Investing in silver made simpler with Groww Mutual Fund’s latest offering: Groww Silver ETF

Groww Mutual Fund has introduced a new offering: Groww Silver ETF, an open-ended exchange-traded fund that replicates the domestic price of physical silver.

The ETF aims to offer investors a convenient and efficient way to invest in silver, without the need for physical storage, insurance or direct ownership.

The NFO period for the scheme is between May 2 and 16, 2025.

What is Groww Silver ETF?

Groww Silver ETF is designed to track the domestic price of physical silver. It is based on the daily spot fixing price published by the London Bullion Market Association (LBMA).

By investing in dematerialized units of silver through this ETF, investors can participate in the silver market in a simple, transparent, and potentially liquid manner via the stock exchange.

Reasons to consider Groww Silver ETF

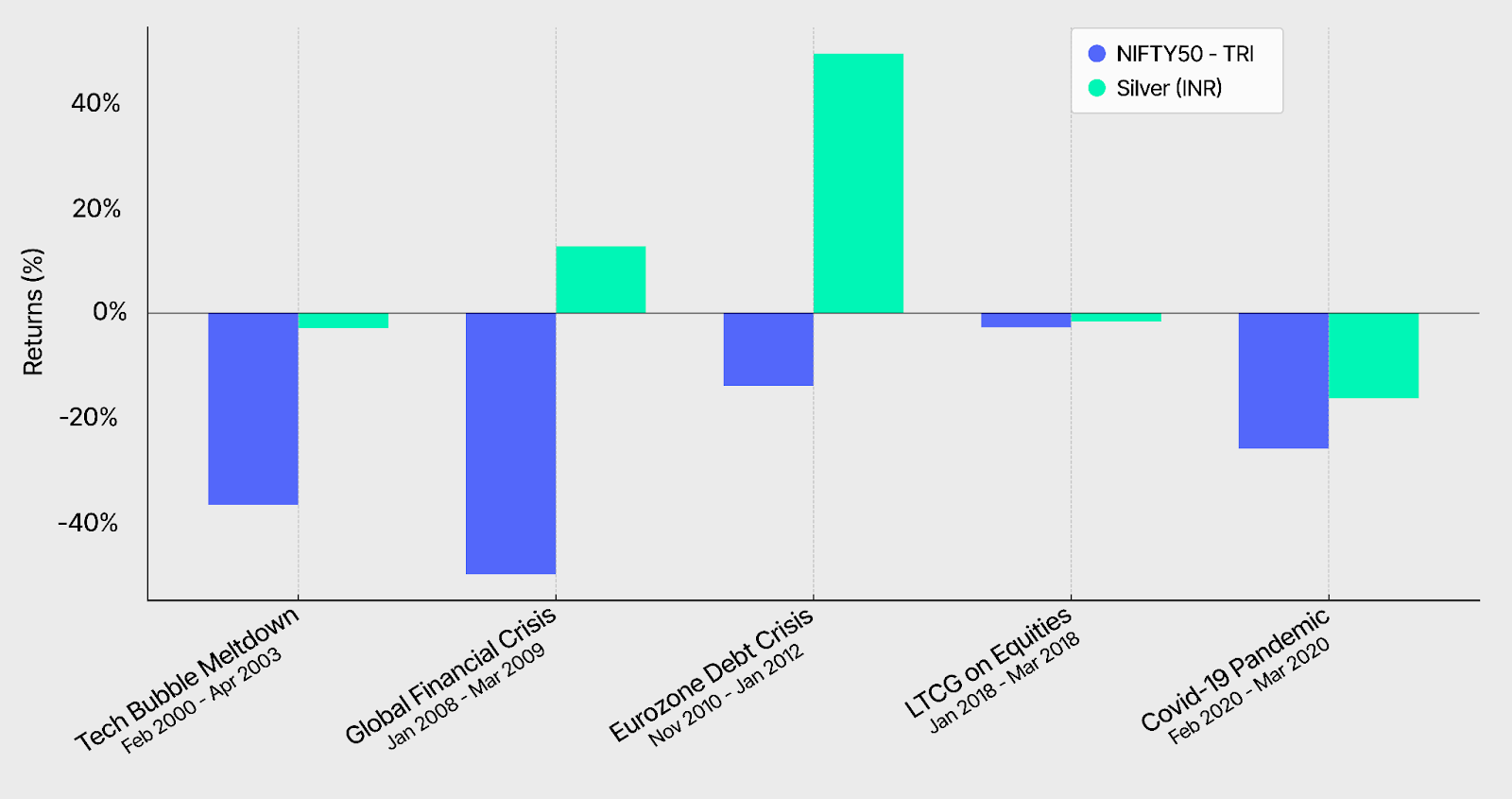

Low correlation with equity markets

Silver has historically shown a low correlation with equity markets. This means that its price movements may be independent of stock market trends, offering a potential diversification opportunity for investors.1*

Source: NSE, Bloomberg, data as on April 10, 2025

Past performance may or may not be sustained in future and is not a guarantee of any future returns.The above is the performance of the index and does not in any manner indicate the performance of any individual scheme of the mutual fund. Please consult your financial advisor before investing.

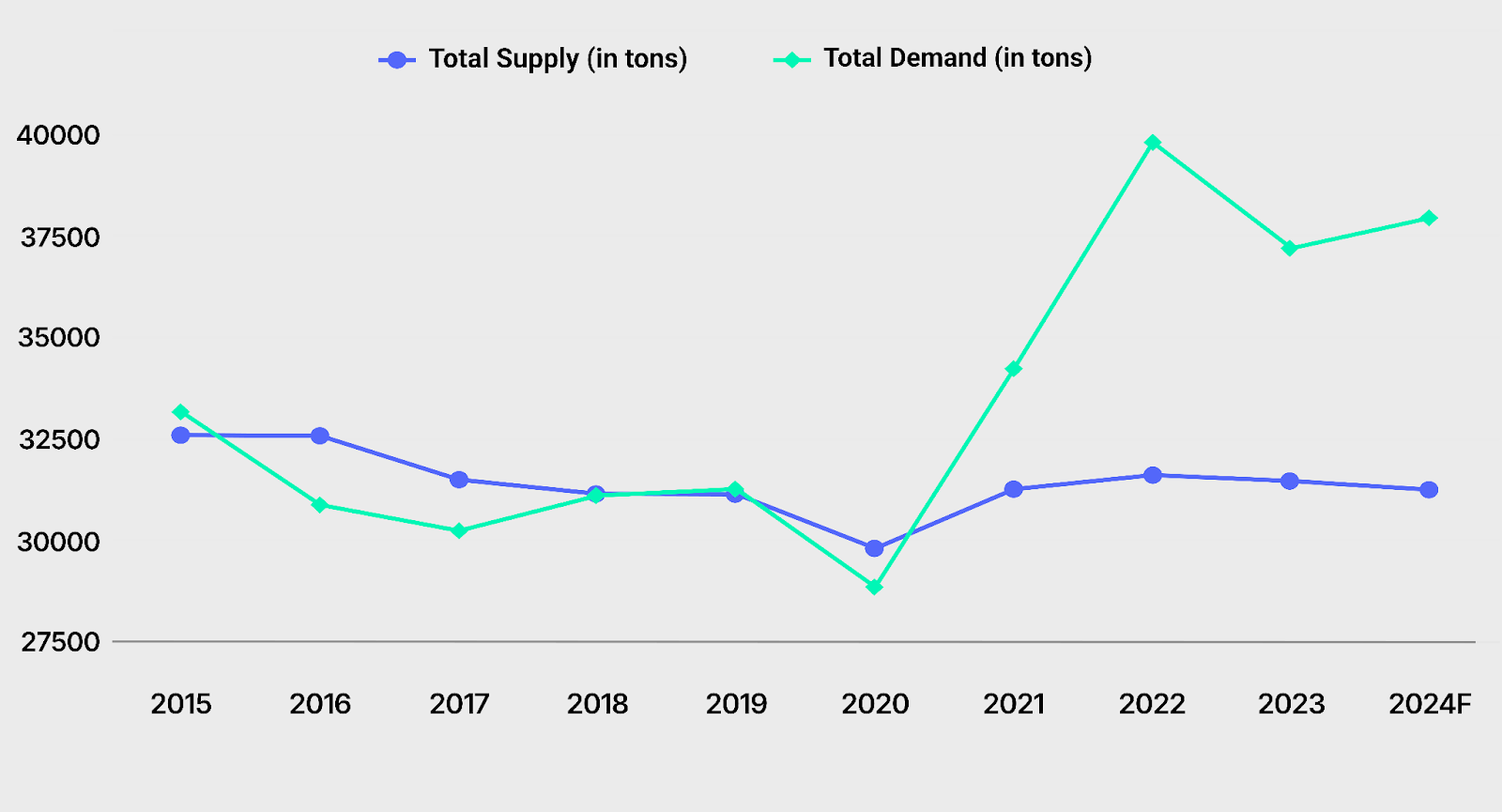

Demand and supply dynamics

Global demand for silver exceeded supply in 2024, driven by increased usage in electronics, electric vehicles, and renewable energy sectors. These trends may continue to influence silver’s long-term pricing.2*

Source: Silver Institute, April 30, 2025

Favorable valuation

The current gold-to-silver ratio stands at 91.64, suggesting that silver may be relatively more affordable compared to gold. This ratio can be a factor to consider when evaluating entry points into the precious metals market.3*

Potential liquidity

Investors can buy or sell units of the Groww Silver ETF on the stock exchange during market hours, offering flexibility and ease of access through a demat account.

The Groww Silver ETF may be considered by investors seeking long-term capital appreciation through commodity exposure, offered in a simple and convenient format. The scheme requires a minimum investment amount of ₹500 and in multiples of ₹1 thereafter. It carries no exit load, providing added flexibility for investors. The fund is managed by Mr. Wilfred Gonsalves.

Please consult your financial advisor before investing.

* Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Source 1: NSE, Bloomberg, April 10, 2025

Source 2: Silver Institute, data as on April 09, 2025

Source 3: NSE, Bloomberg, data as on April 10, 2025