India’s First Railway PSU Index Fund and ETF: Groww Mutual Fund introduces funds aimed at leveraging the growth of Indian Railways

Groww Mutual Fund has introduced the Groww Nifty India Railways PSU Index Fund and Groww Nifty India Railways PSU ETF, aiming to offer investors the opportunity to invest in one of India’s most critical infrastructure sectors - railways.

The New Fund Offer period for these funds is between January 16, 2025 and January 30, 2025. Both funds aim to track the Nifty India Railways PSU Index, which comprises Public Sector Undertakings (PSUs) integral to the Indian Railways sector, covering everything from infrastructure and logistics to financial services and technology.

The Indian Railways Sector

As the fourth-largest railway network in the world1, Indian Railways recorded passenger traffic of 6.7 billion in FY 2024, nearly equivalent to the world’s total population2. Additionally, freight loading in FY 2024 exceeded 1,588 metric tonnes3.

The sector is undergoing a transformational phase, driven by a ₹2.62 lakh crore capital expenditure plan for FY 2024-254. Modernization efforts include station redevelopments, high-speed rail initiatives, and a shift towards renewable energy.

Nifty India Railways PSU Index

-

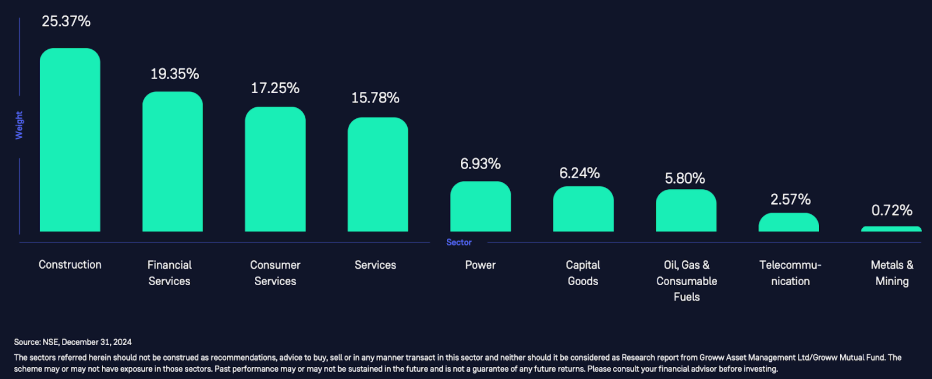

Exposure to railway ecosystem5

The ETF mirrors the Nifty India Railways PSU Index-TRI, offering exposure to a broad range of core and non-core PSUs within the sector.

2. Potential for growth

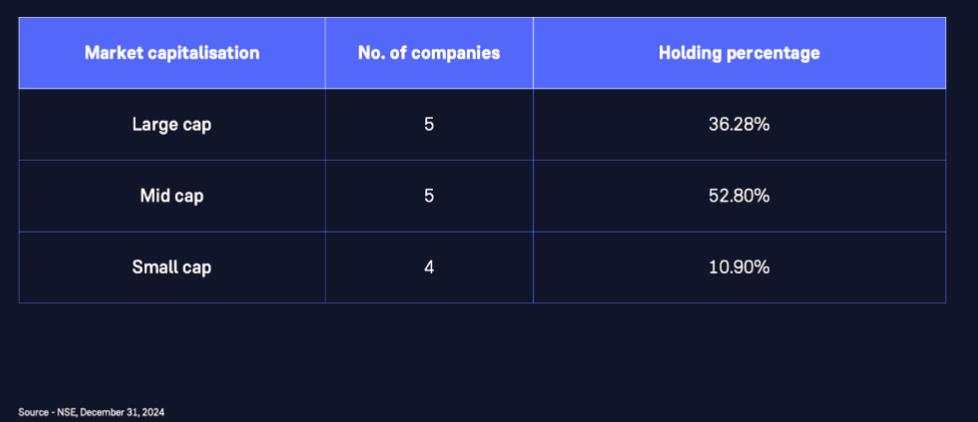

The portfolio is weighted towards mid-cap stocks, which could present opportunities for growth over the long term5.

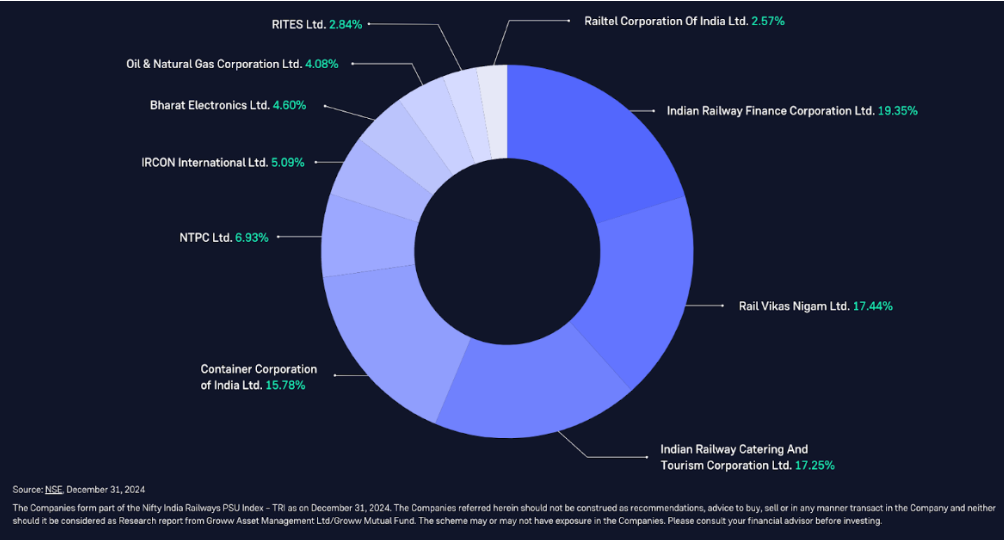

3. Top 10 constituents by weightage5

The portfolio is made up of 14 stocks with growth potential, with the top 10 stocks being:

4. Index Performance

Data suggest the Nifty India Railways PSU Index has outperformed the Nifty 500 Index.

Why consider Groww Nifty Railways PSU Index Fund and ETF?

- Exposure to the entire railway ecosystem

The fund provides exposure to the dynamic railway sector, which presents significant growth opportunities.

2. Vital infrastructure

Indian Railways is a cornerstone of India’s transportation and logistics network, facilitating large-scale passenger and freight movement while driving economic activity.

3. Government-driven modernization

With a historic ₹2.62 lakh crore capital expenditure allocated for FY 2024-254, modernization projects like high-speed rail, station redevelopment, and renewable energy integration are set to boost operational efficiency and meet sustainability goals.

4. Support for economic growth6

Indian Railways is integral to key industries such as steel, cement, and manufacturing. It plays a crucial role in India’s economic expansion, contributing to the $5 trillion economy vision through initiatives like PM Gati Shakti, which enhances exports and streamlines transit times.

The Groww Nifty Railways PSU Index Fund and Groww Nifty Railways PSU ETF may be considered by investors seeking long-term capital appreciation, those seeking exposure to the railway sector and PSU companies, and investors aiming to invest in equity and equity-related instruments of the Nifty India Railways PSU Index - TRI.

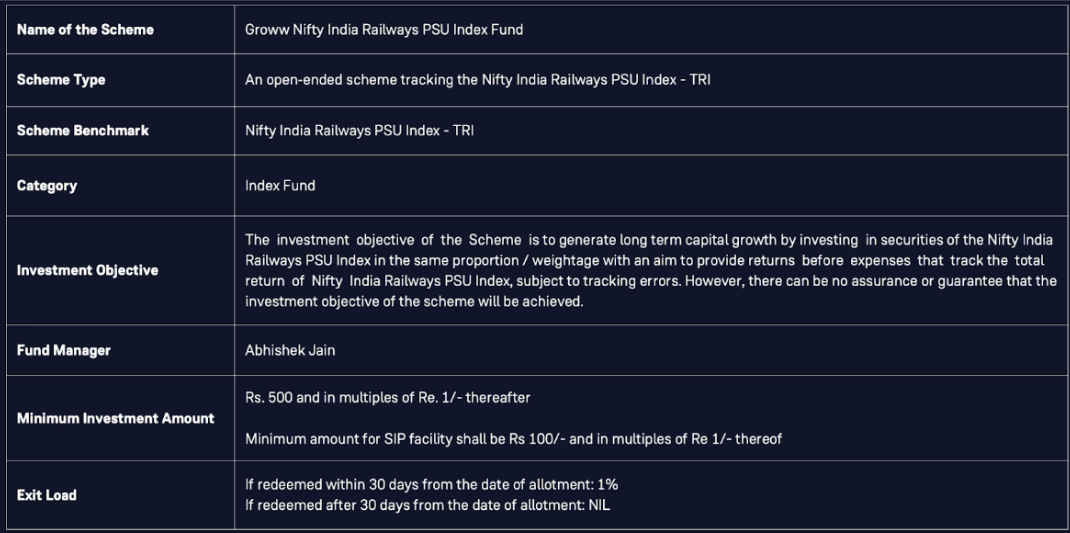

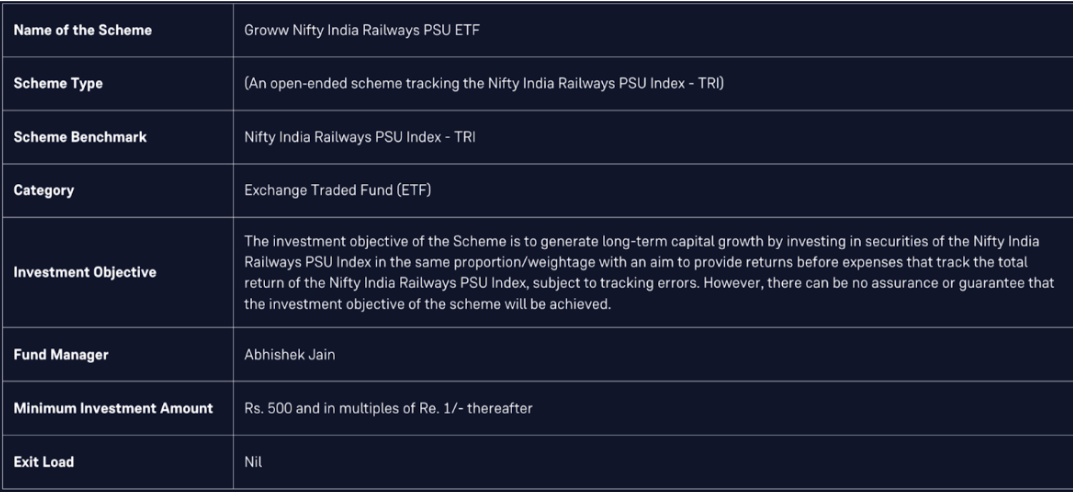

Scheme Details :

Source 1 - Press Information Bureau, July 22, 2024

Source 2 - Moneycontrol, data as on July 22, 2024

Source 3 - IBEF, November, 2024

Source 4 - Press Information Bureau, July 23, 2024

Source 5 - NSE, December 31, 2024

Source 6 - Times of India, December 6, 2023