What is SIP & How Does Systematic Investment Plan(SIP) Works?

Investing regularly in mutual funds/stocks on a monthly, quarterly, annual, or semi-annual basis is known as SIP.

The full form of SIP is Systematic Investment Plan. It is a “long-term investment strategy” where one can start investing with as little as ₹100.

According to AMFI (Association of Mutual Funds in India), in July 2025, SIP inflows touched an all-time high of ₹28,464 crore. The reason behind these numbers and why retail investors are choosing SIP investments is the “compounding effect” that builds wealth over time.

What is SIP?

In the Systematic Investment Plan, the investor invests a fixed amount of money (usually monthly or quarterly) into a mutual fund scheme or stock. The investment is made on a regular basis and in a disciplined manner, regardless of market volatility and conditions.

Now that we have explained the SIP meaning, the next section explores its simple yet powerful working mechanism.

How does SIP work?

-

SIP Set-Up

To start investing in SIP, the investor needs to decide on the three important parameters, i.e.,

-

- Investment Amount: It is the amount of money chosen to invest at regular intervals. This can be ₹100 per month or higher amounts like ₹1,000, ₹5,000, ₹20,000, or even in lakhs, depending on income flow and financial goals.

- Investment Frequency: This refers to how frequently the investment is made, whether on a daily, weekly, monthly, quarterly, annual, or semi-annual basis.

- Mutual Fund Scheme or Stock Selection: The amount chosen is invested in the selected mutual fund scheme. For those who opt for a stock SIP, the amount is invested in the selected stock.

- Investment Amount: It is the amount of money chosen to invest at regular intervals. This can be ₹100 per month or higher amounts like ₹1,000, ₹5,000, ₹20,000, or even in lakhs, depending on income flow and financial goals.

The entire investment process and returns will solely depend on what one selects in this step.

Once the parameters are decided, the SIP can be set up via a third-party investment platform like Groww, a financial advisor, or directly through AMC.

-

Auto-Debit

After setup, the autopay mandate needs to be activated. So, the predetermined amount is auto-debited from the bank account and invested in the mutual fund on the specified date.

-

Unit Allocation

Every mutual fund unit has an NAV (Net Asset Value), which is directly proportional to the mutual fund investment value.

As NAV increases (⬆️), the mutual fund investment value also increases (⬆️) and vice versa.

For each investment, the individuals are allocated units of the mutual fund scheme based on the current Net Asset Value.

Here’s how!

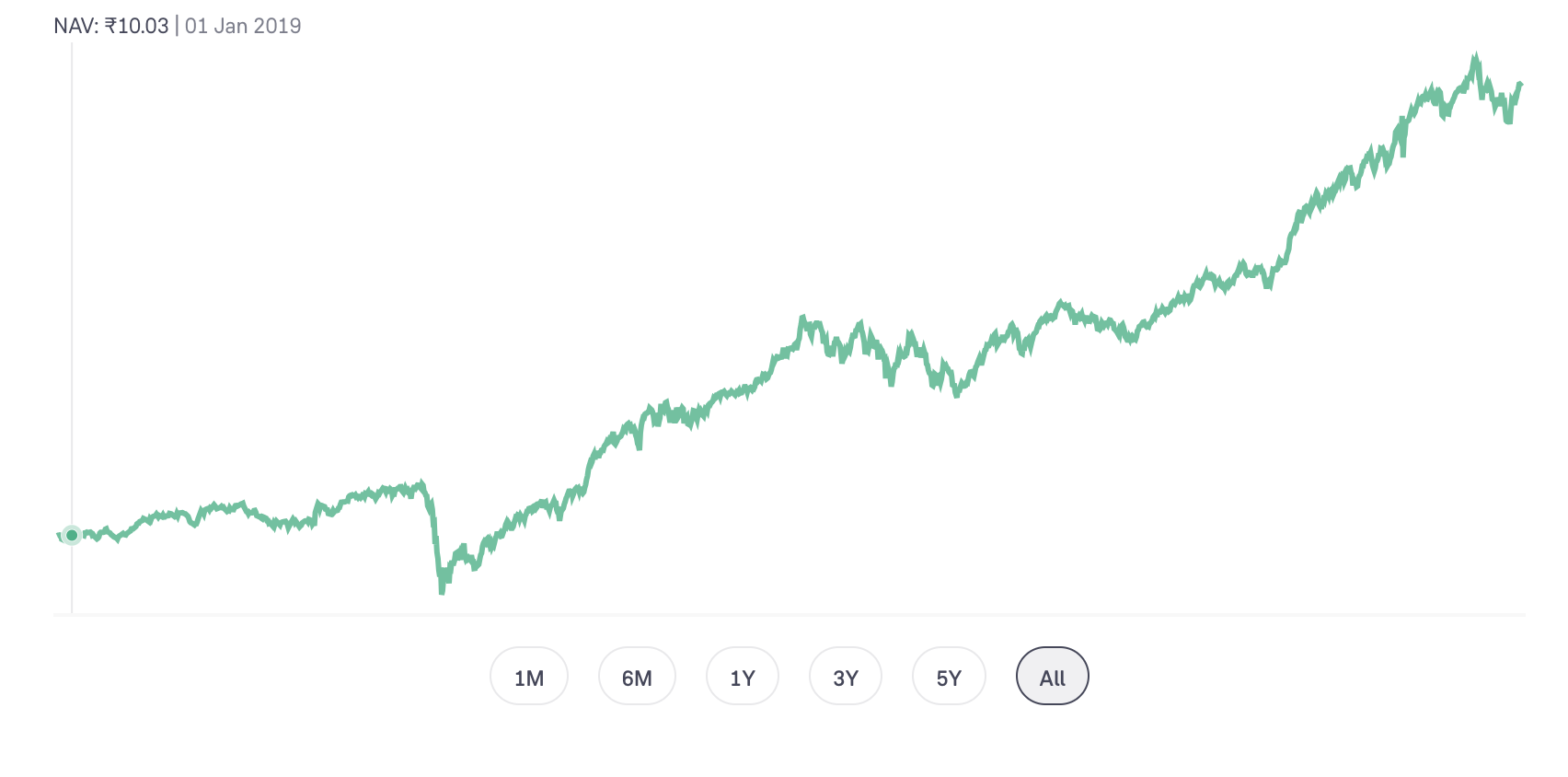

Below is the NAV graph of Groww Aggressive Hybrid Fund Direct Growth

On 01-Jan-19, the NAV was 10.03

On 01-Jan-24, the NAV was 19.69

In 5 years, the fund has almost given annual returns of 14.4%.

A monthly investment of ₹5,000 in the Groww Aggressive Hybrid Fund Direct-Growth over 5 years (total investment: ₹3,00,000), at an annualised return of 14.42%, would have grown to approximately ₹4,09,650.

Disclaimer: Past performance is not indicative of future results. Investment in mutual funds or any other financial product involves risks, and the value of investments may fluctuate.

-

Compounding Effect

SIPs leverage the power of compounding, which leads to exponential growth in investment value over time.

Let’s understand this with an example.

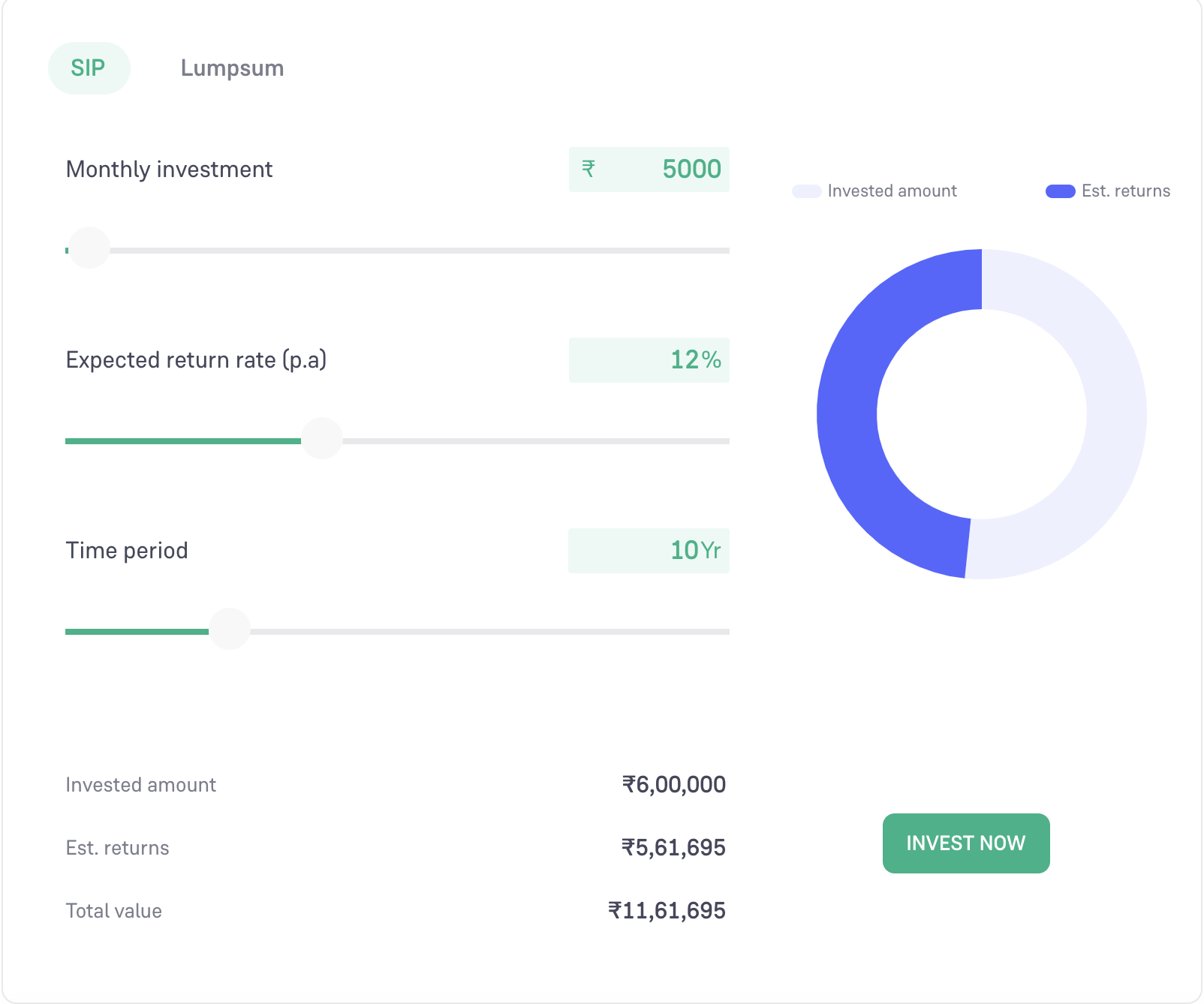

Raj invests ₹5000 monthly in an XYZ mutual fund scheme for 10 years.

The total amount invested is ₹6,00,000.

Expecting 12% returns p.a., the future value of Raj’s investment will be approximately ₹11,61,695 (approx).

In 10 years, the money will almost double up, thanks to the power of compounding and disciplined investment.

So,

“Start early,

&

Stay invested long-term to get a high return on investment!”

Types of SIP

Mutual funds SIPs are of different types.

-

Regular SIP

In a regular SIP, a predetermined amount is invested at regular intervals for a fixed period.

Perfect For: Individuals looking for disciplined investing over the long term.

Example: Mr A decides to invest ₹5000 every month for one year in a mutual fund scheme. Here,

-

- Pre-determined amount: ₹5000

- Regular interval: monthly

- Fixed period: One year

-

Perpetual SIP

In a Perpetual SIP, the amount and investment frequency are pre-defined. However, these don’t have a fixed tenure, and investors can invest as long as they want.

Perfect For:

-

- Younger generations who haven’t decided on their goals,

- With an investment surplus, or

- Those who want to keep investing without worrying about the end date.

Example: Vijay invests ₹5,000 every month in a mutual fund scheme with no fixed period. The investment will be continued until he decides to stop it.

-

Top-up SIP/Step-up SIP

In a top-up SIP or step-up SIP, the invested amount is increased periodically (e.g., on an annual basis). It allows investment to keep pace with inflation.

Perfect For: Those who can’t commit to a big investment initially and want to increase it according to their income.

Example: Starting the investment with ₹5,000 and increasing it by 10% every year, i.e., ₹500.

-

Flexible SIP/Anytime SIP

As the name suggests, flexible SIPs are flexible investment options. Here, the investment frequency and amount are flexible. So, the investor can increase or decrease the SIP amount based on their financial situation.

Perfect For: Individuals with irregular income or those who may face occasional cash flow constraints.

Example: Investing ₹5,000 one month and ₹3,000 the next, based on fund availability.

-

Multi SIP/Combo SIP

Multi SIP/Combo SIP allows investors to invest in multiple schemes of the same fund house through a single SIP. From the investor's perspective, it appears as a single SIP, but once the amount comes in, the mutual fund house bifurcates it into different schemes.

In short, with Multi SIP/Combo SIP, one can invest in large-cap, flexi-cap, and debt funds simultaneously.

Perfect For:

-

- Those who want to diversify investments across different mutual funds using a single consolidated SIP.

- If a mutual fund house has multiple schemes that are performing well.

Benefits of Investing In SIPs

SIP investments offer numerous advantages. Below, we have explained a few!

-

Rupee Cost Averaging Factor

SIPs allow investors to take advantage of the Rupee Cost Averaging Factor, or RCA.

What is the Rupee Cost Averaging Factor?

When investors invest regularly over time, irrespective of market volatility, the overall cost of investments is averaged out. This way, when the market is down, more mutual fund units will be allocated and fewer units when markets are up.

Let’s understand the concept with an example.

Vijay invests 2000 every month in an equity mutual fund via an SIP. Below is an illustrative overview of his 12-month investment journey, including NAV and MF units.

|

Month |

NAV |

MF Units |

|

Jan |

20 |

100.00 |

|

Feb |

18 |

111.11 |

|

March |

22 |

90.91 |

|

April |

16 |

125.00 |

|

May |

24 |

83.33 |

|

June |

20 |

100.00 |

|

July |

26 |

76.92 |

|

August |

15 |

133.33 |

|

Sept |

28 |

71.43 |

|

Oct |

17 |

117.65 |

|

Nov |

30 |

66.67 |

|

Dec |

19 |

105.26 |

With the above table, it is clear that:

|

Falling market (Less NAV) |

More mutual fund units |

|

Rising market (More NAV) |

Fewer mutual fund units |

Here,

Average NAV cost: ₹21.25

Average Mutual fund unit cost: ₹20.31 per unit

So, Vijay got mutual fund units at a lower cost than the average NAV of the units. This is how the Rupee Cost Averaging Factor reduces the average cost per unit over time and mitigates the impact of market volatility.

-

Disciplined Investing

SIPs encourage investors to invest a fixed amount at regular intervals.

This way, one can enjoy several benefits, like

-

- A habit of consistent and disciplined investing

- Regularly investing small amounts helps gradually build a substantial corpus without large lump-sum contributions.

-

Investment Flexibility

SIPs, majorly Flexible SIPs, allow you to increase or decrease the investment amount based on your financial situation. This flexibility ensures that temporary financial challenges (if arise) don’t affect your investment journey.

-

Start With Small Contributions

SIP investment is perfect for all types of investors, including those with limited funds. You don’t need a large sum of money; even small monthly contributions can grow significantly over time.

Important Things To Remember Before Investing In SIPs

-

Exit Load

Exit Load refers to the fee charged when you exit your SIP or redeem the mutual fund units before a specified period (usually within 1-3 years). The general exit load starts at 1% and varies depending on the fund chosen.

-

7-5-3-1 SIP Investing Rule

Follow the 7-5-3-1 SIP investing rule for better returns on your investment. It stands for:

7: Invest for at least 7 years

5: Invest the amount across five different funds/asset classes. For instance, small-cap, mid-cap, large-cap, ETFs, Value Stocks, Global Stocks, etc.

3: Be prepared to face the three phases that might urge you to give up on your SIP.

-

- The Disappointment Phase: During this phase, returns may vary between 7% and 10%. Investors might have expected better and be disappointed by such returns.

- The Irritation Phase: The returns on this phase are lower than those on fixed deposits (0-7%), which might lead to frustration and dissatisfaction.

- The Panic Phase: In this phase, the value of your portfolio might end up negative (<0%), i.e., less than what you have invested. This might trigger feelings of anxiety, concern, and panic.

1: Increase the SIP amount at least once a year.

-

Expense Ratio

It is the annual fee mutual fund companies charge to manage the fund. Always opt for funds with the lowest expense ratio, as it increases overall returns.

-

Tax Implications

SIP investment has the following tax implications:

-

- If held for less than one year, STCG (short-term capital gain) is applicable, i.e., 20%.

- If held for more than one year, LTCG (long-term capital gain) is applicable, i.e., a return up to 1.25 lakh will be tax-free; beyond that, 12.5% of tax will be levied.

Common Questions Regarding SIPs

-

Which is better: SIP or lump sum investment?

Both SIP and lump-sum investments have their own advantages.

SIP is perfect for those investors who

-

- Want to invest regularly for a long period (5 years, 15 years, and so on.)

- Don’t get bothered by market fluctuations.

Lumpsum is perfect for investors:

-

- With a large amount of money to invest upfront

- Who can handle losses in case of market volatility

-

I am not a long-term investor. Is SIP investment right for me?

SIPs are generally more suitable for long-term investors, as they generate returns with a compounding effect. The real return on investment is visible only after 5 to 10 years of investing.

-

The stock market is down. Is it the right time to invest in SIP?

Absolutely, yes! Investing when the market is down can be advantageous, as it allows you to buy more mutual fund units at lower prices (due to rupee cost averaging).

-

I don’t have a demat account. Can I invest in SIP?

Yes, you can invest in SIPs without a Demat account and directly through the Groww Mutual Funds platform.

-

I missed my one-month SIP instalment. Will I be charged any penalties?

If you miss an SIP instalment and the auto-pay mandate fails due to insufficient balance, the mutual fund house does not charge any penalty. However, your bank will levy a penalty anywhere from ₹100 to ₹750. To avoid these penalties, you can pause your SIP prior if you cannot pay any specific month's instalment.

Conclusion

SIPs offer a simple, disciplined, and effective way to invest in mutual funds. By investing a fixed amount regularly, you can build a substantial corpus for your future goals.

Always remember

Consistency is the key, and starting early can make a huge difference!

Related Mutual Fund Pages