Groww Nifty India Internet ETF – Invest in India’s Internet-Led Growth Story

India’s internet revolution is here — and it’s not just transforming how we live, work, shop, and invest. It’s also creating a new class of internet-first businesses, driving a structural shift in our economy.

To help investors tap into this trend, Groww Mutual Fund has launched the Groww Nifty India Internet ETF, India’s first ETF tracking the Nifty India Internet Index – TRI.

NFO Period: June 13 – June 27, 2025

The Rise of India’s Internet Economy

India is undergoing a once-in-a-generation digital transformation — and investors now have a way to participate in it.

Today, India has:

- 886 million smartphone users1

- 58% internet penetration — rising rapidly in Tier 2/3 cities2

- The lowest mobile data cost in the world (₹3.4/GB)3

- Digital platforms processing 18+ billion UPI transactions monthly4

From online shopping and quick commerce to digital lending and brokerage apps, India’s internet economy is growing at breakneck speed:

- 270 million online shoppers in 20245

- 67% of orders placed on quick-commerce platforms6

- $350 billion digital lending market in 20237

- 83% of rail & 70% of domestic air tickets booked online8

- Digital brokers gained 78% market share by 20249

Government support has been critical — with initiatives like Digital India, IndiaAI Mission, and a 6x increase in MeITY budgets over 7 years, creating a digital ecosystem that’s second only to the US and China in scale.10

The Groww Nifty India Internet ETF is designed to give investors diversified access to these sectors through a single, transparent, and cost-effective product. The ETF helps you invest in companies at the forefront of this digital shift by tracking the Nifty India Internet Index.

If you’re looking for a way to invest in India’s digital future, this ETF offers a timely and compelling entry point.

What Does the ETF Track?

The ETF mirrors the Nifty India Internet Index, which comprises 21 listed companies that derive significant revenue from online business models.

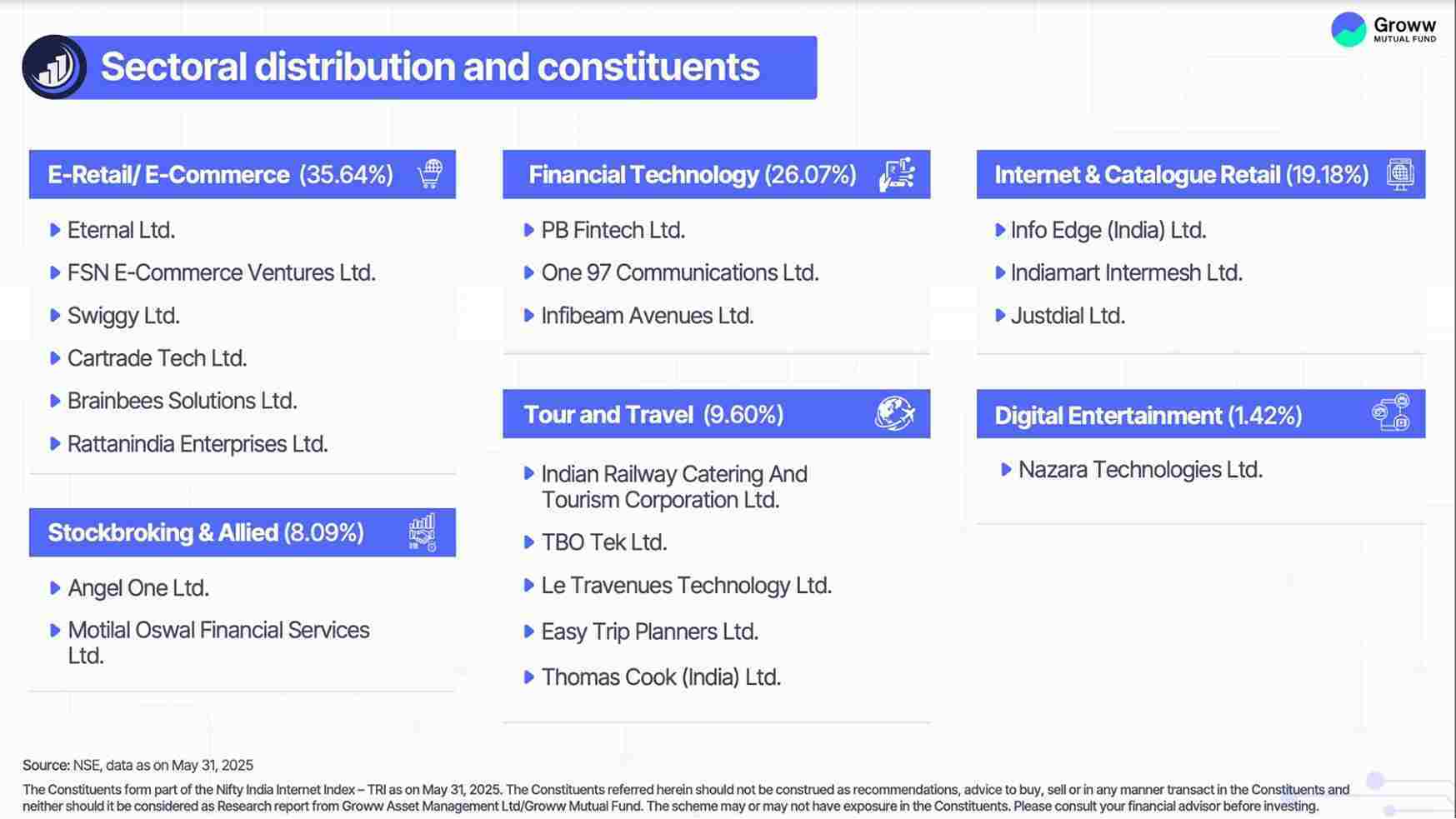

Sector Allocation (as of May 31, 2025):

- E-commerce & E-retail: ~36%

- Financial Technology: ~26%

- Internet-enabled Retail: ~19%

- Stockbroking: ~8%

- Online Travel: ~10%

- Digital Media: ~1.5%

It uses a free-float market cap weighting capped at 20% per stock, is rebalanced quarterly, and reconstituted semi-annually — ensuring it stays responsive to evolving market realities.

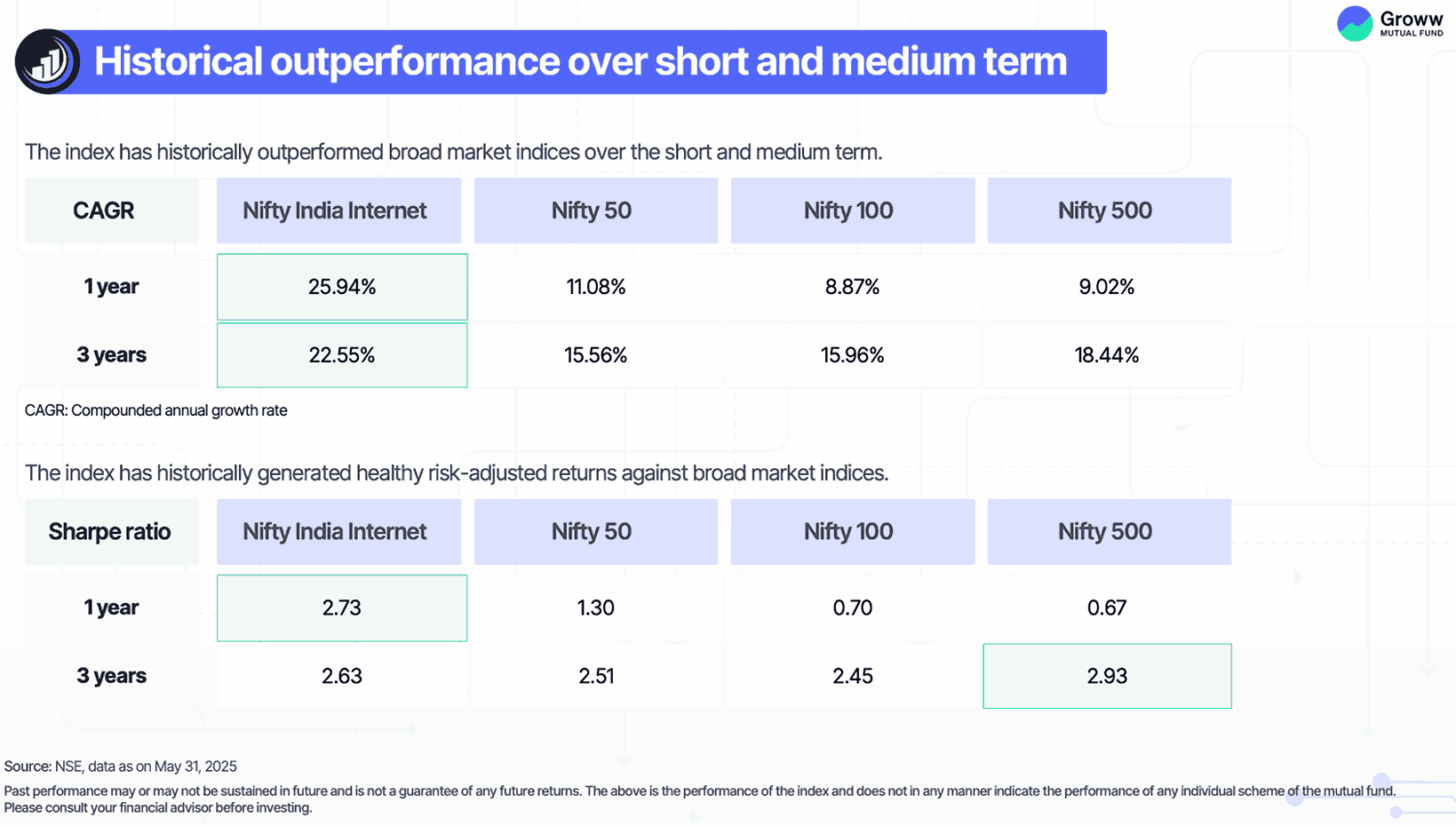

How Has the Index Performed?

As of May 31, 2025, the Nifty India Internet Index posted:

And it’s not just about returns — the top 10 index companies grew their combined revenues 4X in five years (₹18,158 Cr in FY21 to ₹77,788 Cr in FY25), a sign of the underlying economic strength.

Why Consider the Groww Nifty India Internet ETF??

-

Seeks broad exposure to India’s digital-first sectors

The ETF aims to invest across a diverse range of internet-led businesses — including e-commerce, fintech, stockbroking, digital travel, and entertainment — through a single instrument. It seeks to capture the breadth of activity in India’s growing online economy.

-

Smart Diversification in a Single Click

With exposure to 21 internet-focused companies across sectors, the ETF spreads your investment across multiple high-growth areas — reducing single-stock risk while still targeting a high-opportunity space.

-

Rules-Based and Transparent

The ETF passively tracks the Nifty India Internet Index – TRI, which uses a transparent, free-float market capitalisation-based approach with sector and stock-level caps to avoid overconcentration. The index is reviewed and rebalanced regularly to reflect evolving market trends.

-

Aims to benefit from India’s mobile-first and policy-driven growth

With over 886 million smartphone users2, some of the lowest mobile data costs globally, and strong policy support via UPI, e-KYC, and the ₹26,000+ crore Digital India budget3, the ETF aims to tap into long-term digital tailwinds.

The minimum investment amount for this scheme stands at ₹500 and in multiples of ₹1 thereafter, with no exit load. For more information about the scheme, refer to the Scheme Information Documents (SID)

Source 1: IAMAI, data as on January 17, 2025

Source 2: We are social, February 2025

Source 3: Statista, January 09, 2023

Source 4: NPCI, April 30, 2025

Source 5: Statista, data as on May 27, 2025

Source 6: Chryseum, data as on September 26, 2024

Source 7: Statista, August 30, 2024

Source 8: VIDEC’s, data as on April 2025

Source 9: Fintech Report, December 2024

Source 10: MeITY Annual Reports