Groww Mutual Fund introduces ETF and FOF based on the Nifty EV & New Age Automotive Index

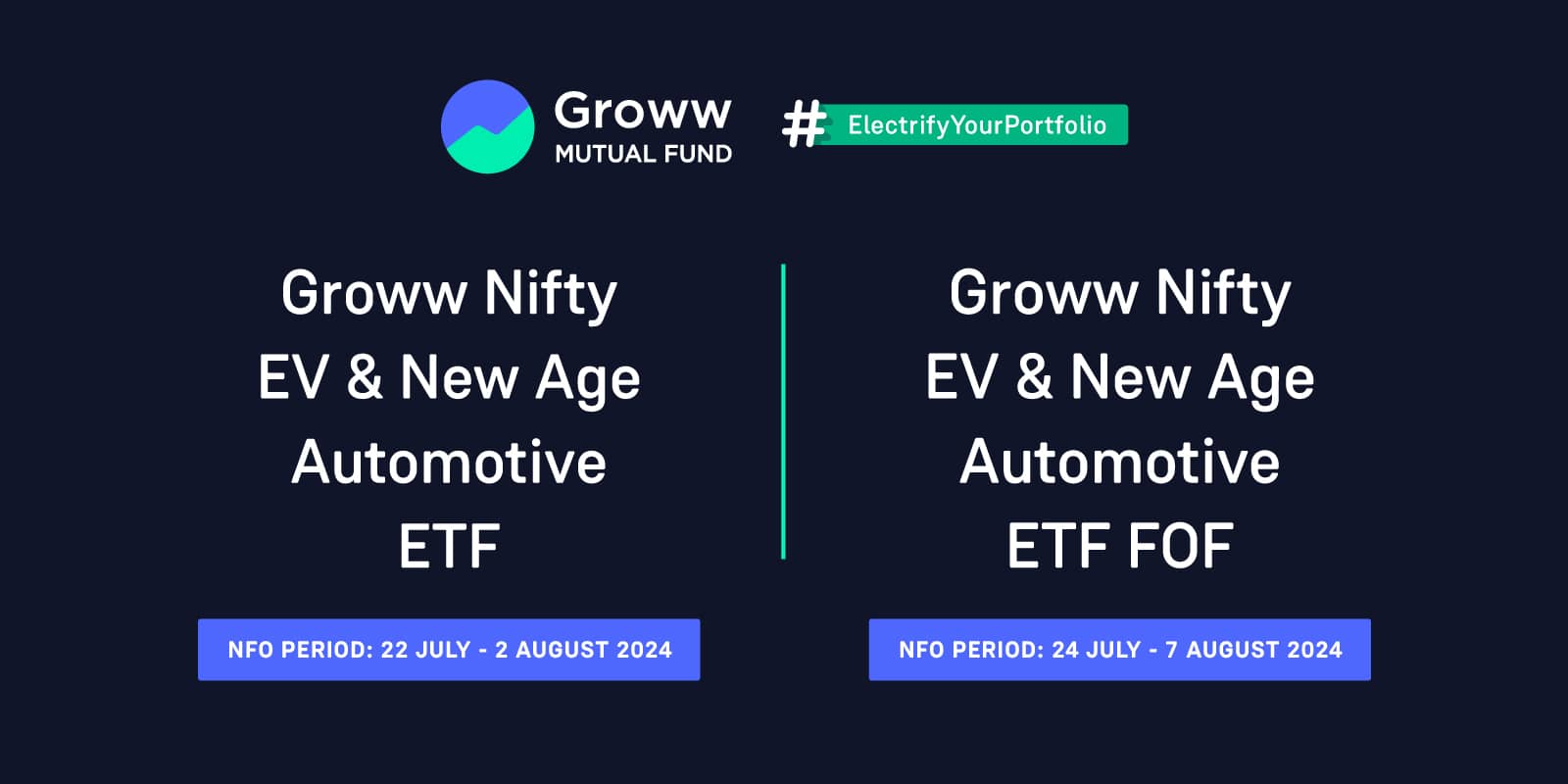

Groww has their ongoing NFOs ie Groww Nifty EV & New Age Automotive ETF and Groww Nifty EV & New Age Automotive ETF FOF open for subscription.

Electrify your portfolio by investing in

Groww Nifty EV & New Age Automotive ETF is now listed on NSE and available to trade.

Groww Nifty EV & New Age Automotive ETF FOF is closed now.

The NFO period of Groww Nifty EV & New Age Automotive ETF will be till August 2, 2024 and the NFO period for Groww Nifty EV & New Age Automotive ETF FOF will be from July 24 till August 7, 2024.

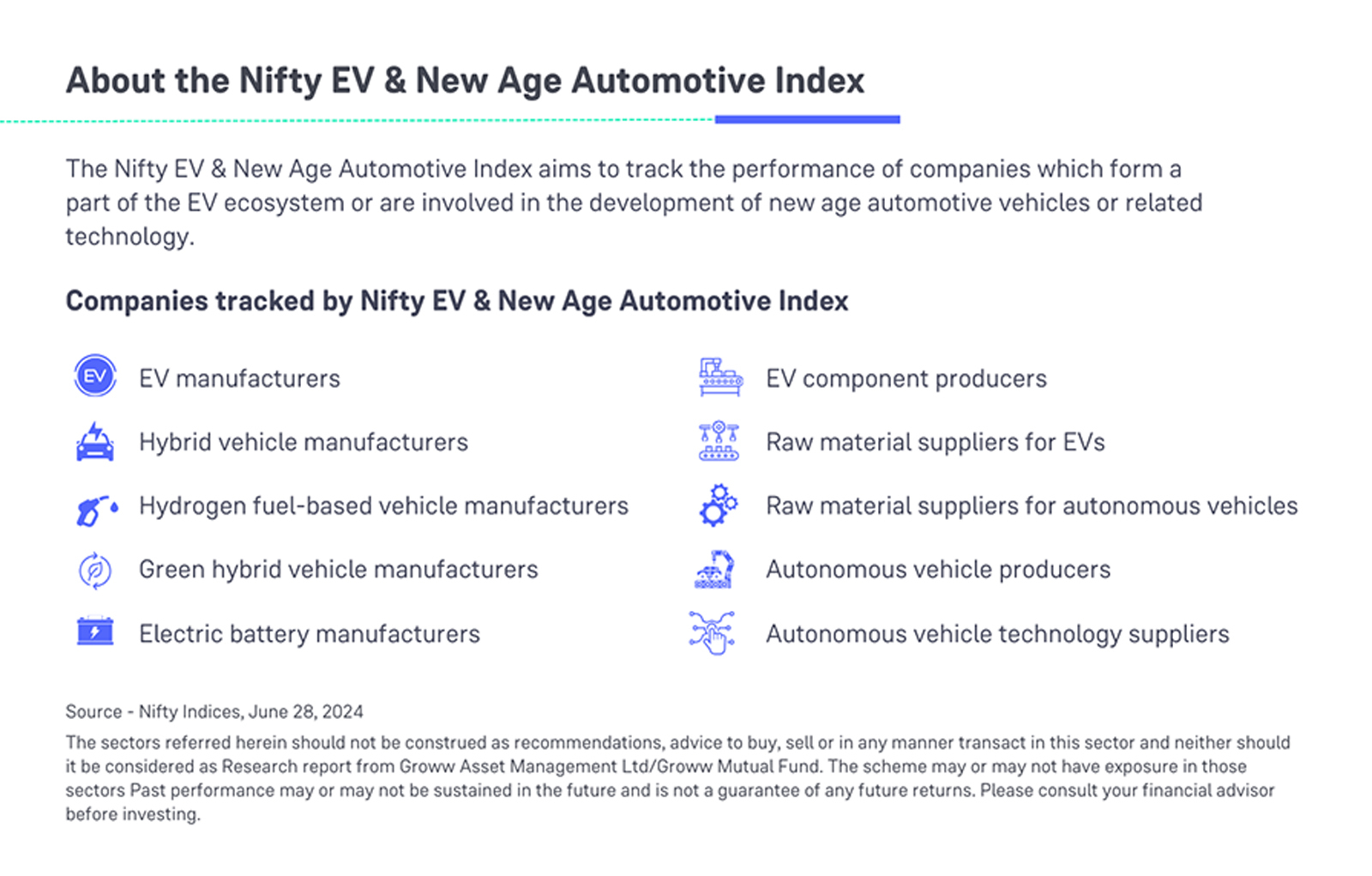

The introduction of these funds reflect India’s rapidly expanding Electric Vehicle (EV) market, which saw sales surpass 1.7 million units in FY 2024. Both schemes’ underlying benchmark index is Nifty EV & New Age Automotive index, which aims to track the performance of companies that are part of the EV ecosystem or are involved in the development of new age automotive vehicles or related technology.

India is currently focused on becoming more sustainable, and as a country where transportation contributes to 13.5% of the country’s total carbon emissions, transitioning to electric vehicles is the need of the hour. This has directed a lot of encouragement, especially from the government to the country’s expanding EV ecosystem, which currently includes batteries, charging infrastructure, and more. As a sign that this sector is poised for growth, in 2023, EV sales in India nearly doubled, reaching 2% of all passenger vehicle sales.

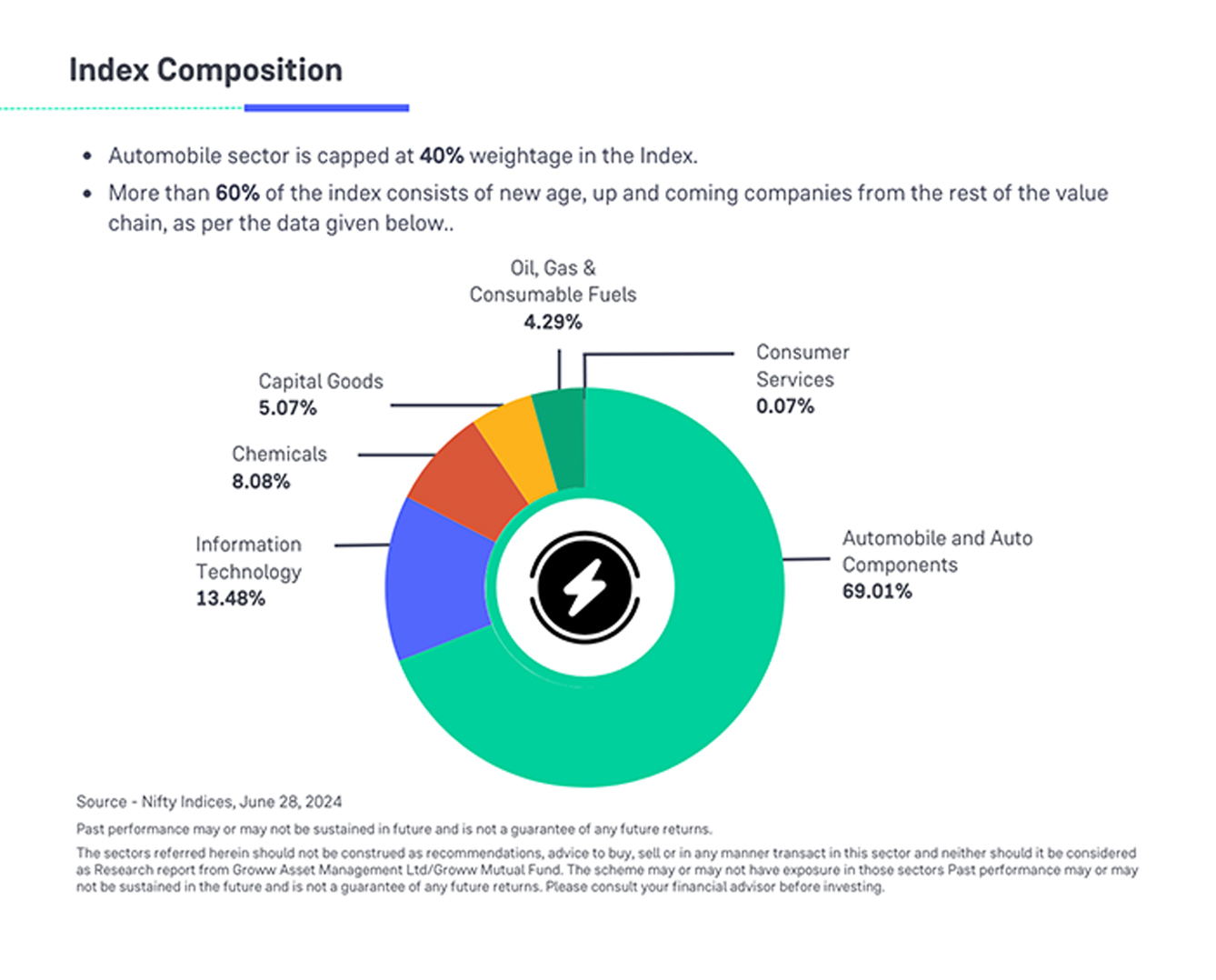

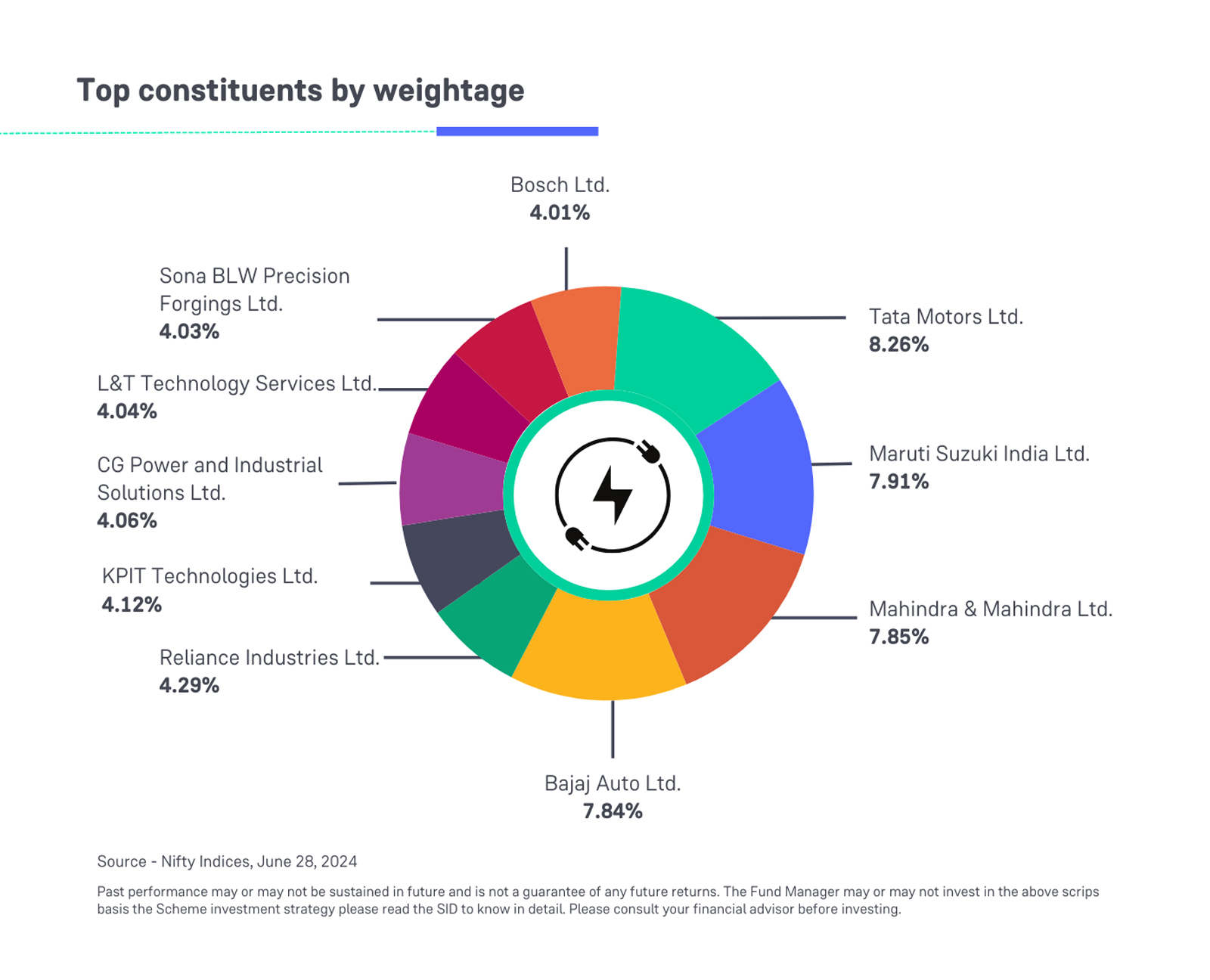

The Nifty EV & New Age Automotive Index is designed to monitor ~33 companies from the Nifty 500 index, which are engaged in EV manufacturing, including hybrid and hydrogen fuel-based vehicles, charging infrastructure, battery production, and other crucial areas of the EV ecosystem. The index is predominantly composed of companies from the EV automobile and EV auto components industry.

Details about the underlying index - Nifty EV & New Age Automotive Index

About Groww Nifty EV & New Age Automotive ETF

The investment objective of the Scheme is to generate long term capital growth by investing in securities of the Nifty EV & New Age Automotive Index in the same proportion / weightage with an aim to provide returns before expenses that track the total return of Nifty EV & New Age Automotive Index, subject to tracking errors. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

This scheme is suitable for investors seeking long-term capital appreciation and investment in equity and equity-related instruments of the Nifty EV & New Age Automotive Index. However, investors should consult their financial advisor before investing.

Allocation of the scheme

|

Instruments |

Indicative Allocation (% of total assets) |

|

Equities & Equity-related securities of companies engaged in or expected to benefit from Electric Vehicles & New Age Automotive Themes |

Minimum - 95 Maximum - 100 |

|

Money market instruments/debt securities, Instruments and/or units of debt/liquidschemes of domestic Mutual Funds |

Minimum - 0 Maximum - 5 |

For more information refer to the scheme information document.

About Groww Nifty EV & New Age Automotive ETF FOF

The investment objective of the Scheme is to generate long term capital gains by investing in units of the Groww Nifty EV & New Age Automotive ETF. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

This scheme is suitable for investors seeking long term capital appreciation and to invest predominantly in units of Groww Nifty EV & New Age Automotive ETF. Further, the risk associated with the Scheme is very high.

Allocation of the scheme

|

Instruments |

Indicative Allocation (% of total assets) |

|

Units of Groww Nifty EV & New Age Automotive ETF or similar ETF tracking the Nifty EV & New Age Automotive Index |

Minimum - 95 Maximum - 100 |

|

Debt & Money Market Instruments / and Units of debt/liquid schemes of domestic Mutual Funds |

Minimum - 0 Maximum - 5 |

For more information refer to the scheme information document

Fund Details : Groww Nifty EV & New Age Automotive ETF

|

Name of the scheme |

Groww Nifty EV & New Age Automotive ETF |

|

Scheme Type |

An open-ended scheme replicating/tracking Nifty EV and New Age Automotive Index -Total Return Index |

|

Scheme Benchmark |

Nifty EV and New Age Automotive Index-Total Return Index |

|

Investment Objective |

The investment objective of the Scheme is to generate long term capital growth by investing in securities of the Nifty EV & New Age Automotive Index in the same proportion / weightage with an aim to provide returns before expenses that track the total return of Nifty EV & New Age Automotive Index, subject to tracking errors. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved. |

|

Fund Manager |

Abhishek Jain |

|

Minimum Investment Amount |

Rs 500 and in multiples of Re. 1/-thereafter |

|

Exit Load |

Nil |

Fund Details : Groww Nifty EV & New Age Automotive ETF FOF

|

Name of the scheme |

Groww Nifty EV & New Age Automotive ETF FOF |

|

Scheme Type |

An open-ended fund of fund scheme investing in units of Groww Nifty EV & New Age Automotive ETF |

|

Scheme Benchmark |

Nifty EV & New Age Automotive Index |

|

Investment Objective |

The investment objective of the Scheme is to generate long term capital gains by investing in units of the Groww Nifty EV & New Age Automotive ETF. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved. |

|

Fund Manager |

Abhishek Jain |

|

Minimum Investment Amount |

Monthly SIP: Rs. 100/- and in multiples of Re.1 for purchases and of Re 0.01 for switches. Lumpsum: Rs. 500/- and in multiples of Re.1 for purchases and of Re 0.01 for switches |

|

Exit Load |

Exit Load: If redeemed within 30 days from the date of allotment: 1%; If redeemed after 30 days from the date of allotment: NIL. |

Investors should read Scheme Information Document/Key information Memorandum before investing in the Schemes (https://www.growwmf.in/downloads/sid)

Investors can start investing in the NFO of Groww Nifty EV & New Age Automotive ETF till August 2 and in the NFO of Groww Nifty EV & New Age Automotive ETF FOF from July 24 till August 7, via any mutual fund investing platform or directly through Groww Mutual Fund.