Income Tax Online Payment

Income Tax is a type of direct-tax levied by the Government of India on any income (other than that generated from agriculture and related activities) as per the Income Tax Act, 1961.

It is applicable to the taxable income earned by individuals, members of a Hindu Undivided Family, firms, companies, Limited Liability Partnerships, local authorities, as well as any artificial juridical person. Usually, those with an income of over Rs. 2.5Lakh/annum are liable to pay income tax under the ITA within 31st August of the preceding year.

Taxes are imperative for any nation to grow and income tax is the main source of revenue for any government, which is used for the upliftment of major sectors of the country.

On failing to pay the requisite taxes, the above-mentioned entities can be penalised and subjected to further legal actions. Therefore, it is crucial for individuals to pay their taxes and file their income tax returns on time to avoid any such disputes.

Who can File Income Tax Returns Online?

India, like many other countries, follows a progressive income-tax structure resulting in high-income earners falling in higher tax rate slabs. Any individual or entity liable to pay income tax is eligible to file income tax returns. Moreover, even if the income is below the taxable limit, one can always file a nil return to avail of the associated benefits such as easy loans.

According to the Income Tax Act, you are liable to file ITR if you belong to the following categories.

- Indian citizens who have an annual income of more than or equal to Rs. 2.5 Lakhs

- Indian citizens above 60 years who have annual income more than 3 Lakhs

- Citizens over the age of 80 with annual income more than 5 Lakhs

- A firm (falling under guidelines of section 44AB), Cooperative Society, BOI, AOP, Artificial Juridical Person, and Local Authority (ITR 5).

- If you are a resident of India but have property or financial interest in an entity outside India.

- An assesse who is responsible for producing returns U/S 139 (4B) (ITR 7)

- If you are resident Indian with signing authority of any account that you are holding outside India.

- If you claim tax relief under sections 90 or 90A or the deductions were claimed as per section 91.

- All companies are liable

How to Pay Income Tax Online?

It is often seen that people usually consider tax payment as a hefty task and some extra amount at times adds surplus worries to it. So, to put people at ease, the Income Tax department of our country has leveraged the power of technology to ensure the payment of taxes on time and in a hassle free manner.

The salaried individuals can make their income tax online payment by following some simple steps. However, one should make sure that online payment can only be done through net banking.

Step 1:

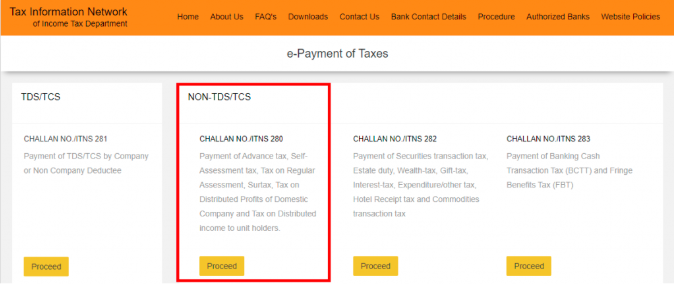

Visit the Tax Information Network

To pay income tax online, visit the tax information network of the income tax department and click on the proceed option inside “CHALLAN NO./ITNS 280” as the preferred income tax challan for online payment.

Step 2:

Enter Personal Information

For individuals:

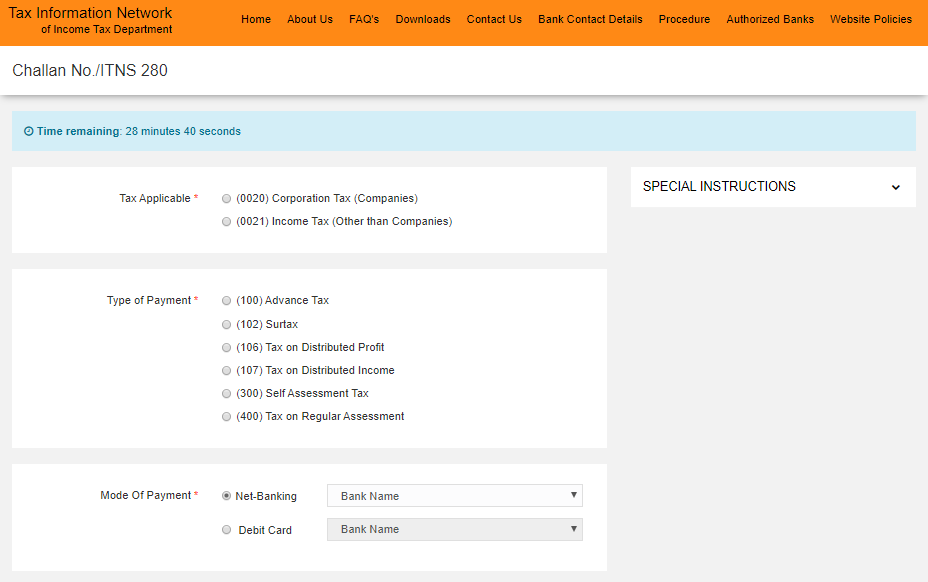

1st Step : Select (0021) Income Tax (Other than Companies) in ‘Tax applicable option’

2nd Step: Select the type of payment correctly from the following:

- (100) Advance Tax

- (102) Surtax

- (106) Tax on Distributed Profit

- (107) Tax on Distributed Income

- (300) Self Assessment Tax

- (400) Tax on Regular Assessment

Select the option ‘Self-assessment tax’, if you have any taxes due to pay.

3rd Step: Select the mode of payment of your choice. There are two options available – Net banking or Debit Card.

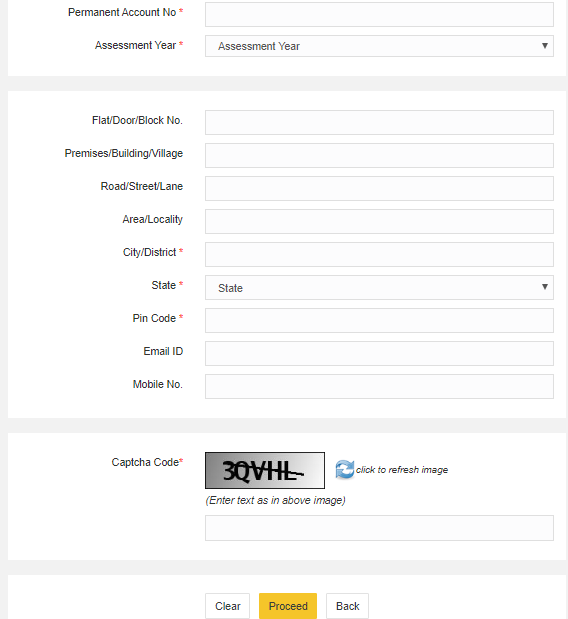

4th Step: Enter your PAN (Permanent Account Number) and select the relevant Assessment Year (AY). For the financial year 2022-23, 1st April 2022 – 31st March 2023, the relevant AY is 2023-24.

5th Step: Enter your complete address

6th Step: Enter the captcha code in the given space and click on ‘Proceed’

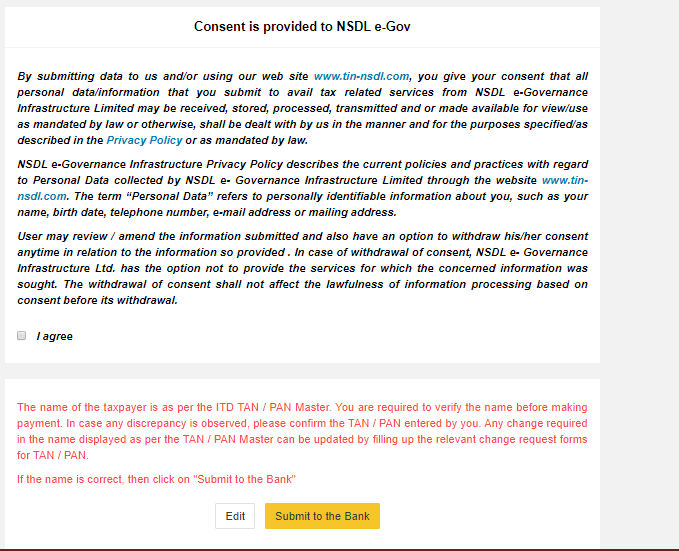

Step 3:

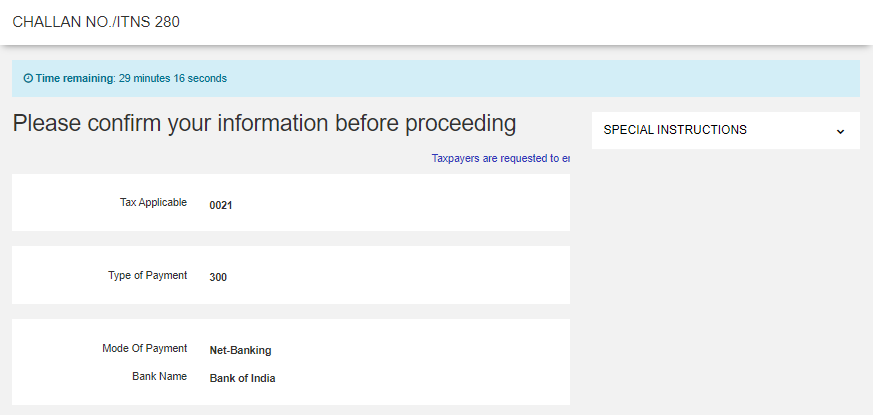

Cross-check all the information provided by you and then you will have to submit the request to the bank. You will be directed to the bank’s payment page.

Step 4:

Check Receipt (Challan 280)

You’ll get a tax receipt on the next screen on successful completion of the payment, where you can see the payment details. You can check the BSR code and challan serial number on the right side of the challan.

Note: Save a copy of your tax receipt or take a screenshot. You’ll require the BSR code and challan number to enter in your tax return.

How to File Income Tax Return after the Payment?

On successful completion of income tax online payment, individuals will need to declare the same in their income tax returns. This can be done by visiting the “file income tax return” page in the official income tax page.

Advance Tax Payment

Advance taxes are applicable for those who have outstanding tax dues exceeding Rs. 10,000. In most cases, for salaried individuals, tax payments are taken care of by their respective employers along with TDS. However, those falling under a higher income group need to avail the advance income tax online payment facility to make their tax payments in full.

Following are a few instances under which individuals have to make advance income tax payments –

- When their quantum of tax payment exceeds Rs. 10,000 as a result of returns from capital gains, interest earned and rental income.

- For freelancers and business owners.

Advance Tax Calculation and Payment

To calculate one’s payable advance tax amount, they will have to know their taxable income first. To do so, one has to add their earnings from –

- All sources like salary, capital gains (from Mutual Funds, shares, etc.), interest, etc.

- Freelancers will need to form an estimate about their annual income and deduct their applicable expenses like workplace rent, bills, travel expenses, etc. from it.

- Next, individuals have to determine the deductions (under Sections 80C, 80CCD and 80CCC of the Income Tax Act) allowed on their income.

After applying these deductions to the total earnings, individuals can estimate their taxable income. The payable advance tax is then calculated on the basis of the income tax slab rate applicable to the individual in question.

The following table illustrates Advance Tax Payment due dates are:

| Due Date | For respective individuals |

| Before 15th June | 15% of total advance taxation |

| Before 15th September | 45% of total advance taxation |

| Before 15th December | 75% of total advance taxation |

| Before 15th March | 100% of advance taxation |

If an individual fails to pay the requisite advance tax, he/she will be levied with a penal interest under Sections 234C and 234B.

In addition to this, individuals might find that they have some tax payable due during the time of filing their income tax returns. This amount, known as “self-assessment tax” can be paid online at that time to ensure that the tax returns are filed successfully.

Individuals should also make interest payments on the tax amount due, under Section 234C and 234B when they pay online income tax payment of self-assessment tax. Thus, with these few details in mind, it is easier to file the returns successfully after making income tax online payment in full.