Income Tax e-Filing

According to Section 139 (1) of India, any individuals whose total income in the last year exceeds the tax exemption bracket should file their ITR or income tax returns. E-filing is the process through which an individual file their income tax returns online.

As a taxpayer, you can seek expert assistance or file your own taxes by registering on the income tax departments or other relevant websites. While the deadline for e filing income tax returns is July 31 each year, the government may give a grace period of 15-30 days to file the forms online or in person.

How to File ITR Online - ITR Filing Online Process

Here is a step-by-step guide for filing ITR online-

Step 1: Calculate Income and Tax

The first step while e-filing income tax is to calculate the income and applicable tax with respect to the tax provisions.

The income tax calculation should be done by considering income from every source and computed after claiming the valid deductions.

Step 2: TDS Certificates and Form 26AS

The next crucial step is to summarize the TDS amount from the TDS certificates received. Note a Form 26AS can be used to compute the summary of TDS and tax paid during a certain financial year.

Step 3: Select the Suitable Income Tax Form

In step 3, a taxpayer is required to select the ITR Form before filing the returns. Note as a taxpayer, you can file income tax returns either online or offline. For online ITR filing, only 2 forms, i.e. ITR 1 and ITR 4, are available.

Rest all the other income tax forms will be required to be uploaded offline by generating XML and uploading on the portal.

Step 4: Download ITR utility from Income Tax Portal

Visit the official Income Tax portal at www.incometax.gov.in and click on ‘Downloads’. Now, select the assessment year to download the offline utility software

Step 5: Fill Out the Downloaded File

Once you download the offline utility, ensure to fill out the required details that would include your income, tax payable, refund receivable, etc.

Step 6: Validate the Information Entered

After filling out the form, click on the 'Validate’ button finally to confirm all the filled in details.

Step 7: Convert the File to XML Format

Post validation, click on ‘Generate XML’ option of the file to convert the file into XML format.

Step 8: Upload the XML File on the Official Income Tax Filing Portal

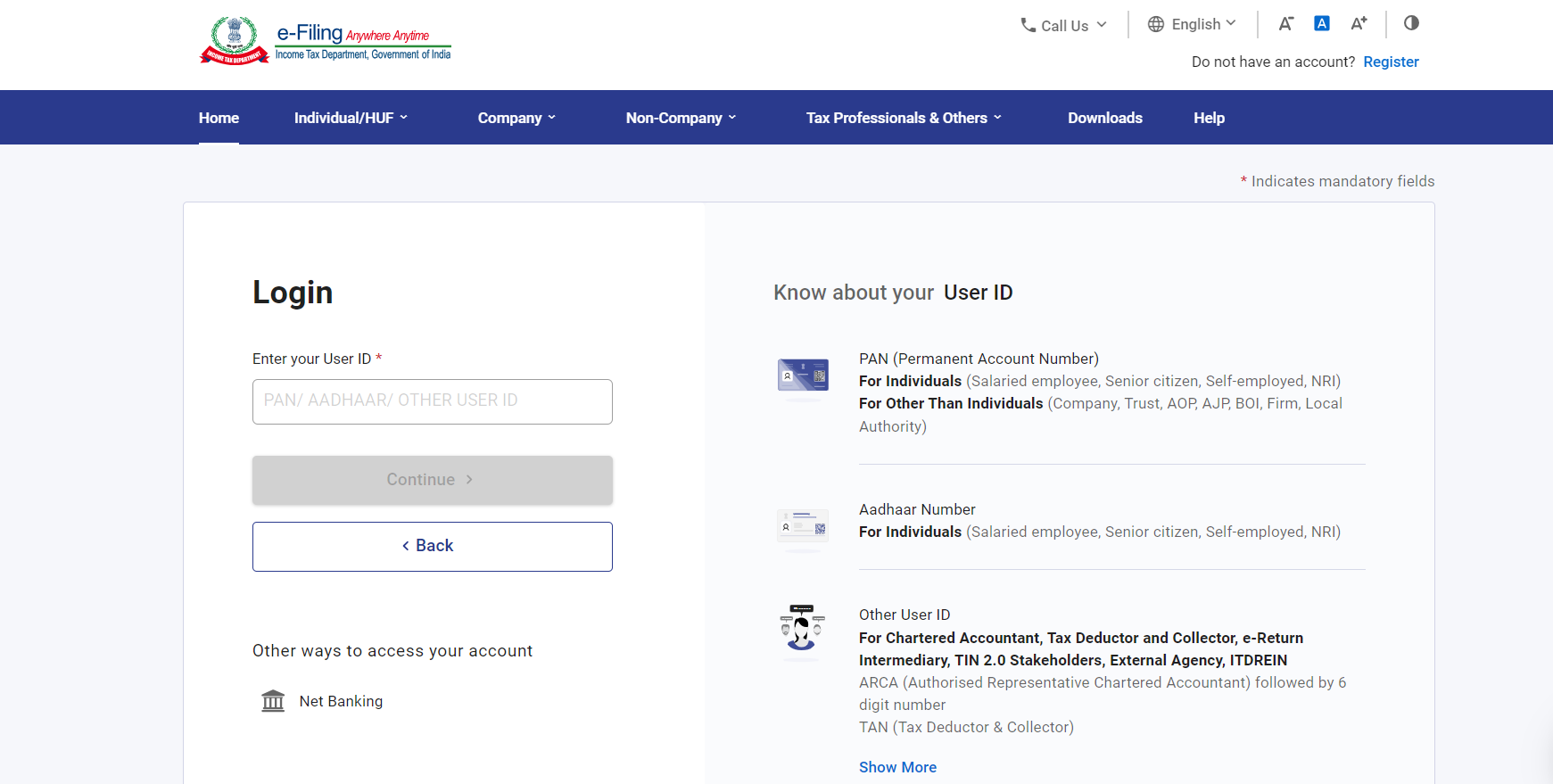

Log in to the official income tax e-filing portal. Click ‘e-File’ option and then click on ‘Income Tax Return’.

Here, make sure to provide the required information including PAN Card details, ITR Form number, assessment year and the submission mode as well.

Next, attach the respective XML file from your computer and click ‘Submit’.

Finally pick one of the verification modes - Electronic verification code (EVC), Aadhaar OTP, or sending a manually signed copy of ITR-V to CPC.

|

Due Date for Income Tax e filing Individuals have a deadline until July 31st of the relevant assessment year to file their ITR, while taxpayers whose accounts are subject to audit have time until October 31st. Know more about Income Tax Returns Filing Due Date. |

Required Documents for Income Tax Filing

It is always a good idea to be prepared before filing your income tax, whether online or in person. The information provided below should act as a checklist to assist you in getting started with e filing income tax returns.

- General Details - Bank details, PAN.

- Salary Reporting - Rent receipts to claim HRA, pay receipts, and form 16.

- House property income - Address proof, details of the co-owners with the share in the mentioned property and PAN, Date of construction, in case not yet constructed, it needs to be the day of purchase and certificate for home loan interest.

- Capital Gains - Stock trading statement, capital gains of shares sold, sale price, registration details, mutual fund statements, purchase details of equity funds, and more.

- Reporting Income - The income from interest reported, interest proof from tax-saving bonds, and corporate bonds need to be reported.

Rules for e Filing in Income Tax

Filing Only with Aadhaar: You can use Aadhaar to file your income tax return when you don't have a Permanent Account Number. Furthermore, when applying for a new PAN, you must present your Aadhaar Card.

Taxpayers who file their returns using their Aadhaar card will be assigned a PAN after their demographic data is obtained from the Unique Identification Authority of India, according to the new income tax guidelines (UIDAI).

The new rule was implemented by the Government of India in order to improve tax compliance while making the tax payment procedure easier for taxpayers. As of now, taxpayers must provide their PAN while filing their taxes. However - you will be required to link your Aadhaar and PAN in order to file your taxes.

How to Check the eReturn eFill Status

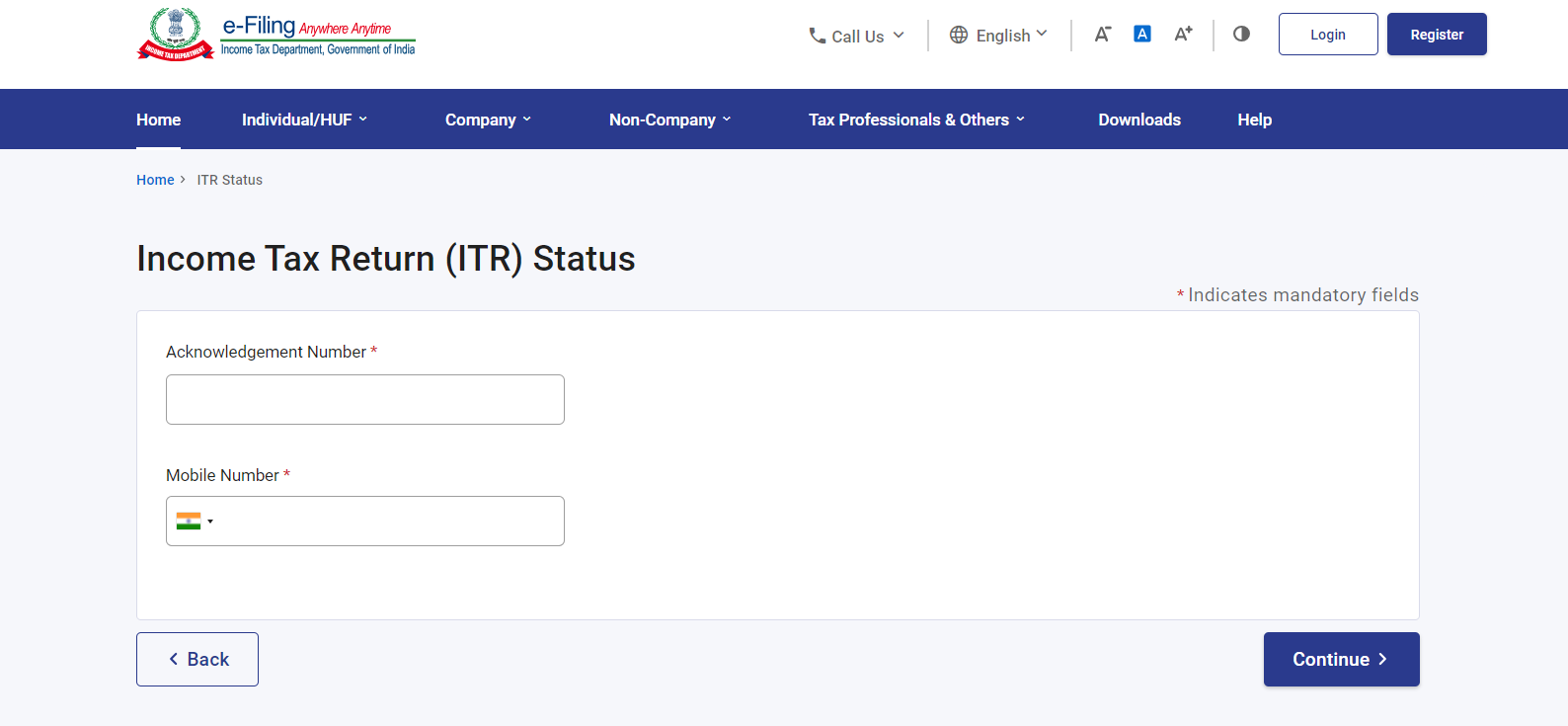

Follow the procedures below to check the Status of the income tax eFiling using the acknowledgement number:

Step 1: Go to the ITD's official website at https://www.incometax.gov.in/iec/foportal.

Step 2: Select the 'Income Tax Return (ITR) Status' option.

Step 3: Enter the PAN, acknowledgement number, and captcha code, then click the 'Submit' button.

The Status would be displayed on the screen as a result.

Penalty for Late Filing

When you fail to file the ITR by the deadline, the Central Board of Direct Taxes (CBDT) assesses a penalty. The maximum fine for late e-filing is Rs.10,000. The punishment is imposed in accordance with Section 234F.

|

Know more about Penalties for Not Filing Income Tax Returns within the Due Date here. |

Benefits of E-Filing of Income Tax

The Government of India has made e-filing of income tax returns mandatory. The method is much simpler than the previous paper filing process.

The following are the benefits of submitting ITR filing or income taxes electronically-

- Every year, the deadline for e filing income tax returns is July 31st. If the user uploads it one or two months before the deadline, they will be able to accomplish the assignment more quickly and with less congestion, as servers tend to become overwhelmed as the deadline approaches.

- This record may be useful if the taxpayer desires to conduct future business with any other organization that supports similar records.

- If a taxpayer is unable to file income tax returns for the preceding year, he must incur penal interest for each extra day until payment is made. As a result, filing your income tax return early saves you from the additional fee.

- Online filing of tax returns allows the taxpayer to retain a more effective record of all financial interactions with the Income Tax Department.