth noting.

- Dow Theory is not perfect. Critics say that it's a lagging system. Also, the theory's dependence upon two indices (Industrial and Transportation) seems antiquated in an age of technological supremacy and international market diversification.

- It also does not account for abrupt, news-related market changes. Dow Theory is not readily applicable to non-trending markets or short-term trading patterns.

- In addition, it is of limited use within sideways markets where there is no discernible trend. Despite these drawbacks, its usefulness for long-term trend detection is still recognised.

Practical Use in Trading

Dow Theory is used in real-life scenarios primarily to confirm long-term market trends and shape overall investment strategy. Here are some other key aspects that you should know about.

- It can be utilised by traders to position themselves with the underlying market trend. It can help traders avoid trading in the wrong direction. For instance, if both DJIA and DJTA point towards a bullish trend, investors may build exposure to equities.

- Dow Theory also helps traders avoid responding to noise by focusing on confirmation and volume.

- However, it is most effective when used in conjunction with other resources, since it does not give clear entry or exit signals. It is very useful for position trading and long-term portfolio strategy.