Trade with Lightning-Fast Execution on Groww: Introducing Bracket Orders for F&O Trades

When it comes to trading, speed and precision can make a real difference, especially for active traders who manage quick entries and tight stop losses.

To support faster, more disciplined trading, we are thrilled to introduce Bracket Orders on Groww built to deliver faster execution speed, near-zero slippage for stop-loss orders, and a redefined trading experience.

With this recent update, Groww now supports sub-50ms order latency, making execution faster and more predictable during active market conditions.

Bracket Orders are designed to help F&O traders manage risk better, reduce manual effort, and trade with more confidence.

What are Bracket Orders?

Bracket orders combine an entry order with a built-in stop-loss and target, automating risk management for traders, especially in intraday F&O trading.

Users can place bracket orders at entry, defining stop-loss and target prices upfront for disciplined risk management. This empowers planned trades, especially for those entering positions with predefined entry-exit strategies in mind.

Why Use Bracket Orders?

Better Risk Control

- Losses are automatically limited using a stop loss.

- Profits can be booked at a predefined target.

- Emotional decisions during fast markets are reduced.

Faster and Cleaner Execution

Bracket Orders on Groww are optimized to:

- Trigger stop losses more reliably.

- Reduce slippage during exits.

- Handle fast market movements smoothly.

Less Manual Monitoring

Since entry, stop loss, and target are placed together:

- You don’t need to constantly manage orders.

- Trades are easier to track.

- You can focus more on the market and less on execution steps.

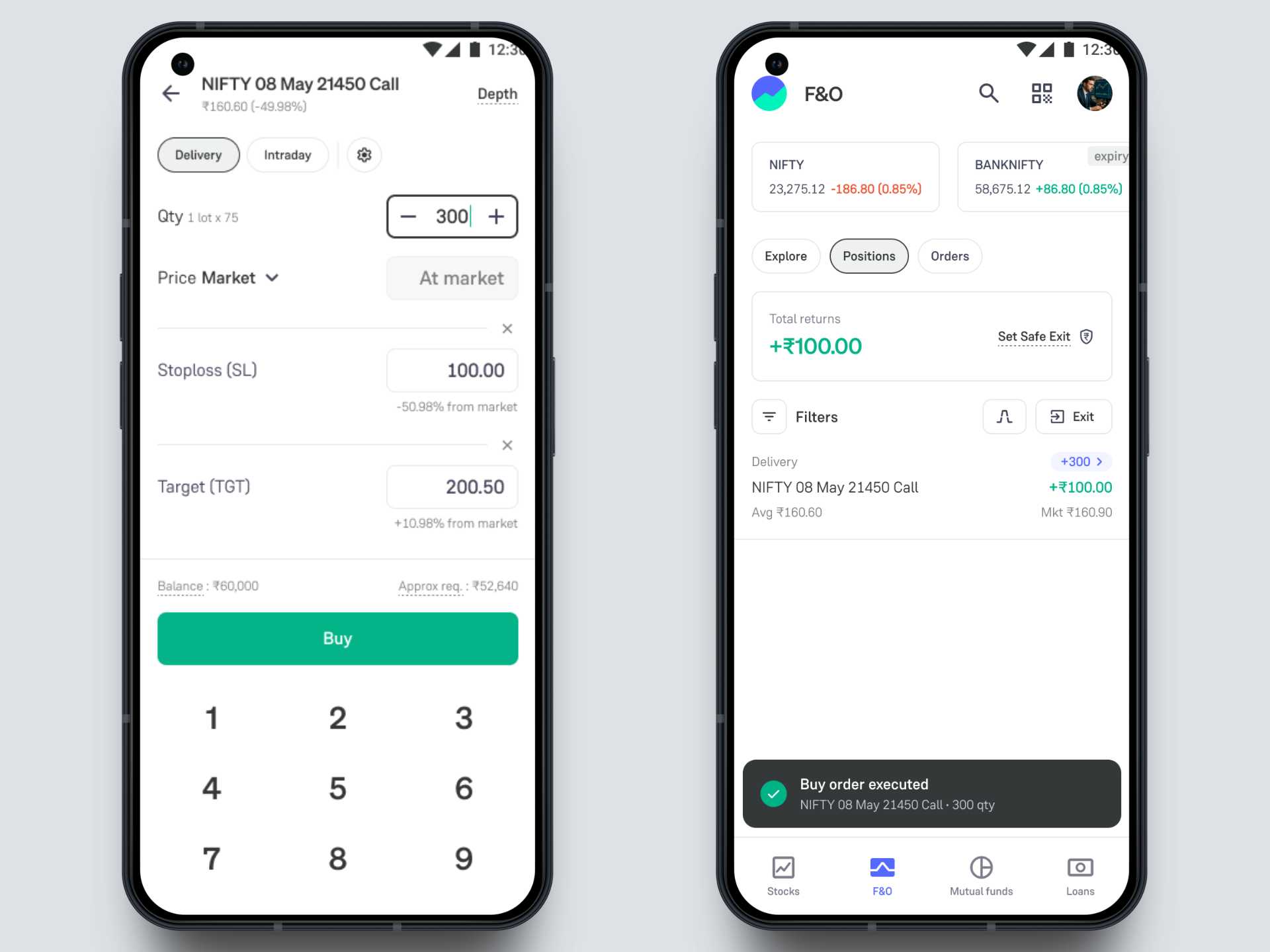

How to Place a Bracket Order on Groww?

Step 1: Open the Groww app or website and navigate to the F&O section.

Select your preferred index (NIFTY, BANKNIFTY) or stock and go to the order placement screen.

Step 2: Tap on “Add stoploss/target”.

This enables the Bracket Order setup with optimized routing for faster execution.

Step 3: Set your entry price, stop loss, and target levels, and place the order.

Once placed, Groww handles execution automatically, including faster SL triggers and smoother exits.

More Order Capabilities on Groww

Along with Bracket Orders, Groww supports several other order types to help traders manage entries, exits, and risk across different trading scenarios.

-

OCO Orders with Near Zero Slippage on Stop-Loss Execution

OCO orders allow you to place a stop loss and a target together for an open position. When one order gets executed, the other is automatically cancelled. With Groww’s recent improvements to order execution, stop-loss orders placed as part of OCO, experience faster and more precise execution, helping reduce slippage during volatile market movements.

This helps manage both downside and upside without requiring manual order cancellations, especially during fast market movements.

-

Trigger-Based Entry Orders (SL Entry)

SL Entry orders allow traders to enter a position only when the price reaches a predefined level. These orders are commonly used for breakout or breakdown strategies, where traders want to enter trades only after the market confirms a move.

-

GTT Orders for Planned Trades

GTT (Good Till Triggered) orders are useful for trades that are planned in advance. They allow traders to set trigger conditions so that orders are placed automatically when price levels are reached, without the need to monitor markets continuously.

Ready to trade smarter?

Bracket Orders are now live for all Groww users.

Update your Groww app or visit Groww Web → Open F&O → Place a Bracket Order to start trading with faster execution and better risk control.

Happy Trading!

- Team Groww

Frequently Asked Questions

1. Who can use Bracket Orders on Groww?

Bracket Orders are available for F&O trading on Groww. They are especially useful for intraday traders who want to define their stop loss and target at the time of entry.

2. Can I place a Bracket Order outside market hours?

You can place Bracket Orders only during market hours. Orders placed during market hours are executed based on current market conditions.

3. What happens if my stop loss or target is hit?

When either the stop loss or target is executed:

- Your position is exited.

- The remaining order is automatically cancelled.

This helps avoid multiple or conflicting exits.

4. Will Bracket Orders help reduce slippage?

Bracket Orders on Groww are optimized for faster execution, which can help reduce slippage, especially for stop loss execution during volatile market movements. However, slippage may still occur depending on market conditions.

5. What happens if I exit the position manually?

If you exit the position manually, any pending stop loss or target orders linked to the Bracket Order are automatically cancelled.

6. Is there any additional cost for using Bracket Orders on Groww?

There is no separate charge for placing Bracket Orders. Standard brokerage and applicable charges apply as per Groww’s pricing.

7. Can I use Bracket Orders along with other order types?

Bracket Orders are one of several order types available on Groww. You can also use OCO orders, SL Entry orders and GTT orders.