Inverted Yield Curve

Interest rates are a significant aspect of the economic environment of a nation and the world. Interest rates and changes in interest rates impact the overall lending and borrowing environment and other markets, such as equities. Along with interest rates, bond yields also play a crucial role in determining the dynamics of debt securities. In this blog, we will explore what is an inverted yield curve, its relationship with interest rates, and its impact.

What is an Inverted Yield Curve?

Before exploring the meaning of an inverted yield curve, we need to understand the yield curve.

A yield refers to the income generated by investing in a security. For example, the interest that an investor earns by investing in a bond is known as the bond yield. When the yield of similar securities with varying maturity periods is plotted graphically, you obtain a yield curve.

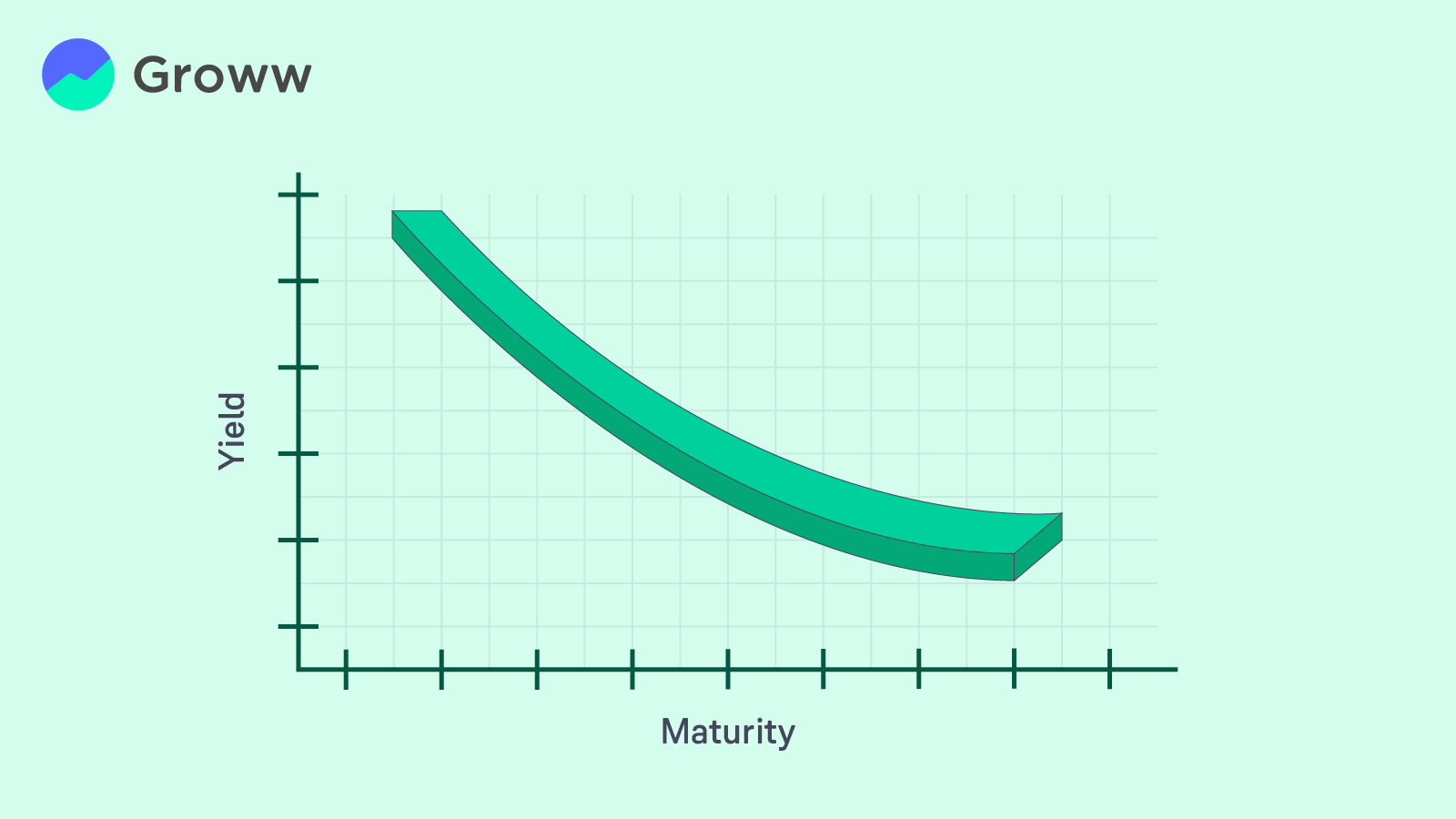

Typically, the yield curve slopes upwards, which indicates that the yield increases with an increase in the maturity period. When lenders lend money for a longer period, they take on more risk due to various factors such as inflation or default risks.

However, when the short-term interest rates are higher than the long-term interest rates, the yield curve gets inverted.

When the interest rate for short-term bonds rises above that of long-term bonds, we get an inverted yield curve. This indicates that lenders are moving money from long-term bonds to short-term bonds. As a result, an inverted yield curve is often associated with a pessimistic future outlook and is considered an indicator of recession.

Example of an Inverted Yield Curve

Let us understand the inverted yield curve with an example.

On January 17, 2024, the interest rate of the 10-year government securities (G-secs) dropped below the rate offered by the 182-day Treasury Bill. Since the interest rate of the short-term debt instrument was higher than that of the long-term debt instrument, it gave rise to an inverted yield curve.

In 2023, too, the yield curve was inverted due to one-year bond yields trading slightly higher than the 10-year bonds.

Although an inverted bond yield is often associated with an oncoming recession, the yield curve may also get inverted due to liquidity issues.

Interpreting Inverted Yield Curve

For investors and market participants, the interest rate environment is a significant factor to look out for. The yield curve can be an important indicator to gauge the market sentiment and the future outlook of the economy.

An inverted yield curve signals that investors are moving money from longer-term bonds or debt securities to shorter-term bonds. Longer-term bonds carry higher risks and when lenders are not confident enough to take on that risk, they move to shorter-term bonds.

As a result, an inverted yield curve has often occurred before recessions and is seen as an indicator of an oncoming recession. Due to its significance, the inverted yield curve is often tracked closely by market participants.

10-year to 2-year Spread

Market participants often use the spread between the bond yields of the 10-year and 2-year US Treasury bonds to understand the future direction of the economy. When the bond yields of the 2-year bonds are higher than the 10-year bonds, the yield curve gets inverted and is often seen before a recession.

Inverted Yield Curve and Recession

On several occasions, an inverted yield curve has preceded a recession. Here are some examples:

In 1998, the spread between the 10-year and two-year US Treasury yields was inverted due to Russia defaulting on its debt. A recession was prevented by the US Federal Reserve through interest rate cuts.

Similarly, the bond yield spread was inverted in 2006 while long-term bonds outperformed equities in 2007. 2008 marked the start of the global financial crisis and a recession.

Prior to the recession caused by the COVID-19 pandemic, the bond yield spread between the two-year and 10-year bonds gave rise to an inverted yield curve.

Inverted yield curves have been seen in India, too. However, it is not a common phenomenon.

Although the inverted bond yield is considered an indicator of recessions, it does not cause them. The inverted yield curve signifies that lenders expect yields to decline in the longer duration.

In some cases, an inverted bond yield may not be a direct precursor to a recession. In 1998 and December 2023, the US economy witnessed an inverted yield curve due to a surge in inflation. However, measures were taken to avert a recession and bring down inflation.

Conclusion

Bond yields, interest rates, and inflation are important factors in every country’s economic environment. For investors, understanding the meaning and implications of the inverted yield curve is important as it not only sheds light on the market sentiment but is often used as an indicator of an oncoming recession. Several factors impact the yield curve, and its impact is significant.