What is Pledge Margin and How to Use it for MTF

In case you’re new to stock market trading and investments, you might wonder if you could trade without cash in your account. The answer is yes! Cashless Trading through Pledge Margin in Margin Trading Facility (MTF) allows you to trade without depositing any cash upfront.. Understanding pledge margin could be advantageous, particularly if you wish to grow your capital without any liquidation of your holdings. Let us dive into how pledge margin works and how you can make the most of your existing holdings.

What is Pledge Margin?

Pledge margin allows you to use your current/existing stocks and other eligible securities in your Demat account as collateral for securing additional trading margins. Meaning, you can pledge your existing holdings to get additional margin. This margin is secured against the value of your pledged holdings.

Traders usually resort to this facility to buy additional shares, trade in futures and options, do intraday trading, etc. This system gives you ample flexibility to expand your trading positions without having to deposit more cash instantly.

For example, if you have holdings valued at ₹200,000, then you could get a margin of roughly ₹1,70,000 against the same.

The Power of Cashless Trading in MTF

Typically, you are required to bring in a cash margin - a portion of the trade value - when utilising the Margin Trading Facility (MTF). However, Groww now allows cashless MTF trading, where you need not bring in additional funds if you already have holdings in your Demat account.

Why this matters:

- You can start trading using MTF with a ₹0 cash balance

- You can maintain liquidity with your pledged securities doing all the work, and your cash remains untouched

- You can use your holdings as collateral without selling them

How to Pledge Your Holdings?

Here is an example of how you can pledge your holdings by initiating a margin pledge request on Groww.

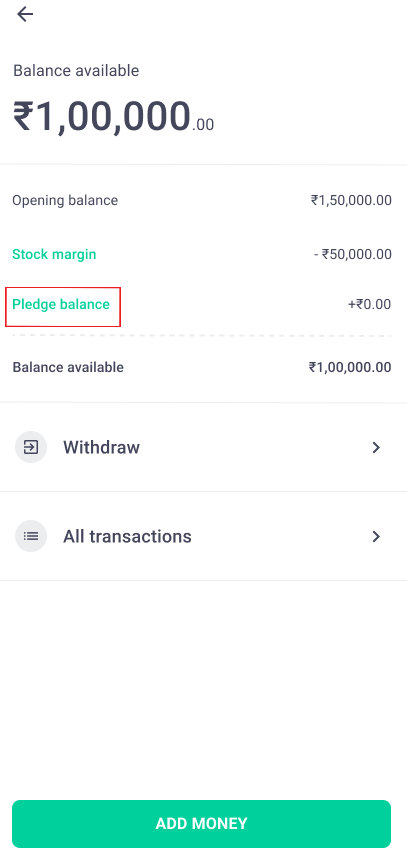

Step 1: Open your Stocks Balance section. Then click on pledge balance

You can also view access Pledge on Groww via your stock holdings.

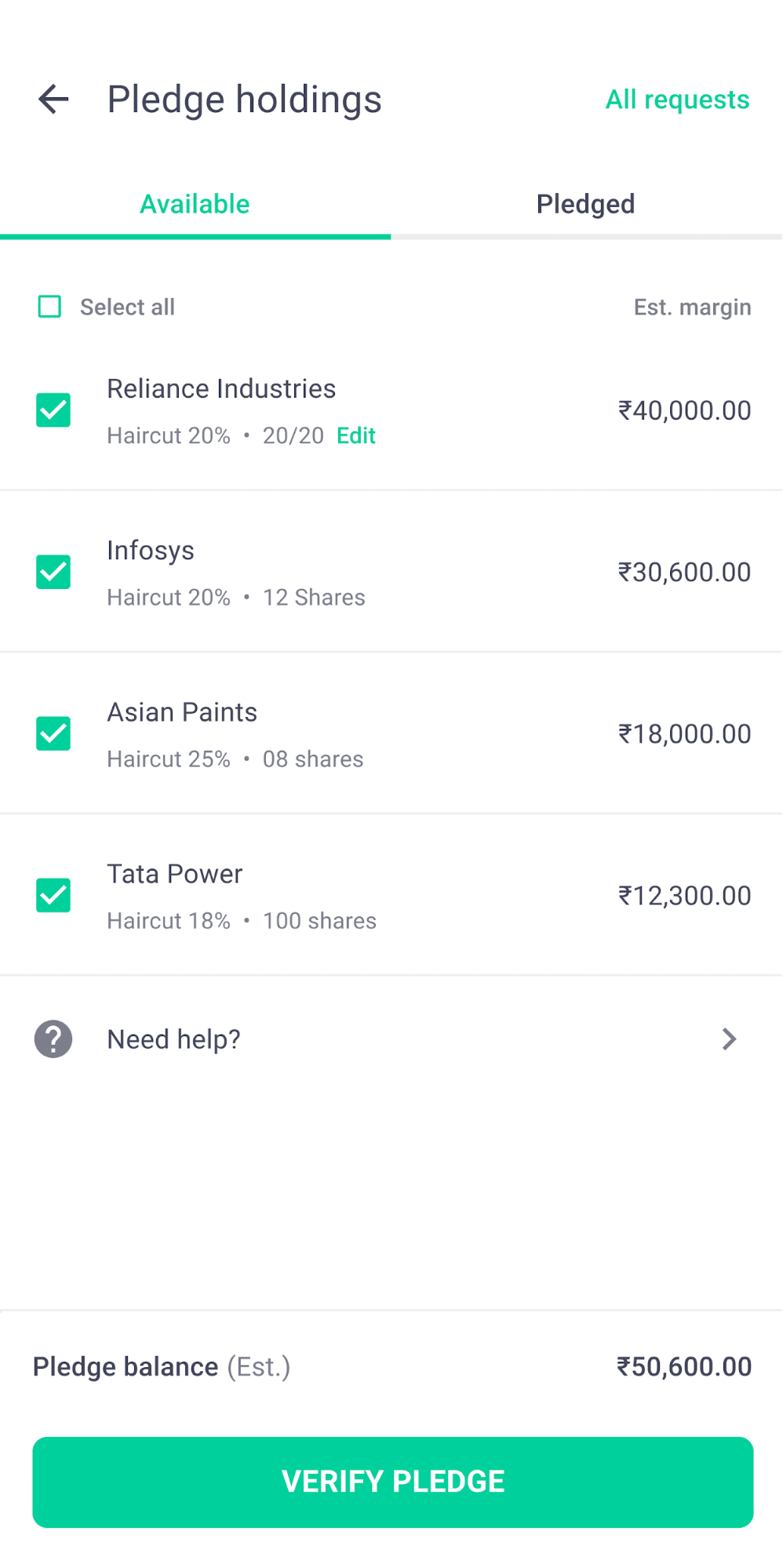

Step 2: All stocks eligible for pledging from your total holdings will be displayed on the screen. Select the stock you wish to pledge and click on Verify Pledge.

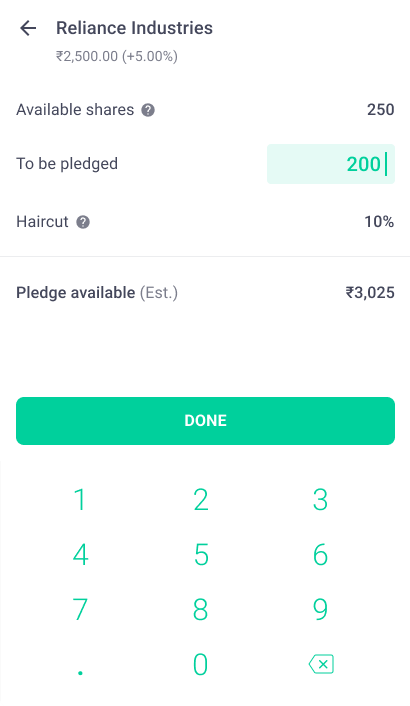

Step 3: Edit the stock quantity that you wish to pledge (Here you can view the total margin that you are eligible for and the haircut that is levied in total)

Note: No interest or charges are applicable to the usage of pledged margin.

Note: A one-time charge of ₹20 + GST is applicable on pledging holding.

Step 4: Click the Verify Pledge button and enter the OTP that you receive, after which the All Request screen will be displayed. Check your pledge status in the order details menu thereafter.

Note: Remember that not all stocks are eligible for pledging- only those with approval by the broker and exchanges may be pledged.

Read more about the Pledging feature on Groww here: https://groww.in/blog/new-feature-alert-pledging

How to do Cashless Trading in MTF via Pledge Margin?

Thanks to Pledge Margin, there are two major benefits that you stand to get:

- You can now place MTF orders even when you do not have adequate cash. Cashless trades are thus enabled for maximum convenience.

- You can avoid margin shortfalls as well.

How It Works:

- Pledged shares work as collateral if your trades require a higher margin due to volatility (fall in the last traded price), an increase in haircut, or both.

- You can thus experience the benefit of cashless trading, buying stocks without initially paying the full amount upfront.

- It helps you maintain suitable margins and prevents auto square-offs for MF positions.

- You don’t have to liquidate your holdings to meet margin requirements.

What to Watch Out For:

- Price drops in pledged shares

- Market volatility

These may lead to margin calls, and you have to meet them to avoid your positions being liquidated.

How can Pledge Margin be used to meet margin requirements and avoid margin shortfall?

Pledge margin helps you use existing securities as collateral for meeting the margin requirements and avoiding shortfalls. You can use the margin or loan to trade in multiple instruments, and the broker will keep tracking the market value of these pledged shares. Additional margin may be needed in case the market value comes down. You may unpledge shares once you no longer require the margin.

Thus, you can leverage the existing investments without having to sell them and maintain flexibility all along. However, note the haircut or percentage deduction applicable for the value of your pledge securities to cover market risks. If the market value of these pledged shares falls, you may get a margin call to deposit more funds or liquidate your position.

How Are the Cash Balance and Pledge Margin Utilised

In case both pledged margin and cash balance are present, brokers may usually follow a specific order of utilisation -

The pledge margin is used first, followed by the cash balance. Charges may apply in this case for using the pledge margin.

When MTF orders are placed using the pledge margin, there will be interest charged on the total amount that you’ve borrowed from Groww and the pledged margin.

In case there is an MTF loss, then the cash ledger will go negative, and the pledged holdings will be squared off if the loss is not added in GB.

In many cases, the pledged margin covers the margin requirement for the open positions, while the cash balance may be used for further withdrawals/trading, mostly for instruments like F&O (futures and options). The pledged margin will not be seen as cash in the account statement, although it will keep fulfilling the margin obligations.

Let’s take an example of two different scenarios for buying shares.

Scenario 1 - MTF without pledge margin

- Suppose the total value of the shares you wish to buy is ₹10 lakh.

- Assume that you do not wish to pledge your holdings, due to which you need to pay ₹2.7 lakh as margin.

- Groww will pay the remaining ₹7.3 lakh.

- You can now expand your position by buying shares with the MTF facility.

Scenario 2 - MTF with pledge margin (where you pledge your holding value as collateral).

- The total value of shares you wish to buy is ₹10 lakh.

- In this case, you don’t have to pay any cash, since you’re pledging your holding value.

- The pledge margin will be ₹2.7 lakh based on your holdings and will be taken as collateral.

- Groww will pay the remaining ₹7.3 lakh.

Ramifications

Here are some possible ramifications of pledge margin or margin pledging.

- Keep track of interest charges

Whenever MTF orders are placed via pledge margin, there is interest charged for the amount borrowed and the pledged margin used in the entire duration for which the position is open. - Maintain the margin coverage suitably

Remember that market movements are swift and hard to predict. In case your pledged shares fall in terms of their value, then your available margin may also come down. To maintain your MTF positions, make sure that you have an adequate margin buffer in the account. - Have a strategy for volatile markets

In case there are dynamic stock market movements or persistent volatility, keep reviewing the values of your pledged stocks and all open MTF positions to stay ahead. - Understand what can be pledged

Pledging may only be available for select listed stocks that have approval from the broker and exchanges. ETFs, mutual funds, and many other instruments are not yet eligible.

Final Notes

Using pledge margin strategically will give you more purchasing power and flexibility, without hindering your long-term investments as well. However, staying alert and informed is the need of the hour, along with actively tracking your positions. In fact, this facility can not only help you expand your portfolio, but also diversify it across multiple offerings/products, although you should keep an eye on the risks of margin calls and potential losses of assets that have been pledged.