Groww files RHP to launch ₹6,632.30 crore IPO on November 4; Check key details here

Groww, India’s largest and fastest-growing investment platform (by NSE active users and as of June 30, 2025), has filed its red herring prospectus with SEBI on October 29, 2025, to launch its much-awaited IPO on November 4, 2025. The bidding for anchor investors will open on November 3, 2025.

Groww IPO Details

- Issue Size: According to the RHP, the issue size is pegged at ₹6,632.30 crore, comprising a fresh issue of ₹1,060.00 crore and an offer-for-sale of ₹5,572.30 crore of shares from investor selling shareholders.

- Price Band: ₹95 to ₹100 per share

- Subscription Period: The IPO will remain open from November 4, 2025, until November 7, 2025.

- Allotment & Listing: The basis of allotment will be finalised by November 10, 2025, and the tentative listing on BSE and NSE is scheduled for November 12, 2025.

- Book-running Lead Managers: Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited, Citigroup Global Markets India Private Limited, Axis Capital Limited, Motilal Oswal Investment Advisors Limited

- Registrar: MUFG Intime India Private Limited is the registrar for the issue.

- Use of Proceeds: The company intends to use the IPO proceeds towards the following objectives

- Brand building

- Performance marketing activities

- To fund expenditure towards cloud infrastructure and inorganic growth through unidentified acquisitions

- Invest in material subsidiaries, Groww Creditserv Technology Private Limited and Groww Invest Tech Private Limited, to augment its capital base and fund the margin trading facility (“MTF”) business, respectively.

- General corporate purposes

About the Company

Groww is a leading direct-to-customer (D2C) digital investment platform that allows users to invest in mutual funds, derivatives, IPOs, bonds, and exchange-traded funds (ETFs), as well as trade stocks.

Founded in 2016 by ex-Flipkart colleagues Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, Groww is India’s largest and fastest-growing investment platform by active users on NSE as of June 30, 2025.

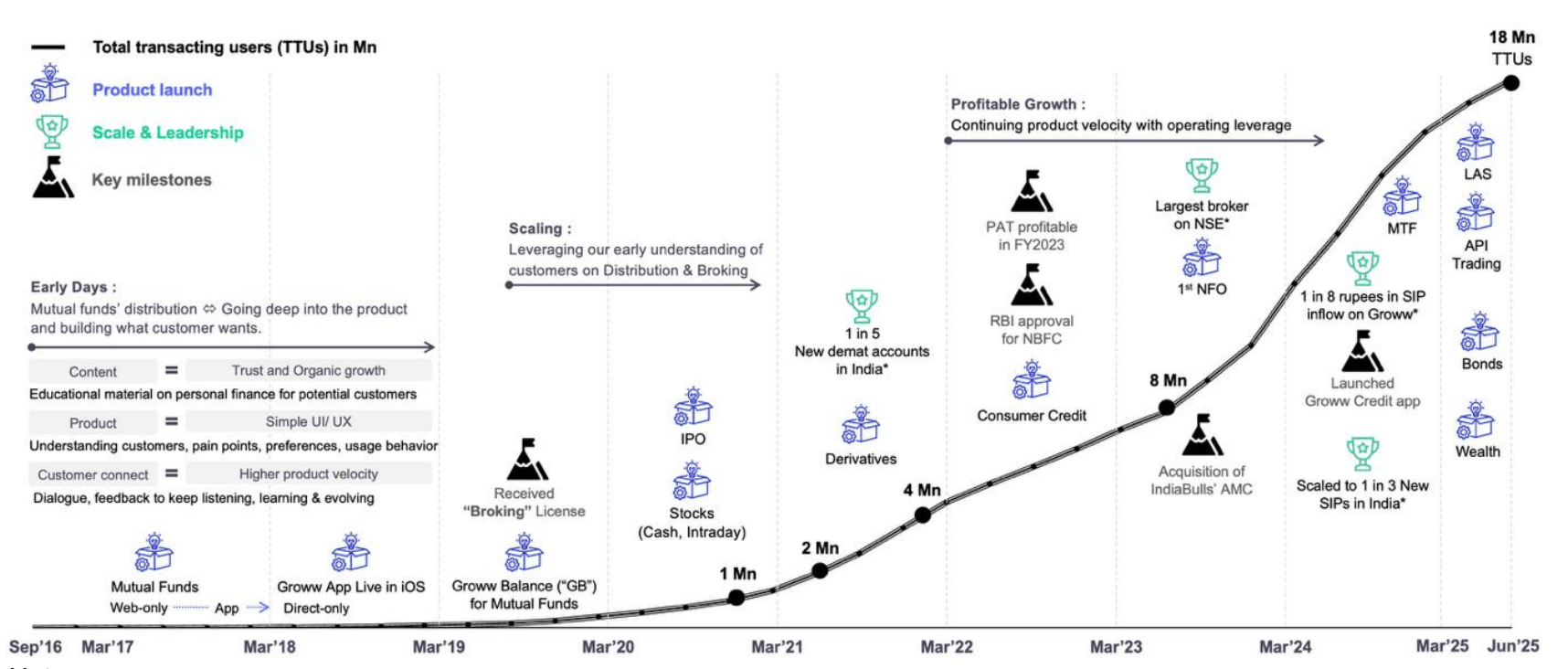

The chart below exemplifies Groww’s journey from inception to June 2025.

Groww’s revenue from operations grew at a CAGR of 127.70% from FY2022 to FY2025. For the full fiscal year 2025, revenue stood at ₹3,901.72 crore, up from ₹2,609.28 crore in FY 2024 and ₹1,141.53 crore in FY 2023.

Further, the company posted a profit before tax of ₹2,463.78 crore for FY 2025 against a loss of ₹618.48 crore in FY 2024 (due to one-time tax expenses related to the amalgamation of the company) and a profit of ₹503.84 crore in FY 2023.

Disclaimer: This news is solely for educational purposes. The securities/investments quoted here are not recommendatory.

To read the RA disclaimer, please click here

To read the Groww IPO disclaimer, please click here