IOTA Cryptocurrency – 9 Things You Need to Know

As the digital currencies market continues to grow, more and more cryptocurrencies are being started. IOTA coin is one of them.

It is the 7th largest cryptocurrency having a market cap of $11 billion and hence, one of the exciting investment prospects among investors. This article will explain all the basic facts about iota.

1. What is IOTA?

IOTA stands for Internet of Things Application and is just another cryptocurrency like bitcoin.

It is a decentralized cryptocurrency that is used to facilitate communications among business and online transactions. Unlike most of the other cryptocurrencies, it is not based on blockchain technology.

The role of technology has increased in our day-to-day lives. Physical devices such as cars, electronic devices, buildings, etc are all connected and allow an exchange of data among themselves.

IOTA coin is developed on the interface of this present and future industrial revolution of the Internet of things (IoT).

Blockchain-based cryptocurrencies like bitcoin are created by miners. The process of mining involves solving a difficult mathematical problem with a 64 digit solution. Whenever each problem is solved, a bitcoin is generated.

IOTA, on the other hand, removes this heavy transaction cost. IOTA coin is a completely open source and nonprofit organization which is focused on building IoT solutions.

2. IOTA Facts

| IOTA Price INR | Rs 215.45 |

| IOTA Rate | $3.39 USD |

| Market Cap | $9,415,019,542 USD |

| Volume | $209,911,000 USD |

| Circulating Supply | 2,779,530,283 MIOTA |

| % Change (last 1 year) | 524.41% |

3. History of IOTA Coin

IOTA Coin was founded in Germany in the year 2015 by David Sønstebø, Sergey Ivancheglo, Dominik Schiener, and Dr. Serguei Popov. IOTA foundation looks around the development and cryptocurrency market of IOTA coins.

In the beginning, a market supply of 2,779,530,283,277,761 IOTA coins was issued. However, there is no mining in the case of IOTA; no more IOTA coins can be generated. A few months after the launch, it converted its platform into an open distributed system where more iota coins can be processed.

4. How Does IOTA Coin Work?

The process differs from bitcoin mining and there are no transaction fees involved. For an IOTA coin user to make a transaction, he or she has to confirm two other random transactions.

The above statement sounds technical but it simply means it is decentralized and as more and more transactions have been verified. This leads to a faster network as more people use IOTA.

5. IOTA vs Bitcoin: Advantages

- No transaction fees. Bitcoin transactions have higher fees involved even in the case of microtransaction. This issue is resolved with IOTA coins.

- Bitcoin has very limited scalability whereas the scope of scalability in IOTA is infinite.

- The mining of bitcoin involves a lot of energy and electricity whereas there is no mining in IOTA coins generation.

- Also, IOTA is focused on the Internet of things which is expected to become a huge market in the future.

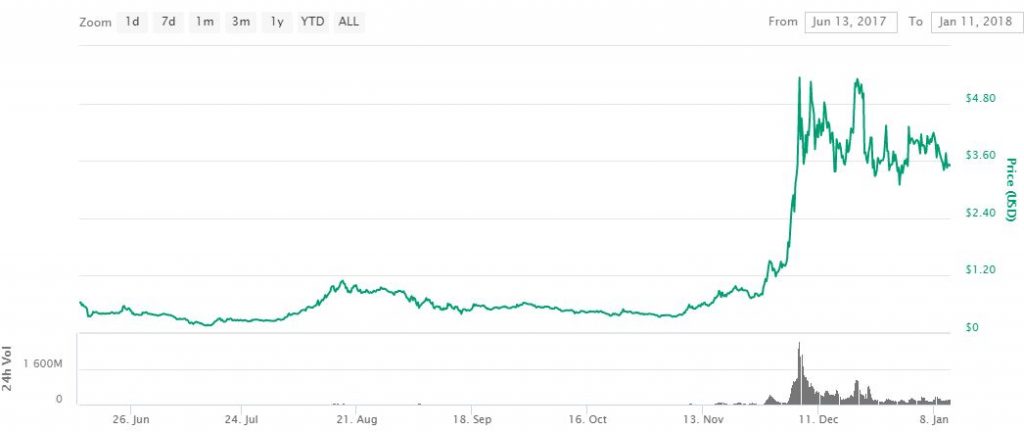

6. IOTA Price Chart

The price movement for IOTA has been very volatile which makes it a very risky investment.

In the initial months of the launch, it had shown upward and downward trends frequently. However, in the last two months, it has seen an upward trend in the market.

7. Should I Invest in IOTA?

Seeing the upward trend and the future technology, one can plan to invest in IOTA coins but it depends on the risk appetite of an investor. You can only purchase IOTA in exchange for another cryptocurrency such as Bitcoin and Ethereum.

You cannot purchase IOTA coins directly with traditional cash, i.e. you have to first purchase other cryptocurrencies then only you can buy iota coins.

However, considering the volatile values of IOTA and the cryptocurrency market being in infancy, it can turn around into a very risky investment. Also, it is not a legal tender in India.

8. IOTA Risk

Most of the regulators across the world have warned investors of dangers and risks associated with cryptocurrencies. They are unregulated, liquid and are more prone to price fluctuations at a rapid level.

Transactions settle or not are very probabilistic and cannot be reported to the regulators and hence, manipulation can occur in the market. Higher prices indicate it a lucrative market for the hackers who are constantly trying to attack investors.

Investors who are directly involved in exchange transactions i.e. using their own account are frequently targeted and prone to lose their capital.

9. Where Else Can I Invest?

If you want to channel your hard-earned money and accumulate wealth with minimized risk, mutual funds can be considered a safer investment.

Mutual funds are an indirect way of investing your money. If investors do not have time and expertise to invest in markets, mutual funds are ideal for your investment. They are managed by professional fund managers who have years of experience in capital markets and investments.

Conclusion:

The cryptocurrencies market appears to be fascinating to investors in terms of returns but it is at its peak according to economists. It can be a bubble that can burst at any moment, hence investors are advised to select the right investment products for their capital such as mutual funds, etc.

Also, the Finance Ministry of India has recently announced that virtual currencies are not the legal tender in India. It is a clear and precise statement from the ministry to protect the citizens from the hazards of hacking.

According to the Finance ministry – “Consumers need to be alert and extremely cautious as to avoid getting trapped in such Ponzi schemes,”. Virtual currencies are stored in electronic form and are more vulnerable to cyber-attacks and can result in loss of money. It is advisable to invest your hard-earned money in the right direction.

To start investing in mutual funds easily, log on to Groww!

Happy investing!

Disclaimer: The views expressed here are those of the author. Mutual funds are subject to market risks. Please read the offer document before investing.