Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Groww Mutual Fund has introduced its latest offering - Groww Nifty 500 Momentum 50 ETF, an open‐ended scheme tracking the Nifty 500 Momentum 50 Index - TRI. The NFO period is from April 3- April 17, 2025

What is Momentum Investing?

Momentum investing focuses on purchasing stocks that are trending upwards and selling them before the trend reverses. This strategy is based on the belief that stocks with upward momentum will continue to rise, driven by market participants' herd mentality. The aim is to buy high and sell higher, prioritizing stock price movements over company fundamentals.

About the underlying Index : Nifty 500 Momentum 50 Index

The underlying index, Nifty 500 Momentum 50 Index, selects the top 50 companies from the Nifty 500 based on their momentum score.

This score is calculated using each company's 6-month and 12-month price returns, adjusted for volatility. The index is rebalanced semi-annually to stay updated with market changes.

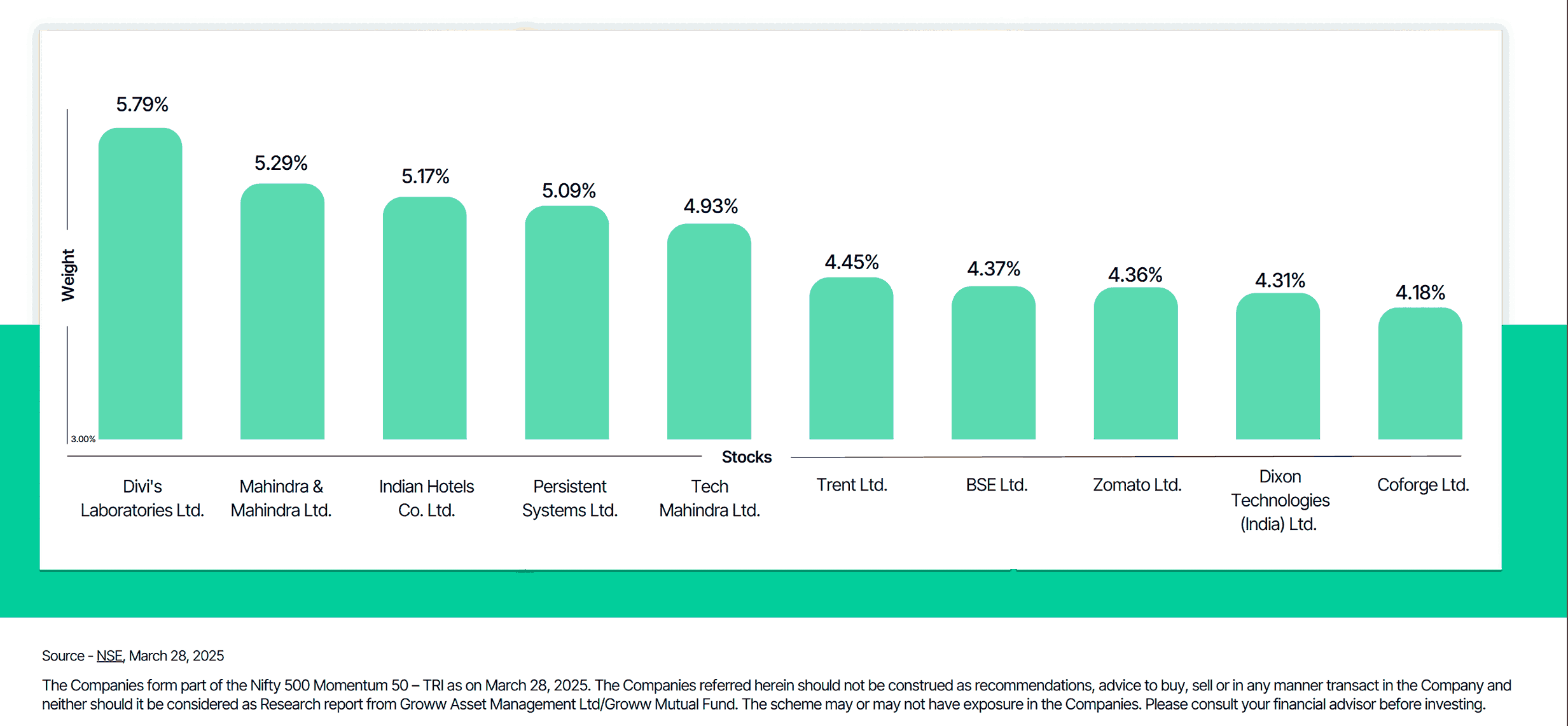

Top 10 constituents by weightage

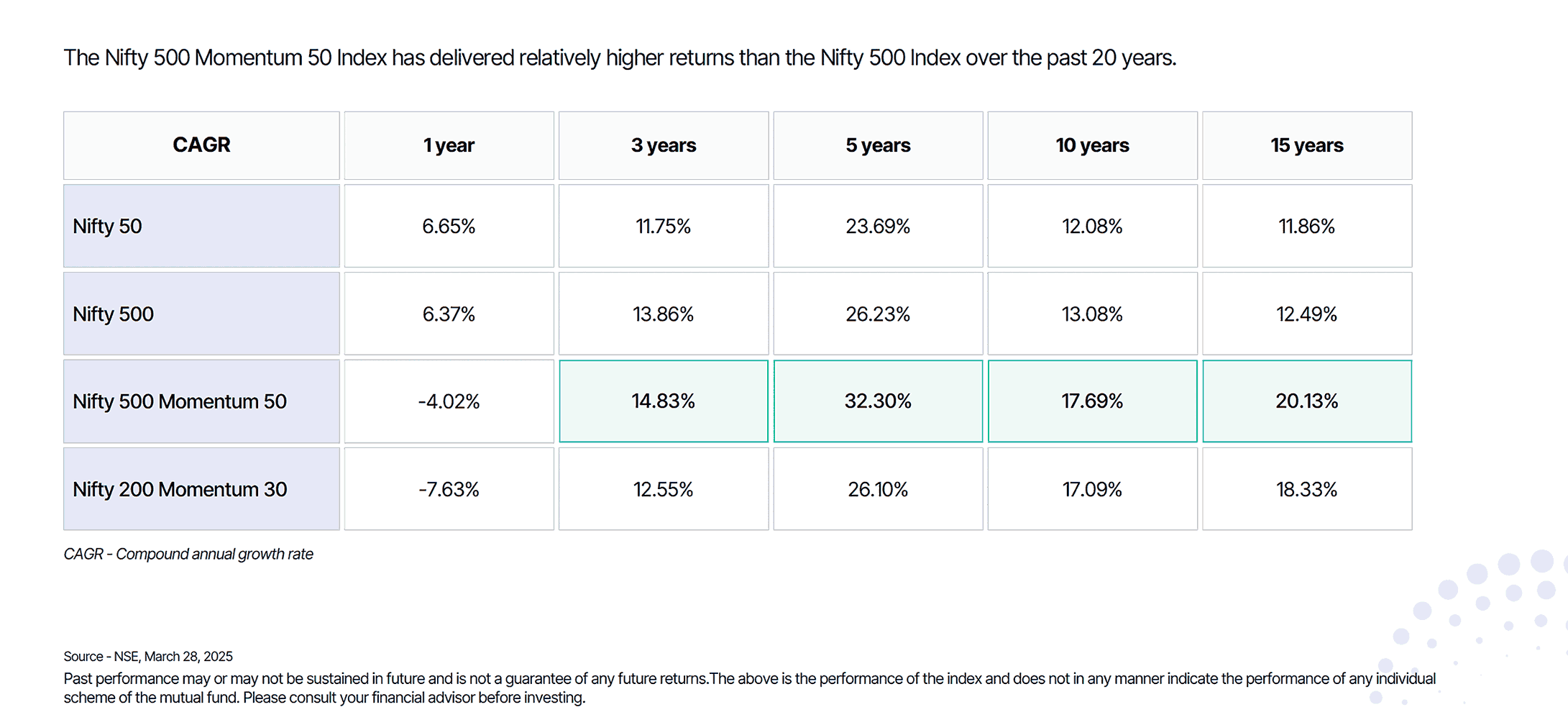

Historical performance of the Nifty 500 Momentum 50 Index

Over various periods, Nifty 500 Momentum 50 has outperformed other broad market indices such as Nifty 50, Nifty 500 etc.

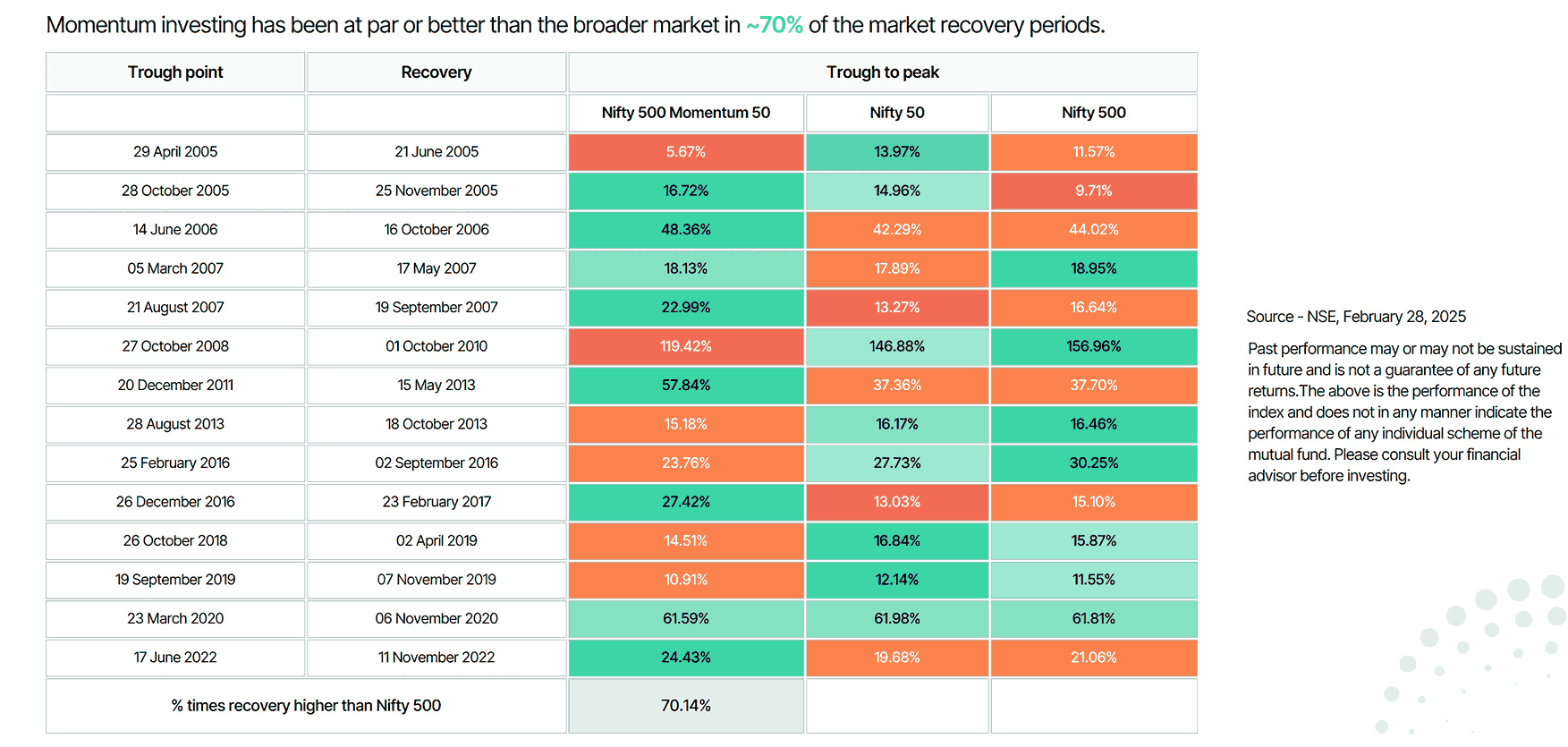

Data suggests that Momentum investing may serve as a potential strategy to benefit from market recovery, as it has outperformed or matched the broader market in approximately 70% of market recovery periods.

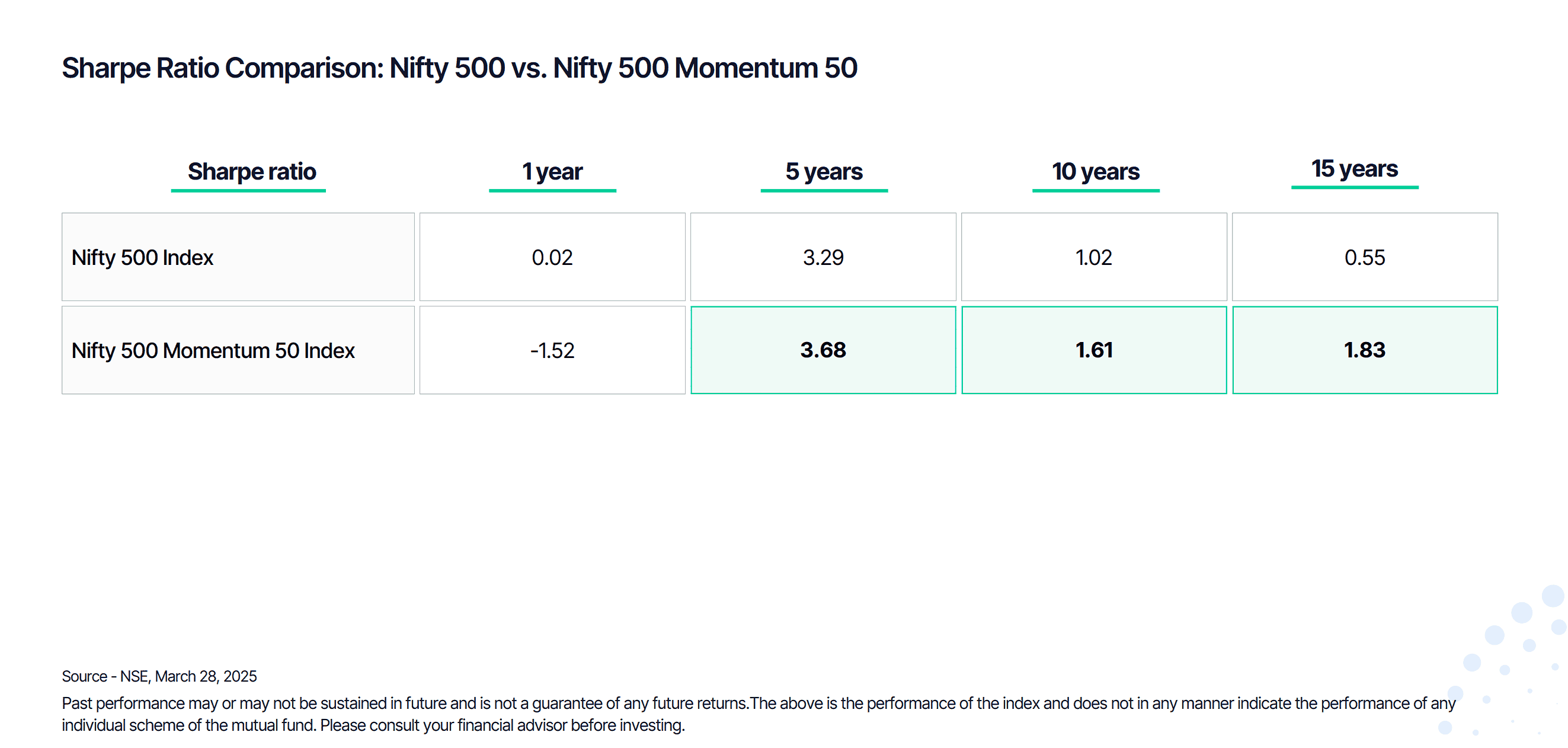

Favorable risk-adjusted returns in the long run

Historically, momentum investing has delivered favorable risk-adjusted returns, positioning it for growth even in volatile markets.

The Groww Nifty 500 Momentum 50 ETF may be suited for investors seeking a simpler way to implement momentum investing strategies, as the scheme follows pre-determined logic and is auto-executed periodically without complex algorithms.

The minimum investment amount in the schemes is ₹500 and the scheme will be managed by Mr. Nikhil Satam.