Groww Mutual Fund introduces its latest ETF - Groww Nifty 200 ETF

Groww Mutual Fund has introduced a new fund, Groww Nifty 200 ETF, which aims to replicate the Nifty 200 Index.

The Nifty 200 Index tracks the performance of India’s top 200 companies, which is a mix of large cap and mid cap companies, therefore aiming to provide the opportunity for diversification.

The Nifty 200 Index1

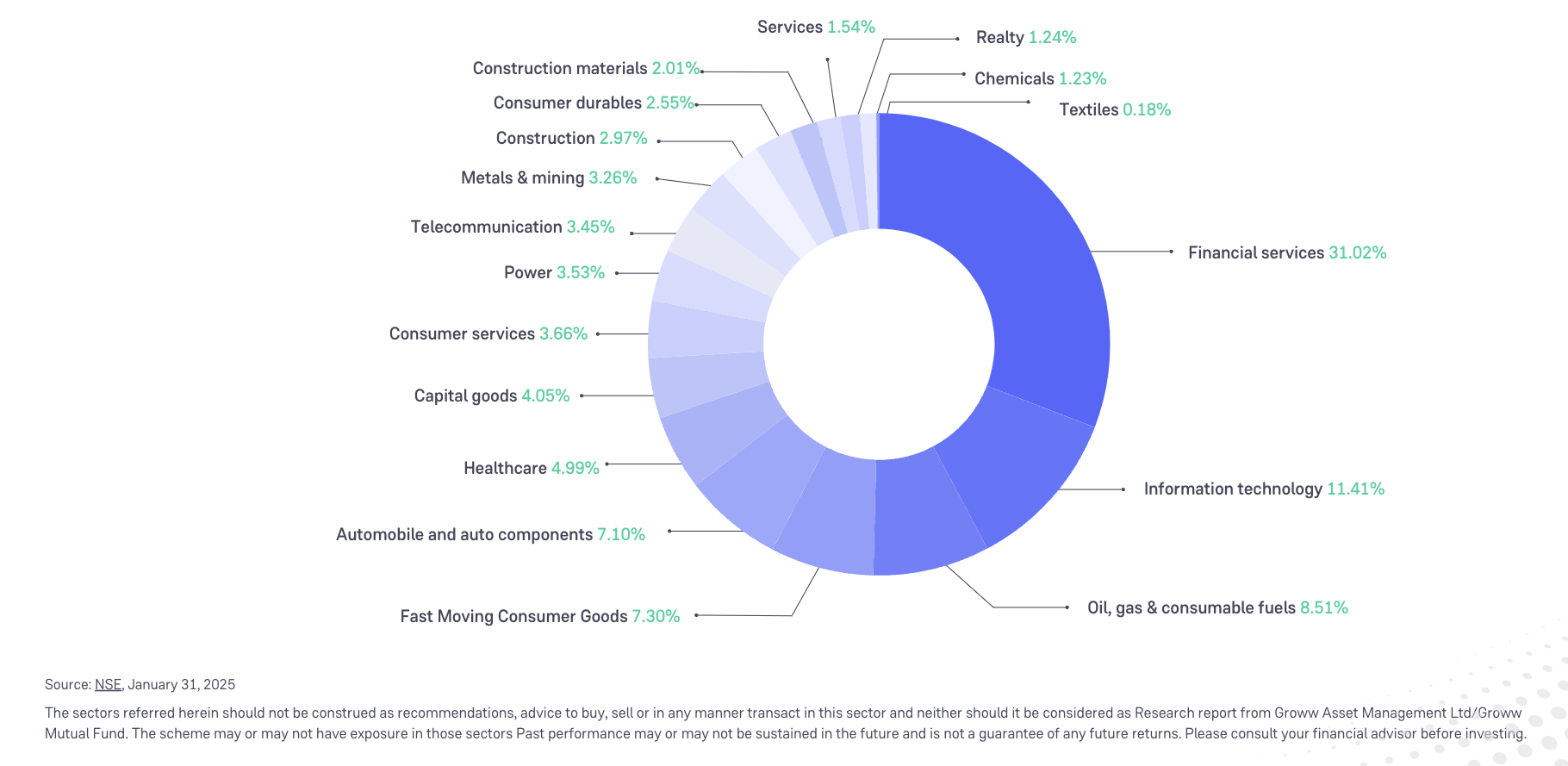

The index has large-cap (82.25%) and mid-cap (17.75%) stocks. The index seeks diversification across ~18 sectors, covering a range of industries including financial services, information technology, oil,gas and consumable fuels and more.

Sector representation

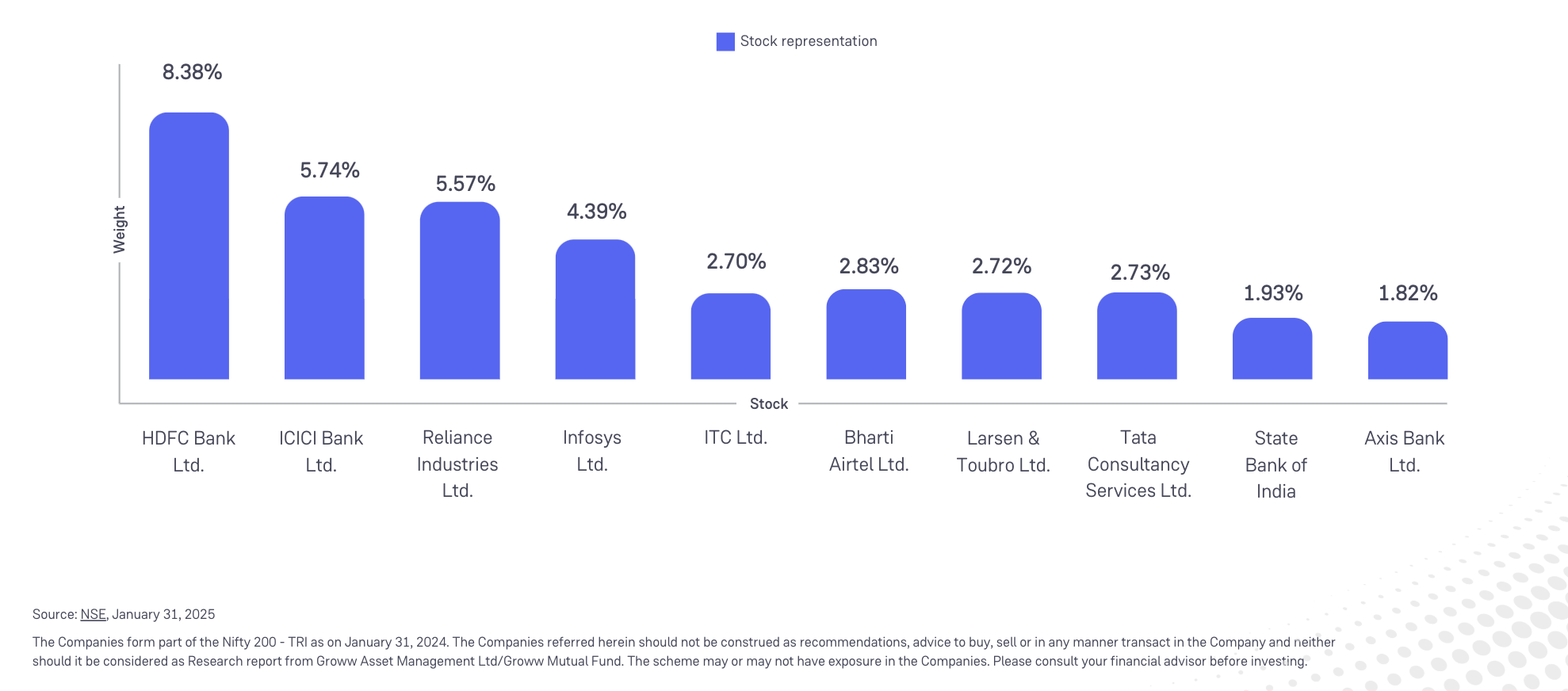

Top constituents by weightage

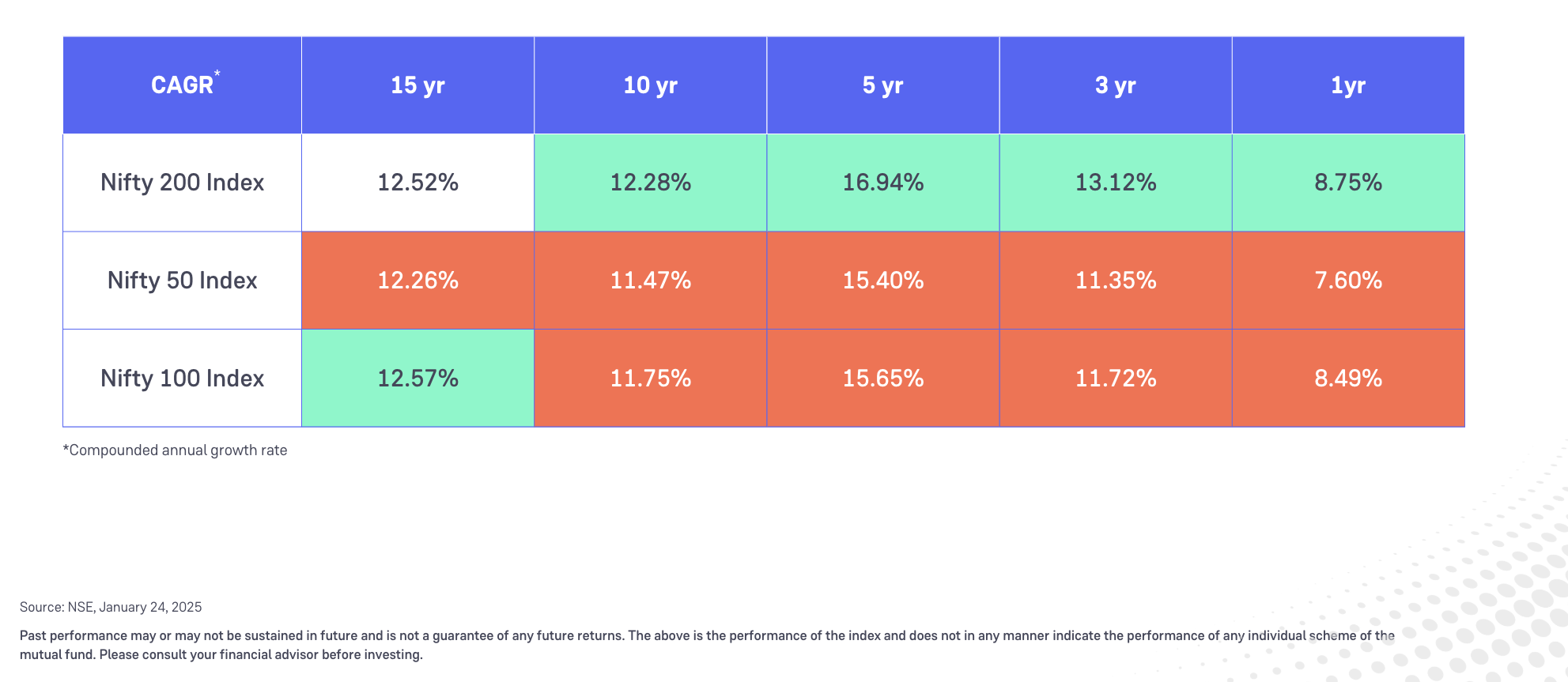

Historical performance

Data suggests that the Nifty 200 Index has historically shown potentially better performance when compared to other large-cap indices.

Potential for lower volatility

Historically, the Nifty 200 index has had a lower standard deviation compared to broader market indices, making it an option that may be considered during volatile times.

Why consider Groww Nifty 200 ETF?

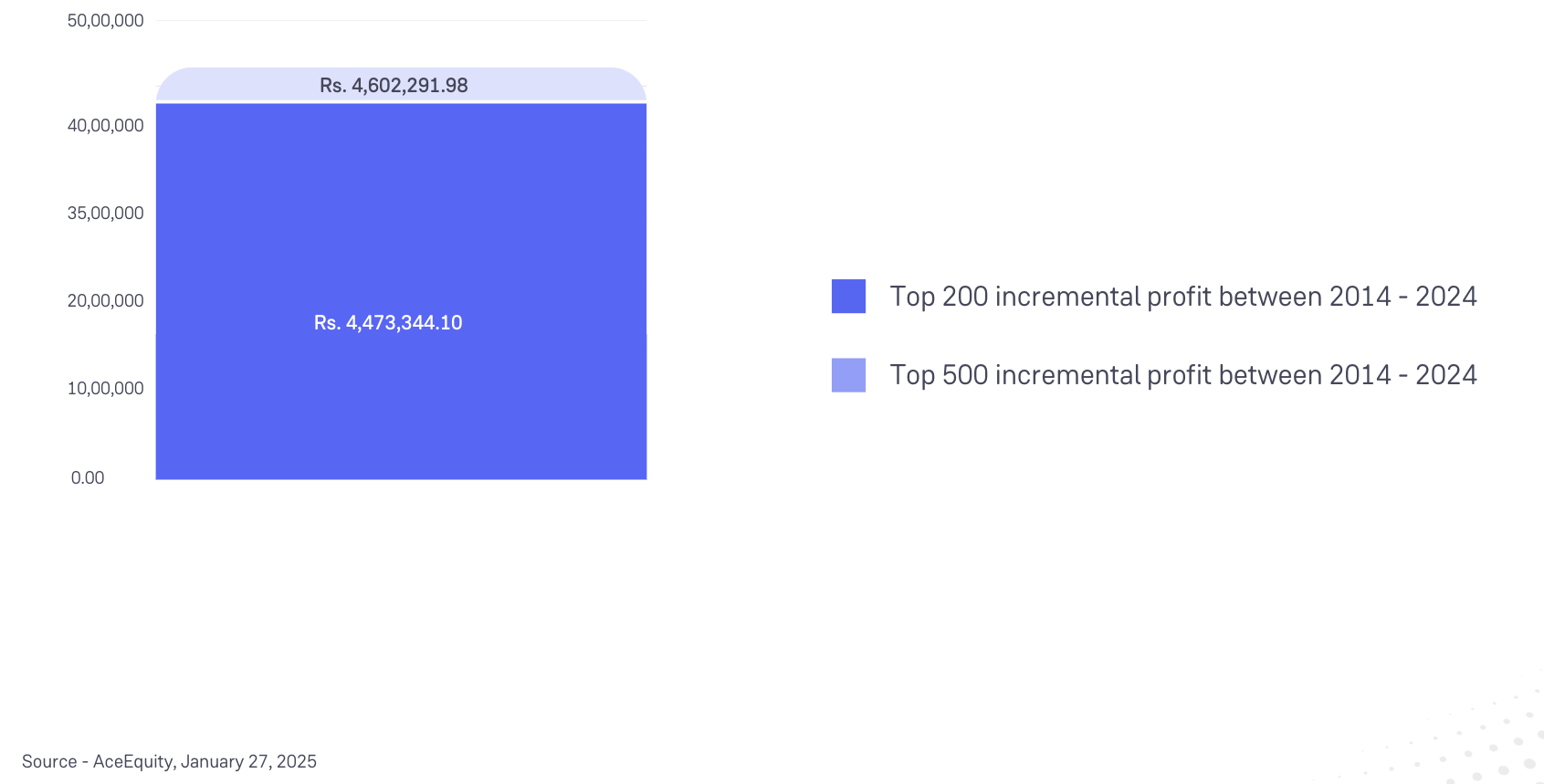

- The top 200 companies historically generate 98% of the incremental profits among the top 500 companies.

- Large caps in India have potential for expansion compared to global peers and hence are poised for growth in the long run.

- As an ETF, Groww Nifty 200 ETF aims to offer the flexibility to buy and sell units on the stock market during market hours.

The Groww Nifty 200 ETF may be suitable for investors seeking long-term growth with a mix of large and mid-cap exposure, as well as those seeking relatively lower volatility in uncertain markets.

The scheme is managed by Mr. Abhishek Jain and requires a minimum investment of Rs. 500, with additional investments in multiples of Re. 1 thereafter. The scheme has no exit load.

Source 1: NSE, January 31, 2025