Groww Mutual Fund is set to Launch Groww Nifty Total Market Index Fund

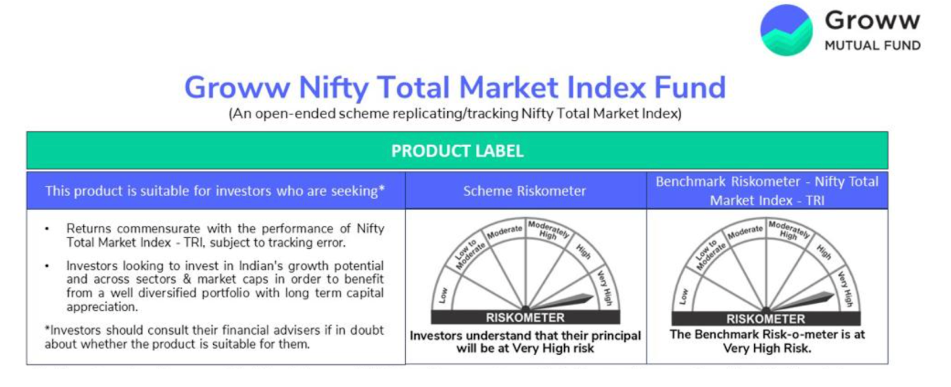

Groww Mutual Fund (formerly Indiabulls Mutual Fund) has received SEBI (Securities and Exchange Board of India) approval to launch its first index fund - Groww Nifty Total Market Index Fund (an open ended scheme replicating/tracking Nifty Total Market Index). The scheme will follow a passive investment strategy. To know in detail about the Scheme please read the Scheme Information Document (SID).

The NFO (New Fund Offer) opens on 3rd October 2023 and closes on 17th October 2023.

About Nifty Total Market Index

The Nifty Total Market Index comprises companies across market caps - large cap, mid cap, and small-cap. Thus, the index provides a much broader view of the Indian stock market compared to any other indices, isn’t it?

The index aims to offer diversification across various market segments, thus, one can infer that it seeks to reduce the impact of individual stock performance on the overall index. Companies in the index are selected based on their total market capitalisation, ensuring representation of both well-established and emerging companies.

Understanding Groww Nifty Total Market Index Fund

Groww Nifty Total Market Index Fund is an open ended scheme replicating/tracking the Nifty Total Market Index. It’s the first Nifty total market index fund in India. The scheme aims to provide a broader view of the Indian equity/stock market and thus seeks to provide an opportunity to diversify their portfolio and access a wide range of company stocks across sectors.

Now let’s look into some of the features of Groww Nifty Total Market Index Fund.

Features of Groww Nifty Total Market Index Fund

Here are some of the features of the Groww Nifty Total Market Index Fund:

- Aims to offer broader exposure to the Indian stock market compared to any other index

- Seeks to give investors an opportunity to access a broad portfolio of stocks with a single investment

- Helps build a diverse portfolio

- Aims to provide long-term capital appreciation

Key Attributes of Investing in Groww Nifty Total Market Index Fund

Here are some of the key attributes of investing in Groww Nifty Total Market Index Fund:

- Investors may get access to diverse sectors via a single investment

- Seeks to reduce the biases towards stock selection

- Aims to provide a broader view of the Indian stock market compared to other indices

- Aims to offer the balance of large caps and the potential upsides of small caps

*Consult your financial adviser before investing, please read the SID to know in detail

Where would the Scheme Allocate its Assets?

The scheme would allocate its assets across market caps. Here’s the split:

|

Large Cap |

72.03% |

|

Small Cap |

16.11% |

|

Mid Cap |

8.60% |

|

Micro Cap |

3.39% |

Data as of 06 September, 2023.

Note: The above is for illustrative purpose only. Allocation to the above market caps may or may not remain the same. Refer to SID to know more about the scheme in detail.

What are the Top 10 Holdings of Nifty Total Market Index?

The table below represents the top 10 holdings of Nifty Total Market index:

|

Company’s Name |

Weightage (%) |

|

HDFC Bank Ltd. |

8.52 |

|

Reliance Industries Ltd. |

5.92 |

|

ICICI Bank Ltd. |

4.87 |

|

Infosys Ltd. |

3.72 |

|

ITC Ltd. |

2.82 |

|

Tata Consultancy Services Ltd. |

2.50 |

|

Larsen & Toubro Ltd. |

2.37 |

|

Axis Bank Ltd. |

1.94 |

|

Kotak Mahindra Bank Ltd. |

1.88 |

|

Hindustan Unilever Ltd. |

1.63 |

Source: NSE (Data as on August 31, 2023)

Disclaimer: The performance of the index shown does not in any manner indicate the performance of the scheme or the intention of the Fund Manager to invest in the above scrips, the Fund Manager may or may not invest in the above scrips basis the Scheme investment strategy please read the SID to know in detail.

Groww Nifty Total Market Index Fund vs Nifty 50

Let’s compare how the Nifty Total Market Index has fared against the Nifty 50 over the years:

|

TRI Index Returns |

|||||

|

1 Year |

3 Years |

5 Years |

10 Years |

15 Years |

|

|

Nifty 50 |

15.90% |

21.81% |

13.74% |

14.46% |

12.67% |

|

Nifty Total Market |

18.45% |

24.71% |

15.13% |

16.33% |

13.79% |

Source: NSE (Data as of 06 September, 2023)

Disclaimer: This table is for educational purposes only and by no means this comparison should be construed as investment advice. Past performance may or may not be sustained in the future. All information contained is for illustration purposes only. The performance of the index shown does not in any manner indicate the performance of the scheme.

Groww Nifty Total Market Index Fund Scheme Details

|

Parameters |

Details |

|

Name of the Scheme |

Groww Nifty Total Market Index Fund |

|

Minimum Application Amount |

₹1,000 and in multiples of ₹1/- for purchases and of ₹0.01 for switches |

|

Exit Load |

Nil |

|

Fund Manager |

Mr. Anupam Tiwari |

|

Investment Strategy |

Passive |

Note: To know in detail about the Scheme please read the Scheme Information Document (SID).

Who may Consider Investing in Groww Nifty Total Market Index Fund?

This fund could be suitable for:

- Investors seeking long-term capital appreciation

- Investors looking to invest in India’s growth potential

- Investors seeking a diversified portfolio

- Investors seeking to invest in passive schemes

However, consult with your financial adviser before investing to know whether this scheme is suitable for you.

How to Invest in Groww Nifty Total Market Index Fund?

You can invest in Groww Nifty Total Market Index Fund:

- Directly

- Via digital platforms

- Through individual mutual fund distributors

Conclusion

The NFO opens on 3 October 2023 and closes on 17 October 2023. So, what are you waiting for? Consult your financial adviser and consider investing in this scheme based on your risk tolerance and investment horizon.

Disclaimer: Groww Asset Management Limited (formerly known as Indiabulls Asset Management Company Limited) Investment Manager to Groww Mutual Fund (formerly known as Indiabulls Mutual Fund) vide SEBI letter dated May 30, 2023 received the approval for change in name of Indiabulls Mutual Fund to Groww Mutual Fund and change in name of the schemes. Please read notice cum addendum no. 11/2023 dated May 31, 2023 for more detail.

Views expressed herein, involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied herein. Stocks/Sectors/Views referred are illustrative and should not be construed as an investment advice or a research report or a recommendation by Groww Mutual Fund (“the Fund”) / Groww Asset Management Limited (AMC) to buy or sell the stock or any other security. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. Whilst Groww Asset Management Limited (the AMC) shall have no responsibility/liability whatsoever for the accuracy or any use or reliance thereof of such information. The AMC, its associate or sponsors or group companies, its Directors or employees accept no liability for any loss or damage of any kind resulting out of the use of this document. The Fund may or may not have any present or future positions in these sectors / securities / commodities. The Fund/ AMC is not indicating or guaranteeing returns on any investments. Readers should seek professional advice before taking any investment related decisions.

The “Product” offered by “the issuer” is not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited (IISL)). NSE INDICES LIMITED does not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of “the Product” or any member of the public regarding the advisability of investing in securities generally or in the “the Product” linked to Nifty Total Market Index Or particularly in the ability of the Nifty Total Market Index to track general stock market performance in India. Please read the full Disclaimers in relation to the Nifty Total Market Index in the Offer Document / Prospectus / Information Statement.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.