How To Set Up Autopay Via OTP On Groww

Keeping user convenience in mind while investing in SIPs, Groww has introduced autopay via the OTP option which is super convenient to set up. This saves you from the hassle of going back and forth on net banking portals outside of Groww app and sign any forms. The process is faster, better, and completely paperless. Read on to know more about the process.

Why is Autopay important?

Autopay is a helpful option for its paperless and seamless features. The money gets deducted from your bank account automatically. You have to set up the mandate just once and your SIP instalments get automated for the rest of the tenure. However, it gets even more essential now as SEBI barred the use of pool accounts for mutual fund transactions from July 1 onwards. Pool accounts are the wallets that your broker has, for example, Groww Balance.

Read more on Groww: SEBI Discontinues Usage of Pool Accounts for MF Transactions

Scroll down to learn How To Upgrade To Groww AutoPay

What is Autopay Via OTP and How to Set it up for My SIPs?

AutoPay is the next iteration of the biller mandate but is more convenient than before. It helps in automating the monthly payments towards your SIPs. Once the AutoPay is done, your monthly payments towards SIP will be done automatically without any intervention. It saves you the hassle of manually making payments towards your SIP. Also, it is quick to set up and completely safe.

- Authorization through Net Banking

- Authorization through Debit Card

For those banks that do not support authorization through net banking, users can make use of their debit cards to set up autopay via OTP. The process to create Autopay for your SIP through net banking and debit card is hassle-free on Groww. Just follow the steps given below for different banks.

1. Kotak Mahindra Bank

Step 1: Login to Groww and under your profile section, select ‘bank and autopay’.

Step 2: Select your ‘Kotak Mahindra Bank’ account.

Step 3: After selecting Kotak Bank, choose the ‘Set Up Autopay’ option.

Step 4: After selecting ‘Setup AutoPay’, click on ‘Continue’ on the next screen.

Step 5: You will receive an OTP on your registered mobile number. Enter the OTP in the space provided.

Step 6: The next few steps will ask you to verify your bank account. You can verify using your debit card details or netbanking.

Step 7: Enter the following details to login and verify by using your debit card details.

Step 8: Select ‘Secure Login’ and confirm all the details on the next screen.

Step 9: Once you confirm the information, your bank website/app will give you all necessary information, reference IDs, acceptance reference number etc. You may save the information in a secure place for your future reference.

Step 10: Once the process is complete on your bank’s platform, you will be re-directed to Groww.

You can check the status in the ‘Bank and Autopay’ section itself.

2. HDFC Bank

Through Net Banking

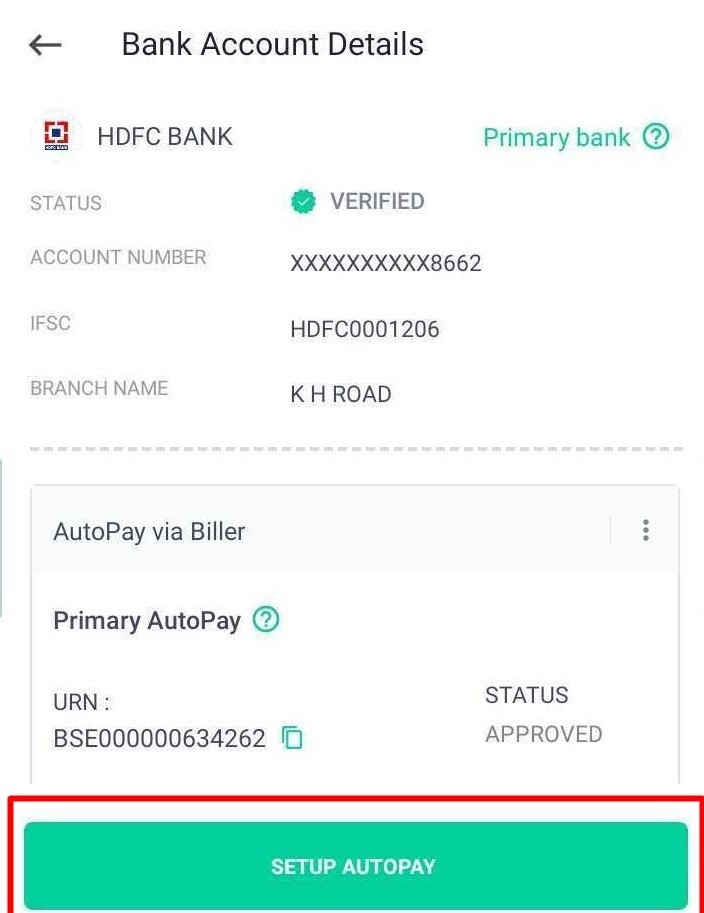

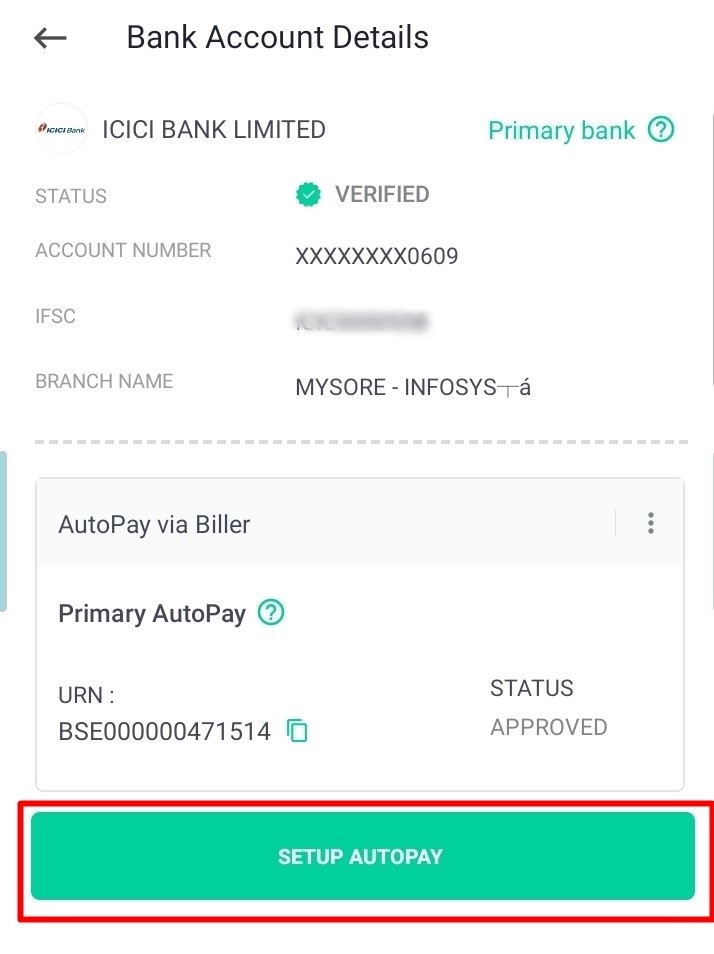

Step 1: Log in to Groww and under “You” section, click on the primary bank account and then “SETUP AUTOPAY” option.

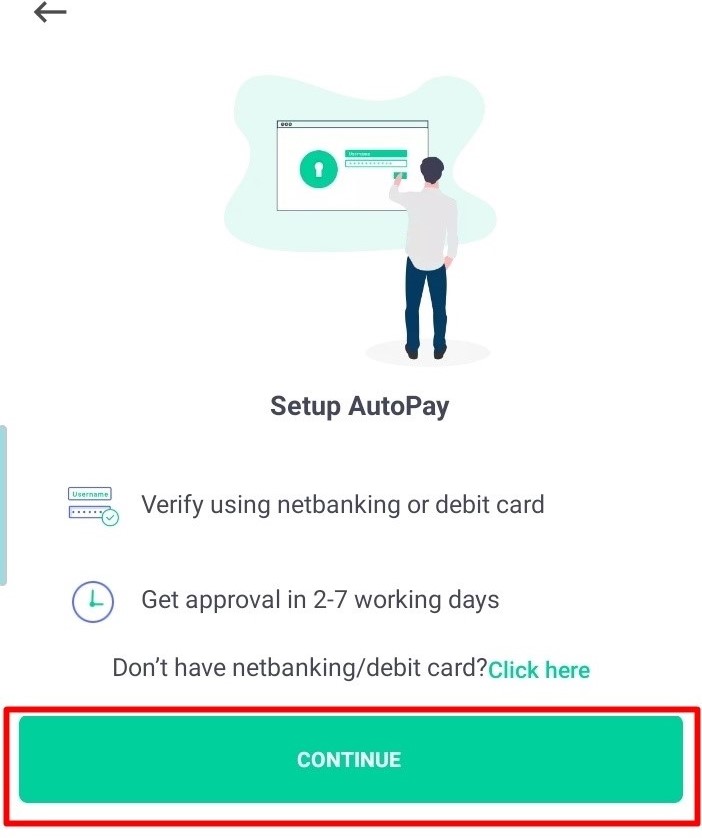

Step 2: In the next step, you will see an intermediate screen where you can click on the ‘click here’ option if don’t remember your net banking password. Else, just click on the continue button.

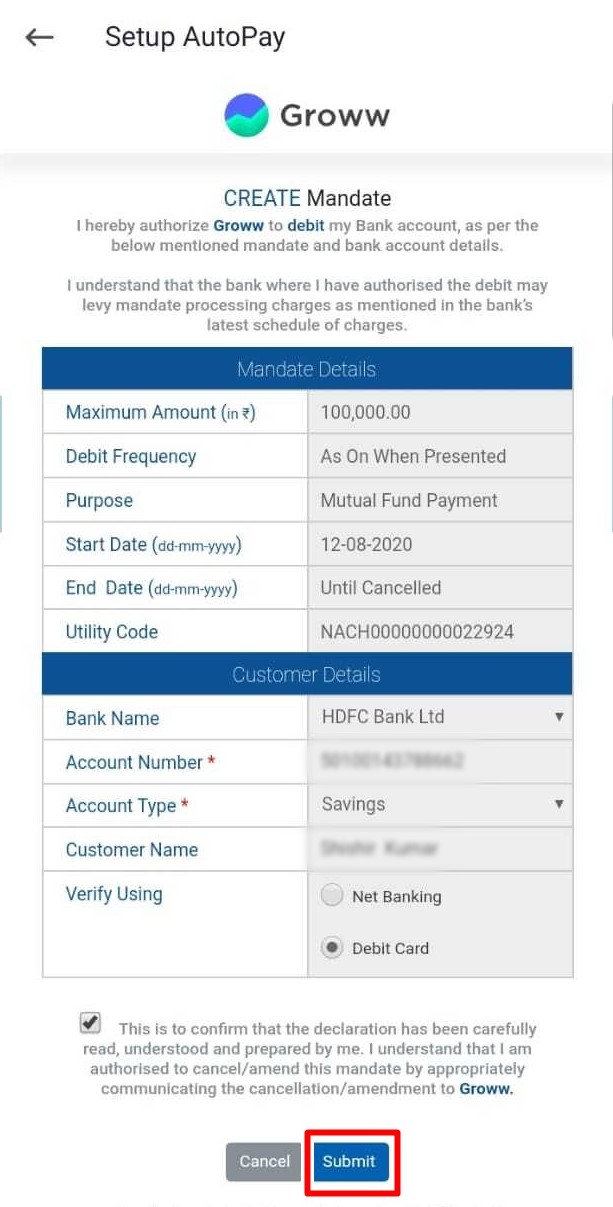

Step 3: In the next step, choose either net banking or debit card (depending on the bank) and give consent by clicking on the checkbox. In this case, we have selected Net Banking.

Step 4: Next, you will see the following screen; here you need to scroll down and check the details.

Step 4.1: After checking all the details, click on the submit button.

Step 5: Next, the screen will route to HDFC’s Net Banking page where you need to enter your credentials to log in.

Step 6: Enter the OTP sent to your registered mobile number

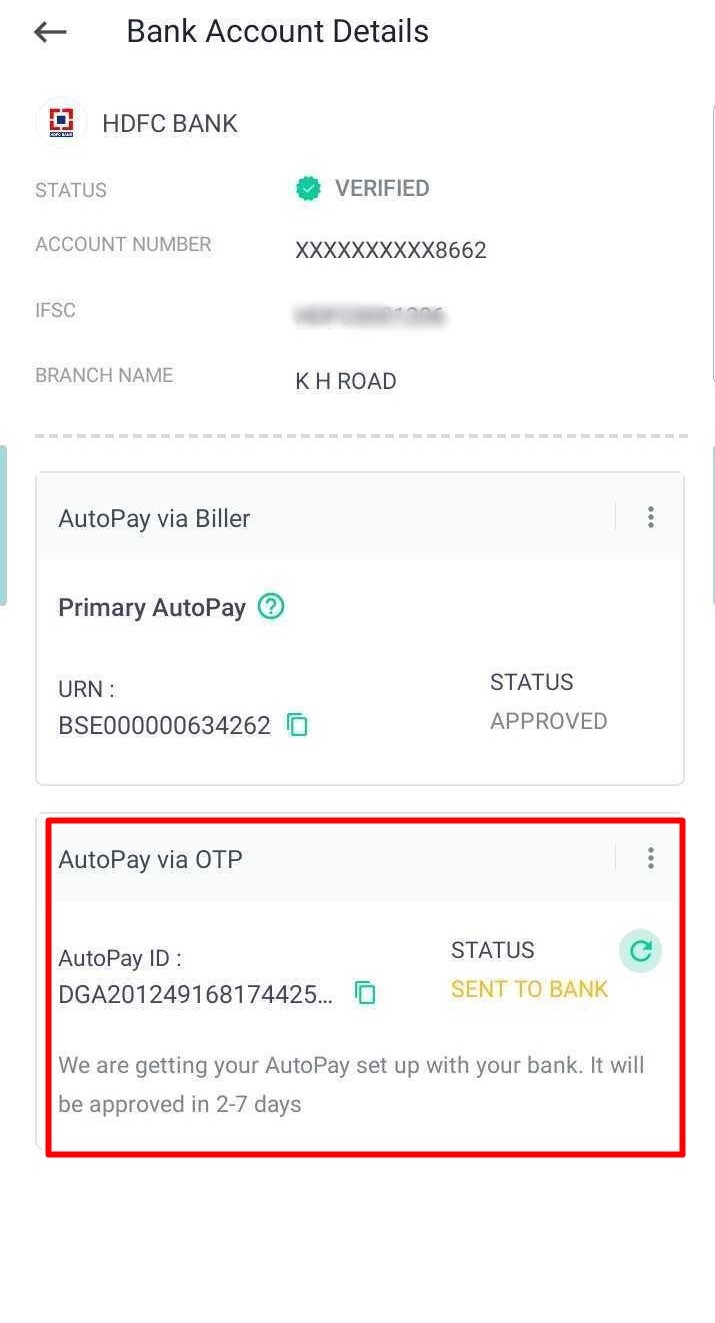

Step 6.1: You will be redirected back to Groww where you can see the success screen and the status change in the bank section.

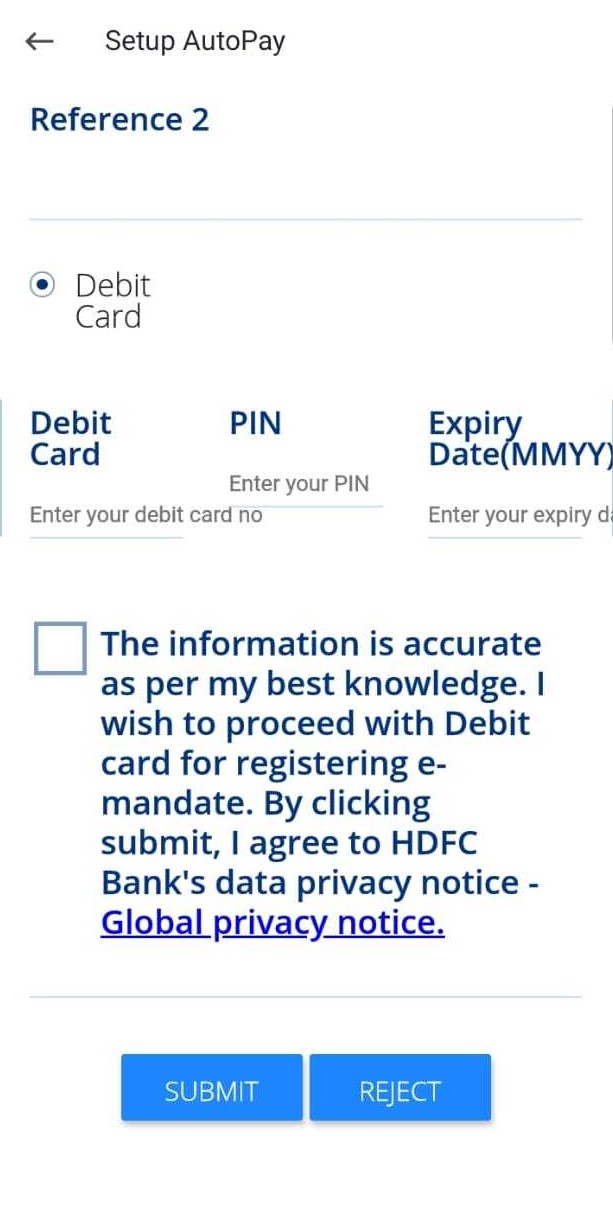

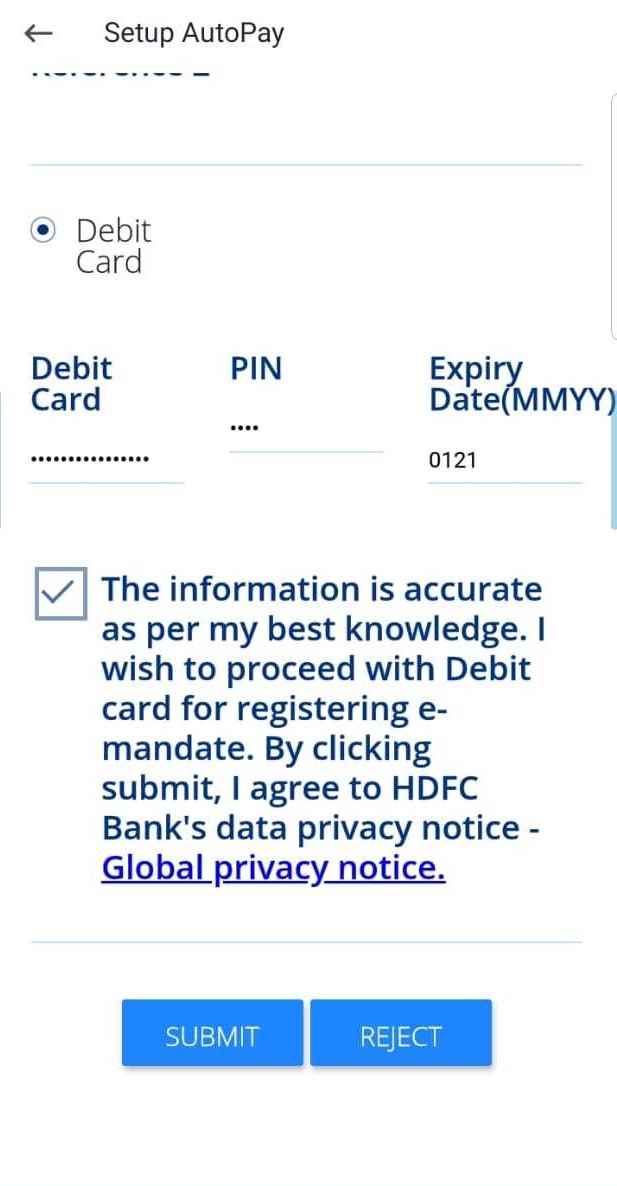

Through Debit Card

Step 1: Log in to Groww and under “You” section, click on the primary bank account and then “SETUP AUTOPAY” option.

Step 2: Click on the continue button.

Step 3: In the next step, choose either net banking or debit card (depending on the bank) and give consent by clicking on the checkbox. In this case, we have selected the Debit Card.

Step 4: Next, you will see the following screen; here you need to scroll down and check the details.

Step 5: In this step, you need to enter your debit card details like card no pin and expiry date, then click on the submit button.

Step 6: Next, you need to enter the OTP sent to your registered mobile number and then click on the verify button. Please note that as a security measure, OTP will be masked as zeroes.

Step 7: You will be then redirected back to Groww where you can see a success screen.

ICICI Bank

Through Net Banking

Step 1: Log in to Groww and under “You” section, click on the primary bank account and then “SETUP AUTOPAY” option.

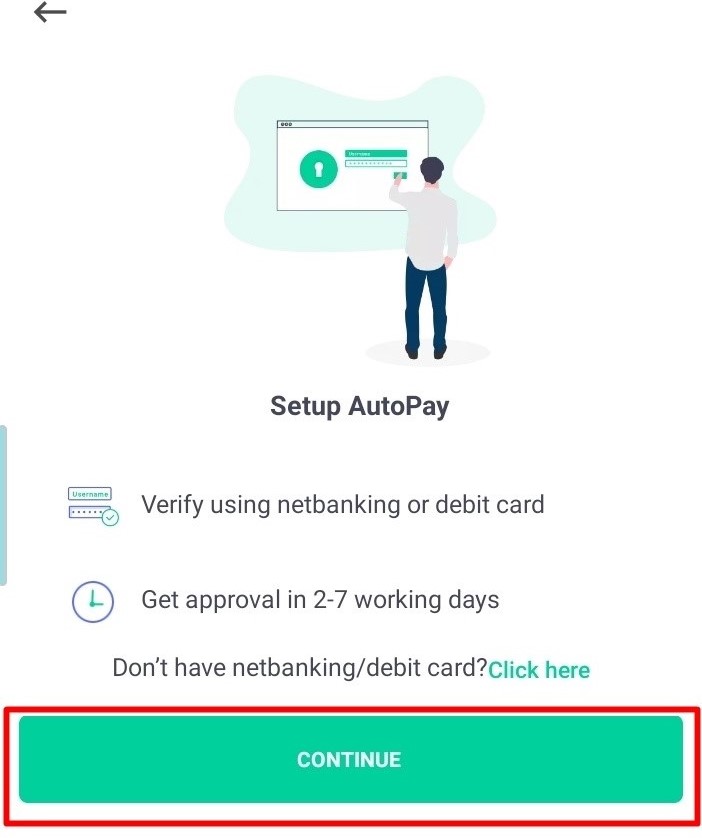

Step 2: In the next step, you will see an intermediate screen where you can click on the ‘click here’ option if don’t remember your net banking password. Else, just click on the continue button.

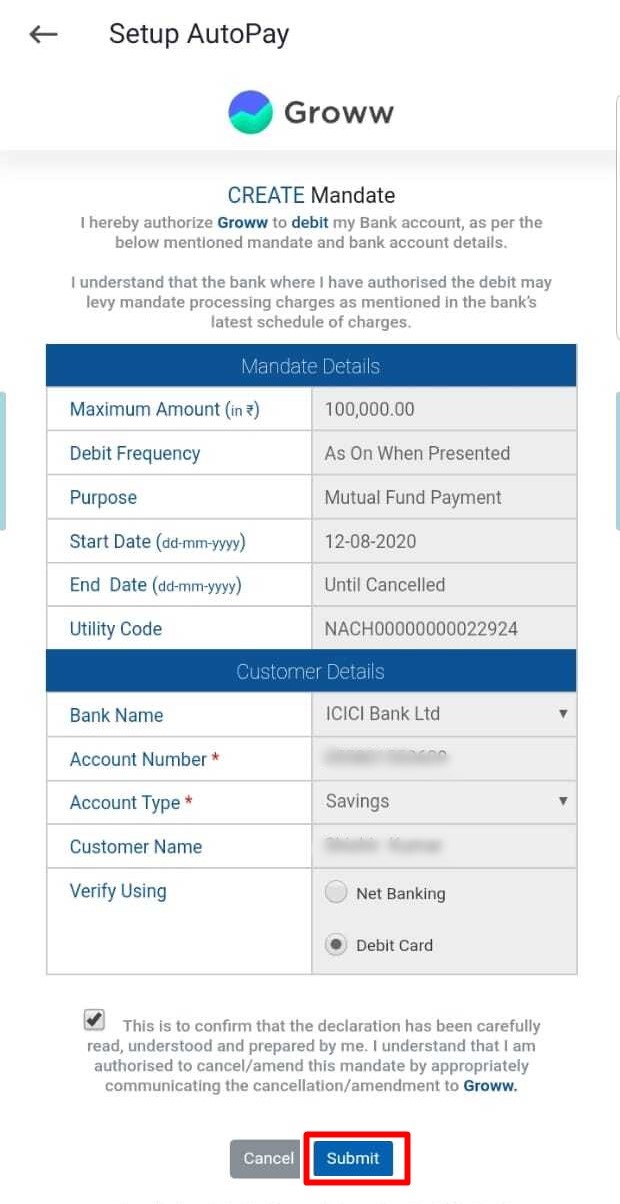

Step 3: In the next step, choose either net banking or debit card (depending on the bank) and give consent by clicking on the checkbox. In this case, we have selected Net banking.

Step 4: Once selected, it will redirect to your Bank’s net banking page.

Step 5: Enter your credentials.

Step 6: Check all the mandate details before confirmation and click on the submit button.

Step 7: In this step, you need to enter the OTP sent to your registered mobile number.

Step 8: On entering the correct OTP, it will prompt a ‘successful authentication’ message.

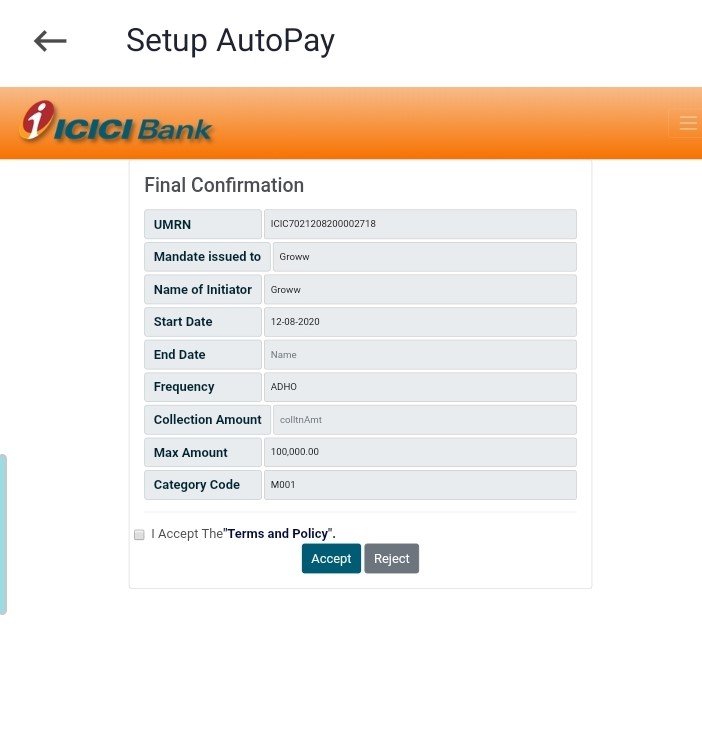

Step 9: In the next window, you will get a mandate approval automation.

Step 10: You will be redirected back to Groww where you will see a success screen and the status of the bank will be changed.

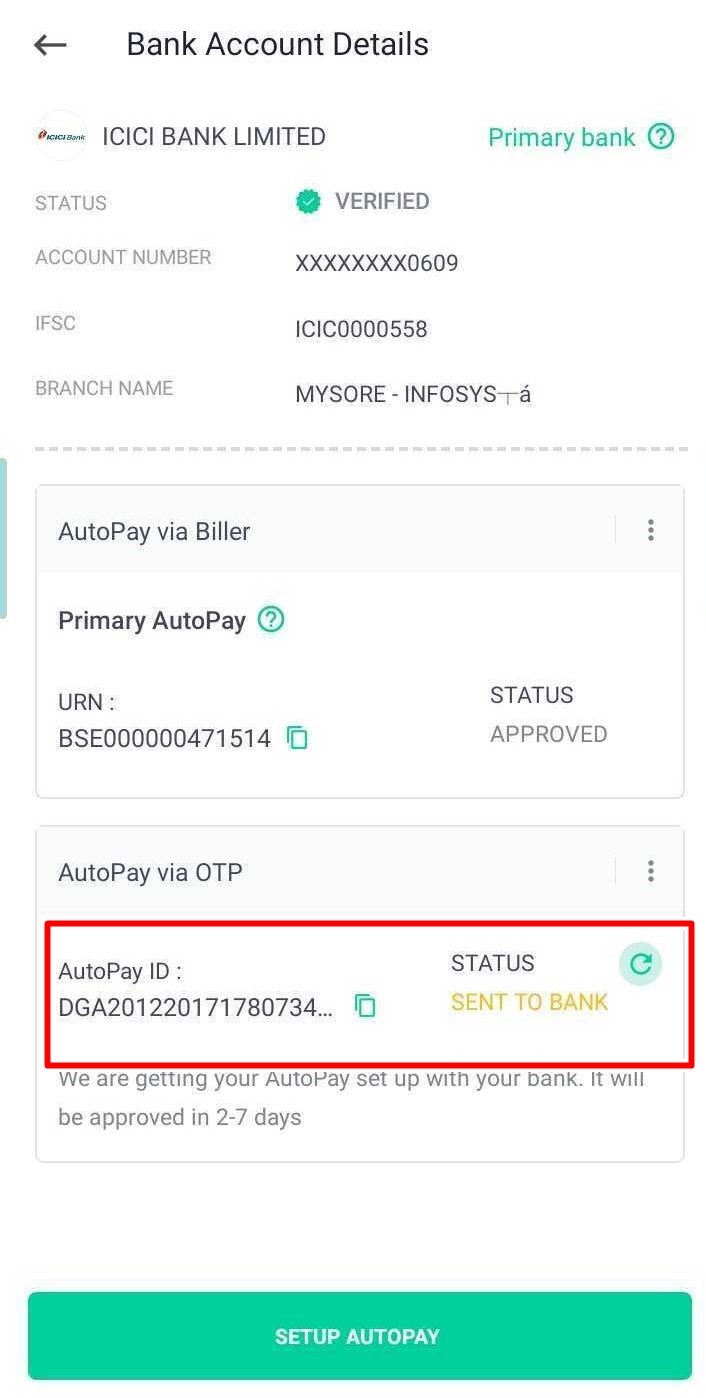

Through Debit Card

Step 1: Log in to Groww and under “You” section, click on the primary bank account and then “SETUP AUTOPAY” option.

Step 2: In the next step, you will see an intermediate screen where you can click on the ‘click here’ option if don’t remember your net banking password. Else, just click on the continue button.

Step 3: In the next step, choose either net banking or debit card (depending on the bank) and give consent by clicking on the checkbox. In this case, we have selected Debit card

Step 4: You will be then redirected to the Bank’s page where you need to enter the details like card no pin and expiry date, then click on the submit button.

Step 5: In the next step, enter the OTP sent to your registered mobile number

Step 6: Accept the terms and conditions by clicking on the accept button

Step 7: You will be redirected back to Groww where you will see a success screen and the status of the bank will be changed.

State Bank of India (SBI)

Net Banking

Step 1: Log in to Groww and under “You” section, click on the primary bank account and then “SETUP AUTOPAY” option.

Step 2: In the next step, you will see an intermediate screen where you can click on the ‘click here’ option if don’t remember your net banking password. Else, just click on the continue button.

Step 3: In the next step, choose either net banking or debit card (depending on the bank) and give consent by clicking on the checkbox. In this case, we have selected Net Banking.

Step 4: Next, the screen will route to SBIs Net Banking page where you need to enter your credentials to log in.

Step 5: Check the payment details and click on the accept button after clicking the terms and conditions checkbox

Step 6: Enter the OTP received and click on confirm

Once you click on the confirm button, you will be redirected back to Groww where you will see a success screen and the status of the bank will be changed.

You can anytime check the status of your mandates from You → Bank section

How To Upgrade To Groww AutoPay

Upgrading to Groww AutoPay has to be done for SIPs individually.

Step 1: Choose the specific SIP from your mutual funds dashboard for which you want to upgrade to Groww AutoPay. You may see the prompt to upgrade to Groww AutoPay when you are viewing the details of any SIP.

Step 2: Select ‘Upgrade to Autopay’ and ‘Confirm’ your request.

Step 4: The next screen will show that your autopay request is pending.

Step 5: You can see the status when you are viewing the details of the SIP.

What To Do Once I Have Submitted My AutoPay Request?

Once the AutoPay request is submitted successfully, just sit back and relax. It might take up to 2-3 working days. If it takes longer than this, please reach out to us, we will be happy to help.

Please note, the Autopay limit is of Rs 1 Lakh as it is based on the industry standard, however, only the specified SIP amount will be deducted. While it depends on the bank in question, the autopay creation usually takes 2-3 days for approval from the user’s bank.

Also, please keep in mind that Groww will deduct the SIP amount from your bank account one day prior to the SIP due date.

So this is how easy it is to create an Autopay on Groww to make your investments systematic. For any queries or follow up questions on the autopay process flow, you can write to us at [email protected] and we will be happy to assist you promptly.

Happy Investing!