Introducing Capital Gains in Redeem - A Faster Way to Track Your LTCGA and STCGA

Dear Investors,

At Groww, we’re always working to make investing easier, smarter, and more transparent for you. Whether it is redeeming your mutual funds or just analysing your portfolio, knowing the tax impact of your investment decisions is always important. That’s why we’ve introduced a new feature to help you redeem smarter, not just faster.

Presenting Capital Gains in Redeem on Groww — a smarter way to track LTCG and STCG during your redemption journey on Groww.

➡️What is “Capital Gains in Redeem”?

Capital Gains in Redeem is a new feature within the Groww app that shows you a detailed breakdown of your holdings into:

- LTCG (Long-Term Capital Gains) – units held for more than 12 months

- STCG (Short-Term Capital Gains) – units held for 12 months or less

It also displays estimated tax implications for both categories, so you can:

- Understand how your redemption will be taxed

- Decide whether to redeem partially or fully

- Opt to redeem only LTCG-qualified units to minimise short-term taxes

✅Feature Highlights: What’s New?

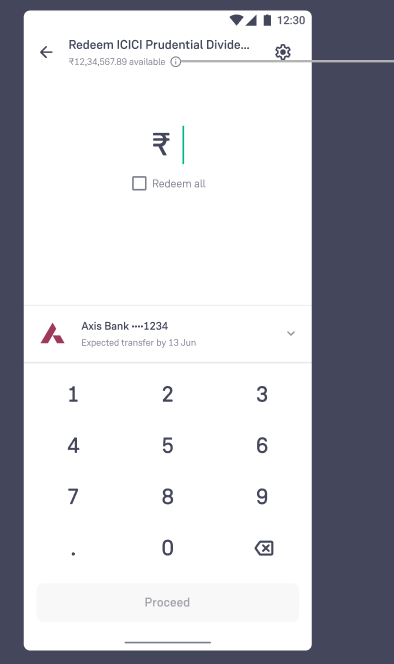

1️⃣ On the Redeem Order Card

When you initiate a redemption, you will see the total “Available to Redeem” amount. Tap the info icon next to it to view the breakdown of the redeemable units into LTCG-qualified and STCG-qualified units.

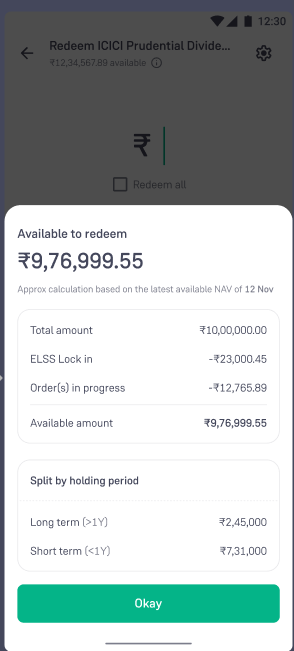

2️⃣ On the Confirmation Popup

Once you enter the amount you wish to redeem, a new “Taxes” section appears, showing estimated STCG and LTCG tax amounts based on your input. Tap the info icon for a detailed explanation of how tax is calculated.

Who Benefits From This?

This feature is especially valuable for:

- Tax-conscious investors planning redemptions near the financial year-end

- Long-term investors who want to avoid unnecessary STCG taxes

- Anyone looking to make data-driven financial decisions while redeeming mutual funds

So, are you ready to start making smarter redemption choices today?

Head to your Mutual Funds > Investments tab on the Groww app and try it out.

— Team Groww

✅Frequently Asked Questions (FAQs)

Q1. What’s the difference between LTCG and STCG?

In mutual funds, LTCG applies to units held for more than 12 months (taxed at 10% beyond ₹1 lakh annual gains), while STCG applies to units held for less than 12 months (taxed at 15%).

Q2. Will Groww calculate my tax liability automatically?

Yes. During redemption, based on your investment history, we show an estimated tax impact for both LTCG and STCG.

Q3. Can I still redeem any amount I want?

Yes. You can redeem the full amount or choose to redeem only LTCG-qualified units.

Q4. Will this be available on both mobile and web platforms?

Yes. The feature has been rolled out for Android and iOS apps and is also available on Groww Web.