How to Check HFFC IPO Allotment Status

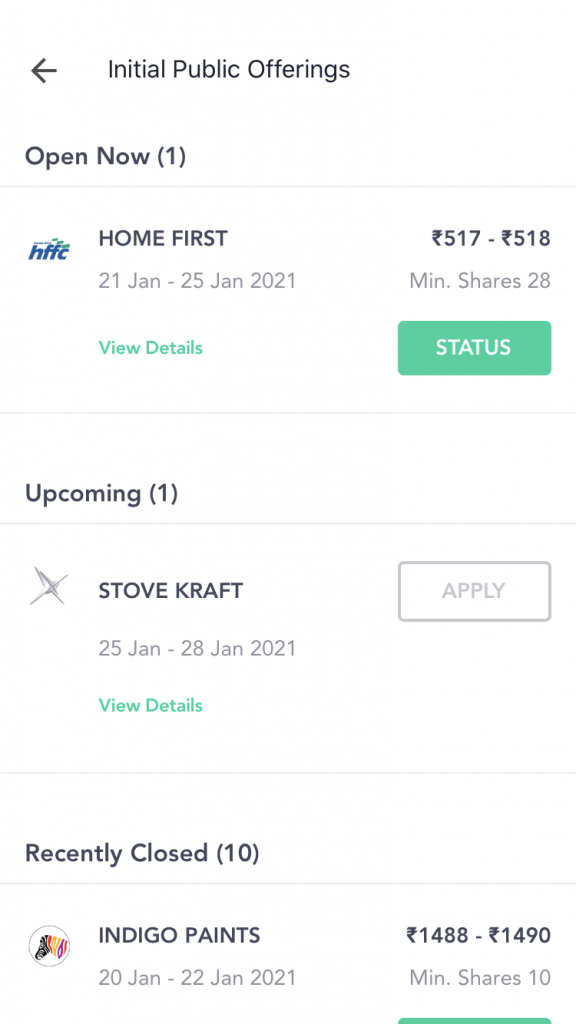

HFFC IPO is open for subscription between January 21 and 25. The allotment will be finalised around January 29. The price band for the IPO was Rs 517-518 and the minimum lot was 28 shares.

Read more on Groww: HFFC IPO – Home First Finance IPO

There are three primary ways to check the status:

a) Check Allotment Status on Groww

Once the allotment status is finalised, you can check your status on Groww, if you had applied for this IPO on our platform. Here are the steps:-

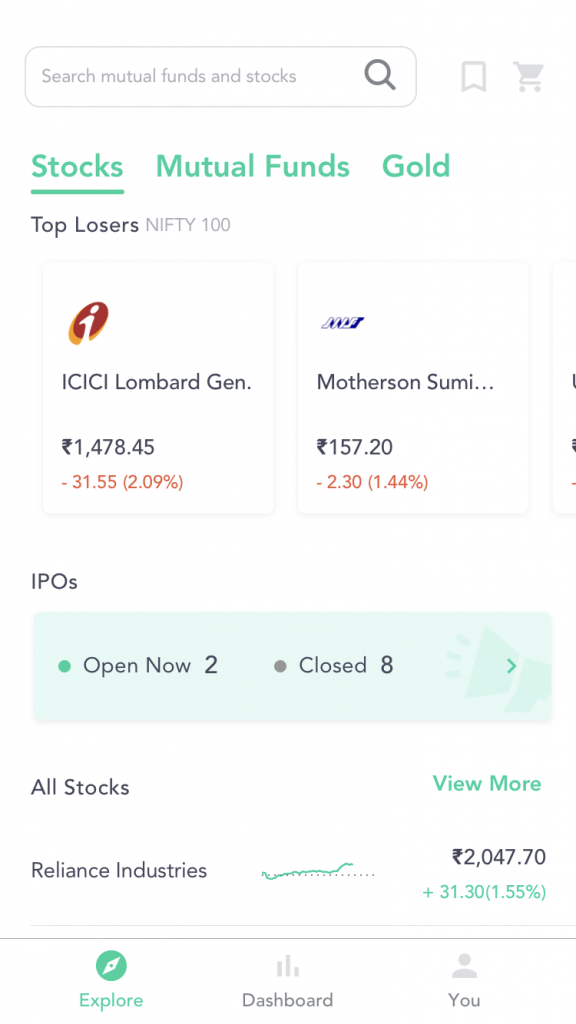

Step 1: Open the Groww App, scroll down the homepage to see the ‘IPOs’ section.

Step 2: Click on IPOs. On the next page click on the ‘Status’ tab next to HFFC IPO (or any other IPO you had applied for). The status tab will not be visible if you have not applied for the IPO.

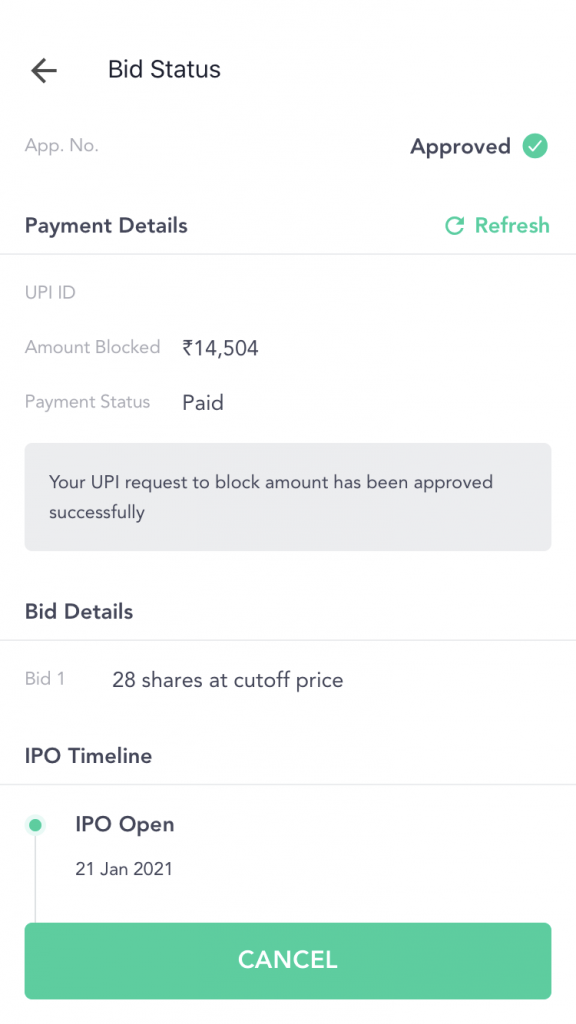

Step 3: If you have received the allotment in the IPO, ‘Allotted’ will be written next to your application number. Or else, the status will show as ‘Rejected’. Until then, the status will show as ‘Approved’ unless your application was rejected for another reason like payment failures, information mis-match etc.

b) Registrar website

The registrar for the IPO is KFintech Private Limited and the shares are proposed to be listed on the BSE and NSE.

After you land on the website’s IPO status page, you will see a drop-down menu that says ‘Select Menu’.

- From the drop-down menu, select ‘Home First Finance Corporation’.

- For identification, you can give your PAN number, application number DP/client ID, account number/IFSC code.

c) BSE

You can also check the allotment status on the Bombay Stock Exchange’s

After you click on the link, you will have to feed in your application number and PAN number to check your allotment status.

FAQs on HFFC IPO Allotment

How do I know if I have received HFFC Allotment or not?

We have discussed the steps for the same above.

What happens to the IPO amount in my bank account?

After applying for an IPO, the required amount is blocked for use from your account. Hence the money is still showing in your balance but is blocked for use.

Can we know the HFFC listing price?

Knowing the price at which the shares will list is almost impossible. The companies do have an issue price. But the listing price depends on the grey market transactions. Say the issue price was around Rs 200, and it was trading at a grey market premium of Rs 20 then we can expect the shares to list at around Rs 220. However, nothing can be said with certainty.

What is the grey market?

Grey market for an IPO is an unofficial market where the transactions that take place are ‘over-the-counter’ (OTC) in nature. They are mostly are dealt with in cash. Because of its unofficial and OTC nature, there are no rules around it. The transactions are done among a smaller group of people. So the HFFC listing price will depend on the grey market premium. The listing premium/discount is higher/lower than the issue price.

How are the HFFC shares being allotted?

If HFFC IPO is oversubscribed, the shares will be distributed proportionately among investors so that each investor gets minimum one lot. This is done on a lottery basis, so there cannot be a guarantee that you will get the shares. It is possible that few investors do not get any shares at all, in case of over-subscription.

Why did I not get HFFC allotment?

There are multiple reasons why an investor may not get the allotment:

- Pure Luck: As mentioned earlier, shares are allotted on a lottery basis. In case of oversubscription, not everyone will be assigned shares.

- Information mismatch: If your HFFC IPO application has any incomplete information or there is a mismatch in your credentials

- If your bid price is not within the price band

Will my money come back if I don’t get HFFC IPO allotment?

If you don’t get the allotment in HFFC IPO, the amount will be unblocked, and you will be able to use the amount in your bank account.

When will HFFC IPO get listed?

HFFC shares will get listed on BSE and NSE on February 3, 2021 tentatively.