Analyse and Trade in One Place: Introducing Greeks on Option Chain

Trading options require both precision and speed. Due to this, traders often find themselves switching between different tools—one for analyzing the Greeks (Delta, Theta, Gamma, Vega) to understand price sensitivity, and another to actually place the trade.

We get it – it's inefficient and can lead to missed opportunities in fast-moving markets.

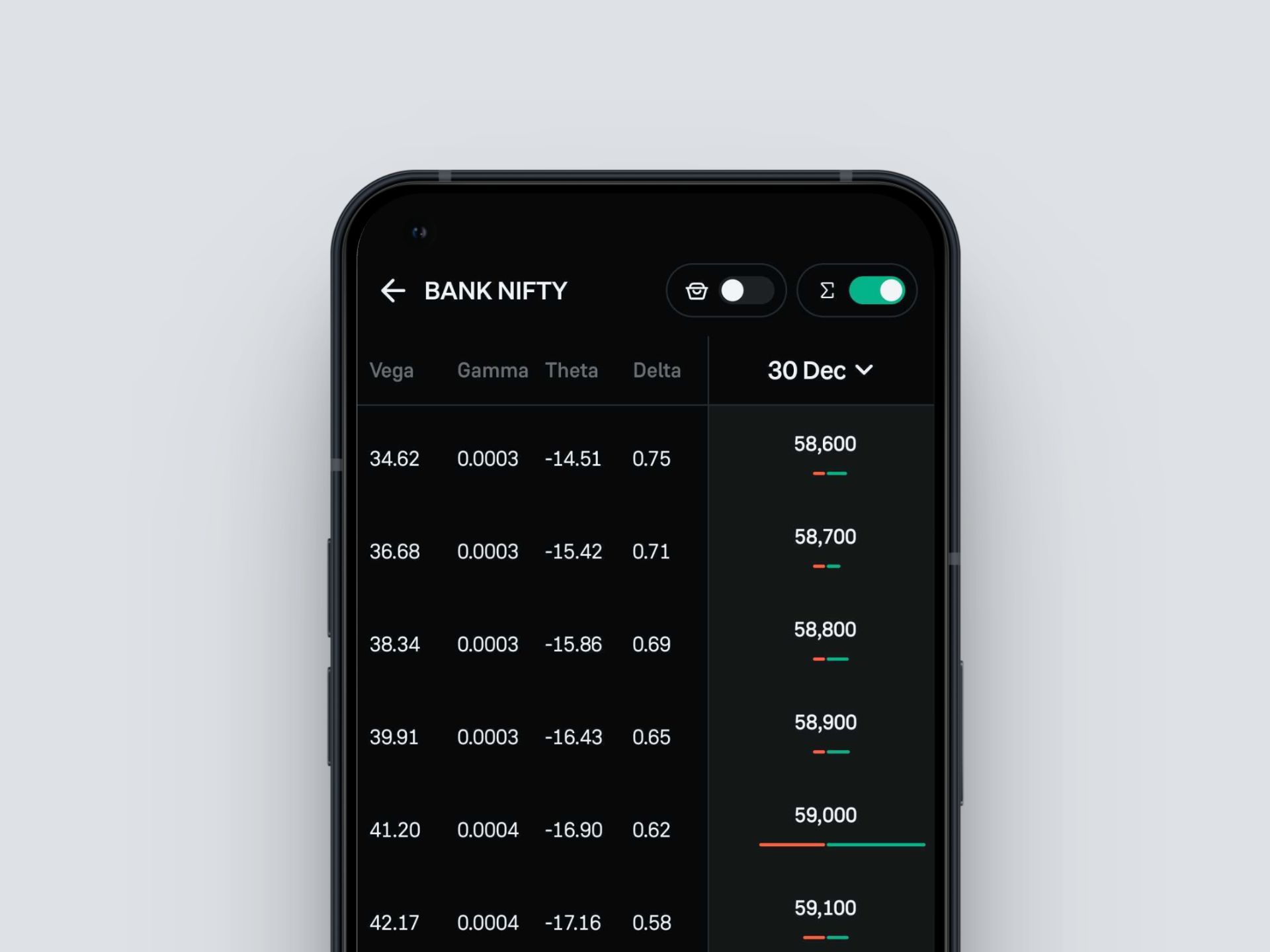

With our latest update, Groww now brings Greeks directly to your Option Chain on both the app and web. No more toggling between analysis tools and order screens. Just a seamless, powerful trading experience where you can analyse risk and execute orders from the same surface.

What's New?

- Integrated Analysis: View key Option Greeks (Delta, Theta, Gamma, Vega) right alongside the strike prices and premiums on the Option Chain.

- Unified View: Analyse the sensitivity of option prices and execute your strategy without leaving the screen.

- Cross-Platform Availability: Available seamlessly on both the Groww App and Web platform.

- Real-time Decision Making: Make faster, data-backed decisions by seeing how time decay (Theta) or volatility (Vega) might impact your trade before you click buy or sell.

How to Enable Options Greeks on Groww?

Step 1: Open the Groww app or website and navigate to the F&O section. Select your preferred Index (NIFTY, BANKNIFTY) or Stock and tap on “Option Chain”.

Step 2: Look for the "Greeks" option or toggle. Tap it to enable Greeks View on the Option Chain screen.

Step 3: You will now see columns for Delta, Theta, Gamma, and Vega displayed next to the call and put premiums. Analyse the data and place your order directly by clicking on the strike price.

Why Did We Build this Feature?

Based on the feedback received from our F&O trading community, many traders indicated that they relied on external calculators or tools to verify Greeks before making trading decisions. This introduced delays and increased the likelihood of missing price movements. Traders needed a way to bridge the gap between analysis and execution.

By bringing Greeks to the Option Chain, we solve two problems:

- Context Switching: Eliminating the need to jump between tabs.

- Speed: Giving you all the data you need to execute high-conviction trades instantly.

Are you ready to level up your F&O analysis?

Update your Groww app to the latest version or visit Groww Web → Open any F&O Option Chain → Enable the Option Greeks View

Greeks on Option Chain is now live for all Groww users.

We hope this feature helps you analyse options more easily and manage your trades with greater clarity.

Happy Trading!

— Team Groww