Safe Exit: F&O Risk Management Tool on Groww

Futures and Options (F&O) trading can be exciting but carries a lot of risks. With the constant ups and downs in the market, many traders worry about losing more than they’re prepared for. That’s where Safe Exit comes in - a feature that allows you to limit your losses or lock in profits automatically!

What is Safe Exit?

Safe Exit helps you protect your trades by automatically closing all your open F&O positions when your profit or loss reaches a specific limit you set. Whether you’re looking to prevent heavy losses or secure your gains, Safe Exit is your personal safety net.

Here’s how it works:

- You can set a loss or profit limit below your current total P&L.

- When your P&L reaches this limit, Safe Exit kicks in and squares off all your open positions automatically.

How Does Safe Exit Help in F&O Trading?

The goal of Safe Exit is to help you manage your trades without having to constantly monitor them. Once you set a limit, it ensures that your positions are closed when they hit that limit, saving you from unwanted losses or allowing you to lock in profits.

For example:

- If your current day P&L is +₹5,000, you can set a profit limit at ₹3,000. When your profit drops to ₹3,000, Safe Exit will trigger and close all your positions to lock in your profits.

- If your P&L is -₹5,000, you can set a loss limit at ₹-8,000. When your loss hits ₹-8,000, Safe Exit will square off your trades, protecting you from further losses.

Key Benefits of Safe Exit

- Protection from Losses: Automatically exit trades once your loss reaches the limit you set.

- Lock in Profits: Set a profit limit to ensure your gains are secured before the market reverses.

- Stress-Free Trading: Safe Exit monitors your positions for you, so you don’t have to worry about manually closing them.

How to Set Up Safe Exit on Groww

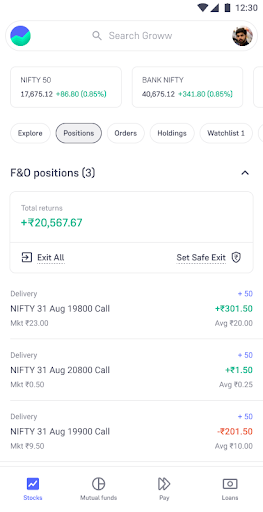

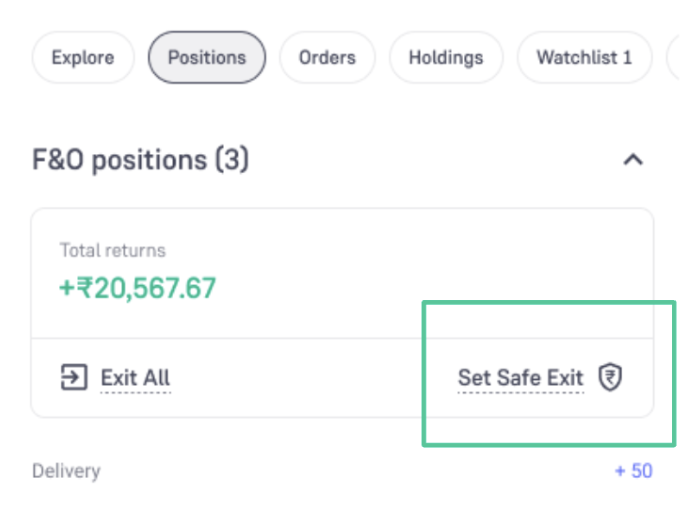

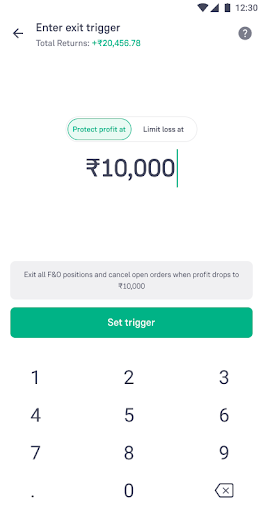

Step 1: Go to the Positions tab in your trading account.

Step 2: Tap on ‘Set Safe Exit’ next to your P&L.

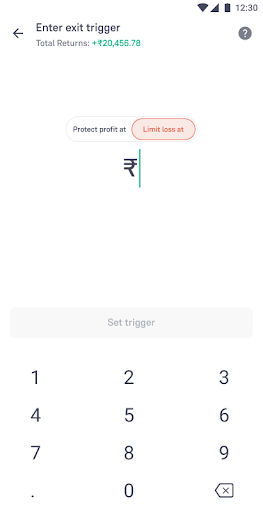

Step 3: Choose whether to set a lower limit in profit or loss. Enter a limit below your current P&L.

Step 4: Confirm your limit. Once set, Safe Exit will activate and monitor your positions.

Step 5: Relax! Safe Exit will automatically square off your positions once your limit is hit.

Can Safe exit limit be Modified or Canceled?

Absolutely! You can modify or cancel Safe Exit anytime before it triggers:

- To modify: Go to the Positions tab, tap on Safe Exit, and adjust your limit.

- To cancel: Tap on Safe Exit and select ‘Remove Safe Exit.’

What Happens When Safe Exit is Triggered?

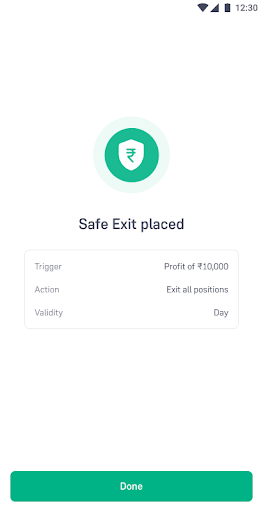

When Safe Exit triggers:

- All open F&O positions are automatically closed.

- You will receive a notification confirming Safe Exit.

- You can check the Orders tab to view the details of the closed trades, clearly marked with “Safe Exit.”

Important Points to Note

- Safe Exit can only be set during market hours (9:15 AM to 3:30 PM).

- Validity period : If your limit isn’t triggered by the end of the day, it will be cleared and you’ll need to set it again the next day.

- The limit you set must be lower than your current total P&L.

- Groww does not charge additional fees to use or access the ‘Safe Exit’ feature. However, standard brokerage fees may apply as per your square-off orders for open positions.

Why May My Final P&L Differ from the Safe Exit Limit?

When Safe Exit triggers, market volatility and slippage might result in your final P&L being slightly different from the limit you set. This happens because the system will place orders at the best available market price, and price movements during the execution process can cause some variations.

Conclusion

Whether you’re looking to protect yourself from significant losses or ensure your gains are secured, Safe Exit on Groww gives you the control you need over your F&O trades. It’s easy to set up, free to use, and can help you trade with greater peace of mind.

Set up a Safe Exit limit on Groww today and trade confidently!