Advance Tax Payment

Advance tax payment is a system wherein taxpayers pay a share of their tax liability before the end of the year. It is often looked at as a tax EMI.

To make the most of this tax payment regime, one must become familiar with all its aspects in due advance.

This includes the advance tax payment dates, the amount of tax payable, eligibility criteria, application process for financial year and more.

What is Advance Tax Payment?

Advance tax meaning, in simple words, would be paying tax liabilities before the end of a fiscal year, is called an advance tax or pay-as-you-earn scheme.

It is payable when the tax liability of an individual exceeds Rs.10000 in a given fiscal year. Notably, such a tax is paid in instalments on due dates and is paid in the same year the income is generated.

It is considered to be favourable for the government as it facilitates a smooth and constant flow of income around the year. In case the estimate of a taxpayer’s income increases or decreases as the instalment progresses, then the payable advance tax amount can be adjusted accordingly.

|

Typically, a minimum of 15% of tax liability is expected to be paid either on the 15th of June or before. 45% of it is expected by the 15th of September, whereas at least 75% must be paid by the 15th of December. Subsequently, the entire advance tax liability should be covered by the 15th of March. |

It must be noted that the amount of advance tax payable on due dates varies among different categories of taxpayers. Also, NRIs, whose accrued income in India exceeds Rs.10,000 are liable for income tax advance tax payment.

Advance Tax Payment Due Date & Amount

The tables below offer a clear idea about the advance tax due dates and liability for different categories of taxpayers.

-

Advance Tax Payment Date for Business Owners and Self-employed

|

Instalment |

Due Date of Tax Instalment |

Amount of Tax Payable |

|

1st Instalment |

Either on or before the 15th of September |

At least 30% of the advance tax liability |

|

|

Either on or before the 15th of December |

At least 60% of the advance tax liability |

|

3rd Instalment |

Either on or before the 15th of March |

100% of the advance tax liability |

-

Advance Tax Payment Date for Companies

|

Instalment |

Due Date of Tax Instalment |

Amount of Tax Payable |

|

1st Instalment |

Either on or before the 15th of June |

At least 15% of the advance tax liability |

|

2nd Instalment |

Either on or before the 15th of September |

At least 45% of the advance tax liability |

|

3rd Instalment |

Either on or before the 15th of December |

At least 75% of the advance tax liability |

|

4th Instalment |

Either on or before the 15th of March |

100% of tax liability. |

For example,

Mr Jay suggests that his estimated taxable income for the current year will be Rs.10,00,000. Based on the assumption that no income deductions were claimed, the taxes to be paid will be Rs.112,500.

As per the rule, the advance tax payment will be planned like this –

- Advance tax payment of Rs.16875 (15%) will be paid before or on 15th June.

- Advance tax payment of Rs.33750 (45%) will be paid before or on 15th September.

- Advance tax payment of Rs.33750 (75%) will be paid before or on 15th December.

- Advance tax payment of Rs.28125 (100%) will be paid before or on 15th March.

Who Can Pay Advance Tax?

A taxpayer whose total tax liability is more than Rs.10000 after adjusting TDS in a fiscal year must pay advance tax.

It applies to all categories of taxpayers, including – freelancers, professionals, salaried and senior citizens.

-

Freelancers, Professionals and Salaried Taxpayers

Individuals whose tax liability in a fiscal year amounts to Rs.10000 or more have to pay advance tax. Regardless, senior citizens who are 60 years of age or older and do not own a business are exempt from advance tax.

-

Presumptive Earnings (Businesses)

Taxpayers who choose a presumptive tax regime under Section 44AD are required to pay the entire advance tax liability in one instalment on or before 15th March. Nonetheless, they can also pay their tax liabilities by the 31st of March.

-

Presumptive Income (Professionals)

Independent professionals like - architects, doctors, lawyers, consultants, etc., come under the purview of the presumptive tax regime under Section 44ADA.

Under the said tax regime, professionals have to pay the entire advance tax liability in a single instalment either on or before the 15th of March. They also have the option to pay the whole amount by the 31st of March.

Advance Tax Late Date of Payment

It must be noted that delaying advance taxes or paying less than the specified amount against the first due date attracts a penalty at the rate of 1% interest on the remaining tax liability each month. Such an interest is paid under Section 234B and Section 234C of the Income Tax Act 1961.

The interest penalty will also apply if taxpayers fail to pay the due amount by the next deadline. In case they fail to pay the third or last instalment, they will be paying 1% S.I. on the default tax for each month until the entire sum is paid.

Advance Tax Payment Calculation

Taxpayers can compute their advance tax liability by following these simple steps –

Step 1 – Taxpayers need to ascertain their earnings for the given year, as advance tax is computed based on estimated income. They must factor in revenue from sources like – capital gains, interest income, rent, professional income, etc.

Step 2 – Proceed to compute the gross taxable earnings of a year by adding salary income to the estimated revenues of the year. Regardless, it must be noted that advance tax is not paid on salary.

Also, the sum of income from non-salaried sources and salary may influence the applicable tax slab and may increase tax liability.

Step 3 – Compute the payable tax amount as per the latest and applicable income tax slab.

Step 4 – Subtract the deducted TDS amount or the TDS that will be deducted according to the suitable tax slabs for different earnings.

Step 5 – At any time, if the tax liability post TDS deduction exceeds Rs.10000, adhere to advance tax payment norms.

In case, taxpayers fail to estimate their expected income correctly; they will have to account for it accordingly. For instance, if the taxpayer had paid an advance tax amount that turned out to be lower than the actual tax due, they will have to pay the penalty along with any applicable interest.

How to Pay Advance Tax Online?

Here is a step-by-step procedure for advance tax payment online:

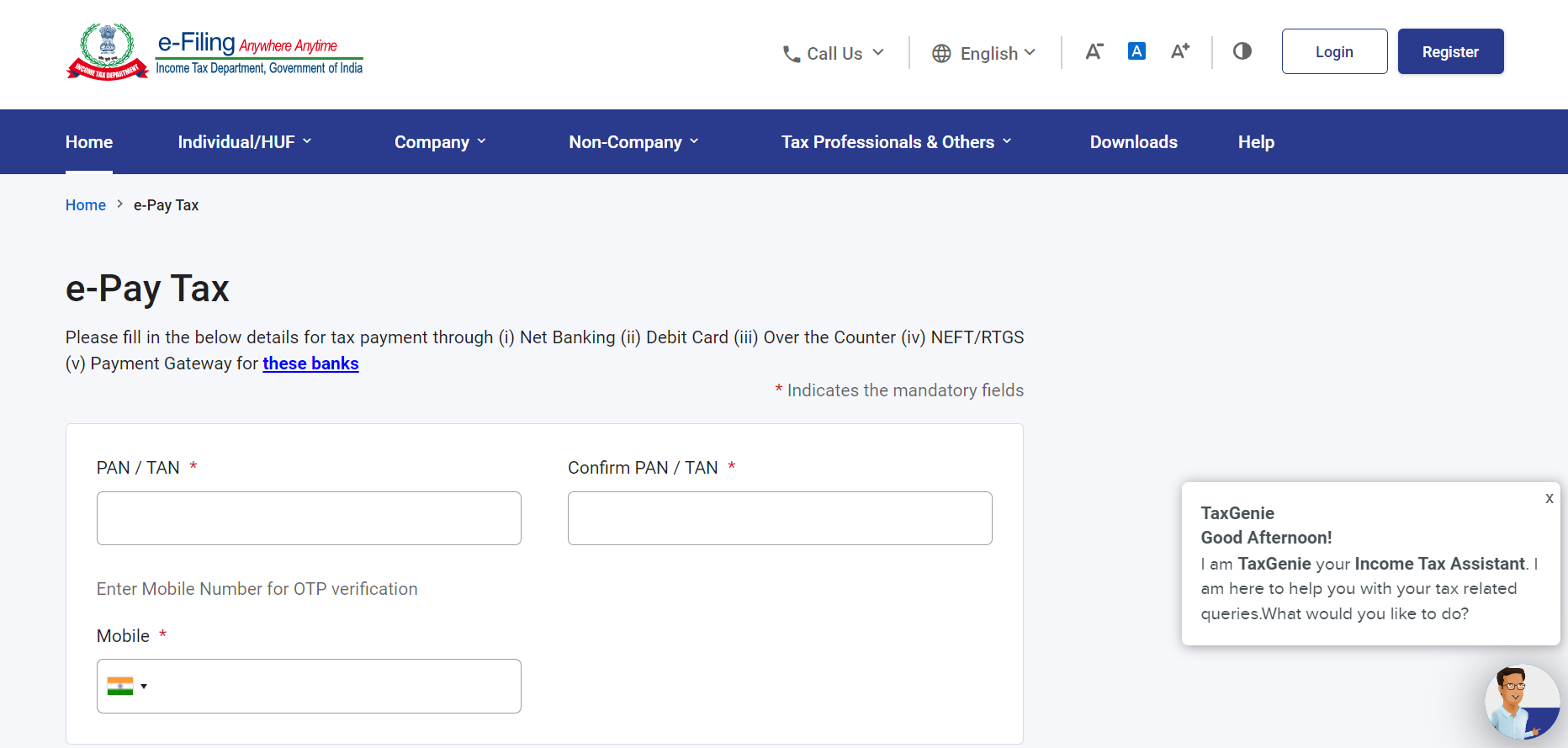

Step 1 – Go to the e-filing portal of the I.T. Department of India.

Step 2 – Click on 'e-pay Tax' under 'Quick Links'.

Step 3 – Enter 'PAN' and 'Mobile Number' and proceed to click on 'Continue'.

Step 4 – Fill out the received 'OTP' and next click on 'Proceed'.

Step 5 – Choose the First Tab that says 'Income Tax' Option and then click on 'Continue'.

Step 6 – Choose the ‘Assessment Year’ and ‘Type of Payment’ as ‘Advance Tax (100)’. Press 'Continue'.

Step 7- Fill out all the details about tax.

Step 8 - Choose the relevant mode of payment and the bank and proceed to click on 'Continue'.

Step 9 - Get a preview of the challan and next press the ‘Pay Now’ button.

Step 10 - Once the payment is completed, an acknowledgement will appear on the following screen. The BSR code and challan serial number will be displayed on the challan's right side. Ensure to get a copy of this receipt since the stated BSR code and challan number will be required in tax return.

Those who are not comfortable with this online advance tax payment method may use the offline payment facility by submitting the challan at the I.T. Department authorized bank branches.

Nonetheless, irrespective of the method, individuals must ensure that they compute and settle their advance tax liabilities on time to avoid getting penalized.

Exemptions

Now that you know how to pay advance tax online here are some details about exemptions-

- Senior citizens above the age of 60 are excused from paying the advance tax.

- If the TDS deducted exceeds the tax payable for the year, the advance tax is not required.

- Salaried people who fall under the TDS net are exempt from paying the advance tax. Any earnings from sources such as interest, rent, capital gains and other non-salary income, on the other hand, will be subject to advance tax.

Refund

Here are some details of the tax refund policy which you must be aware of:

- If the Income Tax Department discovers that you paid more tax than you should have, it will reimburse the difference at the end of the year.

- Taxpayers can request a refund by completing and submitting Form 30.

- They must submit their claim within one year of the end of the assessment year.

Benefits of Advance Tax

There are major advantages of Advance tax payments, and they are-

- Advance tax aids in lowering taxpayer worry. Taxpayers do not have to worry about running out of money or making last-minute tax payments when they pay their taxes in advance.

- It expedites the collection of taxes.

- It assists organizations in effectively managing their finances and offers an estimate of the income received during the fiscal year.

- It raises government funds since the government can receive interest on the money collected.

- People who pay their taxes in advance avoid falling behind on their obligations.