Groww F&O SafeGuard: Protecting Your Financial Well-Being

At Groww, we are dedicated to ensuring our users' financial well-being. We are building a series of products and tools to help enable responsible trading. Since each trader’s risk threshold and capacity are different, it’s crucial to ensure that they trade within safe limits, especially with the risks associated with Futures and Options (F&O) trading. To protect users from significant trading losses, we have introduced a new safeguard where we will ask users with extreme losses to provide additional income proof to ensure continued trading is right for them. While most traders self-regulate, there are a small number of traders who might be affected by the below. Here’s a detailed look at this process for those who are affected.

What Is the New F&O Trading Safeguard of Groww?

The safeguard is a measure designed to protect users who have experienced significant losses in their F&O trading. When we detect that your F&O trading losses have surpassed a safe limit based on your overall activity on Groww, you will receive a warning and will be asked to provide an income proof document to continue trading. Safe limit is different for different users. This limit is based on our best attempt to estimate an individual's safe level.

Why Are We Implementing This Safeguard?

At Groww, we strive to be a responsible broker, always prioritizing the well-being of our users. We are committed to doing right by our customers because we genuinely care about their financial success and security. The world of F&O trading can be volatile and high-risk. While the potential for profit is high, so is the potential for loss. To prevent users from trading beyond their financial capacity, we’ve set up this safeguard to:

- Protect Your Financial Stability: Ensure you are not risking more than your safe limits. This will help you preserve your investment capital for sustained growth.

- Promote Responsible Trading: Encourage sound trading practices and decision-making.

How It Works

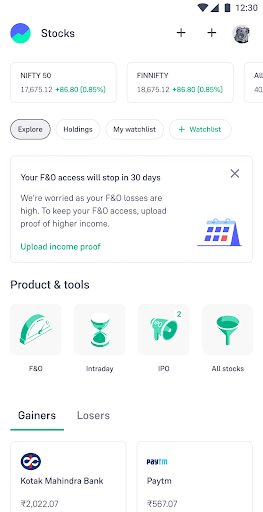

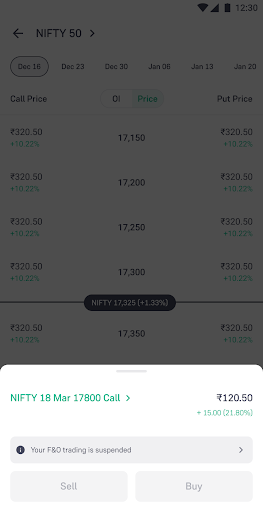

1. Early Warning: When we detect that your F&O trading losses have been significant, you will receive an early warning notification. This is a proactive measure to alert you before your trading reaches a concerning level.

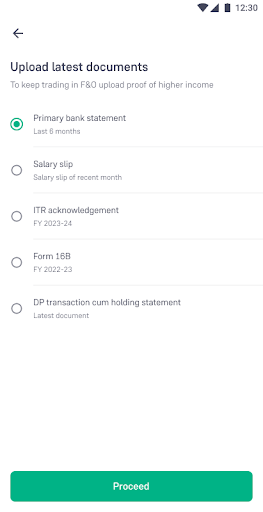

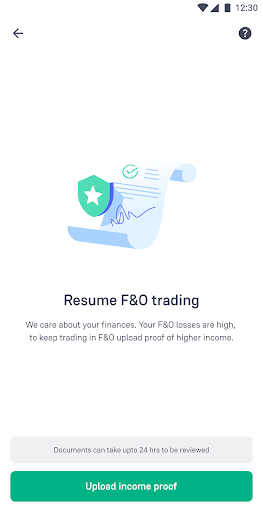

2. Document Submission: To continue trading in F&O, you will be asked to submit an income proof / financial document. This helps us reassess your financial capacity and ensure that you are trading within safe limits. You will have 30 days to submit the required documents.

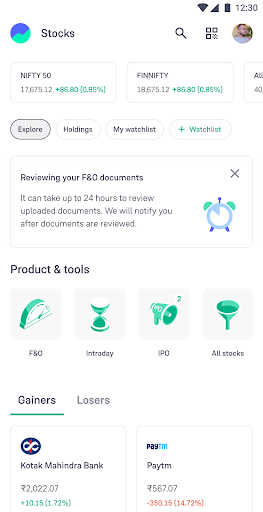

3. Review Period: Once you upload your document, our team will review it promptly. If the document is approved, you can continue trading without interruption. If not, we will guide you on the next steps to ensure compliance.

4. Access Stopped: If the necessary documents i.e, Form 16/ last 6 months bank statement/ Income Tax returns/ DP holdings or Salary slip are not submitted within the 30-day period, your F&O trading access will be stopped. This measure is in place to prevent further financial losses and protect your overall investment health. However, yor access to other products except F&O, e.g. Mutual funds, Stocks, will remain open.

5. Access Open: Even after your F&O access is stopped, you will still be able to go through document submission and its review process. If the document is approved, you will be able to resume trading in F&O.

Thank you for your understanding and cooperation. As always, we are here to support you on your financial journey with Groww. If you have any questions or need further assistance, please don't hesitate to reach out to our customer support team.

Happy Investing!

The Groww Team