SBI Mutual Fund Launches JanNivesh SIP: Now Start Investing with Just ₹250

In partnership with the State Bank of India (SBI), SBI Mutual Fund launched JanNivesh SIP, a systematic investment plan requiring a monthly contribution of just ₹250.

This initiative aims to:

- Promote financial inclusion across India

- Invite small and first-time investors from rural and urban areas to participate in the mutual fund market.

- Encourage underserved population segments to develop savings habits and build wealth through disciplined investing.

The launch of JanNivesh SIP aligns with SEBI’s vision outlined in its consultation paper as on January 22, 2025, which emphasised:

“To promote financial inclusion, encourage regular saving habits, and help new investors start investing in mutual funds — even with small amounts. This makes mutual funds more accessible and affordable for everyone.”

“To meet this goal, SEBI, along with the Mutual Fund industry, has introduced a small-ticket SIP (Systematic Investment Plan) starting at just ₹250. All SEBI-regulated intermediaries who support mutual funds with services and infrastructure have agreed to take part in this effort to make the product practical and long-lasting.”

SBI Mutual Fund is taking a step forward in making SEBI’s vision a reality!

If you also want to invest in this scheme, here are all the details you need to know about the JanNivesh 250 SIP plan.

About SBI Jan Nivesh SIP

The funds invested in JanNivesh SIP will held in the SBI Balanced Advantage Fund. One can start investing with as little as ₹250 on a daily, weekly or monthly basis.

Key Details SBI Balanced Advantage Fund

SBI Balanced Advantage Fund is an open-ended dynamic asset allocation fund launched by SBI Mutual Fund on August 31, 2021. It provides long-term capital appreciation through a balanced mix of equity, cash, and debt holdings.

Fund Overview:

|

Benchmark |

NIFTY 50 Hybrid Composite Debt 50:50 Index |

|

Additional Benchmark |

BSE Sensex TRI |

|

Risk Level |

High |

|

Assets Under Management (AUM) |

₹33305.48Cr (As of 31 Jan 2025) |

|

|

For the Direct Plan: 0.69% |

|

For the Regular Plan: 1.57% |

|

Asset Allocation |

Equity: 42.51% |

|

Debt: 25.82% |

|

|

Cash & Cash Equivalents: 26.63% |

Performance of SBI Balanced Advantage Fund

Since its inception, the SBI Balanced Advantage Fund has given annual returns of 11.63%.

|

1-Year Return |

9.9% |

|

3-Year Return |

12.69% |

The above data is as of 24th February, 2025

Potential Returns To Expect From SBI JanNivesh SIP

Investing in the JanNivesh SIP with a monthly contribution of ₹250 can help you grow your wealth over time through the power of compounding.

What returns can you expect from SBI JanNivesh SIP?

Can you become a crorepati by investing in this fund?

Let’s find out!

Over time, the SBI Balanced Advantage Fund has given decent returns. Using the SBI SIP calculator and assuming an average annual return of 15%, here’s how your investment can grow.

|

Monthly Investment: ₹250 |

|

|

Expected rate of return: 15% |

|

|

Returns after 10 years |

₹65,755 |

|

Returns after 20 years |

₹3,31,768 |

|

Returns after 30 years |

₹14,07,943 |

|

Returns after 40 years |

₹57,61,668 |

|

Returns after 42 years |

₹1,05,85,005 |

As you can see, even a small contribution of ₹250 can turn into substantial wealth and make you a crorepati, provided you stay invested for the long haul!

Holdings of SBI Balanced Advantage Fund

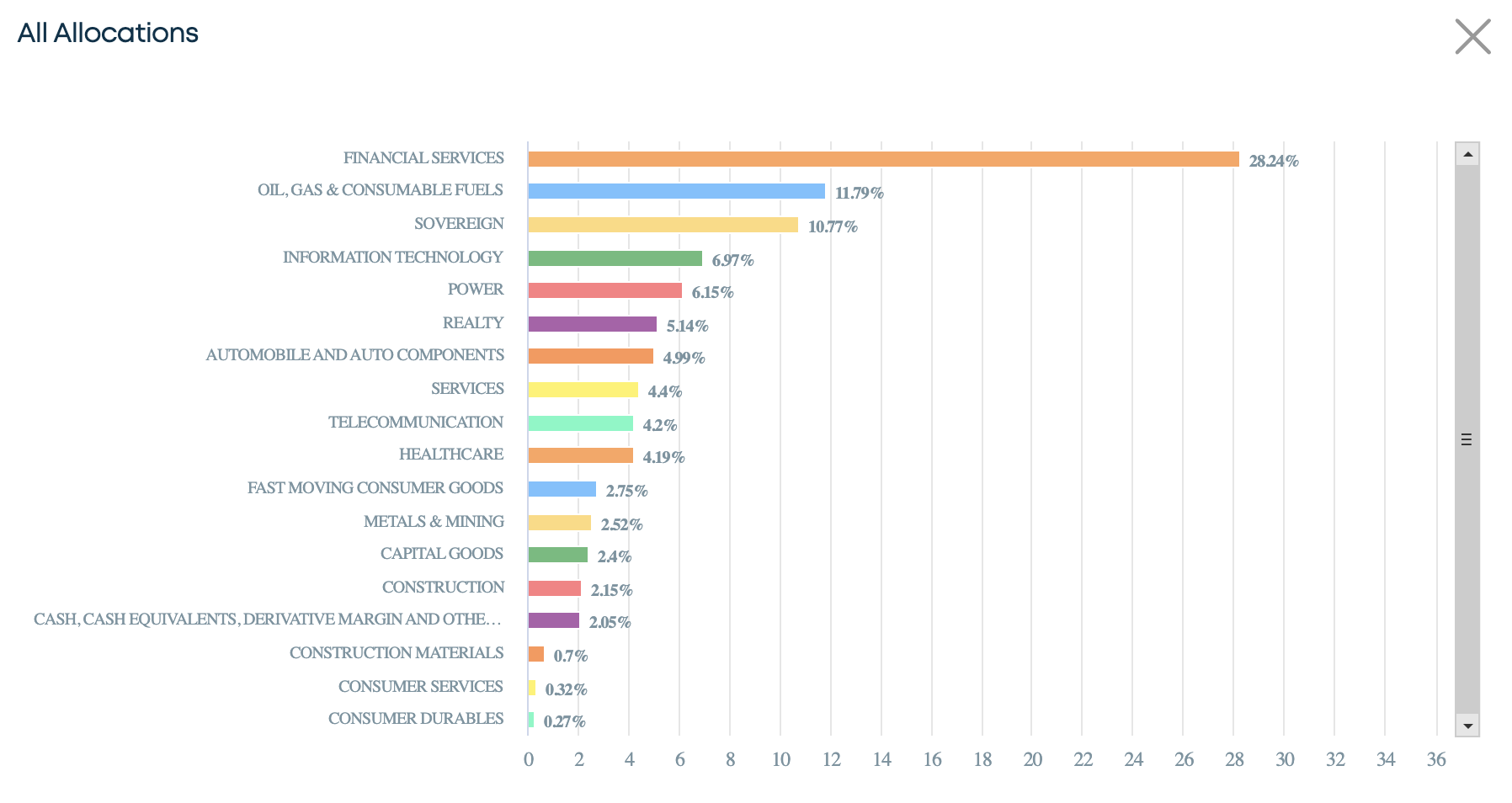

SBI Balanced Advantage Fund investments are spread across various sectors, with financial services having the highest allocation of 28.24%, followed by oil, gas, consumables, and others.

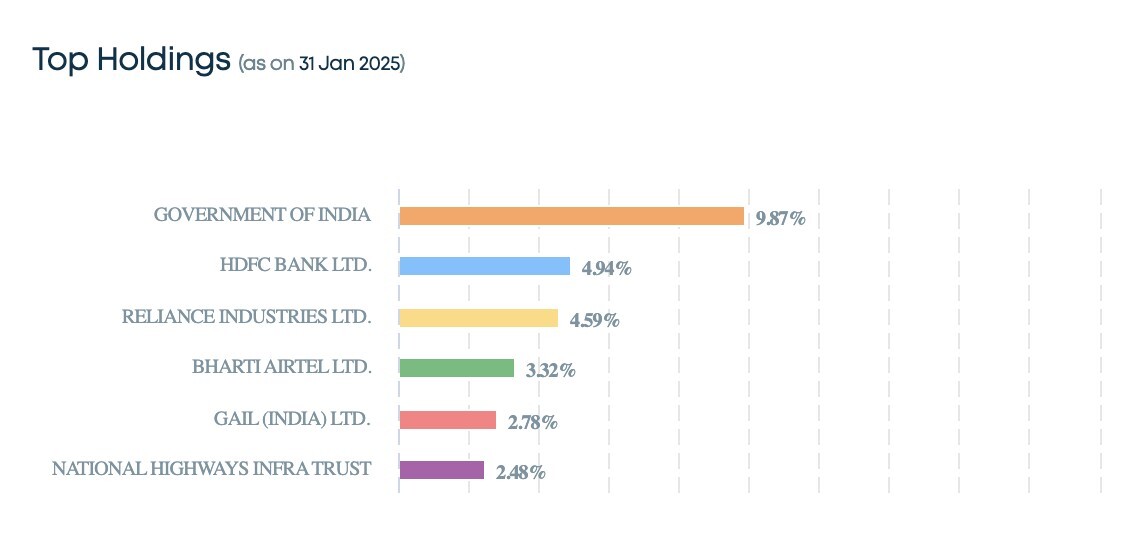

Further, the top-6 holdings of the fund constitute 27.98% of the total fund’s assets (as shown below).

Source: SBI MF Website

To conclude, if you’re looking to start your investment journey with a small, manageable amount, the JanNivesh ₹250 SIP plan offers an excellent opportunity!

|

Disclaimer: This news is solely for educational purposes. The securities/investments quoted here are not recommendatory. To read the RA disclaimer, please click here |