What Are Validated UPI Handles & SEBI Check Tool?

In recent years, impersonation scams have been on the rise. SEBI (Securities and Exchange Board of India) observed that unregistered entities were masquerading as legitimate brokers or mutual fund houses and tricking investors into transferring money to fake UPI IDs/bank accounts.

To enhance investor protection and curb fraudulent money collections by unregistered entities, SEBI introduced two new initiatives in a circular issued on June 11, 2025.

- Validated UPI Handles (“@valid” handles)

- SEBI Check Tool

These rollouts went live on 1 October 2025, SEBI stated in another circular.

This blog will explain in detail everything about validated UPI handles and the SEBI check tool.

What Are Validated UPI Handles?

SEBI-registered investor-facing intermediaries, such as brokers and mutual funds, now have exclusive UPI IDs ending with “@valid” and suffix “.brk” for brokers and “.mf” for mutual funds, with the name of the self-certified syndicate bank.

For instance: xyz.brk@validhdfc, abc.mf@validicici

These validated UPI handles are issued exclusively by the National Payments Corporation of India (NPCI) to SEBI-registered intermediaries for collecting payments from investors. This will help investors quickly identify legitimate entities when making payments.

Key Features of @valid Handles:

- Visual verification: A distinctive green triangle (as shown below) with a thumbs-up icon appears when making payments through these handles. If it doesn’t, it shows that the entity asking for payment is unauthorised.

- Secure QR codes: Specifically designed QR codes linked to @valid handles include the thumbs-up logo at the centre. It exemplifies that payments are being made to SEBI-registered intermediaries.

What Is the “SEBI Check Tool”?

Beyond UPI payments, SEBI has launched the SEBI Check tool to help investors verify the authenticity of bank accounts and UPI IDs of registered intermediaries.

How it Works:

- Investors can validate:

-

- Bank account number + IFSC code (If you are using NEFT, RTGS, or IMPS as payment mode)

- @valid UPI ID of an entity.

- Bank account number + IFSC code (If you are using NEFT, RTGS, or IMPS as payment mode)

- Available via:

-

- SEBI’s Saarthi app available on the Apple App Store and Google Play Store

- SEBI’s Saarthi app available on the Apple App Store and Google Play Store

How to Use SEBI Check Tool:

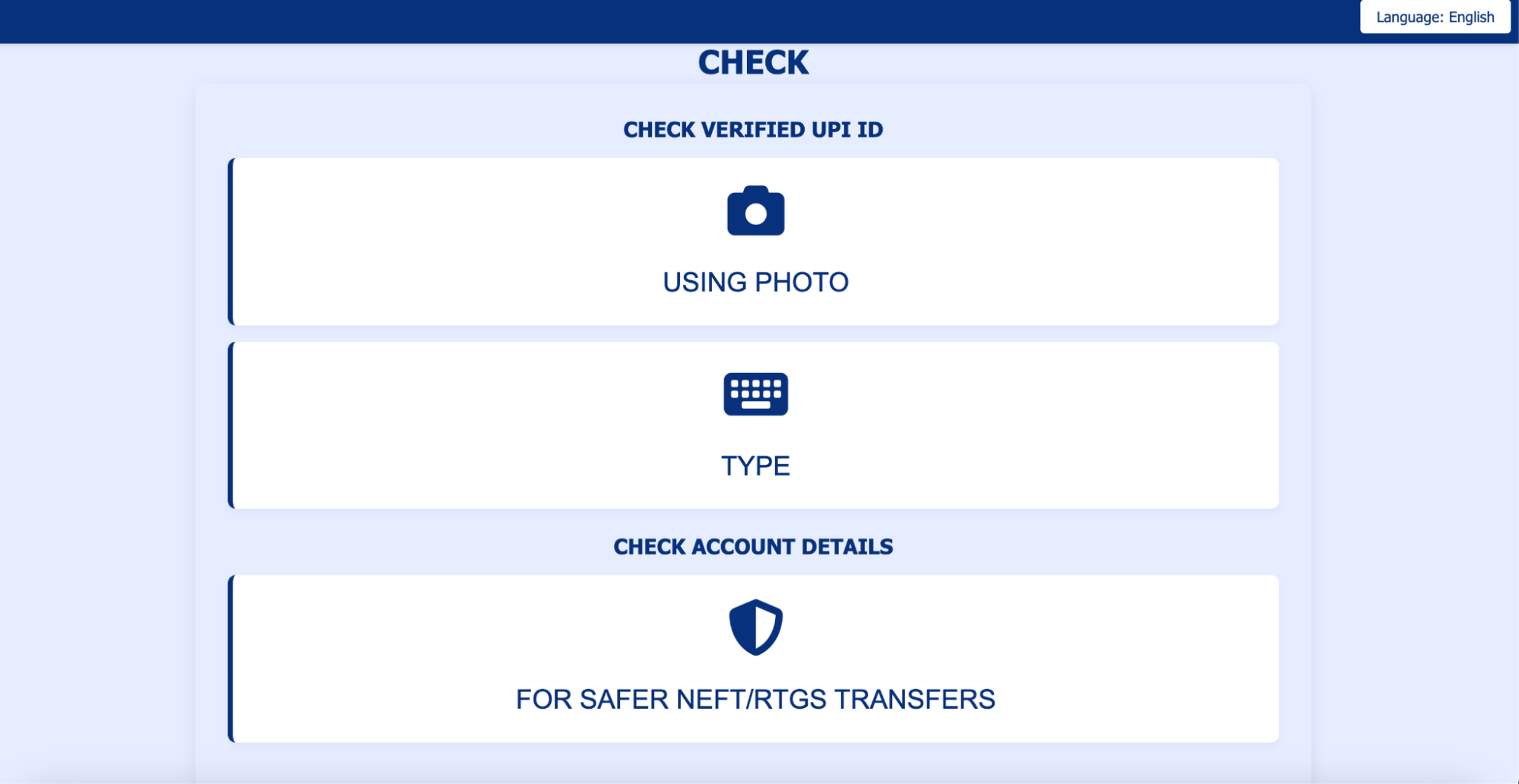

Verifying UPI ID and bank account details via the SEBI check tool is a simple two-step procedure. Simply visit the website and choose the required option. If the broker/MF house is offering a QR code, use the “Photo” option to verify its authenticity.

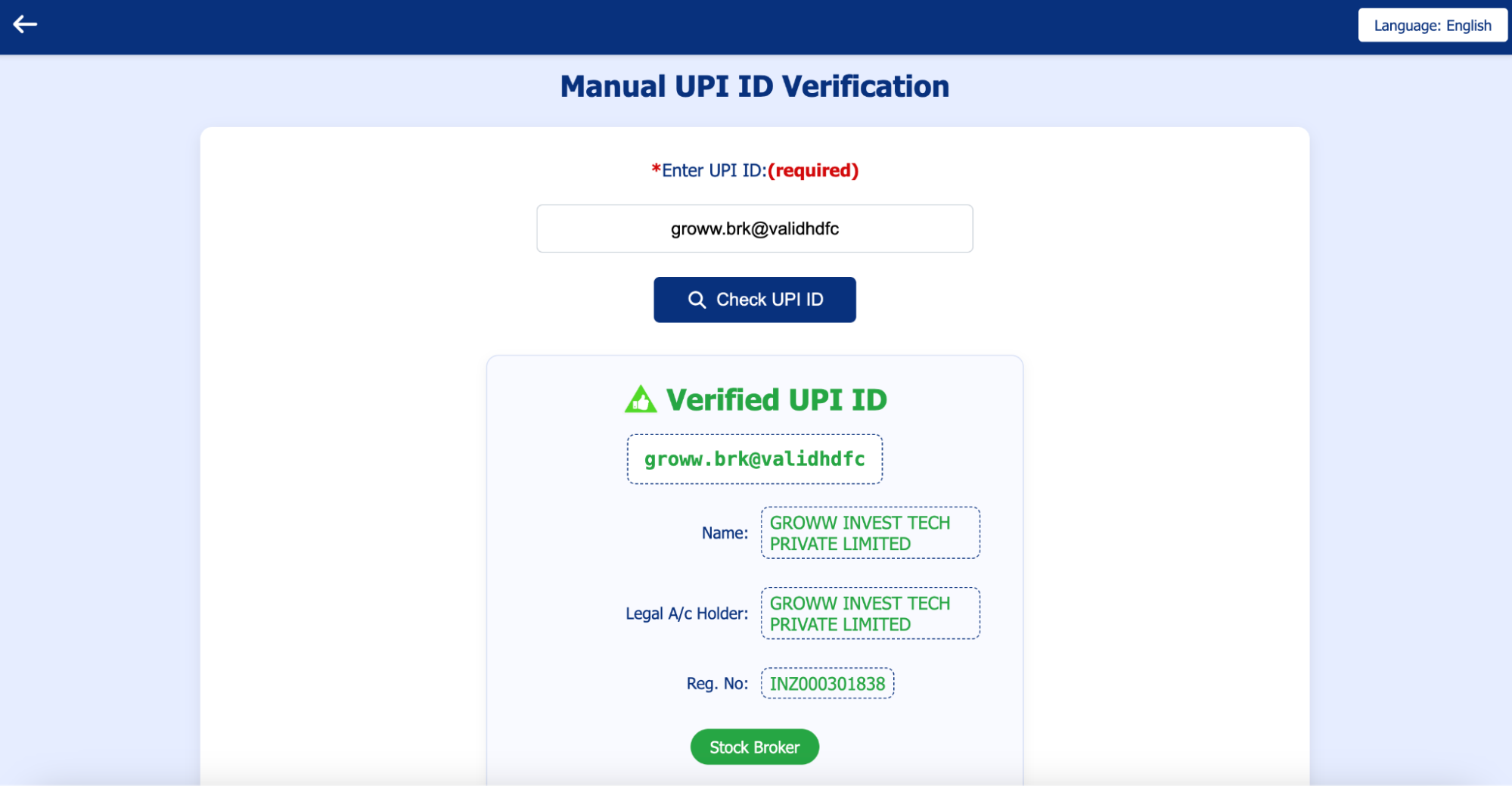

If the UPI ID or bank account details are legitimate, you’ll receive the message below. It shows that the intermediary you are transferring funds to is SEBI-registered.

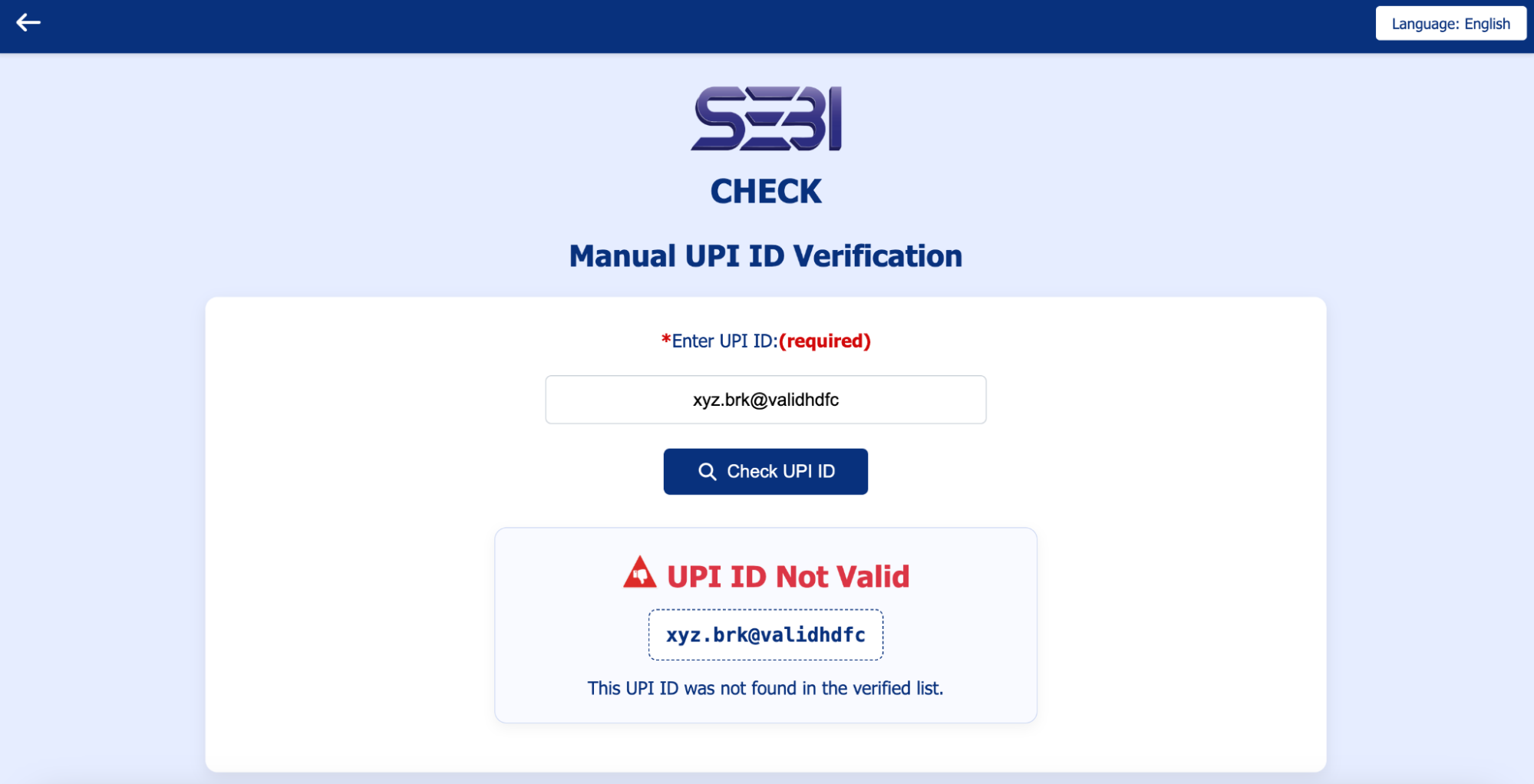

If you receive the below error message, refrain from transferring funds to that broker/mutual fund house.

Why This Matters

These initiatives bring three core benefits to investors:

- Assured Security: Payments go only to verified, SEBI-registered intermediaries.

- Fraud Prevention: The absence of the thumbs-up icon or a failed SEBI check instantly signals a potential fraud.

- Transparency and Trust: A simple, reliable system empowers investors to transact confidently.

With digital transactions becoming the new norm, fraud prevention is critical. These initiatives by SEBI provide investors with reliable ways to identify legitimate intermediaries, verify payment details, and transact with confidence.

For investors, the key takeaway is simple: use these tools actively. Before you pay, always verify.

Frequently Asked Questions (FAQs)

-

What are the new UPI IDs/QR mechanisms introduced by SEBI?

Due to a rise in impersonation scams, SEBI has introduced validated UPI handles and verified QR codes for secure transactions. These are exclusively issued to SEBI-registered intermediaries for collecting payments from investors.

-

How can I identify a validated UPI handle?

Validated UPI handles have a unique format:

UPI ID ending with “@valid” + suffix “.brk” [for brokers] and “.mf” [for mutual funds] + self-certified syndicate bank name (e.g., abc.brk@validhdfc).

-

How can I identify a verified QR code?

Verified QR codes linked to these handles will display a green triangle with a thumbs-up icon, confirming authenticity.

-

What is SEBI Check Tool?

SEBI Check is a verification tool made available by SEBI for investors to validate the authenticity of UPI IDs, QR codes, and bank account details of intermediaries.

-

Do investors need to change their UPI IDs?

No, the mechanism is introduced only for SEBI-registered intermediaries; investors can continue using their personal UPI IDs.

-

Where and how can I access the SEBI Check tool?

The SEBI Check tool can be accessed by the official SEBI Check tool website or through the SEBI Saarthi mobile app.

-

Are these new only for UPI payments? What about NEFT/RTGS/IMPS?

The validated UPI handle system by SEBI can specifically be used to verify brokers’ and mutual fund houses’ UPI IDs legitimacy. However, with the SEBI Check tool, investors can use the “Check Account Details” option and verify bank account details (for NEFT/RTGS/IMPS) as well.

Disclaimer: This news is solely for educational purposes. The securities/investments quoted here are not recommendatory.

To read the RA disclaimer, please click here