8 Reasons to Invest and Not to Invest in Bitcoin

The rise in the prices of Bitcoin has lured many investors toward the cryptocurrency market. In this article, we have discussed the reasons to invest and why not to invest in bitcoin.

8 Reasons to Invest in Bitcoin :

1. Appreciating Value:

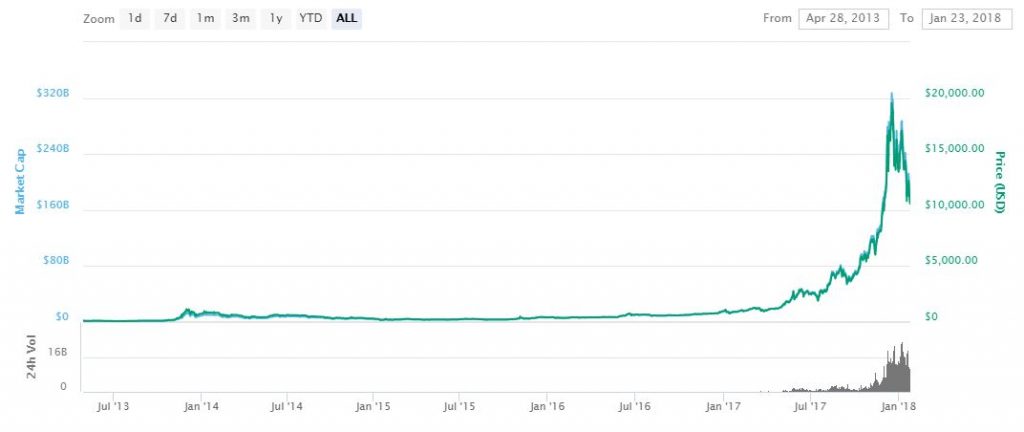

The value of Bitcoin has increased over time. The graph shows an upward trend since the launch of this cryptocurrency. Very few investments in India have shown this trend in terms of monetary trend.

In June 2009:

Price of 1 BTC = .04736 INR

On Jan 2018:

Price of 1 BTC = 680634.36 INR

The price of bitcoin has increased drastically over the period of time.

2. No Third Parties

Bitcoin is operated as a virtual currency platform. There is no third party involved who has been able to tamper with bitcoins. The databases store every redundant copy of the transaction, an investor is making online.

3. No Tracking

If you are a user of bitcoin and own a wallet. The wallet details such as no. of bitcoins, transactions time, etc cannot be tracked by anybody else. The only exception is when the wallet user voluntarily discloses the wallet address, then only it can be tracked.

4. Flexibility

To transfer the funds or investing money, is still a cumbersome process in many traditional investment products. There is a lot of paperwork required such as Address Proof, Pan card, photos, etc (as part of the KYC Process).

There is no such paperwork required to transact in bitcoins. A user is required to create a wallet and address and also, you can have as many addresses as per the feasibility, there is no limit.

5. Accessibility

Bitcoin is easily accessible to mass as it can be transacted using cryptocurrency online exchanges. These exchanges have made cryptocurrencies easy to use and transact. Not only bitcoin but other cryptocurrencies can also easily be purchased or sold through these exchanges.

6. Based on Advanced Technology

Bitcoin is developed in the aftermath of the 2008 financial crisis in the United States. It is based on blockchain technology which eliminates the need for an intermediary for the transactions.

The users can make transactions among themselves safely without the involvement of traditional banks or any central authority. The transaction is transparent and hence, users bypass the unnecessary fees and delays from banks.

7. Growth Prospects in Future

Advanced technologies have disrupted the marketplace, and digitalization is playing an important role. Bitcoin is built on revolutionary technology and it is expanding rapidly.

We have witnessed how the cryptocurrency market has soared in the year 2017. Most of the organizations including a few international banks have also commented on the acceptance of bitcoin.

8. Being used as a Currency

A majority of people these days are attracted to Bitcoin largely because they hope Bitcoin will turn out to be an excellent investment.

That, however, was not the intended use of the creators of Bitcoin.

Its actual use is as a currency and various places are beginning to accept Bitcoin as tender.

The use of Bitcoin to make payments in return for goods and services is widespread in some countries. One such prominent nation is Japan.

Reasons Why Not to Invest in Bitcoins

1. Unregulated

Bitcoin is not regulated by any authority or regulatory organization. Other investments such as mutual funds, etc are regulated by authority organizations or banks.

If we make transactions from bank accounts or use a credit card, we can reach out to banks in case of any discrepancies. The same is not applicable to bitcoin transactions. It can lead investors in a vulnerable situation in case of defaults.

2. Volatile

The price of bitcoin has shown an upward trend in the past but in recent months it has been extremely volatile.

The price of bitcoin on 11 December 2017 was :

1 Price of 1 BTC = 1377202 INR

The price of bitcoin on 23 January 2018 is :

Price of 1 BTC = 680634.36 INR

The above figures show that it is dropped by almost 50% in value. There is a lack of ecosystem in bitcoin functioning and there is not much to analyze as bitcoin is not backed by any other asset.

People are investing in random speculations as not much information is available in this cryptocurrency market. Many economists have predicted that the high soaring prices of bitcoin may form a bubble and can burst which will impact investments drastically.

3. Not a Legal Tender

The trading of bitcoin is still considered illegal in India. Cryptocurrencies are not recognized by the Reserve Bank of India (RBI). RBI has also stated that it has not provided any license related to the trading of cryptocurrencies.

If investors or users are dealing with bitcoins and other cryptocurrencies they are at their own risk. However, the government is planning to introduce laws to levy income tax on the earnings from cryptocurrencies.

4. No Security

Most investors want to pool their capital in safe and secure investments. The major problem with bitcoin is its uncertainty about the future.

There is always a risk of extreme volatility, cyber attacks in digital transactions, and several others.

5. Prone to Illegal Activities

As bitcoin transaction is not regulated by the government and also there is no trail to entail data about the transactions i.e. users at both ends of transactions remain anonymous in case of bitcoin transactions.

This feature of bitcoin is prone to terrorist usage and illegal activities. Many cases have occurred where the hackers have demanded bitcoins from the users. Even after meeting their demands, most of the users found their data lost in this attack.

6. Rise of Other Cryptocurrencies

The rationale behind the rise in the price of bitcoin over the period of time can be attributed to its leadership in the cryptocurrency marketspace.

Now, it is not the only cryptocurrency based on blockchain technology, there are several other cryptocurrencies evolved in the last few years. Hence, there is no guarantee that bitcoin will be the market leader in the upcoming years.

7. Virtual Appearance

Bitcoin exists only on computers as there is no asset which backs the value of bitcoin. Even paper money, bonds, and certificates can be presented to the RBI or banks to redeem money.

There is no such possibility with bitcoin as it is just a code written on the computer and hence it also more prone to attack from hackers.

8. Comparison with Ponzi Schemes

Due to the operational issues and the dubious nature of this cryptocurrency, many advisors have compared it with the Ponzi schemes.

The rationale behind this comparison is the lack of clarity regarding bitcoin trading.

Where Else Can I Invest?

If you want to channel your hard-earned money and accumulate wealth with minimized risk, mutual funds can be considered a safe investment.

Mutual funds are an indirect way of investing your money. If investors do not have time and expertise to invest in markets, mutual funds are ideal for your investment. They are managed by professional fund managers who have years of experience in capital markets and investments.

If you are interested in high-risk investments, you can look at small-cap funds. Here’s a list of some of the best small-cap funds: 3 Top Small Cap Funds.

Conclusion

The cryptocurrency market appears to be fascinating to investors in terms of returns but it is at its peak according to economists.

It can be a bubble which can burst at any moment, hence investors are advised to select the right investment products for their capital such as mutual funds, etc.

Also, the Finance Ministry of India has recently announced that virtual currencies are not the legal tender in India. It is a clear and precise statement from the ministry to protect the citizens from the hazards of hacking.

According to the Finance ministry – “Consumers need to be alert and extremely cautious so as to avoid getting trapped in such Ponzi schemes,”. Virtual currencies are stored in electronic form and are more vulnerable to cyber attacks and can result in loss of money. It is advisable to invest your hard-earned money in the right direction.

Happy investing!

Disclaimer: The views expressed here are those of the author. Mutual funds are subject to market risks. Please read the offer document before investing.