Updates from Groww: tax-loss harvesting, intraday OCO, bonds, & lots more

Hello,

“Unprecedented” — we hear it a lot from financial services experts.

COVID-19, the Russia-Ukraine War, tariffs – are unprecedented in their own way. But since there are so many such crises, they are not collectively unprecedented anymore. In fact, they are frequently occurring in different ways. In just the last five years, we have had many.

Any significant event gives experts a chance to give their opinions. This results in lots of conflicting content that is then consumed by retail investors, further resulting in buying and selling influenced by fear and greed.

Many traders leverage such volatile situations to trade and make profits.

On the other hand, think of someone who started SIPs when Groww started in 2016 and kept stepping it up, checking infrequently, without bothering about all positive and negative events further amplified by commentary on X or other social media platforms.

We are building Groww for both these customers — long-term investors as well as power traders. And while these crazy things keep happening around the world, our team keeps shipping products and features that our customers want.

Here is a long list of updates; do give them a try if you have not already.

Let's start with managing your portfolio.

Portfolio Management

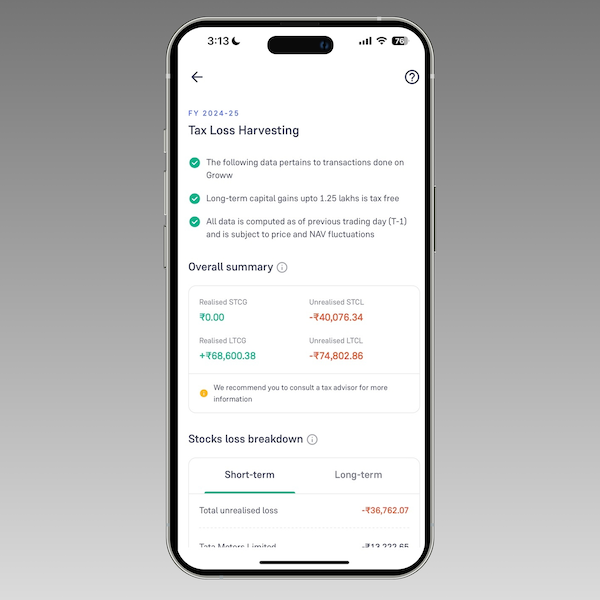

+ Tax Loss Harvesting: The Jan-March quarter was tax season. Markets were down, and we built this timely tool to help customers save some tax.

Tax-loss harvesting helps you sell stocks or mutual funds that are losing money. By selling those, you can reduce your capital gain tax as your net profit goes down.

+ Stock Holding Statement: Many customers need their holding statement on a particular date. Now this report is available from the Reports section.

+ Stocks Order History: Users can now download their order history for any date range. This will include intraday orders as well, which were not present in the previous transaction history.

+ Portfolio Analysis on Stocks: Like the one we have in mutual funds. This feature has been one of the most asked-for features and is currently being rolled out. If you have not got it yet, it should be available in a week or two. We are sure you will love it.

Stock Trading

We continue improving your stock trading experience.

+ We further improved the order execution time. You will definitely feel the speed.

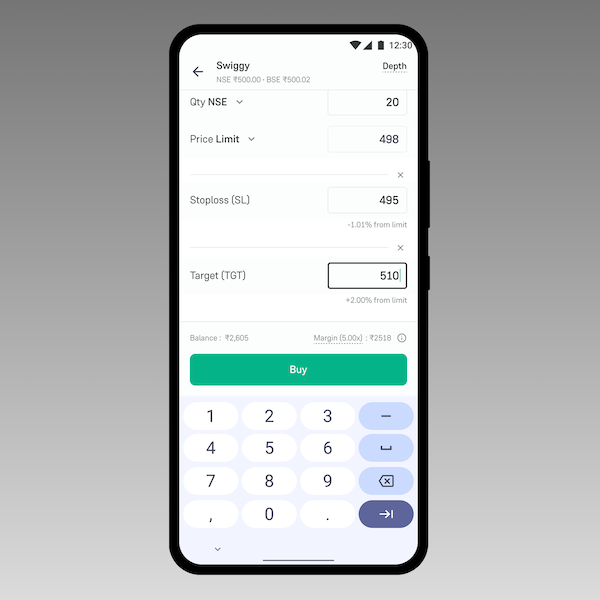

+ Intraday OCO: You can now place OCO (One Cancel Other) orders for intraday.

+ Easier Intraday Trading on Advanced Charts: traders can now check their positions, orders & buy/sell from the chart itself.

+ AMO orders for intraday (MIS) have been enabled.

+ Square-off Warnings: Added an on-product nudge warning users of an upcoming auto-square off to prevent square off charges.

+ Intraday for IPO stocks on the listing day itself has been enabled.

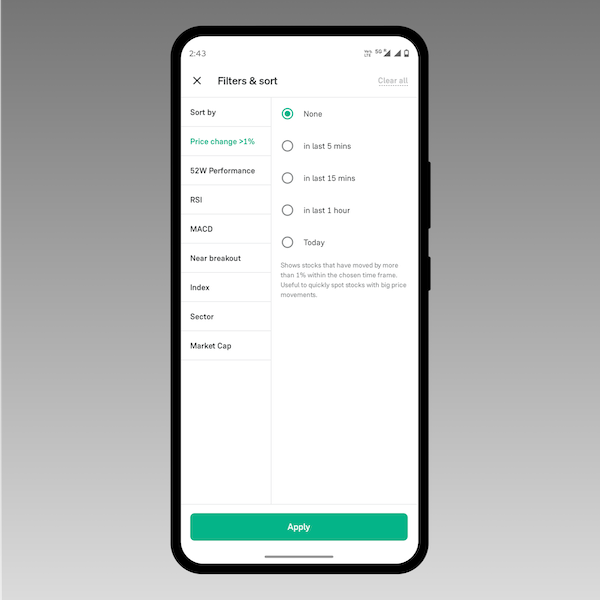

+ Introduced intraday screener to empower traders to spot opportunities in real-time in the live market using price, volume, and technical indicators (on mobile and web). Kind of like a workstation for intraday traders.

+ Exchange Interoperability: earlier, if a user took an intraday position or bought in delivery for a particular ISIN on one exchange, they could only exit/sell on the same exchange. With interop, T-day buy and sell become exchange-agnostic.

MTF

We launched MTF (Margin Trade Funding) last year.

Last quarter, we made more enhancements.

+ AMO for MTF: Now you can place orders with MTF after market hours.

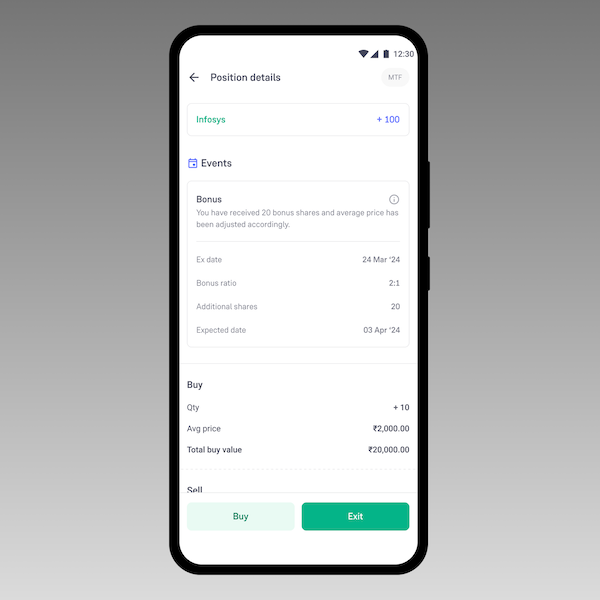

+ Corporate action handling for Stock Split and Bonus.

+ We revamped the entire positions' experience:

- A richer positions details page to help you manage your position better

- Show MTF positions in holdings to avoid showing incorrect average price for overlapping CNC & MTF stocks

+ MTF shortfall handling: Now you will be able to see and manage your shortfall directly from the MTF positions screen, as opposed to earlier, which used to happen over email.

+ Position Conversion: You will be able to convert your MTF positions to delivery and track them in your holdings (launching on 30th April).

+ Most Traded in MTF: You will be able to see the most traded MTF stocks on the Explore screen of Stocks.

There are a lot of things being built for an advanced trading experience.

We keep saying, please use MTF only if you are an advanced trader — margin trading can make you part with your capital permanently.

IPO

We also made some enhancements in the IPO experience.

We revamped order tracking for IPO and also created a new IPO page, with a lot more information available, so you can make better decisions.

We also launched OFS — Offer for Sale.

In addition to the above, there is one big feature that we are launching soon.

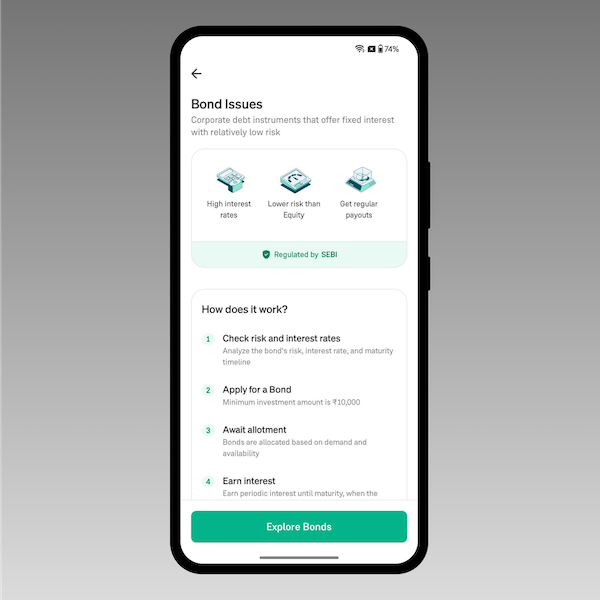

New Launch — Bonds

You can now buy Bonds!

You will be able to see all bond offers in the Stocks Explore screen. Bonds help you diversify your portfolio.

Mutual Funds

We continue investing heavily in our Mutual Funds platform.

+ Mutual funds in demat form: One of the biggest asks from investors was to have mutual funds in demat format. It becomes easier to manage nominees, etc, in the demat form. In addition, pledging also becomes easier. Now, you can hold your mutual funds in the demat format.

Customers also have an option to opt out of demat if they want to continue holding in the SoA format.

+ Short-term & long-term tax: When you redeem your mutual funds, we now tell you the short-term and long-term capital gain tax. This will help you decide how many units you want to sell, effectively helping you manage your taxes better.

+ New and refreshed experience for Redeem and Investment details: We have added a lot more details. This improves transparency, like which bank the money will come to when you redeem, or who the nominee is for a particular folio.

+ We also made a better mutual fund screener with easy and quick filters. For example, now you can filter index funds right from the explore screen.

+ Check Balance for SIPs: Customers often wonder if they have enough money in their account before the SIP date. We added a “Check Balance” button to help you check just that.

Groww Balance

Groww Balance is now cleaner and better.

+ Faster Pledge: You can pledge your holdings instantly. Turnaround time is now 30 seconds (vs 15 minutes earlier).

+ The pledge experience also got a new upgrade.

+ ASBA for secondary trades: customers can invest by blocking their funds through ASBA instead of transferring to Groww Balance.

+ The revamped Groww Balance experience gives better clarity on margin for traders.

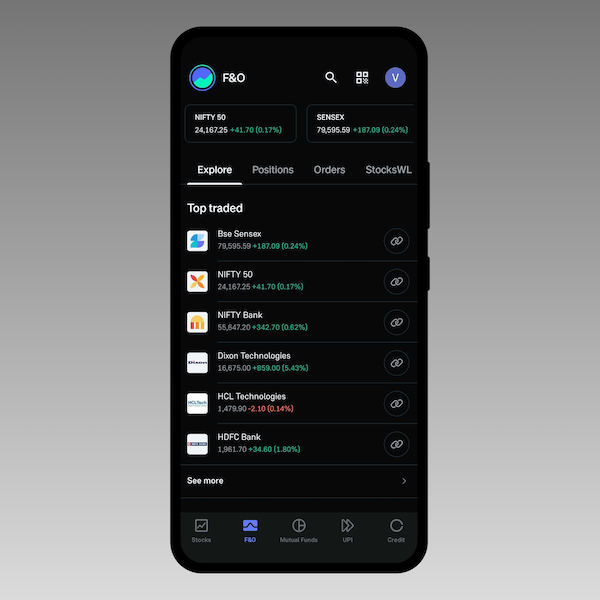

Futures and Options

Post a lot of our responsibility-related launches & SEBI’s regulations, we have seen only serious traders trading on Groww. This enabled us to launch a lot of new features for power traders.

Here is a long list of things we have launched:

+ Separate F&O Section on the app: now you can explore top traded securities, and F&O stocks gainers/losers with 1D, 15m filter. In addition, you can now access traders' corner feed directly from explore.

+ Analyse on Position Tab: traders can now view max profit and max loss of their open positions on expiry, along with the breakeven points.

+ Adjust Position on Chain: Traders can shift an open position from one strike to another strike or from a call option to a put option. Groww is probably the only platform providing this. You would love this experience.

+ Shortcuts from Position Action Tray: traders can open spot charts & spot chain directly from the position pop-up instead of a 3-step journey.

+ Fast Exit Directly from Positions: Traders can now exit open positions with only 1-click!

+ Track Open Orders Against your Positions on the app: quicker modify SL journey to manage your risk easily – no more juggling between the Positions and Orders tab.

+ Easy Access to F&O Positions: Stocks F&O trader can access F&O positions on stocks charts.

Account Management

Some new stuff in your account management.

+ Nominee Centre: Customers can edit nominees on Groww. This was previously done manually and offline.

+ Account Closure: This feature is now self-serve to improve customer experience. That means customers will not have to call or email us. This is in line with our philosophy to provide choice to customers – even if it is about going away from Groww (we will be very sad though).

+ Fast Re-login on Android: logging back into Groww is simpler now. Customers do not have to choose any email from the Google widget; we store it locally and log you in with a single click.

Groww Mutual Fund

We launched new ETFs and funds from our Groww Mutual Fund house.

- Groww Gold ETF and FoF

- Groww Multicap Fund

- Groww Nifty India Railway PSU ETF and Index Fund

- Groww Nifty200 ETF and FoF

- Groww Nifty500 Momentum 50 ETF

Some fun stuff :)

+ Search Smart Collections: You can now search for queries like "Energy stocks with low PE", "High dividend stocks", "NIFTY 100 stocks with returns > 10%". We are working on adding more attributes to the 'search by'!

+ Celebrations is now live on iOS. If it's your birthday, Groww anniversary, or you've reached an SIP or UPI milestone, you're in for some delight.

Groww Credit

Groww Credit app (separate app) is now out of early access and available on both the Play Store and App Store with a new sleek look.

+ We’ve launched LAMF (Loan Against Mutual Funds) for users looking for some liquidity without redeeming their mutual funds.

+ We’ve also launched an “All Loans” and “Credit Cards” section on Groww Credit for users looking to manage their entire debt in one place.

Some stories stay with you, especially those about markets.

We've compiled the first 72 stories from our weekly newsletter, Groww Digest, into a book: Long and Short.

You can find the book at major bookstores or on Amazon.

We also launched 3 new YouTube channels:

-Bottomline by Groww

-Thrive by Groww

-How They Made It.

The early response has been great.

That's all for now.

We are grateful for your support. Your trust motivates us to continue working hard to build something that we all could be proud of.

Lalit Keshre

CEO & Co-founder, Groww