What Are Black Swan Events in Financial Markets?

Usually, we see only white swans. It is very rare to see a black swan. This is the same analogy used in the financial markets. A black swan event is a rare, unpredictable occurrence in the stock market that can have a massive impact on most traders. These events have a very low probability of occurring, but if they do, they can trigger massive price swings. It is important to note that, though black swan events have a negative connotation, they can also unexpectedly lead to massive profits for traders.

Some examples of black swan events are:

- Global financial crises

- Sudden geopolitical conflicts

- Pandemics

- Flash crashes

- Unexpected regulatory or political shocks

There is a common theme in these black swan events. When there is a sharp crash or upward move, volatility usually increases, and liquidity breaks down.

Understanding Tail Risk in Trading

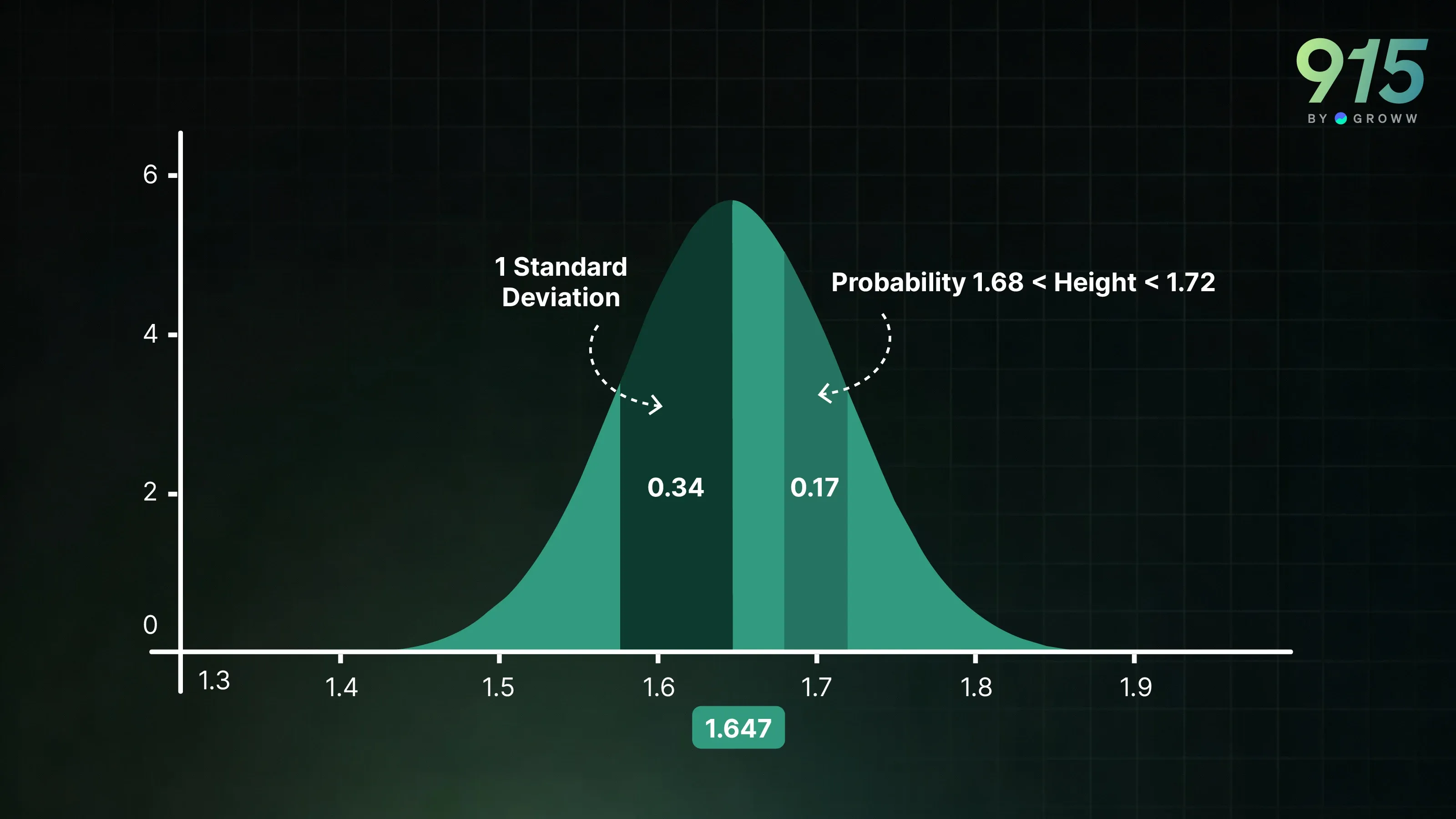

A little bit of statistics. There are many events which are assumed to be “normally distributed”. For example, in a room of 100 people, if they are asked to stand in a queue by height, there is a good chance that 80-90% will have an average height of 165-170 cm. 5% are either very tall or very short.

We can use the standard deviation from the average to estimate the distribution's probability. So if a new person enters the room, we can predict their height based on this phenomenon. However, the tails of both sides of the spectrum still exist.

Even though very rare, it is perfectly possible that the new person who enters is extremely tall (200 cm) or extremely short (140 cm). This is where the concept of tail risk arises. Tail risk is the set of extreme outcomes that can occur in any return distribution.

From a trading perspective, it refers to the risk of a very large, rare but devastating loss. Again, even though it is most often assumed to be a loss, this rare occurrence can be profitable too. For example, if a trader had taken a short futures position and the market suddenly fell by 10%, the trader would make multi-fold returns in a few seconds.

While creating strategies, most traditional trading models assume:

- Markets move normally

- Extreme moves are rare and manageable

However, reality is different. The markets have historically exhibited fat tails, meaning extreme events have occurred more frequently than expected.

Why Options Trading Is Highly Exposed to Tail Risk

Option writing can have massive tail risk. This is because, theoretically, option writing has unlimited loss potential. Moreover, it is a highly leveraged product, which makes it even more susceptible to large movements.

Let's take an example. Let's assume that Nifty is at 26000. A trader short sells an out-of-the-money put option 25500 PE for ₹20. He checks that historically this option had moved around 25%, so to be safe, he keeps the stoploss at 30%. So the stoploss is 20 x (1.3) = 26.

The next day, external news led to a 2.5% gap-down in the Nifty. So Nifty opens up at 25350. This gap-down can push the 25500 PE to around ₹150. The trader who kept a stoploss of 26 has just been stuck with a very tough situation where he is losing ₹130 / lot.

This one move can wipe out months or years of gain in 1 shot.

Common Option Strategies Vulnerable to Black Swan Events

The traders should ensure that risk is under control at all times. Some strategies that appear safe but can lead to huge losses during black swan events are:

1. Short Straddles and Strangles

- These are based on benefiting from low volatility

- But these strategies are prone to suffering massive losses during volatility spikes

- Since they are partially hedged, they are highly exposed during sudden market crashes

2. Naked Option Selling

- This gives good profits if the markets are rangebound

- However, they have unlimited or very high risk

- Moreover, as volatility increases, margins expand as well, which can lead to a crisis. This can often lead to forced exits at huge losses

These strategies perform well most of the time, but fail spectacularly during tail events.

Market Psychology During Black Swan Events

Black Swan events are quickly escalated because they become psychological events. As soon as a black swan event occurs, it can trigger a domino effect. Some typical market behaviour observed during black swan events is:

- Panic selling

- Liquidity vanishes

- Bid-ask spreads widen

- Volatility explodes

- Risk models fail

The worst part is that retail traders can incur losses, leading to margin calls and the forced liquidation of positions. The traders are unable to exit at their expected prices, which can lead to big losses.

Volatility: The Real Enemy in Options Trading

One of the core phenomenon which is accompanied by every black swan event is a rise in volatility. Here are the steps:

- There is a rise in implied volatility

- This leads to the options premium exploding significantly

- This leads to Greeks behaving non-linearly.

So during a black swan event, we notice Greeks change. Some of the key impacts are:

- Vega risk becomes dominant

- Delta changes rapidly

- Gamma risk increases drastically

Option sellers are hit simultaneously from multiple directions.

Managing Tail Risk in Options Trading

It is important to accept that the tail risk cannot be eliminated. It can only be managed. Some of the ideas that the option traders should deploy are:

1. Avoid Naked Option Selling

Naked option selling is very lucrative, but one black swan event can wipe out years of profits. So traders should trade risk-defined strategies to reduce catastrophic exposure.

2. Position Sizing Is Critical

Having highly leveraged positions amplifies the losses during the black swan events. So traders should do smaller sizes to ensure survival during abnormal events.

3. Use Hedged Structures

Some strategies, like iron condors and spreads, help limit extreme losses. The downside is that they give lower profits.

4. Accept Lower Average Returns

Traders should appreciate that the strategies that survive Black Swans usually earn less during calm periods. However, they can protect capital during crises. At the end of the day, survival matters more than maximising returns.

Conclusion

Black Swan events are real and can happen at any time. They also expose the hidden fragility of many options trading strategies. Option trading is very lucrative, but it comes with high tail risks. So, before a trader jumps into option trading, he should understand tail risk, be prepared for extreme events, and design strategies and risk management for such catastrophic events.