Who are Market Makers and How to Profit from Their Moves

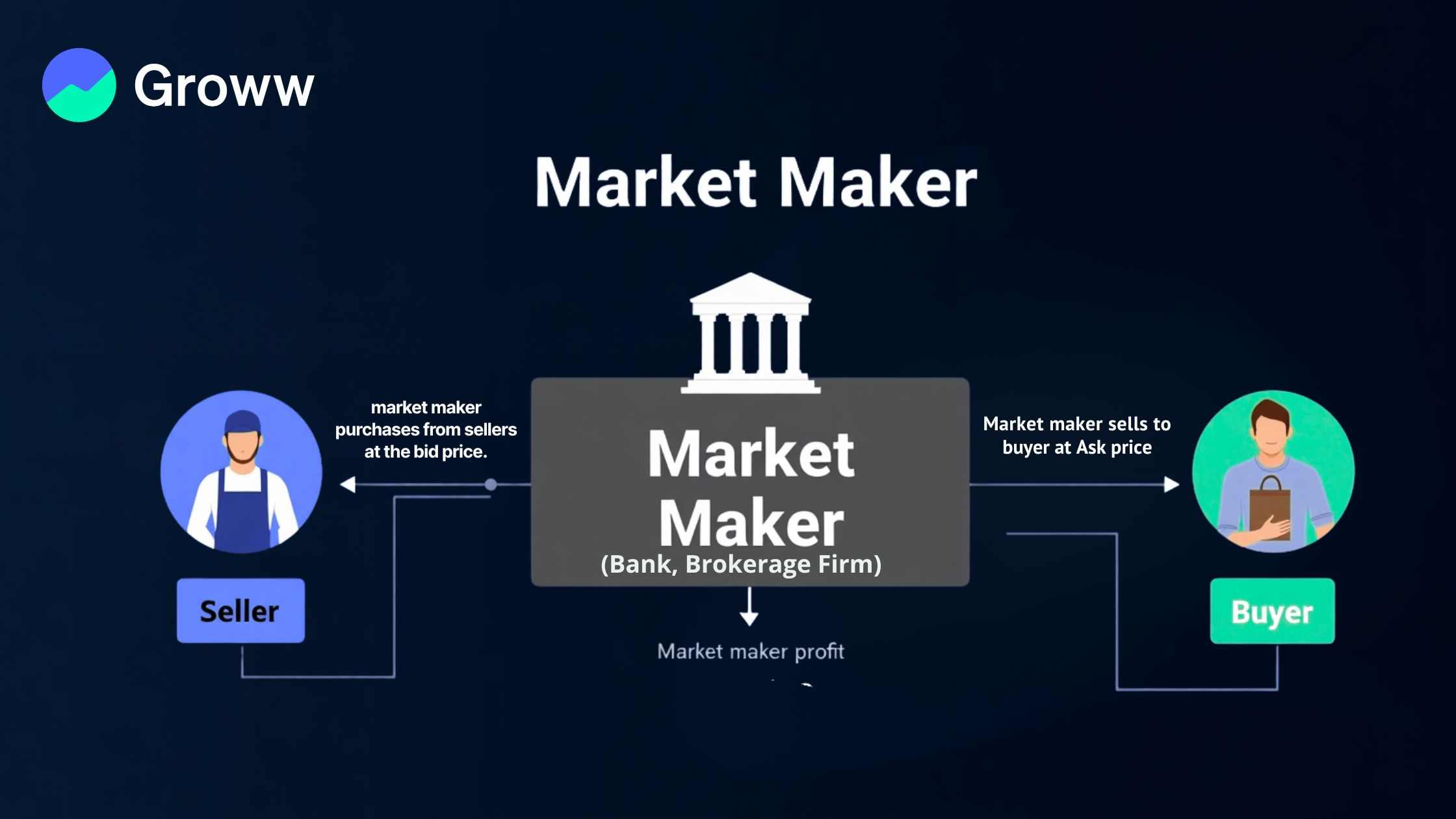

Market makers are companies or individuals who quote both buy and sell prices in a tradable asset that is held in inventory. They hope to earn a profit on the difference between the two, which is known as the turn or bid-ask spread.

Hence, the role of market makers and their positioning are important, especially since they ensure a constant demand and supply for any specific security, through offering to purchase and sell at publicly quoted prices. They also ensure higher market liquidity, enabling an easy trading environment for other investors. Without them, investors would find it difficult to discover parties willing to adopt the opposite side of their trades.

How Market Makers Provide Liquidity

Market makers provide liquidity by always standing ready as a counterparty for buying and selling securities. Market makers in India are obligated to continuously quote the ask and bid prices, even during market uncertainties or volatile periods. They are also prepared to buy or sell a specific number of units/shares of any security, for which they are creating the market. They ensure that someone is always ready to purchase or sell, even when other investors may be unavailable. Hence, they enable trades and enhance liquidity, thereby contributing to a more efficient and orderly market.

Understanding Market Maker Strategies

In terms of the meaning of market makers, it is safe to say that they can be classified as protectors or guardian angels of the market, enabling higher liquidity at all times. However, they operate for a profit, and this is done through strategies that are tailored to capitalise on the same liquidity that they enable. Here are a few points worth understanding in this context.

- Bid-Ask Spread: This is the strategy by which market makers make profits, buying securities at the bid price (the highest they are willing to pay) and selling them at a higher ask price (the lowest they are willing to sell for). This difference or spread accumulates over bigger trades, helping them earn considerable profits.

- Inventory Management: They often hold a specific inventory of securities to enable trading. This may be risky in case of market price fluctuations, although skilled entities/makers can leverage their analytical abilities and knowledge to anticipate future price movements. This helps them buy low and sell high and profit from favourable changes in prices.

- Order Flow Analysis: Market makers keep analysing the flow of buy and sell orders and understand the inherent patterns involved in it. This helps them predict future market movements, adjust the bid and ask prices, and position themselves to earn profits from future price swings.

Identifying Market Maker Manipulation

Sometimes market makers follow manipulation techniques. These deserve to be closely identified. Sophisticated tactics are now being followed, which offer greater challenges to investors and regulatory bodies alike in terms of detecting and preventing them. These tactics are often concealed within the regular process of buying and selling securities, making their detection a major hurdle. Some common patterns include the following:

- Spreading False Information: Market makers may release misleading or false financial data or rumours to sway the prices of stocks, thereby impacting portfolio values.

- Pump and Dump Schemes: They inflate the price of stocks based on exaggerated, false, or misleading information, and then sell the same when prices are high, leading to a crash.

- Spoofing: In this case, they show false interest in a stock by placing orders without any real intent to execute the same. Manipulators may build a false sense of higher liquidity and activity.

Watch out for any abnormal indicators, including erratic price movements or trading volume spikes which do not correlate with any events/news. This may be a sign of possible manipulation by market makers. Also, look out for unexplained and constant price changes at the opening/closing of trading.

Trading Tactics to Leverage Market Maker Activity

Here are some trading tactics to leverage market maker-driven activity:

- Active Market Making: This means positioning yourself strategically to accumulate bigger inventories of specific securities you feel will see price appreciation. This strategy also involves dynamically adjusting the bid-ask spread based on market conditions and initiating market movements to influence sentiments and potentially trigger price movements to profit from their positions.

- Passive Market Making: This means maintaining liquidity and order over actively tapping market movements. The strategy involves maintaining tighter bid-ask spreads without looking to maximise profits from every transaction, along with order matching. This is where they function as intermediaries who match buy and sell orders with minimal pricing interventions.

- Delta-Neutral Strategy: This is a unique strategy, enabling profits from market movements without exposing oneself to directional risks. For options trading, Delta is a vital concept that indicates the rate of change in the price of an option relative to a change in the price of the underlying asset. Holding the underlying asset or adopting a long position is the first step, along with hedging with options to generate consistent profits.

- Grid Trading: Grid trading may help leverage market fluctuations while maintaining the core objective of providing higher liquidity. This involves placing buy and sell orders around a central price at pre-fixed intervals. It leads to a grid of orders which can help capture profits from price movements in either direction. Hence, trades are automatically executed with increases/decreases in prices based on the pre-set grid. This strategy may enhance liquidity while capturing profit in more volatile markets, while lowering the risks of major losses.

- High-Frequency Trading: Market makers often deploy HFT strategies with swift algorithms to leverage fleeting inefficiencies in the market. This helps react/adapt to changes in milliseconds, while enabling tighter spreads and better price discovery, although there is always a dependence on sophisticated technical equipment and algorithms, along with regulatory concerns.

Risks and Ethical Considerations

Here are some risks that market makers may face, along with some key ethical considerations.

- Ethical Hurdles: Ethical conflicts of interest lead to manipulative or unfair practices. Another challenge is a vested interest in any particular asset or security, or any position in an asset that they are market-making.

- Liquidity Challenges: Market makers have the responsibility of ensuring liquidity, although they are also exposed to risks resulting from markets suddenly becoming illiquid. This may lead to issues in exiting positions and considerable losses.

- Price Risks: Major price risks are involved in buying and selling securities, especially if the market goes against your view, which could lead to losses.

- Regulatory Risks: Market making is stringently regulated, and entities have to comply with several regulations. Not complying with these policies may lead to reputational damage and considerable fines. Fair trading practices and transparent reporting are a must for market makers to maintain ethical standards.

- Counterparty Risks: Market makers may often carry out transactions with dealers, brokers, or other market participants, creating counterparty risks, i.e., issues resulting from the other parties defaulting on their commitments.

- Technical Risks: System failures and crashes may be major risks for market makers since they require robust technological equipment in many cases.

Conclusion: Profiting from Market Makers

As an investor, you can take a closer look at the strategies mentioned above in terms of market making and the risks and considerations that come into play accordingly. Build up your market knowledge, watch out for manipulation, and put in place a strategy to profit from market maker activity.