Groww BSE Power ETF – Invest in India’s Transforming Power Sector

India's power sector is undergoing a significant transformation — driven by growing electricity demand, renewable energy adoption, and large-scale infrastructure upgrades. At the center of this shift are companies generating, transmitting, and powering India’s energy future.

To help investors participate in this evolving theme, Groww Mutual Fund is launching the Groww BSE Power ETF — offering focused exposure to India’s leading power sector companies through a transparent, low-cost vehicle.

About the Power Sector

Over the past two decades, India’s electricity consumption has increased nearly 4x, closely tracking its GDP growth. This demand is rising across residential, industrial, agricultural, and commercial sectors — a reflection of deeper electrification and rising prosperity.

India has also made a major leap in electricity generation, with a diversified energy mix including coal, solar, wind, and nuclear sources. In fact, India is now the third-largest producer of wind and solar power globally, with solar energy alone growing from negligible capacity to nearly 100 GW by 2024.

With:

- Universal electrification achieved

- Ambitious clean energy goals (500 GW renewables target by 2030)

- Per capita electricity demand still below global averages

...there’s significant headroom for growth.

India has also transitioned from power deficits to surpluses, even beginning electricity exports to countries like Bangladesh, Nepal, and Bhutan — and planning undersea transmission links to the UAE and Saudi Arabia.

About Groww BSE Power ETF

What Does the ETF Track?

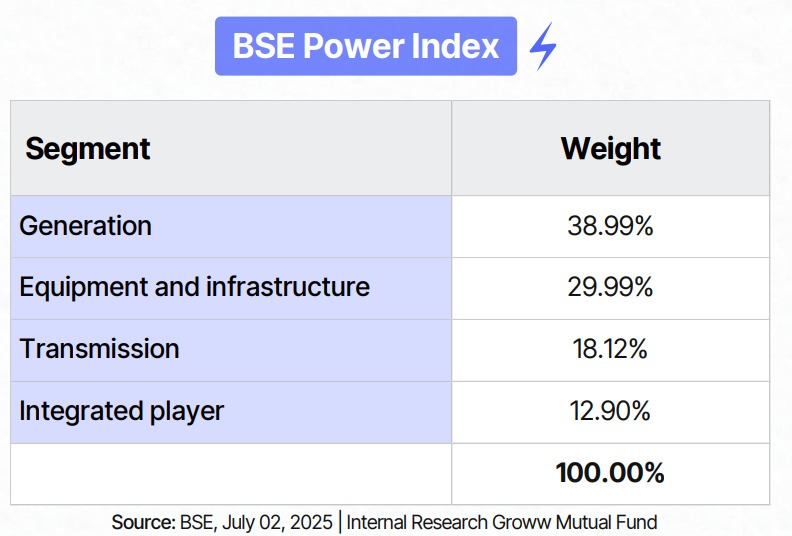

The Groww BSE Power ETF aims to replicate the performance of the BSE Power Index – TRI, which includes companies across the entire power value chain:

- Generation (e.g., NTPC, Adani Power)

- Transmission & Distribution (e.g., Power Grid, Torrent Power)

- Equipment & Infrastructure (e.g., ABB, BHEL, Siemens)

Key index features:

- Free-float market-cap weighted

- Selected from the BSE 500 universe

- Minimum 90% trading frequency filter

- Semi-annual reconstitution (June & December)

This makes the ETF a comprehensive and diversified way to access India’s power sector without stock-picking.

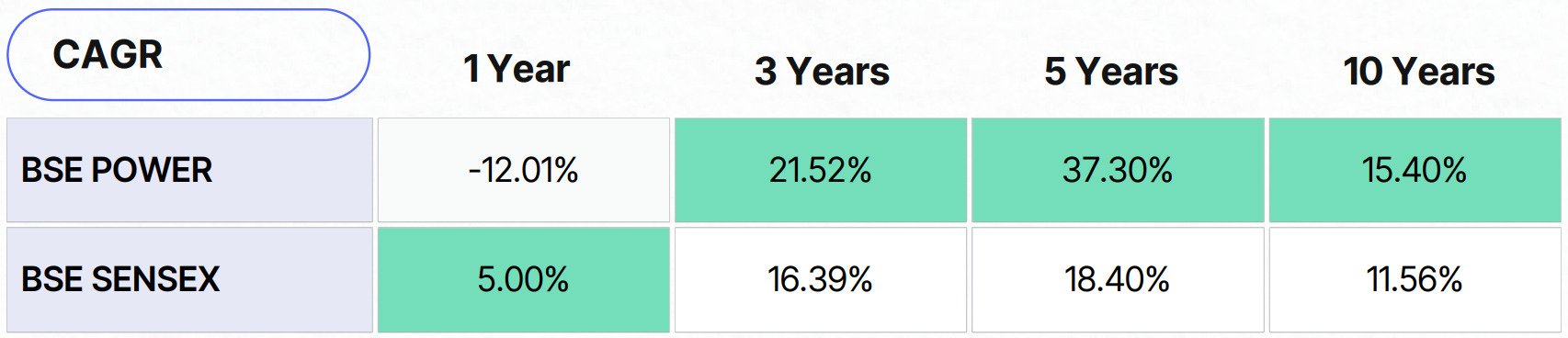

How Has the Index Performed?

The BSE Power Index has historically outperformed the broader market (BSE Sensex) over the medium to long term:

The index constituents have also shown strong business fundamentals:

- Revenue nearly doubled from ₹217,152 Cr (2020) to ₹394,169 Cr (2024)

- Net Profit more than tripled from ₹19,939 Cr (2020) to ₹67,600 Cr (2024)

Why Consider the Groww BSE Power ETF?

- India’s Power Demand is Set to Surge

Electrification is no longer about access — it's about usage. India's per capita electricity consumption remains well below developed nations, offering immense headroom for growth as incomes rise and technology adoption increases.

- Government-Led Sector Transformation

From PLI schemes and ultra-mega solar parks to revamped distribution reforms, policy support is driving investment and operational efficiency across the sector.

- A Gateway to Renewables

India's transition to clean energy is in full swing, with solar and wind now forming nearly 30% of installed capacity. The BSE Power Index includes key players like Adani Green, Tata Power, and JSW Energy that are at the forefront of this shift.

- Powering Emerging Technologies

The electricity demand from EVs and AI/data centers is expected to rise significantly by 2032:

- EV power demand: <1 TWh → 38 TWh

- Data center share of power use: 0.5% → 3.0%

- Improving Company Fundamentals

The index includes companies that have nearly doubled revenues and tripled profits in five years — reflecting structural improvements, not just cyclical growth.

- Pure Play on India's Power Sector

Unlike broad energy indices influenced by oil and gas prices, the BSE Power Index is focused purely on India’s power value chain — offering structural growth exposure with minimal commodity risk.

Who Should Consider This ETF?

You may consider this fund if you:

- Believe in India’s long-term infrastructure and energy growth

- Seek targeted exposure to the power sector through a single investment

- Prefer a rules-based and diversified ETF, without the complexity of stock selection

- Are investing with a long-term capital appreciation goal

The minimum investment amount for this scheme stands at ₹500 and in multiples of ₹1 thereafter, with no exit load. For more information about the scheme, refer to the Scheme Information Documents (SID)

Source 1: Statista, July 07, 2025

Source 2: Ember Energy, July 07, 2025

Source 3: Source: BSE, July 02, 2025 | Internal Research Groww Mutual Fund

Source 4: BSE, July 02, 2025 | Constituents’ official websites

Source 5: Source - BSE, Bloomberg, July 02, 2025

Source 6: Ace Equity, July 08, 2025

Source 7: The Print, May 15, 2025

Source 9: ET Energy World, Feb 21, 2025