Parabolic Moves in Stocks: A Warning Sign of the Final Leg?

A parabolic move in the stock market has a similar architecture. When the stock price rises rapidly, leading to steep vertical lines on the chart, it’s called a parabolic move.

While these moves look very attractive, they are actually warning signals that the strength will weaken very soon.

Here’s what a parabola looks like in geometry

Why Parabolic Moves Appear So Powerful

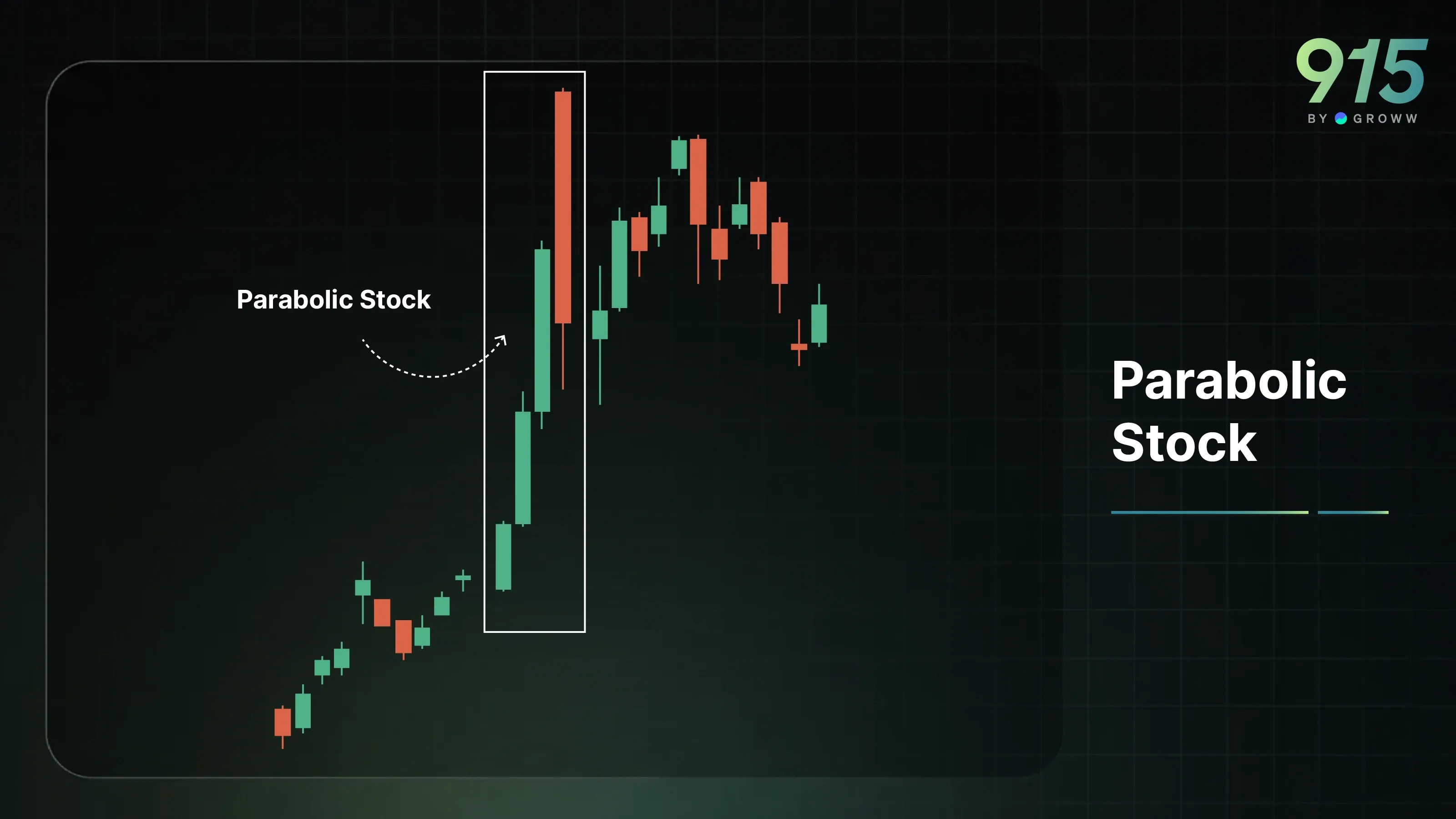

Usually, when markets or stocks move, they do so in a staircase pattern. Here is how the stocks usually move up and down:

However, when there is a sharp parabolic movement, it creates an illusion of certainty. Some of the common aspects we notice during such phases are that the pullbacks are very shallow or completely disappear.

Often, the dip is bought very aggressively. Most of the momentum indicators, such as RSI, remain overbought for a prolonged period, and the news flow is extremely positive. All these things together convince traders that the stock will keep moving up forever. Many retail traders jump on this bandwagon, only to be caught at the top and suffer huge losses.

The Market Mechanics Behind Parabolic Moves

One of the main reasons parabolic moves happen is late participation rather than conviction. Some of the typical drivers are:

- Short covering by trapped sellers

- FOMO buying by retail traders

- Momentum chasing by funds

- News amplification after the move has already started

As we can see, all the above points are classic examples of getting trapped. Most of the time, the smart money has already taken entry at low levels and accumulated positions much earlier.

Why Parabolic Moves Often Signal the Last Leg

As shown earlier, a healthy trend usually consists of a cycle of pullbacks, consolidation and a rotation of participants. On the other hand, a parabolic move has no time to balance supply and demand. It does not create any meaningful demand zones below the price. And it usually comes with a poor risk-reward for new buyers. Always remember that when the price accelerates too quickly, it comes with limited upside and downside risk that expands exponentially. This change in risk and reward, along with the lopsided balance, is why parabolic phases often mark the final leg of a trend, not the beginning.

During a parabolic move, the volume plays a critical role. It is common to notice a sharp volume expansion within 2-3 candles near the top during such times. This shows that there is high participation after large price moves. And many times, the climax candle, which is the candle from which the market will reverse quickly, ends up having the maximum volume.

The volume actually indicates distribution and not accumulation. The volume is coming because smart money is quickly offloading gains, while retail participants are buying extremely late.

Psychological Shift During Parabolic Moves

Let's look at a parabolic move in ADANIPOWER.

Notice how the volumes peaked at the highest candle, and then there was a sell-off. Usually, these parabolic moves are emotional events. Some typical behaviours seen during parabolic moves are, first, that traders fear missing out. They can see the stock is rallying quickly, and even though the fundamentals or technicals don’t align, they want to jump on the bandwagon.

Often, there is also a complete failure of risk management. Due to the euphoria, the stoploss is either very wide or not kept at all. And finally, greed drives higher position sizes to make more profit. All these factors create an emotional intensity that is unsustainable, resulting in losses for traders.

How Parabolic Moves Usually End

A common feature of all parabolic moves is that they end very quickly. This is accompanied by sharp reversals, violent corrections, or breakdown of key support zones. Many times, an extended sideways range is formed after a parabolic move.

So beginner traders should only jump on parabolic moves with small capital. Other safer approaches might be to completely avoid fresh buying near vertical moves. The traders should have good risk management and deploy trailing stoplosses. The aim should be capital protection rather than quick profits.

Difference Between Strong Trends and Parabolic Moves

Often, strong trends can be mistaken for parabolic moves. Here is the differentiation between the two:

|

Feature |

Strong Trend |

Parabolic Move |

|

Structure |

Higher highs & pullbacks |

Vertical acceleration |

|

Risk |

Balanced |

Asymmetric |

|

Participation |

Early and broad |

Late and emotional |

|

Longevity |

Sustainable |

Short-lived |

Conclusion

Parabolic moves are visually impressive but structurally fragile. They are formed by late-stage enthusiasm and emotional participation rather than sound fundamentals. They also offer very poor risk-to-reward to new entrants. So traders should appreciate that in markets, speed is not strength. When the price is moving vertically, it is a signal that the trend is going to exhaust, so be careful.