Best and Worst IPOs of 2024 By Listing Gains

2024 marked a record-breaking year for India’s IPO market, with over 300 IPOs launched across SME and Mainboard categories. According to reports, more than Rs 1.6 lakh crore and Rs 8,753 crore were raised through mainboard and SME IPOs, respectively.

From skyrocketing debuts that left investors in awe to underwhelming launches that plummeted expectations, the year has offered a little bit of everything.

In this blog, we’ll do a roundup of the five best and worst mainboard and SME IPOs based on their listing gains.

Top 5 Mainboard IPOs of 2024

|

Company Name |

Issue Price |

Listing Price (OPEN) |

Listing Gain |

Current Price (As of 31st Dec 2024) |

|

Vibhor Steel Tubes Ltd. |

₹151 |

₹425 |

181.46% |

₹214.08 |

|

Mamata Machinery Ltd. |

₹243 |

₹600 |

146.91% |

₹568.57 |

|

BLS E-Services Ltd. |

₹135 |

₹305 |

125.93% |

₹204.65 |

|

Unicommerce eSolutions Ltd. |

₹108 |

₹235 |

117.59% |

₹168.37 |

|

Bajaj Housing Finance Ltd. |

₹70 |

₹150 |

114.29% |

₹127.45 |

1. Vibhor Steel Tubes Ltd.

- Issue Price: ₹151

- Listing Price: ₹425

- Listing Gain: 181.46%

Market Performance: The Vibhor Steel Tubes IPO, valued at Rs 72.2 crore listed on 20 February 2024.

Specialising in manufacturing high-quality steel tubes and pipes, the company has seen significant growth, with profits jumping by 80% and turnover exceeding Rs 1,100 crore in 2023.

Among all the mainboard IPOs launched in 2024, Vibhor Steel Tubes had the highest listing gain, at 181.46%, and became the IPO with the second-highest listing gain of all time.

The issue price was ₹151 per share, and the listing price soared to ₹425 per share.

Current Position: Despite the initial excitement, the stock has struggled to maintain its momentum and is currently hovering around ₹214.08 per share.

2. Mamata Machinery Ltd.

Issue Price: ₹243

Listing Price: ₹600

Listing Gain: 146.91%

Market Performance: The leading manufacturer and exporter of plastic bag/ pouch-making machines, Mamata Machinery’s Rs 179.4 crore IPO launched at an issue price of ₹243.

The company was listed on December 27 at ₹600 per share. With gains of 146.91%, it became the second-best IPO of 2024 (in terms of listing gains) after Vibhor Steel Tubes.

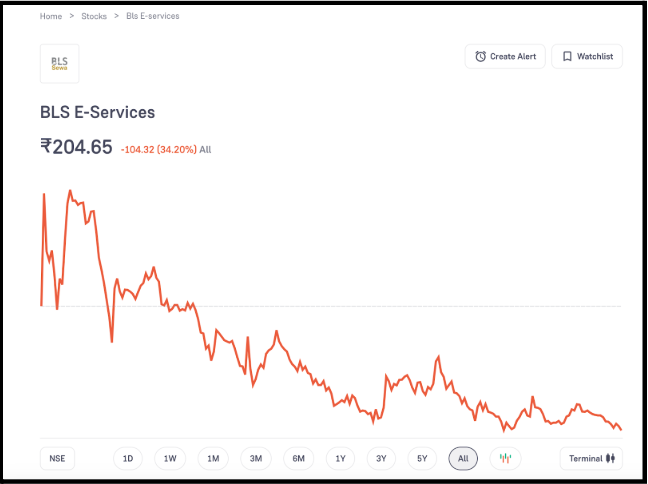

3. BLS E-Services Ltd.

Issue Price: ₹135

Listing Price: ₹305

Listing Gain: 125.93%

Market Performance: BLS E-Services Ltd., a leading comprehensive IT services and digital solutions provider and subsidiary of visa services provider BLS International Services Ltd, launched its ₹310.9 cr IPO in February 2024.

The company's shares rose significantly on the first day. With an issue price of ₹135 and a listing price of ₹305, the listing gain was approximately 125.93%.

Current Position: Eleven months (in December), the stock has declined 34.2%, and its current price hovers around ₹204.

4. Unicommerce eSolutions Ltd.

Issue Price: ₹108

Listing Price: ₹235

Listing Gain: 117.59%

Market Performance: India’s largest e-commerce enablement SaaS platform brought its ₹276.6 crore IPO in August. On its listing day, the stock surged to ₹235, marking an impressive listing gain of 117.59%.

Current Position: Five months since listing, it's trading at ₹168.37, a down of 28.19%.

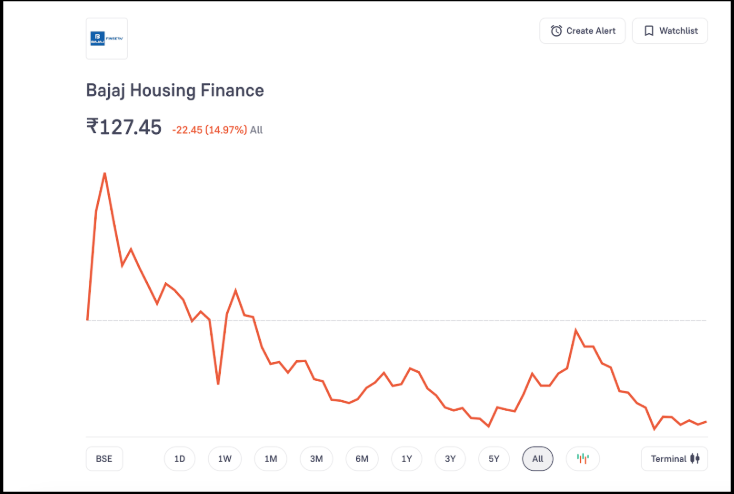

5. Bajaj Housing Finance Ltd.

Issue Price: ₹70

Listing Price: ₹150

Listing Gain: 114.29%

Market Performance: Bajaj Housing Finance Ltd was among the most highly anticipated IPOs of 2024 that almost doubled investors’ money! From an issue price of ₹70, share prices surged to ₹150, delivering an impressive listing gain of 114.29%.

As the subsidiary of Bajaj Finance Ltd and known for providing home loans, affordable housing solutions, and loans against property, Bajaj Housing Finance has established a solid reputation for offering loans at competitive interest rates with flexible repayment options.

Current Position: The stock has declined by 14.97% since listing.

Worst 5 Mainline IPOs of 2024

|

Company Name |

Issue Price |

Listing Price |

Listing Discount |

Current Price (As of 31st Dec 2024) |

|

R K Swamy Ltd |

₹288 |

₹250 |

13.19% |

₹267.16 |

|

ACME Solar Holdings Ltd |

₹289 |

₹251 |

13.15% |

₹235.65 |

|

Godavari Biorefineries Ltd |

₹352 |

₹308 |

12.5% |

₹314.90 |

|

Capital Small Finance Bank Ltd |

₹468 |

₹430.25 |

8.11% |

₹293.15 |

|

Carraro India Ltd |

₹704 |

₹651 |

7.53% |

₹637.65 |

1. R K Swamy Ltd

- Issue Price: ₹288

- Listing Price: ₹250

- Listing Discount: 13.19%

Market Performance: R K Swamy Ltd., a well-known name in the advertising and marketing industry, had a disappointing IPO debut in March. In fact, among all the mainboard IPOs of the year, it recorded the highest listing discount of 13.19%.

Current Position: However, the stock has recovered 0.18%, and it’s currently trading at ₹268.

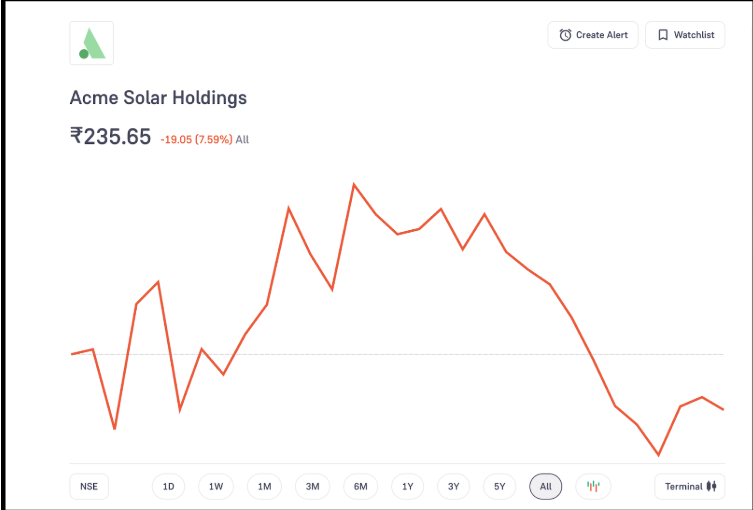

2. ACME Solar Holdings Ltd

- Issue Price: ₹289

- Listing Price: ₹251

- Listing Discount: 13.15%

Market Performance: ACME Solar Holdings, one of India's top 10 renewable energy companies (in terms of operational capacity), experienced a tough market debut. The IPO was issued at ₹289, but the stock opened at ₹251, marking a listing discount of -13.15%.

Current Position: Since its listing in November, the stock has struggled to recover, dropping further to ₹235.65.

3. Godavari Biorefineries Ltd

- Issue Price: ₹352

- Listing Price: ₹308

- Listing Discount: 12.5%

Market Performance: Godavari Biorefineries, one of India’s largest ethanol and ethanol-based chemicals producers and manufacturers, launched its ₹554.8 crore IPO in October with great expectations. However, the stock opened at ₹308, below the issue price of ₹352, resulting in a listing discount of 12.5%.

Current Position: After almost two months since listing, Godavari Biorefineries has shown little movement and is trading at around ₹314.

4. Capital Small Finance Bank Ltd

- Issue Price: ₹468

- Listing Price: ₹430.25

- Listing Discount: 8.11%

Market Performance: Capital Small Finance Bank, which started its operations as India’s first small finance bank in 2016, launched its ₹523.1 crore IPO in February. While the bank has a strong customer base in rural and semi-urban areas, it experienced a disappointing start with its IPO.

The issue price was ₹468, but the stock opened at ₹430, a listing discount of 8.11%.

Current Position: After an initial listing discount of 8.11%, the stock has further declined to ₹293.80.

5. Carraro India Ltd

- Issue Price: ₹704

- Listing Price: ₹651

- Listing Discount: 7.53%

Market Performance: Carraro India Ltd.'s IPO performance in 2024 was one of the weakest. The stock opened at ₹651, below the issue price of ₹704, marking a listing discount of 7.53%.

Top 5 SME IPOs of 2024

More than mainboard IPOs, their SME counterparts stole the limelight in 2024, both in terms of listing gains and a higher number of launches.

|

Company Name |

Issue Price |

Listing Price |

Listing Gain |

Current Price (As of 31st Dec 2024) |

|

Winsol Engineers Ltd. |

₹75 |

₹365 |

386.67% |

₹272.25 |

|

Kay Cee Energy & Infra Ltd. |

₹54 |

₹252 |

366.67% |

₹346 |

|

Maxposure Ltd. |

₹33 |

₹145 |

339.39% |

₹87.95 |

|

Medicamen Organics Ltd. |

₹34 |

₹137.85 |

305.59% |

₹53.90 |

|

GP Eco Solutions India Ltd. |

₹94 |

₹375 |

298.94% |

₹267.75 |

1. Winsol Engineers Ltd.

- Issue Price: ₹75

- Listing Price: ₹365

- Listing Gain: 386.67%

Market Performance: Winsol Engineers surpassed all the other SME IPOs in 2024 with an astounding listing gain of ₹386.67%.

Yes, you read that right!

The company, known for its sustainable energy solutions, saw its stock price skyrocket from an issue price of ₹75 to a listing price of ₹365.

Current Position: Despite making such huge listing gains, Winsol Engineers failed to maintain its position and is currently down 25%.

2. Kay Cee Energy & Infra Ltd.

- Issue Price: ₹54

- Listing Price: ₹252

- Listing Gain: 366.67%

Market Performance: In 2024, SME IPOs Kay Cee Energy & Infra Ltd. had the second-highest listing gain of 366.67%. The issue price was ₹54, and the stock opened at ₹252.

Current Position: Even after witnessing such huge listing gains, the stock continued to perform well and is currently trading at ₹346, i.e., up 35%.

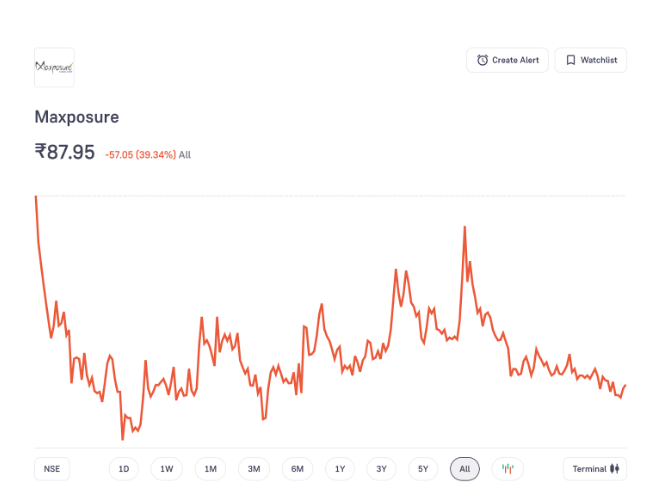

3. Maxposure Ltd.

- Issue Price: ₹33

- Listing Price: ₹145

- Listing Gain: 339.39%

Market Performance: Maxposure, a 360-degree media and marketing firm, made a strong market debut in January. The company's shares, issued at ₹33, opened at ₹145, with a listing gain of 339.39%.

Current Position: Since its listing in January and despite the initial surge, the stock has fallen flat to ₹87.95, i.e., 39% down.

4. Medicamen Organics Ltd.

Issue Price: ₹34

Listing Price: ₹137.85

Listing Gain: 305.59%

Market Performance: Established in 1995, Medicamen Organics, a pharmaceutical manufacturing company, saw its IPO perform exceptionally well. With an issue price of ₹34 and a listing price of ₹137.85, the stock achieved a listing gain of 305.59%.

Current Position: Since its initial success, the stock has declined significantly. Currently, it is trading 60% below its listing price, at ₹53.90.

5. GP Eco Solutions India Ltd.

Issue Price: ₹94

Listing Price: ₹375

Listing Gain: 298.94%

Market Performance: GP Eco Solutions’ ₹30.8 crore IPO delivered an impressive listing gain of 298.94%. The company's stock, issued at ₹94, opened at ₹375.

Current Position: Since the listing, the stock has experienced a pullback and is currently trading at ₹267.

5 Worst SME IPOs of 2024

|

Company Name |

Issue Price |

Listing Price |

Listing Discount |

Current Price (As of 31st Dec 2024) |

|

MVK Agro Food Product Ltd. |

₹120 |

₹79 |

34.17% |

₹40.70 |

|

Kalana Ispat Ltd. |

₹66 |

₹45.15 |

31.59% |

₹44.40 |

|

Bikewo Green Tech Ltd. |

₹62 |

₹45 |

27.42% |

₹28.70 |

|

Lamosaic India Ltd. |

₹200 |

₹164 |

18% |

₹101.10 |

|

Sona Machinery Ltd. |

₹143 |

₹125 |

12.59% |

₹122.05 |

1. MVK Agro Food Product Ltd.

- Issue Price: ₹120

- Listing Price: ₹79

- Listing Discount: 34.17%

Market Performance: MVK Agro Food Product Ltd. experienced the steepest decline among SME IPOs in 2024. Issued at ₹120, the stock opened at ₹79, resulting in a listing discount of 34.17%.

Current Position: The stock has continued to decline, and it is currently trading at ₹40.70, i.e., 50% down from its opening price.

2. Kalana Ispat Ltd.

- Issue Price: ₹66

- Listing Price: ₹45.15

- Listing Discount: 31.59%

Market Performance: Kalana Ispat, a billet manufacturing company listed in September, faced a 31.59% listing discount. The issue price was ₹66, but the stock was listed at ₹45.15.

Current Position: The stock price has remained relatively stable, hovering around the initial listing price ₹45.

3. Bikewo Green Tech Ltd.

- Issue Price: ₹62

- Listing Price: ₹45

- Listing Discount: 27.42%

Market Performance: Bikewo Green Tech, an electric two-wheeler retailer, listed on the NSE at a 27.42% discount. The issue price, set at ₹62, plummeted to ₹45 upon listing.

Current Position: Bikewo’s steep fall continued and is currently down by 35.44%.

4. Lamosaic India Ltd.

- Issue Price: ₹200

- Listing Price: ₹164

- Listing Discount: 18%

Market Performance: Lamosaic India went public in November with an issue size of 61.2 cr. It listed at a discount of 18% and opened at ₹164.

Current Position: The stock continued to face downward pressure and is currently trading 37.59% below its listing price.

5. Sona Machinery Ltd.

- Issue Price: ₹143

- Listing Price: ₹125

- Listing Discount: 12.59%

Market Performance: Sona Machinery Ltd., known for its agricultural machinery products, had a rough start in the market. Issued at ₹143, the stock listed at ₹125, resulting in a listing discount of 12.59%.

Current Position: Ten months since listing, the stock has shown limited movement. Currently, it’s trading at ₹122, which is slightly below its listing price of ₹125.

Conclusion

Nevertheless, it’s safe to say that 2024 was the year of IPOs. Many IPOs debuted with impressive listing gains but struggled to maintain that momentum. On the other hand, some initially posted losses but managed to recover over time.

It will be interesting to see what unfolds in 2025. The start is pretty good, as some of the big names, like PhysicsWallah (Edtech Unicorn), A-One Steels India, Ather Energy, and Anthem Biosciences, have already filed their IPOs and are planning to go public soon.

|

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory. To read the RA disclaimer, please click here RA Sign - |