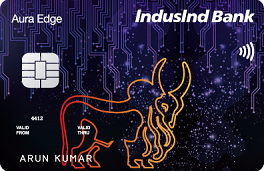

IndusInd Bank Platinum Aura Edge Credit Card

IndusInd Platinum Aura Edge credit card is a Mastercard credit card with a contactless feature. The card is designed to increase savings and manage everyday expenses. The transactions in this card can also be converted to easy EMIs.

This credit card is most suitable for major spending on Entertainment and Shopping choices.

Image Source: IndusInd Bank Official website

Highlights of the IndusInd Platinum Aura Edge Credit Card

|

Suitability |

Entertainment and Shopping |

|

Joining Fees |

Rs. 500 |

|

Annual Charges |

Nil |

|

Best Feature |

1% cashback on all retail spends |

Characteristics and Benefits of IndusInd Aura Edge Credit Card

The benefits and characteristics that come along with this card are:

-

Cashback Benefits

There is a 1% cashback on spending up to Rs. 10,000 in a statement. The cashback earned over the current statement cycle would be credited to the credit card account in the subsequent statement cycle.

-

Fuel Benefits

You will be getting a 1% surcharge waiver on your fuel spent at all of the petrol stations across the country.

-

Entertainment Benefits

In association with BookMyShow, you can get one assured movie ticket of Rs. 200 for every six months of a calendar year.

-

EMI Benefits

Exclusively for this card, you can convert your transactions and outstanding balance into an EMI at the rate of 1.1% for a month with zero processing fees.

-

Travel Benefits

There is travel insurance for all your trips, and it provides the below-mentioned coverages:

- Lost Baggage

- Loss of Passport

- Delayed Baggage

- Missed Connection

- Lost Ticket

-

Total Protect Feature

This card comes with a total protection feature, which is coverage under unauthorised transactions and counterfeit fraud. This ensures coverage over the entire credit limit of the card of fraudulent activity.

-

Air Accident Coverage

You get a complimentary personal air accident insurance coverage of Rs. 25 lakhs through the Aura card.

Application Process of IndusInd Bank Platinum Aura Edge Credit Card

You can apply for the card through the below-mentioned method:

Step 1: Visit https://www.indusind.com/in/en/personal/cards/credit-card/platinum-aura-edge-visa-and-mastercard-credit-card-easy-credit.html.

Step 2: Enter your personal and professional details with the required documents.

Step 3: Click on submit.

Step 4: Choose the best offers the card has to offer to you.

Step 5: Now click on ‘Proceed’.

After the application has been submitted, you will be provided with an application number, and the bank will let you know your application's status in a couple of days.

IndusInd Aura Edge Credit Card Charges and Fees

The fees and charges of the Aura Edge card are as follows:

|

Fee |

Amt (Rs.) |

|

Joining Fee |

Rs. 500 |

|

Annual Fee |

Nil |

Documents Required to Apply for the IndusInd Bank Platinum Aura Edge Credit Card

The mandatory documents required to apply for the card are:

- ID Proof: PAN, Passport, Aadhaar, Voter ID, Job Card, etc.

- Address Proof: House Agreement, Bank statement, Utility Bill, Telephone Bill and more.

- Income Proof: ITR, Pay Slip, or Bank Statement

Eligibility Criteria to Apply for the IndusInd Platinum Aura Edge Credit Card

The below-listed criteria are eligible to apply for the credit card:

|

Age |

Above 18 years |

|

Residence |

Indian |

|

Occupation |

Self-Employed or Salaried |

|

Income |

More than Rs. 25,000 per month |

Similar Credit Cards

|

Card Name |

Annual Fee and Best Feature |

|

HSBC Smart Value Credit Card |

Nil Three reward points can be earned for every Rs. 100 spent online, dining, and telecom |

|

Rs. 500 10X CashPoints on purchases at Reliance Smart SuperStore, Amazon, BigBasket, Swiggy, and Flipkart |

|

|

Nil 5% cashback for Amazon Prime members on Amazon spends |