Groww Nifty India Defence ETF - An Opportunity to Invest in India’s Defence Companies

Groww Mutual Fund has introduced a defence ETF, the Groww Nifty India Defence ETF, providing an opportunity to invest in India’s defence stocks. The NFO period for this scheme is from 23rd September to 4th October, 2024.

Why Invest in the Defence Sector?

India's defence sector is receiving significant support from the government, particularly through the AtmaNirbhar Bharat initiative, under which it is encouraging self-reliance and exports, creating substantial potential for growth.

India’s defence production is projected to triple, reaching ₹3 lakh crore by FY 2029, with an estimated investment pipeline of $138 billion from FY 2024 to FY 2032. Furthermore, defence exports are set to increase by 2.5 times, targeting ₹50,000 crore by FY 2029, up from the current ₹20,000 crore.

Groww Nifty India Defence ETF

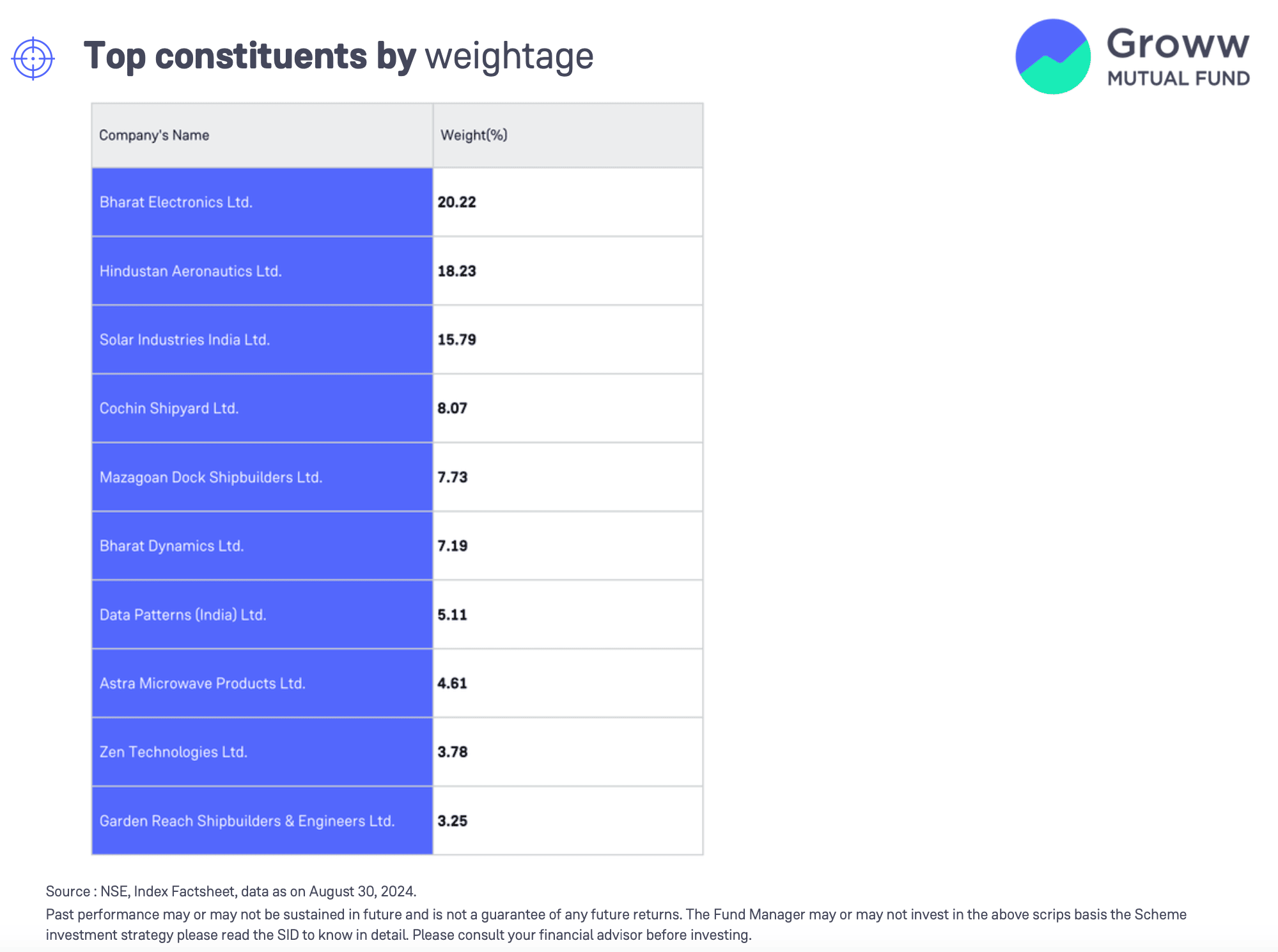

The Groww Nifty India Defence ETF is composed of the country’s leading defence companies based on free float market capitalization and is a basket of these 15 defence stocks. The defence ETF tracks the Nifty India Defence Index.

Key Growth Drivers

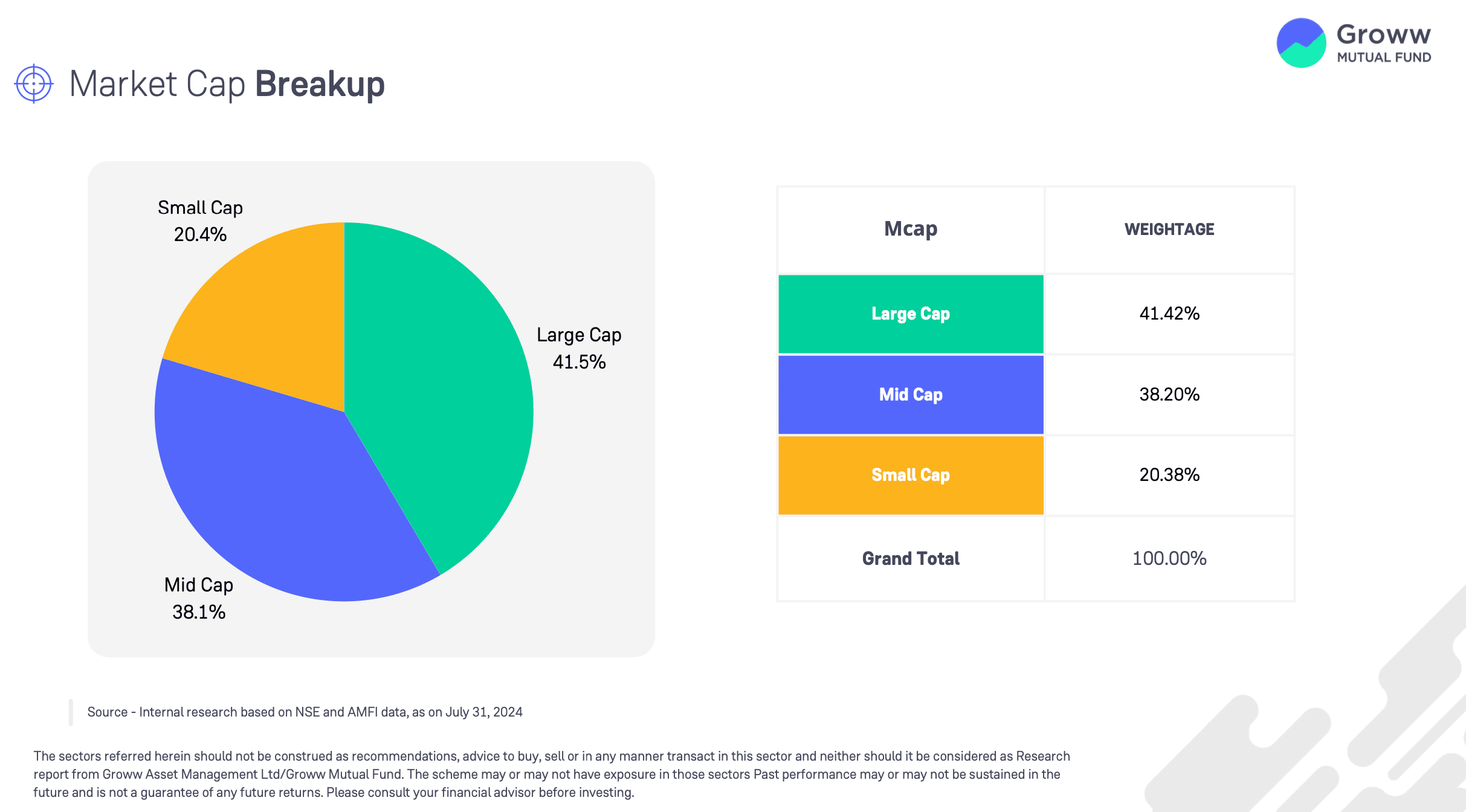

- Diverse Exposure: The ETF offers access to a wide range of companies in the defence sector, covering various market capitalizations - large-cap, mid-cap and small-cap stocks.

- Long-Term Growth Potential: Rising government spending on defence and potentially strong order books suggest long-term growth potential for the sector, making it a potential option for defence mutual funds as well.

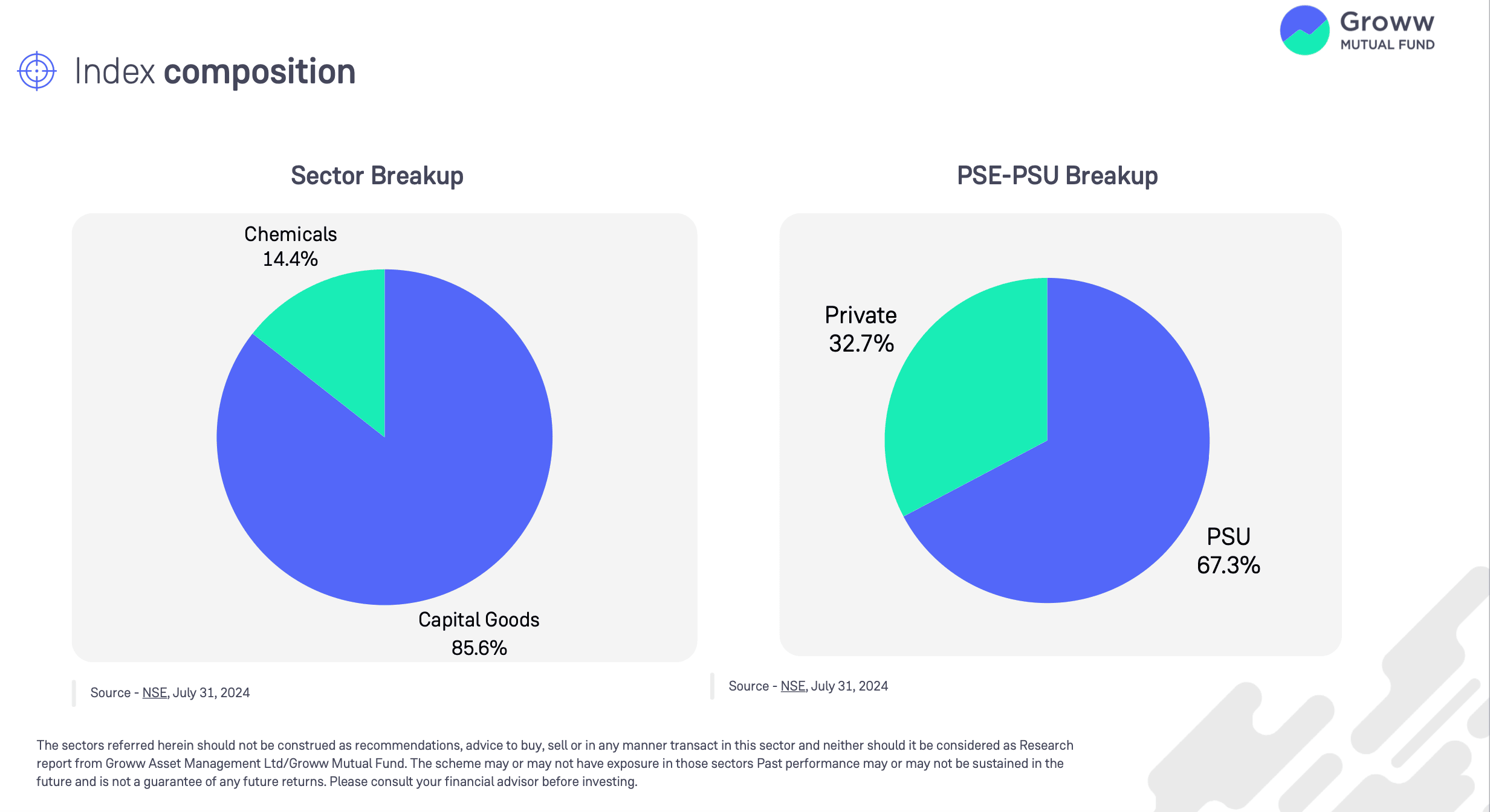

- Diverse Sector Focus#: The index also includes sectors related to defence, such as capital goods and chemicals.

About the Nifty India Defence Index

The Nifty India Defence Index captures the performance of India’s defence firms across large-cap, mid-cap, and small-cap segments, with mid and small-cap companies making up 58% of the index. The companies within the index also have potentially strong order books, ensuring visibility of future cash flows6. By capping stock weights at 20%, the index prevents any single company from dominating the portfolio.

The minimum investment amount for this scheme stands at ₹500 and in multiples of ₹1 thereafter, with no exit load. For more information about the scheme, refer to the Scheme Information Documents (SID).