Groww Nifty Non-Cyclical Consumer Index Fund Now Open for Subscription Between 2nd-16th May 2024

Groww Asset Management Limited has an upcoming NFO tracking the Nifty Non-Cyclical Consumer Index i.e. Groww Nifty Non-Cyclical Consumer Index Fund, which will open for subscriptions from 2 May to 16 May 2024.

GrowwNifty Non-Cyclical Consumer Index Fund is an open‐ended scheme tracking Nifty Non-Cyclical Consumer Index – TRI ie India's first ever non-cyclical index fund, which seeks long-term capital appreciation by investing in equity and equity related instruments of Nifty Non-Cyclical Consumer Index.

About the Groww Nifty Non-Cyclical Consumer Index Fund

Groww Nifty Non-Cyclical Consumer Index Fund shall be managed by Abhishek Jain, who has almost 12 years of experience in equity markets. Before joining Groww Asset Management Ltd, he was associated with Edelweiss Tokio Life Insurance as a senior dealer and was also associated with Acko General Insurance and Shriram Asset Management Co Ltd

Understanding Groww Nifty Non-Cyclical Consumer Index Fund

The core objective of this scheme is to generate long-term capital growth through investments in securities of the Nifty Non-Cyclical Consumer Index with the same weightage, with the motive of providing returns before expenses that track the total return of the Nifty Non-Cyclical Consumer Index.

Note: There is no 100% assurance that the said objective will be achieved and investors should read the Scheme Information Document or consult their financial advisor before investing.

Minimum Investment Amount

The minimum lumpsum investment in this scheme is Rs. 500, in the multiple of Re. 1. In the case of SIP, the minimum amount to invest is Rs. 1,200(Subject to a minimum of 12 SIP instalments of Rs. 100/- each for monthly instalment and Rs.300 for quarterly instalments.).

The minimum redemption amount for the scheme is Rs. 500 and in the multiple of Re. 1.

Load Details

The exit load in respect of each purchase/switch-in of units, an Exit load of 1% is payable if

units are redeemed/switched out within 30 days from the date of allotment.

- No Exit Load is payable if units are redeemed /switched out after 30 days from the date of allotment.

- No Entry / Exit Load shall be levied on Units allotted on Re-investment of Income Distribution cum Capital Withdrawal.

- In respect of Systematic Transactions such as Systematic Investment Plan, Systematic Transfer Plan, etc.

- Exit Load, if any, prevailing on the date of registration/enrolment shall be levied.

(Investors should consult their financial advisor and read SID before investing in the Scheme)

Schemes Underlying Investments

The schemes underlying investment look something like this:

- 95% to 100% invested in equities and equity-related securities.

- 0% to 5% in debt and money market instruments, united of debt schemes, and united of debt ETFs.

Please read the SID to know in detail about the Scheme.

Features of Groww Nifty Non-Cyclical Consumer Index Fund

The core features of the fund are:

Kind of Scheme: The Groww Nifty Non-Cyclical Consumer Index Fund is an open-ended scheme that tracks Nifty Non-cyclical Consumer Index - TRI.

The objective of the Investment: The investment objective of the Scheme is to generate long term capital growth by investing in securities of the Nifty Non-Cyclical Consumer Index (TRI) in the same proportion / weightage with an aim to provide returns before expenses that track the total return of Nifty Non-Cyclical Consumer Index, subject to tracking errors. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

Benchmark of the Scheme: Nifty Non-Cyclical Consumer Index - TRI

Sector Breakup of the index tracked by the scheme: Nifty Non-Cyclical Consumer Index

|

Sector |

Weight |

|

Fast Moving Consumer Goods |

42.49% |

|

Consumer Services |

20.71% |

|

Consumer Durables |

20.37% |

|

Telecommunication |

12.15% |

|

Services |

2.38% |

|

Textiles |

1.11% |

|

Media, Entertainment & Publication |

0.78% |

Source : NSE Indices Data as on March 28, 2024 The sectors referred herein should not be construed as recommendations, advice to buy, sell or in any manner transact in this sector and neither should it be considered as Research report from Groww Asset Management Ltd/Groww Mutual Fund. The scheme may or may not have exposure in those sectors Past performance may or may not be sustained in the future and is not a guarantee of any future returns. Please consult your financial advisor before investing.

Stocks composition of the index tracked by the scheme: Nifty Non-Cyclical Consumer Index

|

Company Name |

Weight (%) |

|

Bharti Airtel Ltd. |

10.97% |

|

Hindustan Unilever Ltd. |

9.11% |

|

ITC Ltd. |

8.69% |

|

Titan Company Ltd. |

7.99% |

|

Asian Paints Ltd. |

6.72% |

|

Nestle India Ltd. |

4.89% |

|

Zomato Ltd. |

4.64% |

|

Trent Ltd. |

4.52% |

|

Tata Consumer Products Ltd. |

3.95% |

|

Varun Bevarages Ltd. |

3.58% |

Source : NSE Indices Data as on March 28, 2024. The sectors referred herein should not be construed as recommendations, advice to buy, sell or in any manner transact in this sector and neither should it be considered as Research report from Groww Asset Management Ltd/Groww Mutual Fund. The scheme may or may not have exposure in those sectors. The Fund Manager may or may not invest in the above scrips basis the Scheme investment strategy please read the SID to know in detail. Past performance may or may not be sustained in the future and is not a guarantee of any future returns. Please consult your financial advisor before investing.

|

Parameters |

Details |

|

Name of the Scheme |

Groww Nifty Non-Cyclical Consumer Index Fund |

|

Minimum Amount of Investment |

Rs. 500 for lumpsum and Rs. 1,200 for SIP.(Subject to a minimum of 12 SIP instalments of Rs. 100/- each for monthly option and 4 SIP instalments of Rs.300/- for quarterly option) |

|

Exit Load |

In respect of each purchase/switch-in of units, an Exit load of 1% is payable if units are redeemed/switched-out within 30 days from the date of allotment. • No Exit Load is payable if units are redeemed / switched-out after 30 days from the date of allotment. No Entry / Exit Load shall be levied on Units allotted on Re-investment of Income Distribution cum Capital Withdrawal. In respect of Systematic Transactions such as SIP, STP, etc. Exit Load, if any, prevailing on the date of registration / enrolment shall be levied. |

|

Fund Manager |

Mr. Abhishek Jain |

|

Type of Scheme |

Index Fund |

Who May Consider Investing in Groww Nifty Non-Cyclical Consumer Index Fund

Investors who can consider investing in this stock are:

- An investor who seeks long-term capital appreciation.

- Investors who aim to invest majorly in equities and equity-associated securities.

- Investors who wish to invest in a passive scheme.

However, you need to choose your investment based on personal financial goals and professional consultation.

As already mentioned, the fund opens on 2nd May and closes on 16th May.

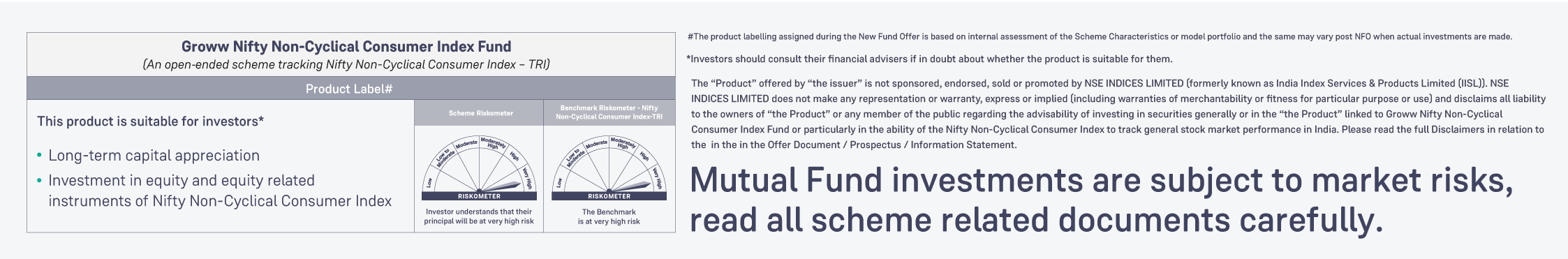

Product Label