TDS Traces

The Income Tax Department offers Traces (TDS Reconciliation Analysis and Correction Enabling System) as an online service at www.tdscpc.gov.in.

The goal of this tool is to allow both TDS payers and deductors to view and reconcile their TDS payments online in order to file returns and seek refunds.

Objective of the TRACES Website

The TDS TRACES website enables taxpayers and TDS deductors to perform different tasks but it is not limited to the following-

- Form 26AS can be seen and downloaded.

- Submit a request for TDS/TCS statement revisions.

- Check the challan status.

- Online, you can check the status of numerous tax statements.

- Make a refund request online.

- Download the consolidated file, as well as the Justification Report and Forms 16 and 16A. (for TDS deductors only.)

- The online services accessible on the website of TRACES offer a convenient way to carry out a variety of tax-related tasks. This has mostly supplanted prior paper-based systems, which were far more time-demanding. PAN information and challan corrections can be easily made using this online rectification facility.

- Corrections to previously submitted TDS returns must be completed online.

- OLTAS Challan rectification online.

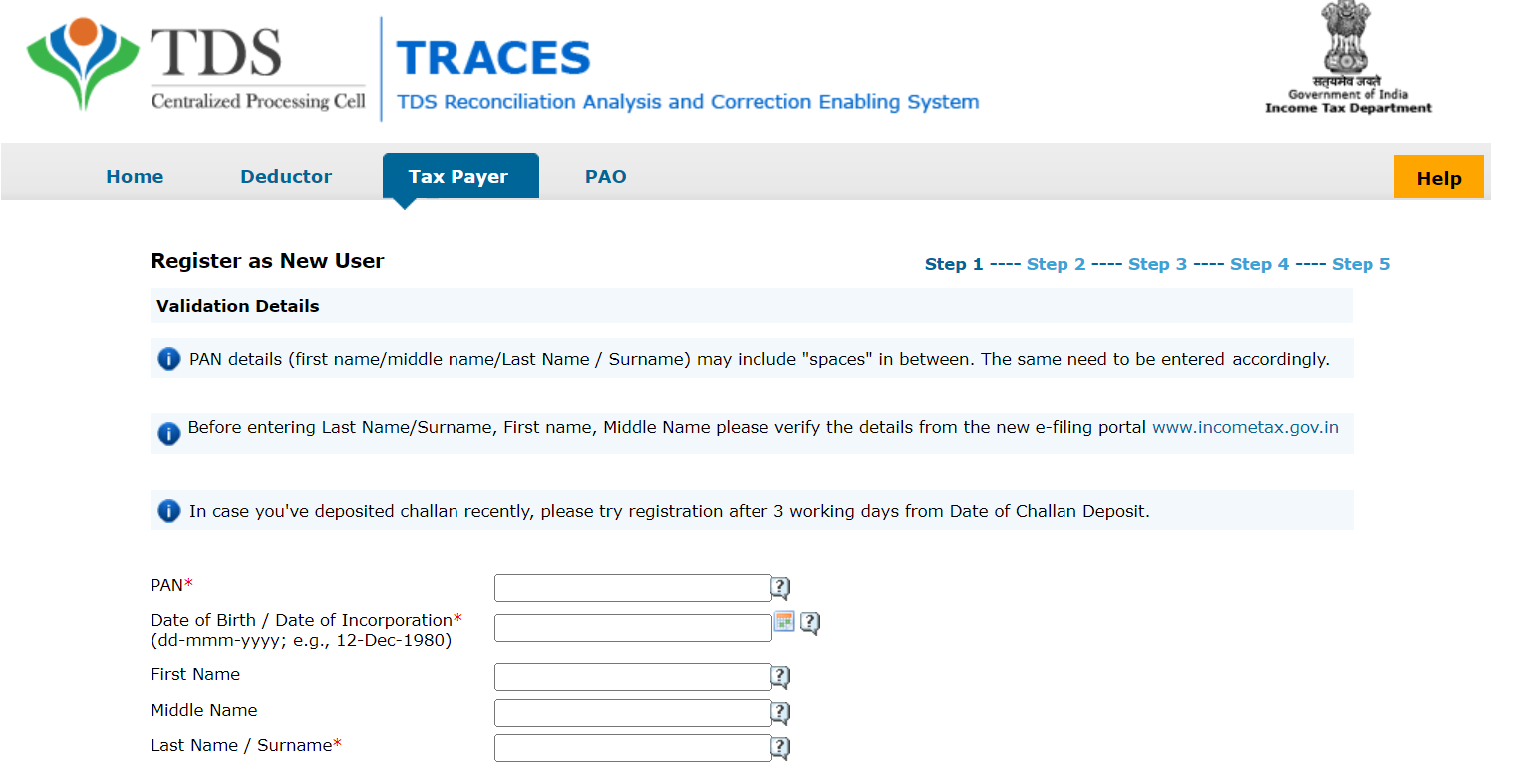

How to Register for TRACES as a Taxpayer?

Taxpayers/PAO/Deductors must register on the TRACES website in order to use the numerous online services available through TRACES. The key stages for registering on TRACES India are as follows-

Step 1: Click on 'Register as New User' to access the option to register.

Step 2: When you click on the link, you will be directed to the taxpayer page.

Step 3: After entering the necessary information, click 'Create Account.' To authenticate the supplied information, a confirmation page will appear. If you wish to update any of the data presented on the confirmation screen, you can use the edit tab to do so.

Step 4: After checking the data, an activation link and activation code will be provided to the applicant's email address and mobile number.

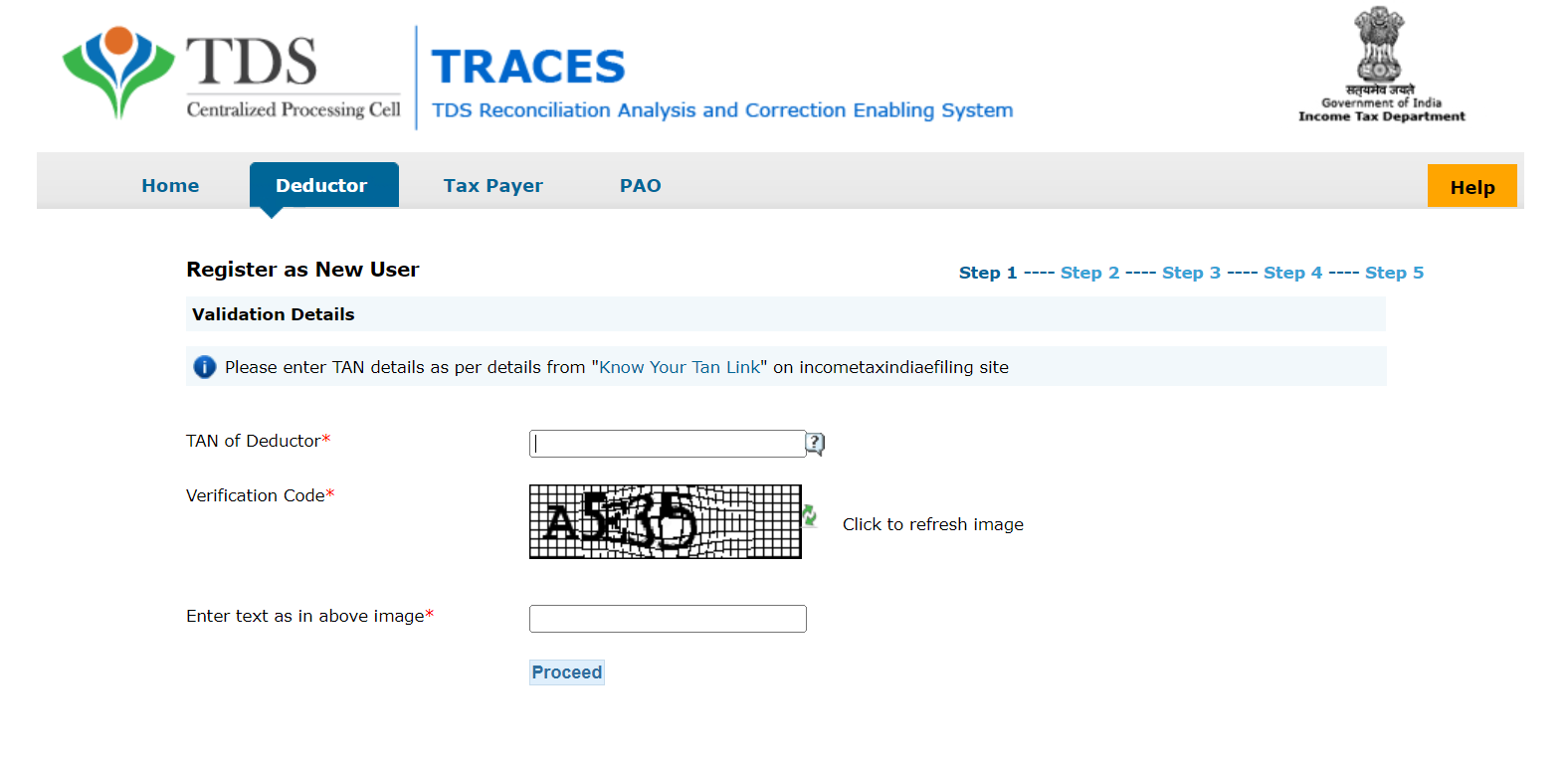

How to Register for TRACES as a Deductor?

Step 1: Visit the TRACES webpage.

Step 2: Select 'Register as New User.'

Step 3: Choose 'Deductor' as the User type.

Step 4: Fill in all the necessary information to register as a deductor on TRACES.

Step 5: Following successful registration, an activation link will be provided to the registered email address, as well as separate activation codes to the registered email address and cellphone number.

Step 6: Enter your user ID and activation credentials by clicking the activation link.

Step 7: After activation, the user can access TRACES.

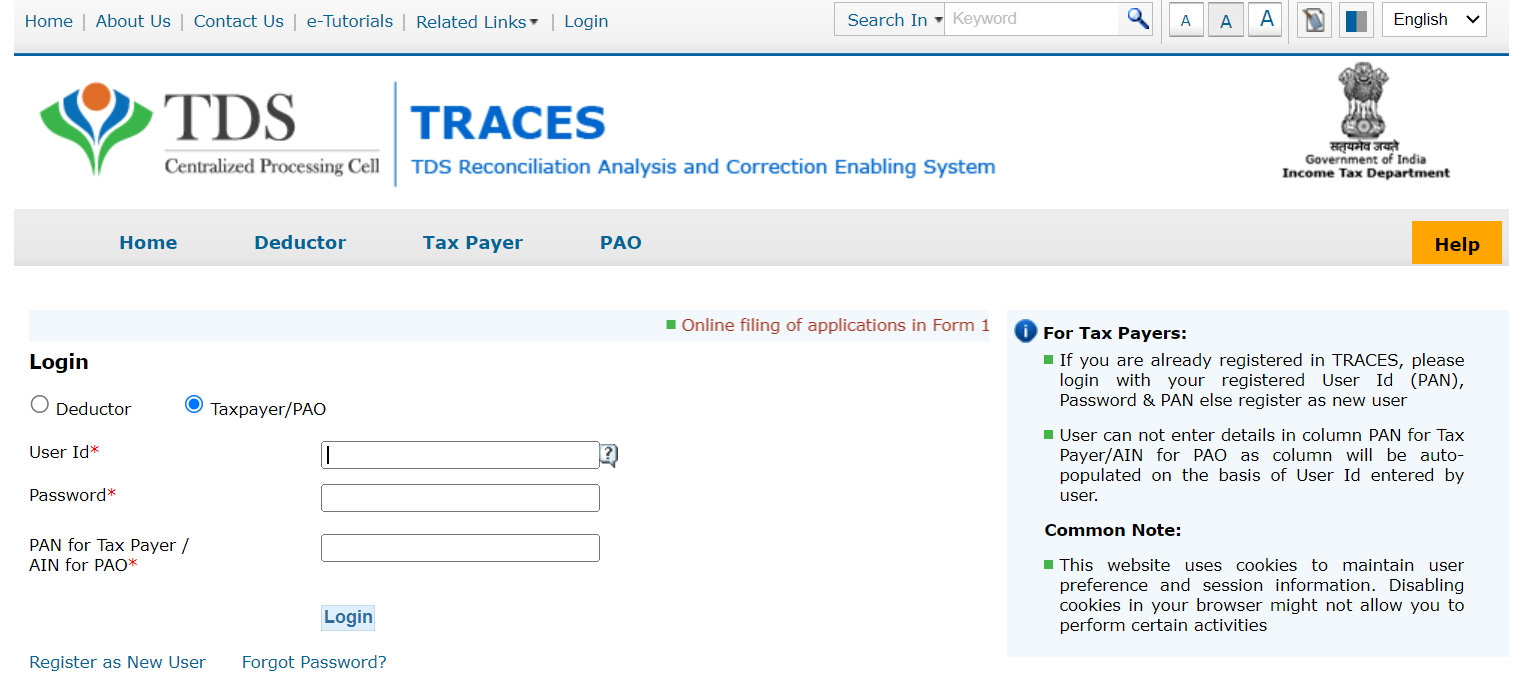

How to Login to the TRACES Portal?

When a deductor has already registered, the key stages for TRACES Login are as follows-

Step 1: Sign in to the TDS - CPC portal. To access the TDS TRACES login screen, click 'Login.'

Step 2: Enter your Login ID and Password, i.e., your TIN number, and then click 'Go.'

Step 3: The login only has the 'Profile menu' enabled; click on it.

Step 4: Enter the deductor's information, such as PAN number, date of birth, and so on, and then click Submit.

Step 5: Confirm the information on the confirmation page and click the submit button.

Step 6: Following successful registration, an activation link will be provided to the registered email address, as well as separate activation codes to the registered email address and cellphone number.

Step 7: Enter the User Id and activation codes after clicking the activation link.

Step 8: The user can access TRACES after activation.

TRACES Justification Report

The TDS TRACES Justification Report contains information on defaults/errors discovered by the Income Tax Office (ITD) while processing the deductor's statement for a specific quarter of the fiscal year.

This paper contains thorough data about the defaults and/or errors that the deductor must correct. This rectification can be completed by completing a correction statement and paying the necessary interest/fees, as well as any other applicable dues. Deductors can also use the material in this report to provide clarifications for any "errors" found by the tax authorities.

How to Generate a TRACES Compliance Report?

The TDS Compliance Report identifies defaults in all TANs connected with entity-level PAN. The taxpayer may generate this report in the following manner-

Step 1 - Begin this procedure by logging into TRACES as a taxpayer.

Step 2 - For this purpose, click the 'Aggregated TDS Compliance tab.

Step 3 - The user could select one of the following options:

- Based on the default.

- Based on the fiscal year.

Step 4 - Select the 'Submit Request' option.

Step 5 - After submitting the request, the corresponding Excel File can be downloaded from the 'Requested Downloads' part of the 'Downloads' menu.

What is the Request for Resolution Facility?

Taxpayers can use the "Request for Resolution" feature to get their complaints resolved. The user can use this service by following the steps outlined below-

Step 1 - To obtain such a resolution, taxpayers must first log in to TRACES as a taxpayer using their registered user ID and password.

Step 2 - Select the 'Request for Resolution' tab.

Step 3 - Select the category for which the resolution request is to be made.

Step 4 - Select the assessment year relevant to the inquiry.

Step 5 - Fill out and submit the relevant information.

Step 6 - Upon submission, a Ticket number is generated, indicating that the request was successfully submitted.

Ticket Status on TRACES

The following are the outcomes of TDS TRACES' ticket status check options-

- Open: The ticket is with the assessing officer and will be acted on within the time period specified.

- In Progress: The requestor/Assessing Officer has provided clarification.

- Clarification Asked: The tax authorities have requested clarification on the request. The ticket will be closed if no clarification is provided within 30 days.

- Request for Closure: This indicates that the deductor has provided clarification and has sent it to the assessee for closure. If no action is made within 30 days on such a request, the ticket will be automatically closed.