Securities Transaction Tax (STT) in India – Meaning, Charges & Tax Impact (Budget 2026)

If you invest/trade in Indian stock markets through equity shares, equity derivatives (futures and options), or equity-oriented funds, you are required to pay STT (Securities Transaction Tax) per transaction.

Taxes are generally levied on profits, but the “Securities Transaction Tax” is not essentially a “tax”. It is paid regardless of whether a trade is profitable or not, just like brokerage, GST, stamp duty, and other charges.

This blog covers everything you need to know about the Securities Transaction Tax (STT), including its meaning, applicability, charges, and the latest STT rate changes announced in the Union Budget 2026.

What is STT?

STT (Securities Transaction Tax) is a direct tax levied by the Government of India on certain securities transactions carried out on recognised stock exchanges like NSE and BSE.

As per SEBI (Securities and Exchange Board of India), STT is charged on the following instruments.

- Purchase and sale of equity shares in a company or units of a business trust, where the transaction is settled by actual delivery or transfer of such units.

- Sale of equity-oriented fund units, where the transaction is settled by actual delivery or transfer of such units. STT is not levied on the purchase of equity oriented fund units.

- Sale of equity shares, units of an equity-oriented fund, or units of a business trust, where the transaction is settled otherwise than by actual delivery or transfer (i.e., non-delivery-based transactions or Intraday)

- Sale of option contracts

- Sale of option contracts, where the option is exercised.

- Sale of futures contracts

STT Charges Across Different Market Segments

STT rates vary depending on the type of trade.

|

Latest Update: In the Union Budget 2026, Finance Minister Nirmala Sitharaman raised STT on futures to 0.05% from the present 0.02%. |

Below is the table summarising:

- STT rates across different transaction types

- Entity responsible for paying the tax, and

- Revised rates effective from April 1, 2026.

|

Transaction Type |

STT Rate |

Payable by |

STT Rate (Effective April 1, 2026) |

|

Purchase of equity shares |

0.1% |

Buyer |

No change |

|

Sale of equity shares (Delivery) |

0.1% |

Seller |

No change |

|

Sale of equity-oriented mutual fund units |

0.001% |

Seller |

No change |

|

Sale of equity shares or units of an equity-oriented mutual fund |

0.025% |

Seller |

No change |

|

Sale of option contracts |

0.1% |

Seller |

0.15% |

|

Sale of option contracts, where the option is exercised |

0.125% |

Buyer |

0.15% |

|

Sale of futures contracts |

0.02% |

Seller |

0.05% |

STT is not applicable to:

- Commodity derivatives (gold, silver, other commodities)

- Currency futures and options

- Off-market transactions

- Debt securities & debt mutual funds

- Unlisted Securities

How STT Appears in Your Trading Statement

You can view Securities Transaction Tax (STT) in multiple ways.

-

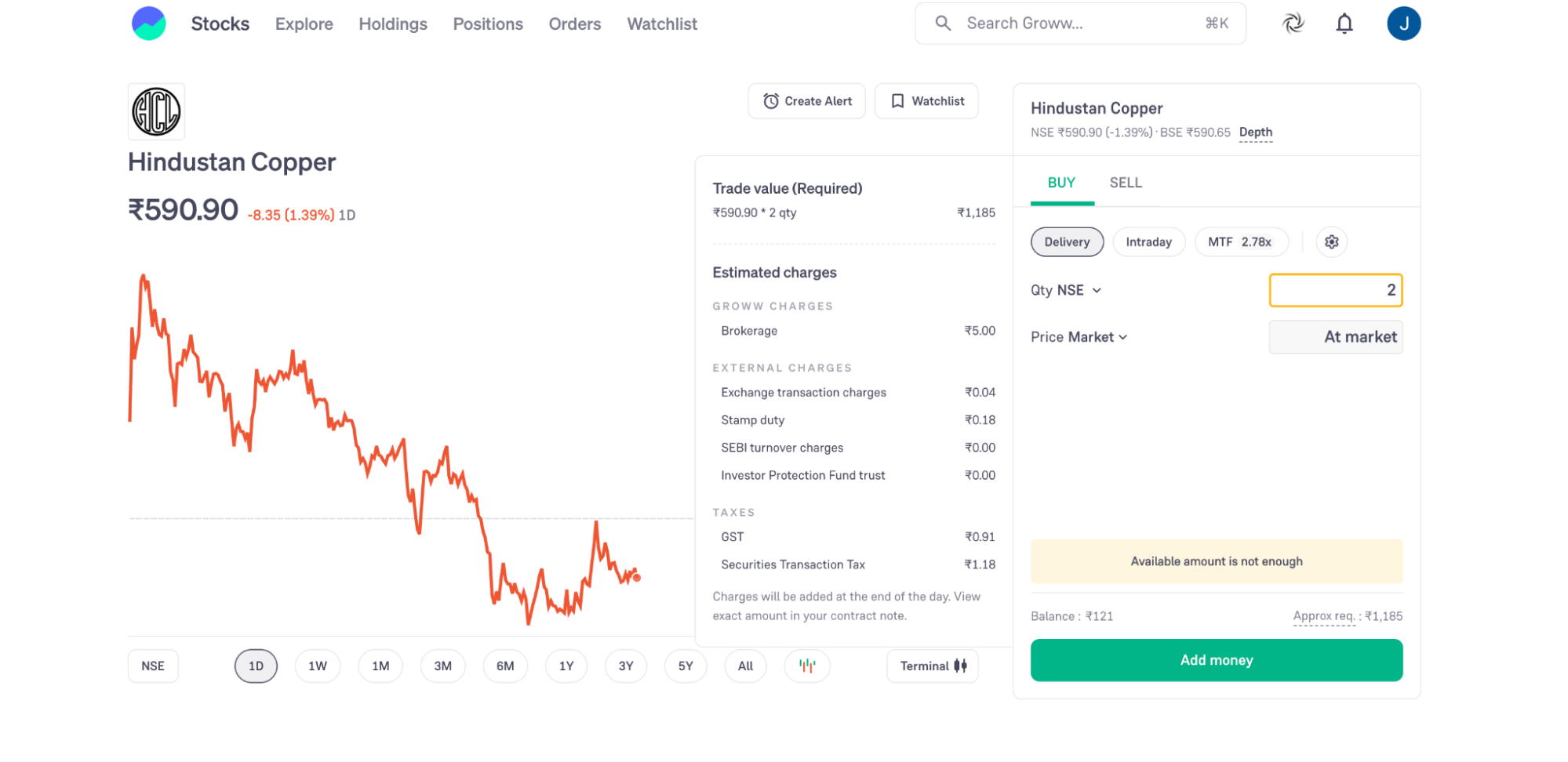

While Placing a Trade

When you place a trade, the charges section (approx. req.) shows an estimated STT amount along with other applicable charges.

However, it is important to note that the charges are approximate, and the exact amounts can only be viewed in the contract note.

-

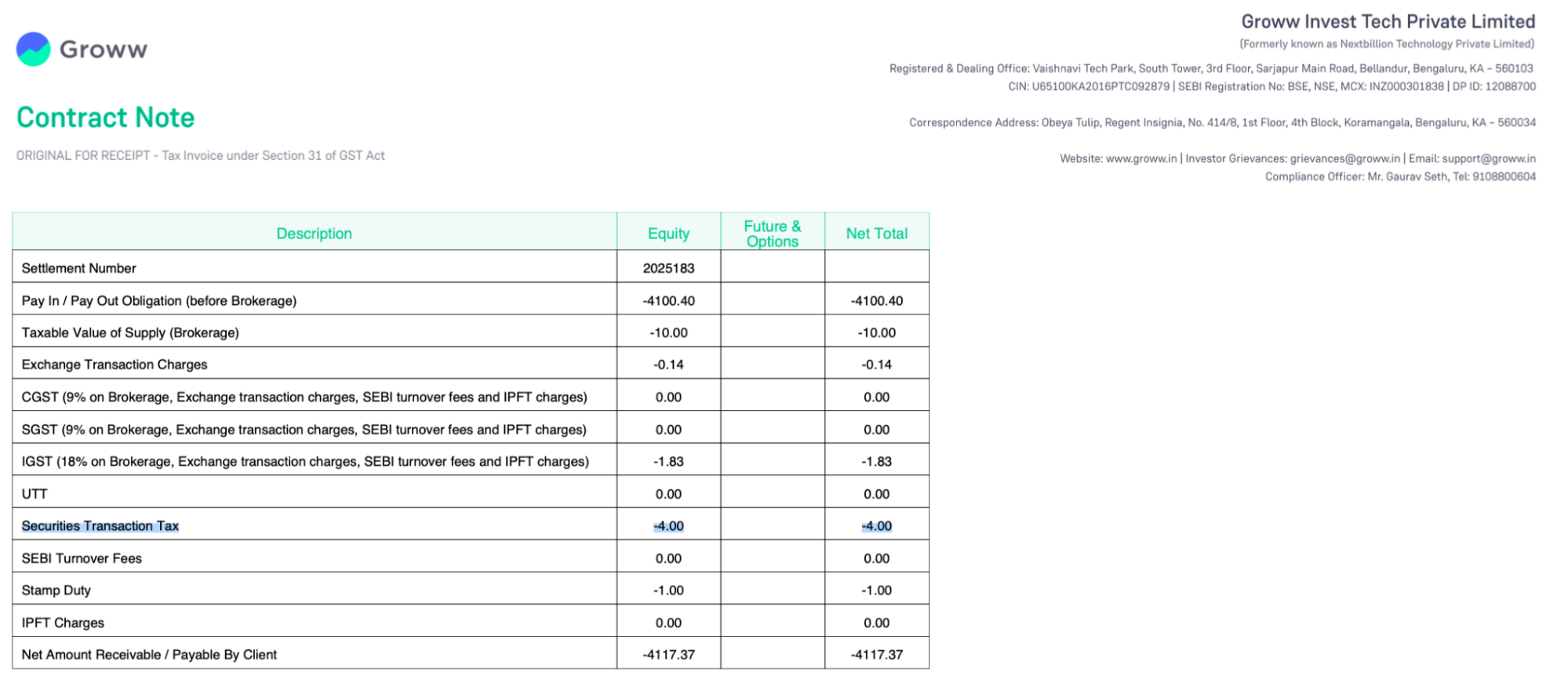

In the Contract Note

At the end of each trading day, your broker sends a contract note via email that provides a complete breakdown of your trades, including STT, brokerage, exchange charges, and taxes. This is the final record of all charges for the day.

You can view the accurate STT charged in the contract note.

-

- STT is listed as a separate line item

- It reflects the actual tax deducted as per applicable rules and is included in total transaction costs.

- STT is listed as a separate line item

-

Profit & Loss (P&L) Statement

STT is also included in the profit & loss statement, where it appears as part of overall trading costs and impacts net returns. You can download the P&L statement via your broker’s app or website.

Why Was STT Introduced?

The government introduced STT due to the following reasons:

- The taxable value of every transaction is calculated uniformly.

- The responsibilities for collection and payment are clearly defined;

- The process for compliance and reporting is transparent and enforceable;

- Mechanisms for penalty, refund, and appeal are codified.

STT vs Other Trading Taxes

When you trade in the stock market, multiple charges apply. Securities Transaction Tax (STT) is just one of them. Here’s how it differs from other common trading taxes and charges.

|

Charge Type |

Who Charges It |

When It Applies |

|

Securities Transaction Tax (STT) |

Government of India |

On eligible equity & equity derivative transactions |

|

Brokerage |

Broker |

On every executed trade |

|

Exchange Transaction Charges |

NSE/BSE/MCX |

On buy and sell transactions |

|

SEBI Turnover Fees |

SEBI |

On total trade turnover (value of purchase and sale transactions) |

|

Stamp Duty |

State Government |

On the buy side of trades |

|

GST (CGST/SGST/IGST) |

Government of India |

On brokerage & exchange-related charges |

Common Misconceptions About STT

- STT is charged on all market transactions

Reality: STT applies only to equity-related instruments, such as on the purchase and sale of equity shares (delivery/intraday), the sale of equity-oriented mutual fund units, sale of option/futures contracts, and the sale of option contracts, where the option is exercised

It is not charged on commodities, debt mutual funds, or currency derivatives.

- STT is part of brokerage

Reality: STT is a government tax, not a broker fee. Brokers only collect and remit it to the government; they do not earn from it.

- STT is refundable

Reality: Once charged, STT is non-refundable, even if the trade results in a loss.

- Paying STT eliminate capital gains tax

Reality: STT and capital gains tax are separate. STT is charged at the time of trading, while capital gains tax, whether STCG or LTCG, is calculated while filing income tax returns.

- STT depends on your profit or loss

Reality: STT is charged on the transaction value, not on whether you make a profit or incur a loss.

Conclusion

Securities Transaction Tax (STT) is a mandatory and unavoidable cost of trading and investing in Indian stock markets. While it is automatically deducted and easy to comply with, understanding where STT applies, the latest rates as per Budget 2026, and its tax implications helps you:

- Accurately calculate net returns

- Plan trades more efficiently

- Avoid confusion during income tax filing

Whether you’re a long-term investor or an active trader, factoring STT into your cost and tax planning leads to better financial decisions.