How to Apply for a HUF PAN card?

If you are an HUF (Hindu Undivided Family) entity, you need an HUF PAN card to carry out all financial activities, such as filing ITRs to save on taxes, opening an HUF demat account for trading and investing, etc.

In this blog, we’ll explain everything about the HUF PAN card and how to apply for it.

Read More : Hindu Undivided Family (HUF): A Smart Way to Save Income Tax

What is a HUF PAN Card?

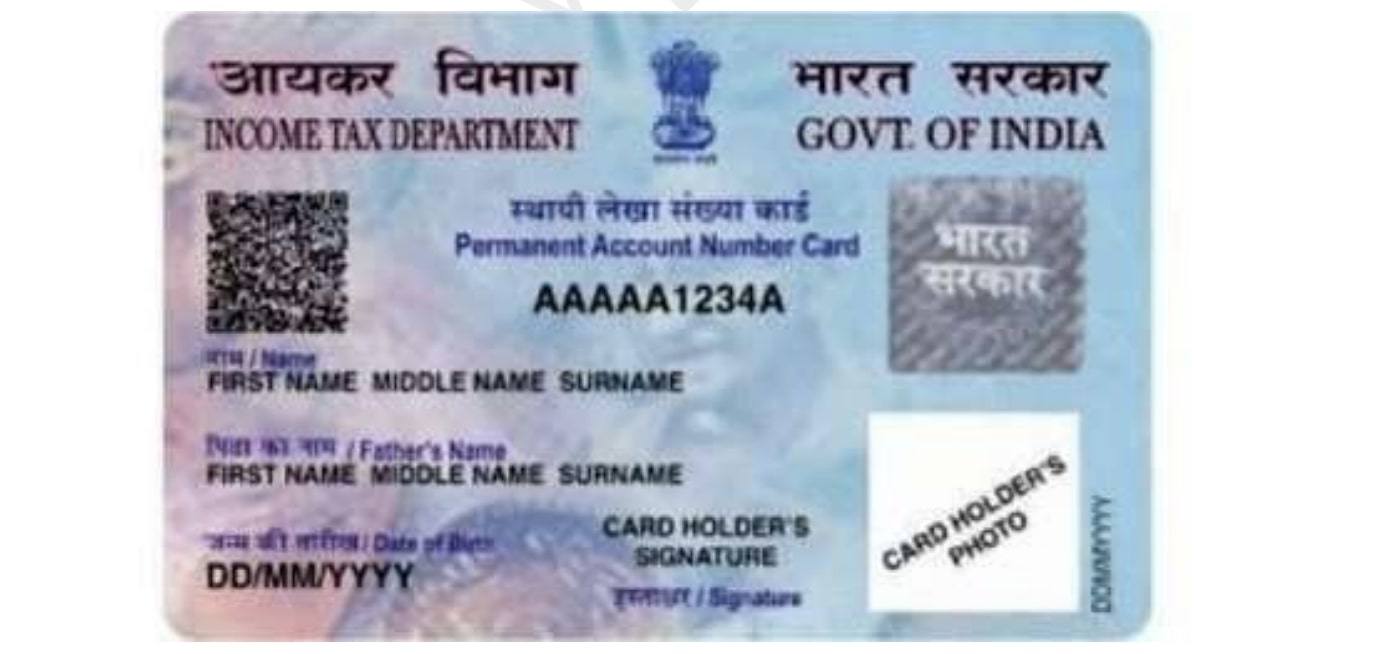

HUF PAN Card is issued by the Income Tax Department of India in the name of the Karta, the head of the HUF. It consists of a ten-digit unique alphanumeric number.

- The first three characters denote the alphabetic series from AAA to ZZZ

- Fourth character of PAN represents panholder status, i.e., "H" for Hindu Undivided Family (HUF)

- The fifth character shows the first character of the PAN holder's surname/last name.

- The last four characters are sequential numbers from 0001 to 9999.

Documents Required to Apply for HUF PAN Card

Below are some of the documents required to apply for an HUF PAN card.

- HUF Deed (Optional)

- HUF Affidavit, stating name, the father’s name, addresses of all the coparceners, date of application, and confirmation that HUF has been formed.

- For Identity proof, address proof, and DOB proof, a copy of any of the following documents bearing the applicant’s name:

- Aadhaar card

- Elector’s photo identity card

- Driving License

- Passport

- Ration card

- Electricity bill, Landline telephone or Broadband connection bill, water bill (Not more than three months old)

Also Read: What is HUF & Benefits? | How to Open Demat Account for HUF - A Step by Step Guide

How To Apply for a HUF PAN Card Online

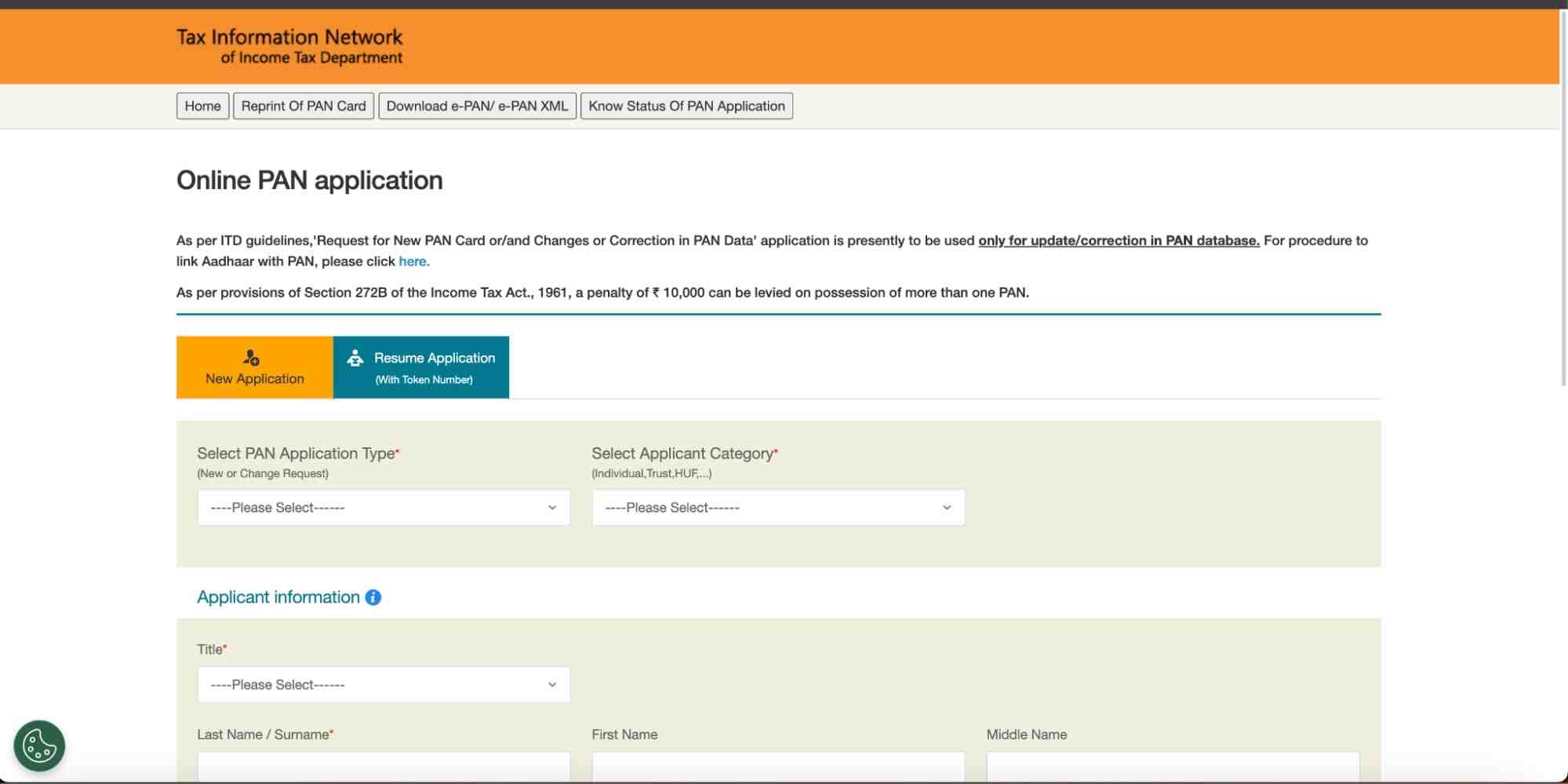

Here is the step-by-step procedure to apply for an HUF PAN card online.

- Visit the NSDL website here.

- Select

- “New PAN” under “Select PAN Application Type.”

- “HINDU UNDIVIDED FAMILY” under “Select Applicant Category.”

- “M/s” under “Title.”

- Enter the complete HUF name under “Last Name / Surname.” For instance, Ram Kumar HUF.

- Mention HUF incorporation date under “Date of Birth / Incorporation / Formation (DD/MM/YYYY)”

- Enter your Email ID and mobile number.

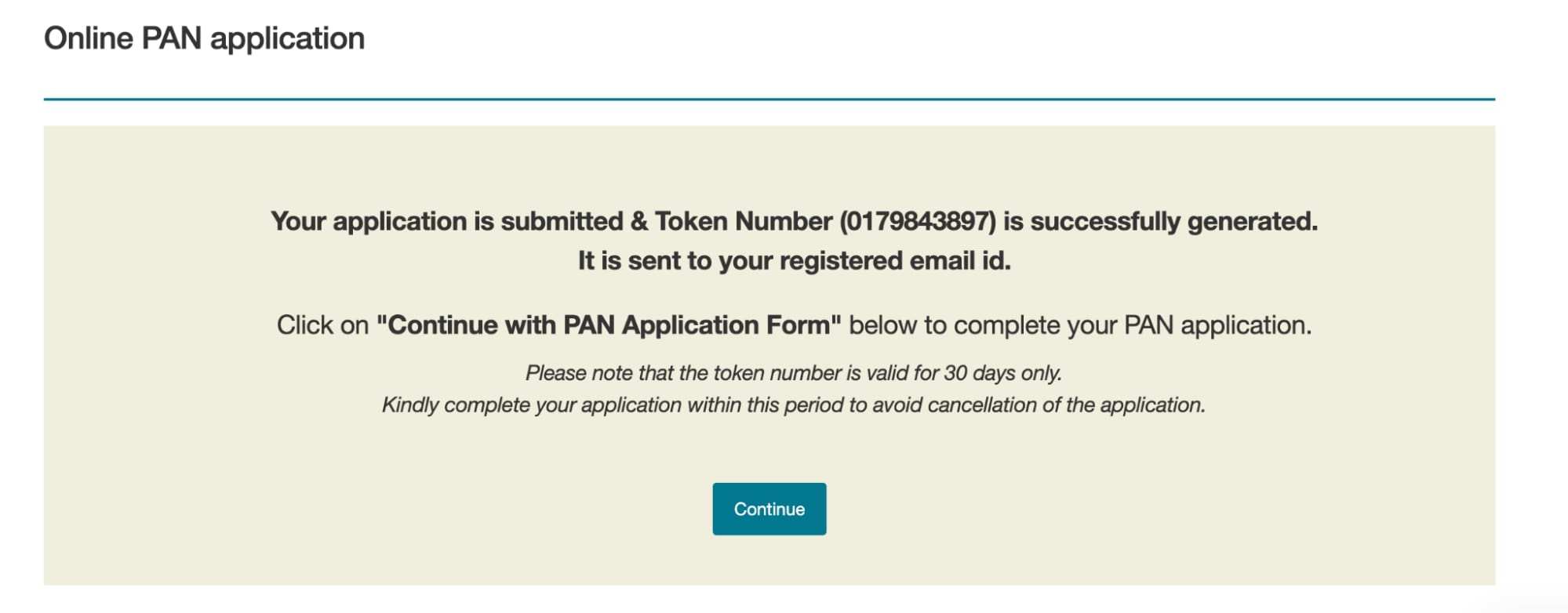

- A temporary token number will be generated, valid for 30 days. Ensure that you complete the remaining PAN application form within the timeframe.

- Fill PAN Application online and courier/speed post application along with supporting documents, will be auto-selected as the online procedure is unavailable for HUF.

- If a physical PAN card is required, click “Yes” (fee applicable) or “No.”

- Verify the details and click “Next.”

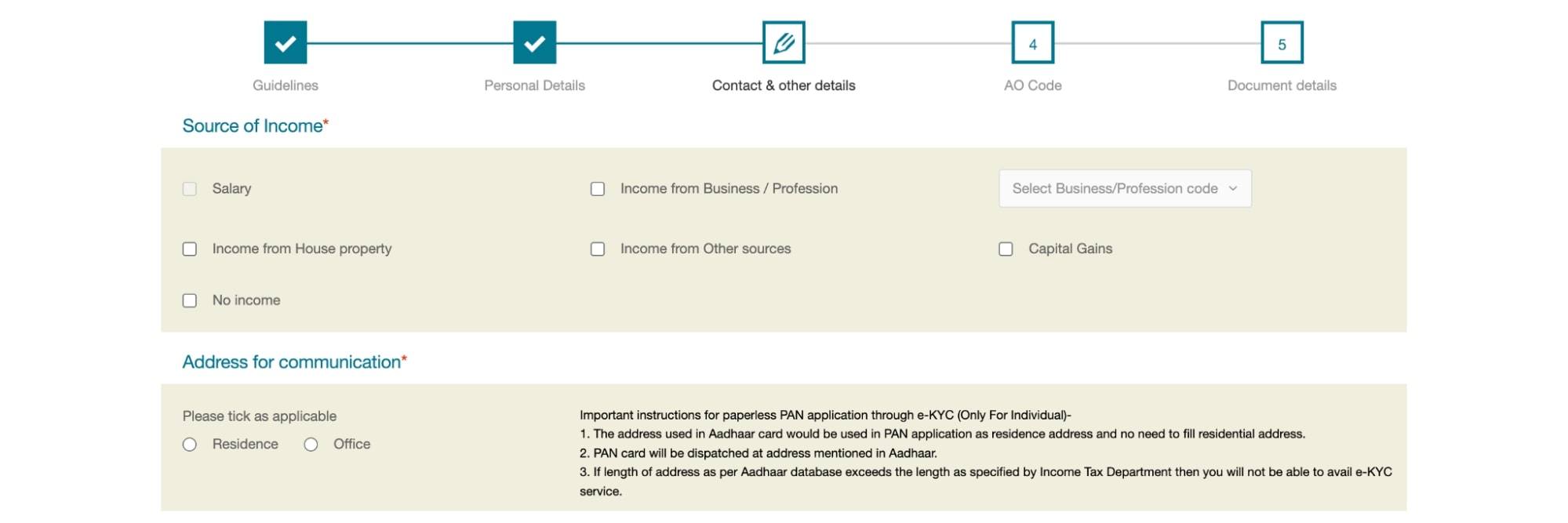

- Select

- Source of Income

- Address for communication, whether residence or office. Enter the address accordingly.

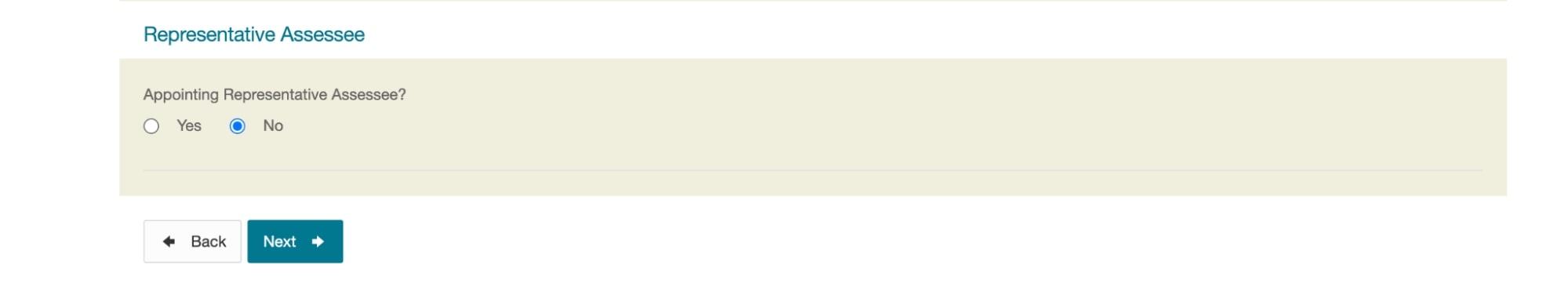

- Under representative assessee, click “No.”

- Click “Next.”

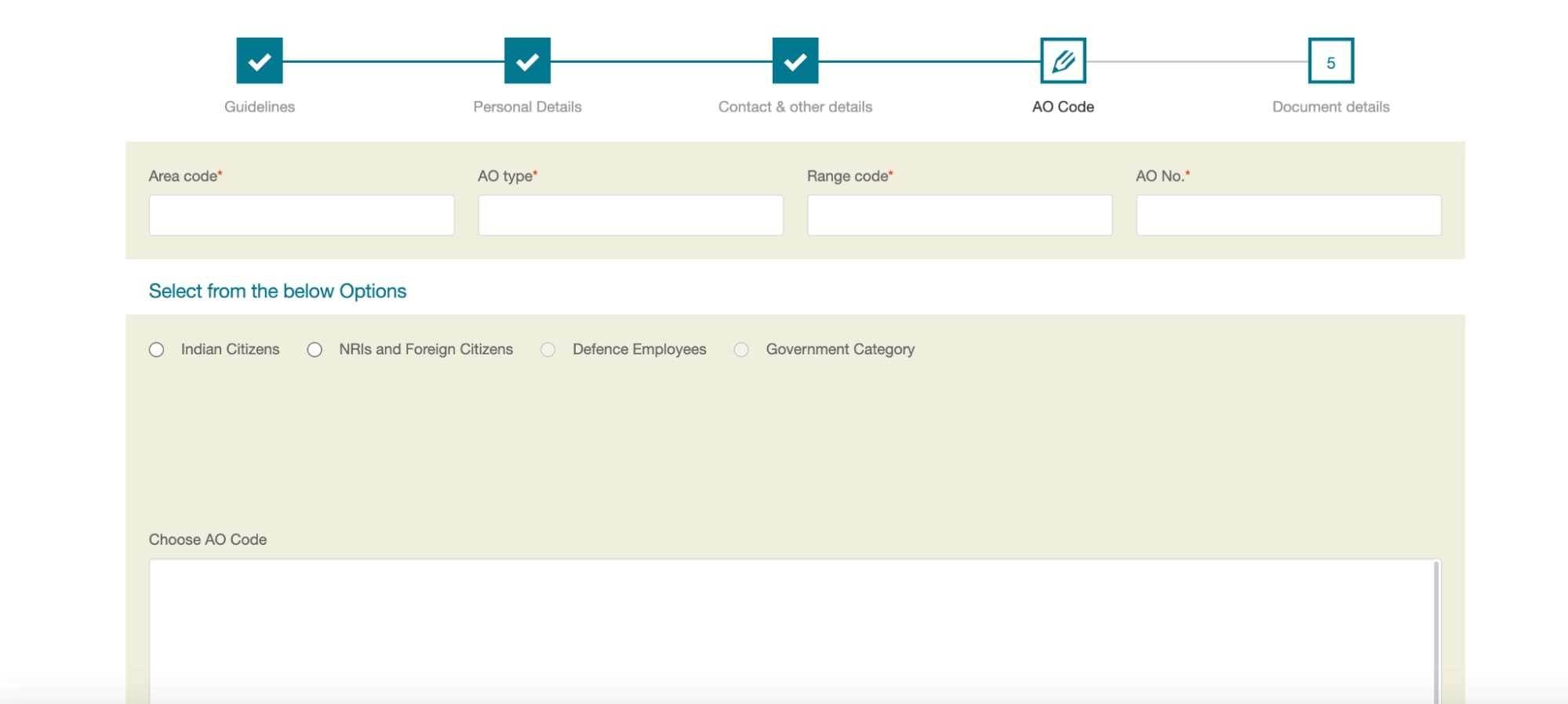

- Now, you need to fill in the AO code; to find out the same, click Indian Citizens, your state, and city.

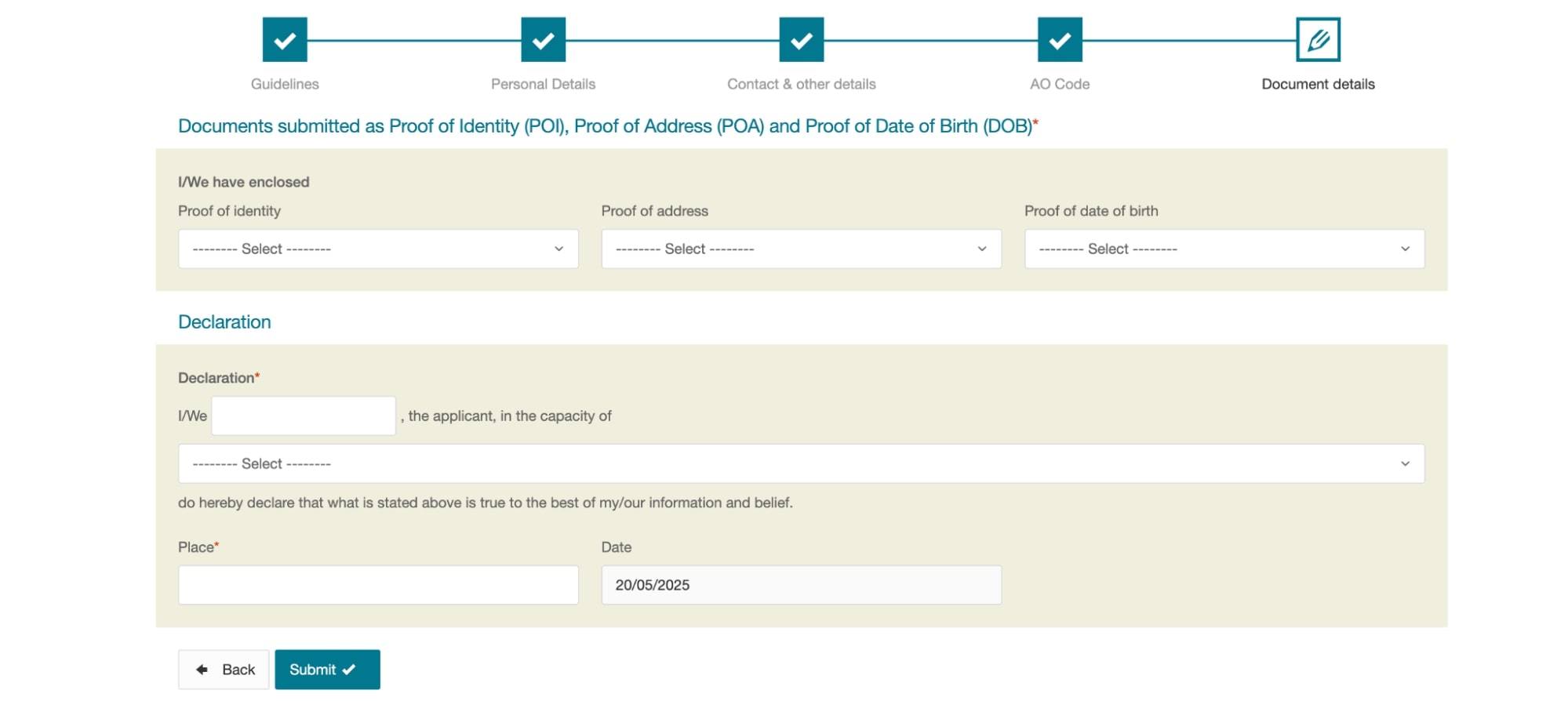

- Select proof of identity, address, and date of birth. You can select the Aadhar card for all. Then, fill in the declaration and click “Submit.”

- Select the mode of payment and pay the amount.

- Complete Aadhaar authentication. After successful completion, a PDF file will be generated, including all the details you have filled in the entire application. Take a printout of the PDF.

- Finally, you’ll receive an email including the office address where you need to courier the duly signed PDF by Karta along with required documents, such as Affidavit, identity proof, etc, via Speed Post.

Post-Application Steps

After applying for HUF PAN card, you’ll receive an acknowledgement number, which you can use to track the PAN status using the following methods.

-

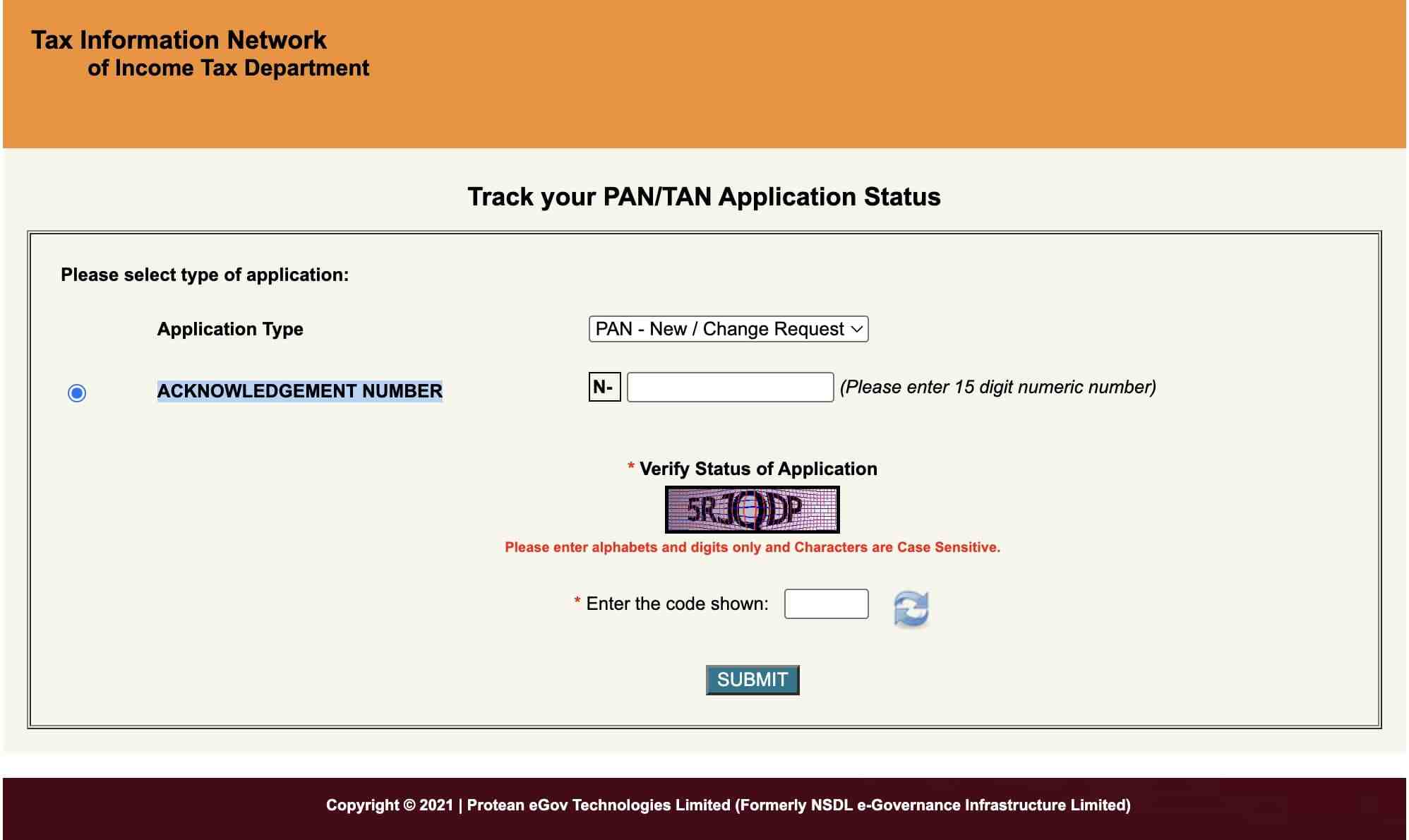

Via TIN NSDL

- Click here to visit the tracking page.

- Select “PAN” under “Application Type.” Enter acknowledgement number, verify captcha and click submit.

-

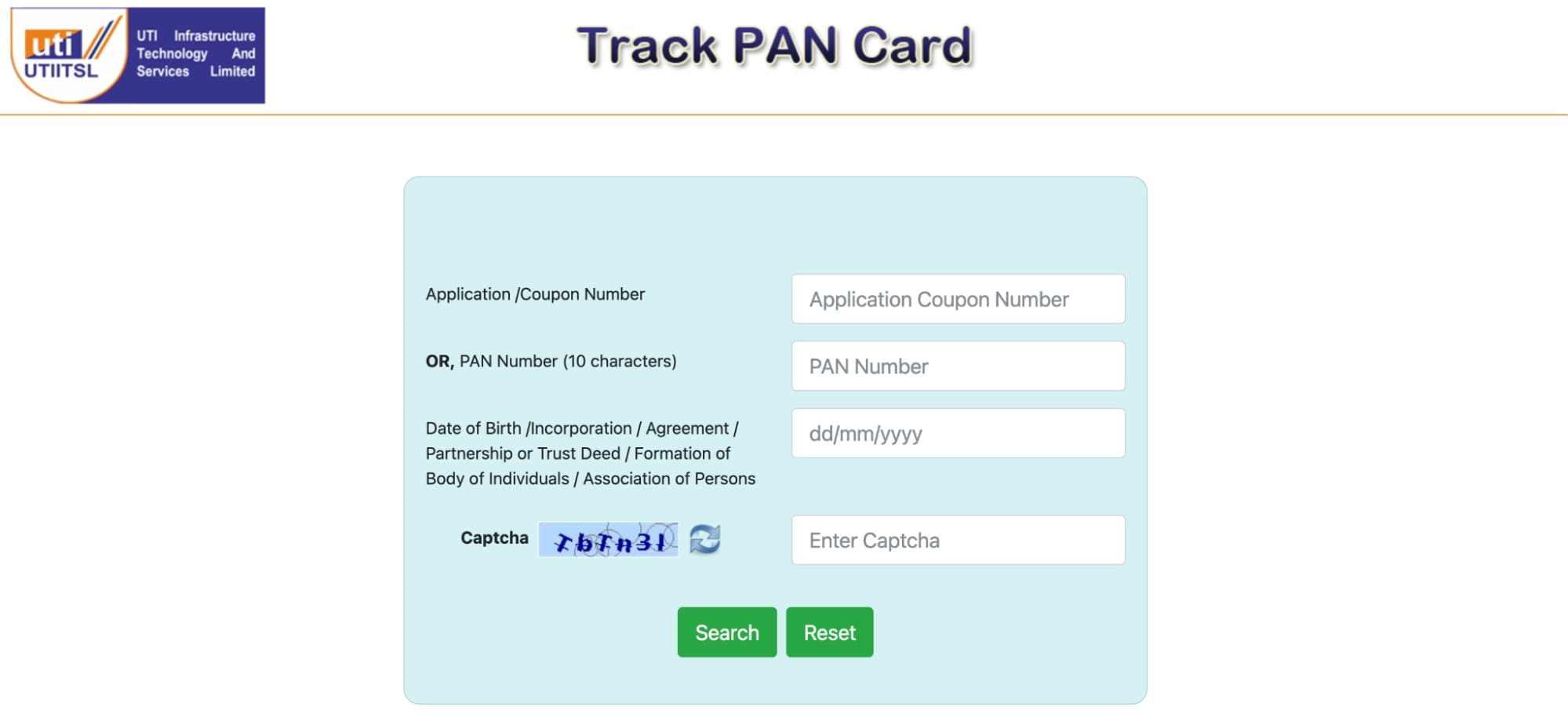

Via UTITSL

- Click here to visit the tracking page.

- Enter all the required details, verify captcha and click submit.

Also Read : Difference Between Individual and HUF Demat Accounts | How to Open a Demat Account for Partnership Firms & Required Documents?

A HUF PAN card is a Permanent Account Number issued by the Income Tax Department in the name of a HUF. It is used for filing income tax returns and conducting financial transactions in the HUF's name.