Groww Nifty 1D Rate Liquid ETF – A Low-Risk Way to Potentially Earn Daily Returns on Idle Money

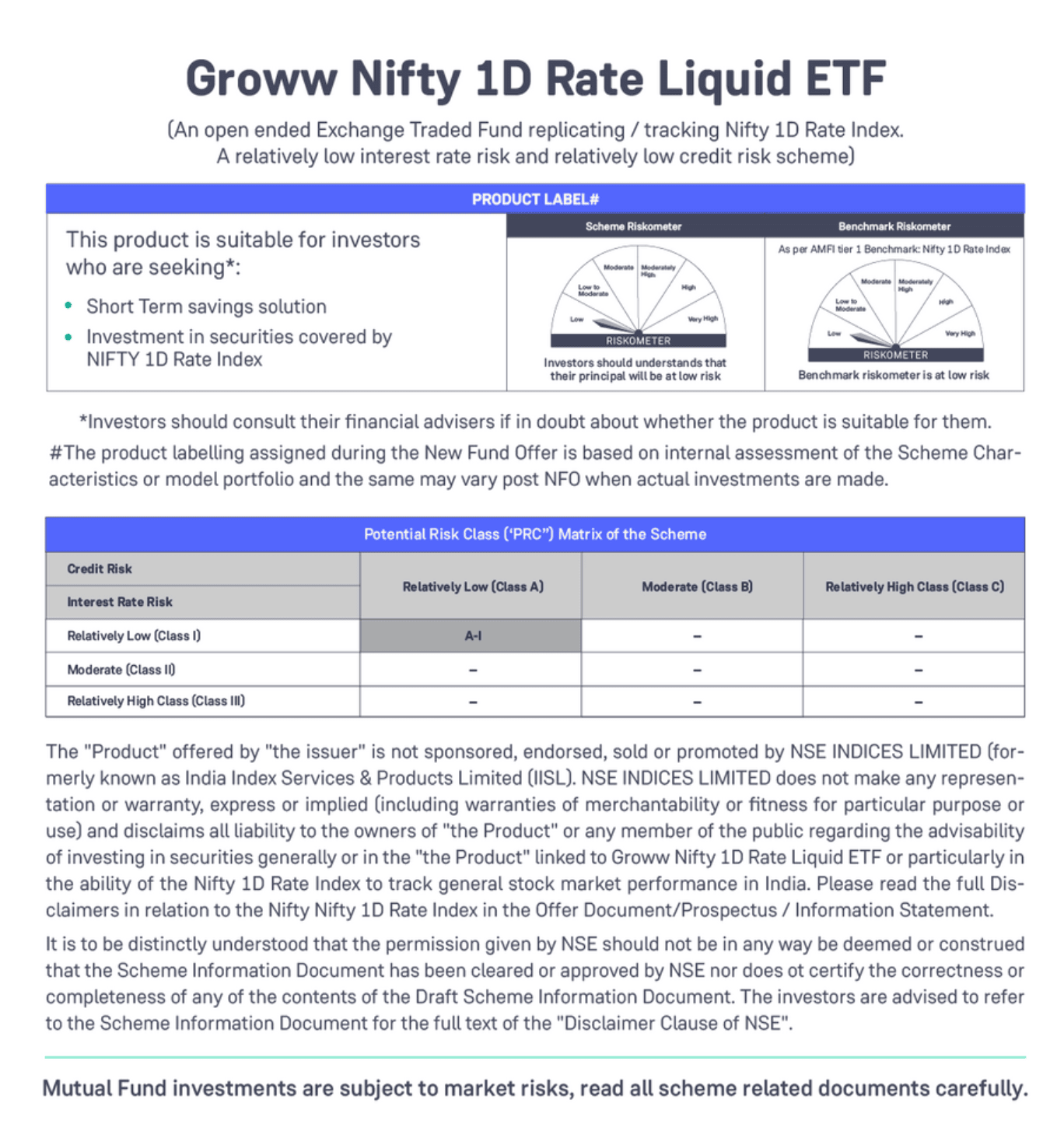

Groww Mutual Fund has launched the Groww Nifty 1D Rate Liquid ETF, a low-risk exchange-traded fund (ETF) designed to potentially provide investors with daily returns on their idle funds. This new liquid ETF seeks to offer an efficient and flexible way for individuals and investors to make the most out of their idle cash.

Groww Nifty 1D Rate Liquid ETF is now listed and available for investment.

How the Groww Nifty 1D Rate Liquid ETF Works

The Groww Nifty 1D Rate Liquid ETF aims to invest in low-risk, *short-term assets such as overnight loans (Repos) and government securities (G-secs). These assets are considered cash equivalents, ensuring high liquidity. This feature means that investors can quickly convert their liquid ETF units into cash whenever needed, providing a flexible solution for those looking to keep their money active without taking on excessive risk.

Why Choose the Groww Nifty 1D Rate Liquid ETF?

Here’s what sets this liquid ETF apart from others:

- Aims to Provide Daily Returns with Low Risk: The liquid ETF is designed to potentially provide daily returns, ensuring that idle funds continue to work even when not actively invested elsewhere. This makes it an ideal option for investors seeking consistent yet low-risk income.

- Flexible Trading with No Exit Load: Like stocks, this liquid ETF can be bought and sold on the stock exchange. Investors can withdraw their funds instantly without any exit fees, offering both flexibility and ease of access.

- Growth NAV Option: Any interest earned from overnight securities is added to the fund's value. As a result, the price of liquid ETF units may increase over time, potentially enhancing the overall return.

- No Securities Transaction Tax (STT): Unlike many other investment options, transactions involving this liquid ETF are free from STT, reducing overall costs for both short-term and long-term investors.

Who Should Consider the Groww Nifty 1D Rate Liquid ETF?

This liquid ETF may be suited for:

- Short-term investors looking for a safe place to potentially park idle funds while waiting for other investment opportunities.

- Investors with low-risk tolerance seeking a steady, daily return without locking in their funds for the long term.

With its low-risk profile and potential for daily returns, the Groww Nifty 1D Rate Liquid ETF aims to maximize the efficiency of idle cash, making it an attractive option for a wide range of investors.

What Are Liquid ETFs?

Liquid ETFs, including the Nifty 1D Rate Liquid ETF, are traded on stock exchanges and focus on short-term investments with a 1-day maturity. They primarily invest in instruments like Tri-Party REPOs, Repos in Government Securities, Reverse Repos, and other overnight securities. These assets function as cash equivalents, offering both accessibility and potential returns.

Key Features of Liquid ETFs

- Potentially Higher Liquidity with Lower Risk: By investing in overnight securities, liquid ETFs aim to offer a comparatively lower-risk profile while seeking high liquidity. This feature makes them ideal for investors who may need quick access to their funds.

- Flexible Trading: Liquid ETFs can be traded throughout the day at market prices, similar to equity shares, allowing investors to manage their investments dynamically.

- Potential for Daily Transparency: Liquid ETFs offer the potential for more transparency through daily disclosures of their portfolio holdings, providing investors with a clear view of the fund’s assets and strategies.

- Potentially More Tax-Efficient: Many liquid ETFs do not issue dividends, making them potentially more tax-efficient, as taxes are only applicable upon the sale of units.

- No STT: The absence of Securities Transaction Tax on liquid ETF transactions further enhances their attractiveness for investors.

- Cash Equitization: Investors can potentially earn returns on idle cash through investments in overnight securities, which aim to generate daily income while remaining accessible for other financial needs.

- Post-NFO Trading Flexibility: After the New Fund Offer (NFO) period, these liquid ETFs can often be bought and sold in minimum lot sizes, making them accessible to a broad range of investors.

- Potential for Enhanced Returns: Liquid ETFs may offer higher returns compared to traditional savings accounts, making them a viable alternative for short-term investors seeking better yields.

Making the Most of Idle Cash with Groww Nifty 1D Rate Liquid ETF

The Groww Nifty 1D Rate Liquid ETF aims to provide a unique opportunity for investors to potentially park their idle cash in a low-risk, highly liquid asset. With benefits such as flexible trading, daily transparency, potential tax efficiency, and the absence of Securities Transaction Tax (STT)

Explore the Groww Nifty 1D Rate Liquid ETF Today!

Please consult your financial advisor before investing.

*Source: NSE, data as of August 30, 2024. Refer to the Index Factsheet for more information.

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully.