How to Convert Physical Share Certificates into Demat Form?

If you have found physical share certificates tucked away in forgotten files, dusty drawers, or inherited documents, you can dematerialise them and encash their value.

What is dematerialisation?

Dematerialisation is the process of converting physical share certificates into electronic format so they can be held and traded digitally through a Demat account.

Why is dematerialisation required?

On March 27, 2019, SEBI issued a circular, banning the transfer of physical share certificates from April 1, 2019, unless they are dematerialised. Shares can still be held as physical paper certificates, but if you want to sell or transfer them after April 1, 2019, shares must be converted into digital form.

Read on to know how the dematerialisation procedure works.

Step-by-Step Procedure To Convert Physical Share Certificates To Demat With Groww

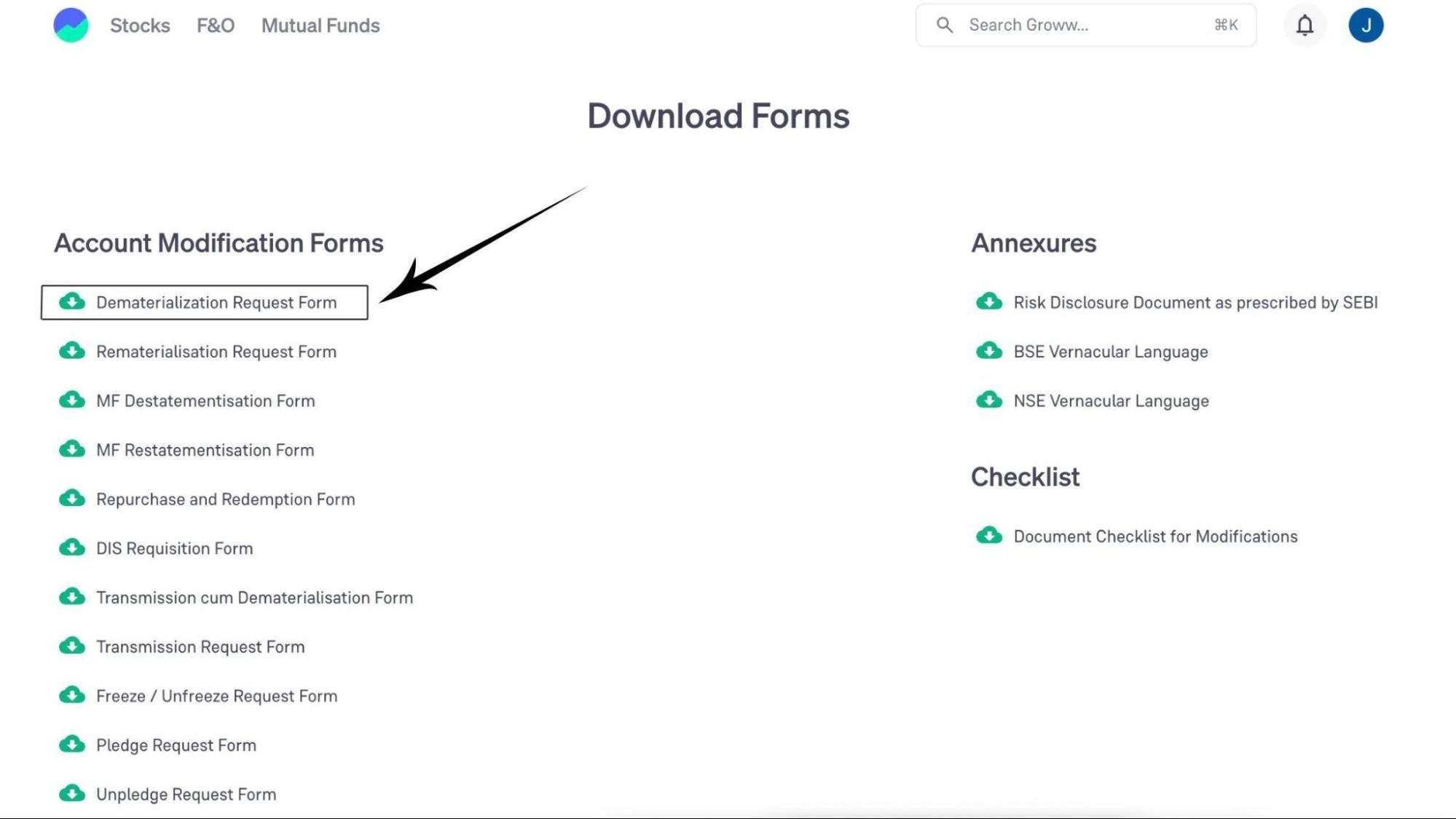

Step 1: Visit https://groww.in/download-forms

Step 2: Click to download the “Dematerialisation Request Form”.

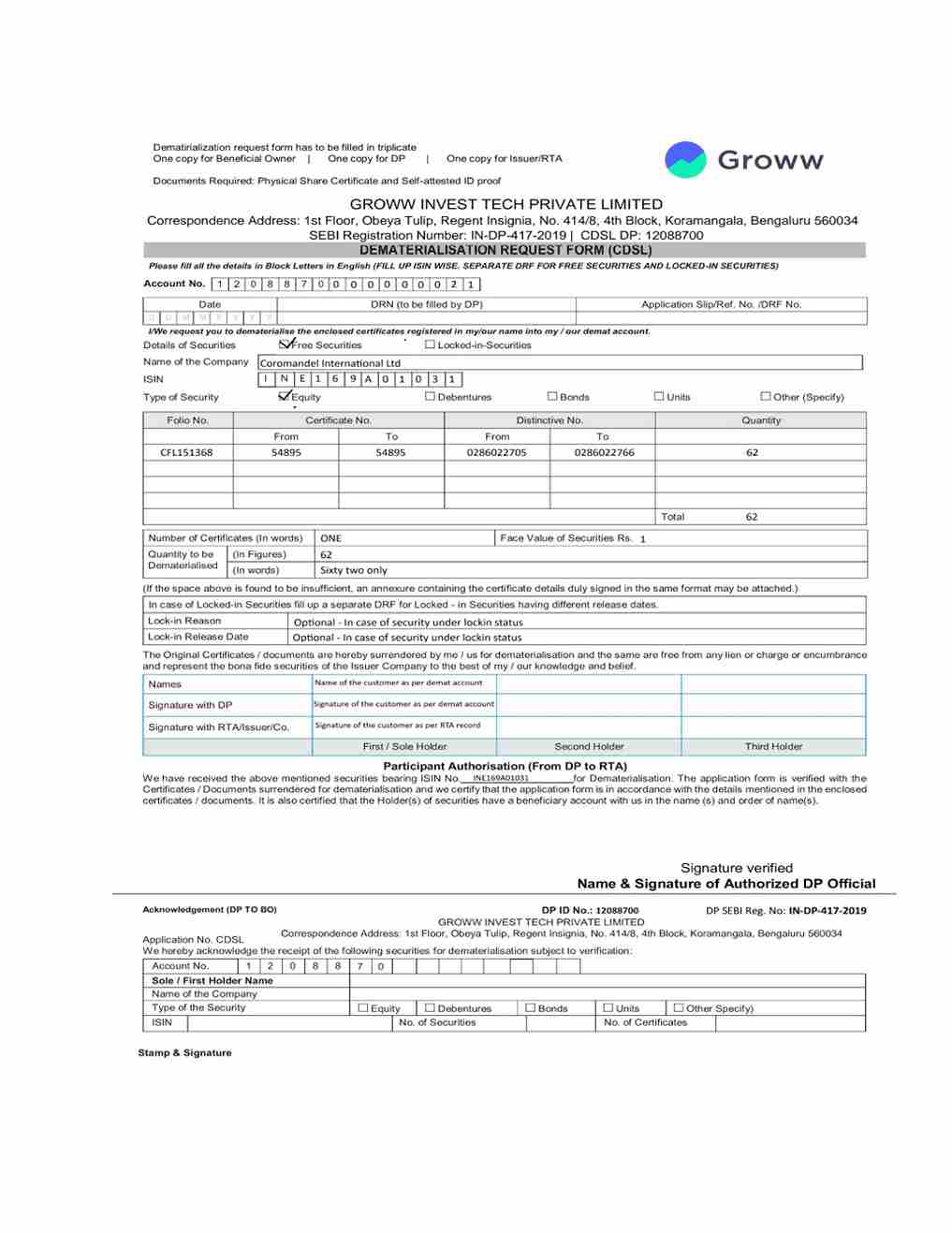

Step 3: Fill in the DRF form accurately with the following details:

- Demat account number

- Name of the company

- ISIN

- Folio No.

- Certificate No.

- Distinctive No.

- Quantity

- Face value

- Number of certificates

- Total quantity in figures

- Total quantity in words

- Name of the customer

- Signature with DP & Signature with RTA

Sample DRF form

Step 4: Courier the

- Filled DRF form

- Physical share certificates

- Self-attested copy of PAN & Aadhaar Card to the below address:

“1st Floor, Obeya Tulip,

Regent Insignia, No. 414/8, 4th Block,

Koramangala, Bengaluru 560034”

|

Dematerialisation charges: ₹150 (per share certificate) + ₹50 (courier charges) + 18% GST |

Step 5: The team at Groww will verify & process the submitted documents & send them to the Registrar & transfer agent (RTA) of the respective company. This process usually takes 20 to 30 days.

Step 6: Once approved, the RTA will cancel the physical certificates, and equivalent shares will be credited to your Demat account electronically.

Important Pre-Submission Checks to Avoid Rejection of Demat Request

If any rejection occurs during the verification process, the customer will be informed via email or call. To avoid this, ensure the following checkpoints are carefully verified before submitting physical share certificates for dematerialisation.

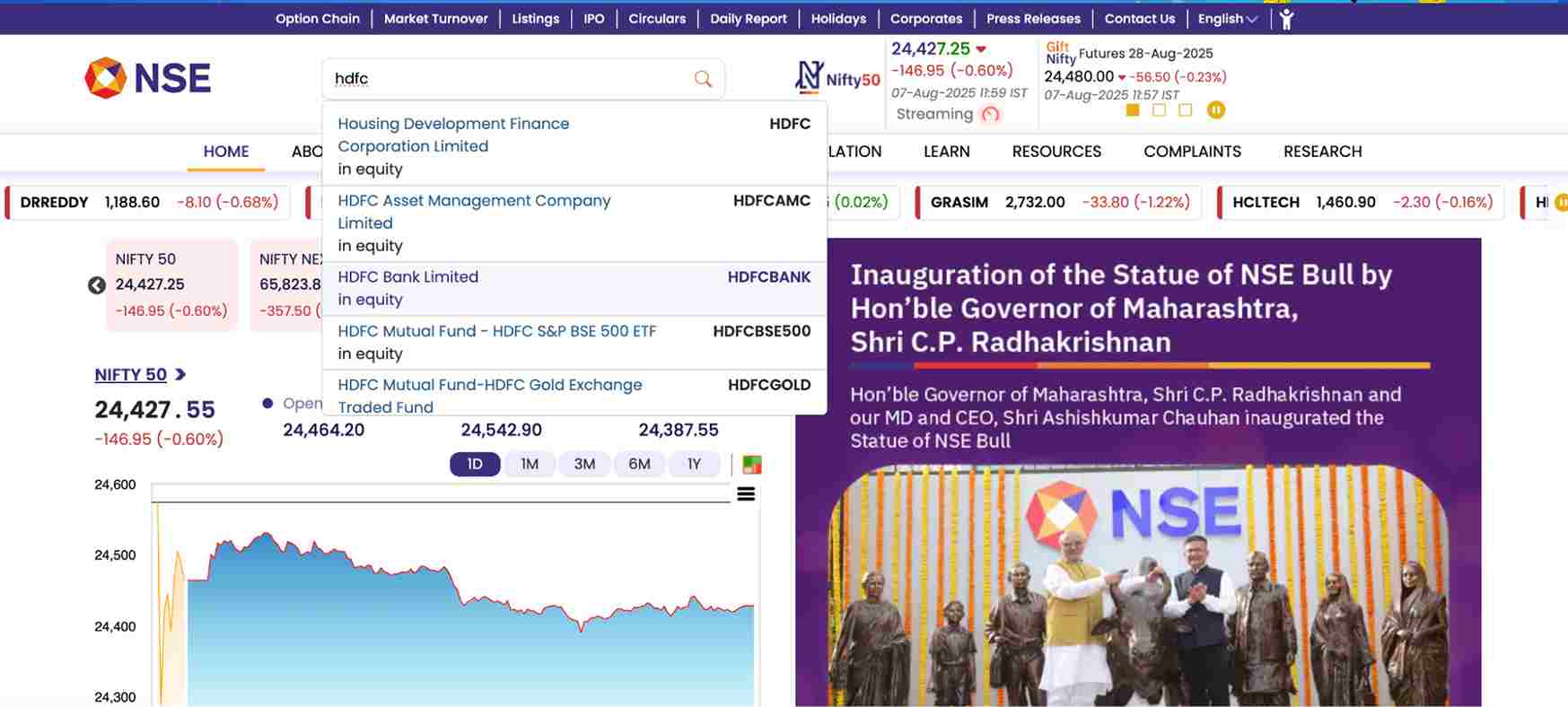

- Company Name: Ensure the company name mentioned on the certificate is currently listed and eligible for demat. You can confirm this on the NSE and BSE websites. For unlisted companies, refer to this list.

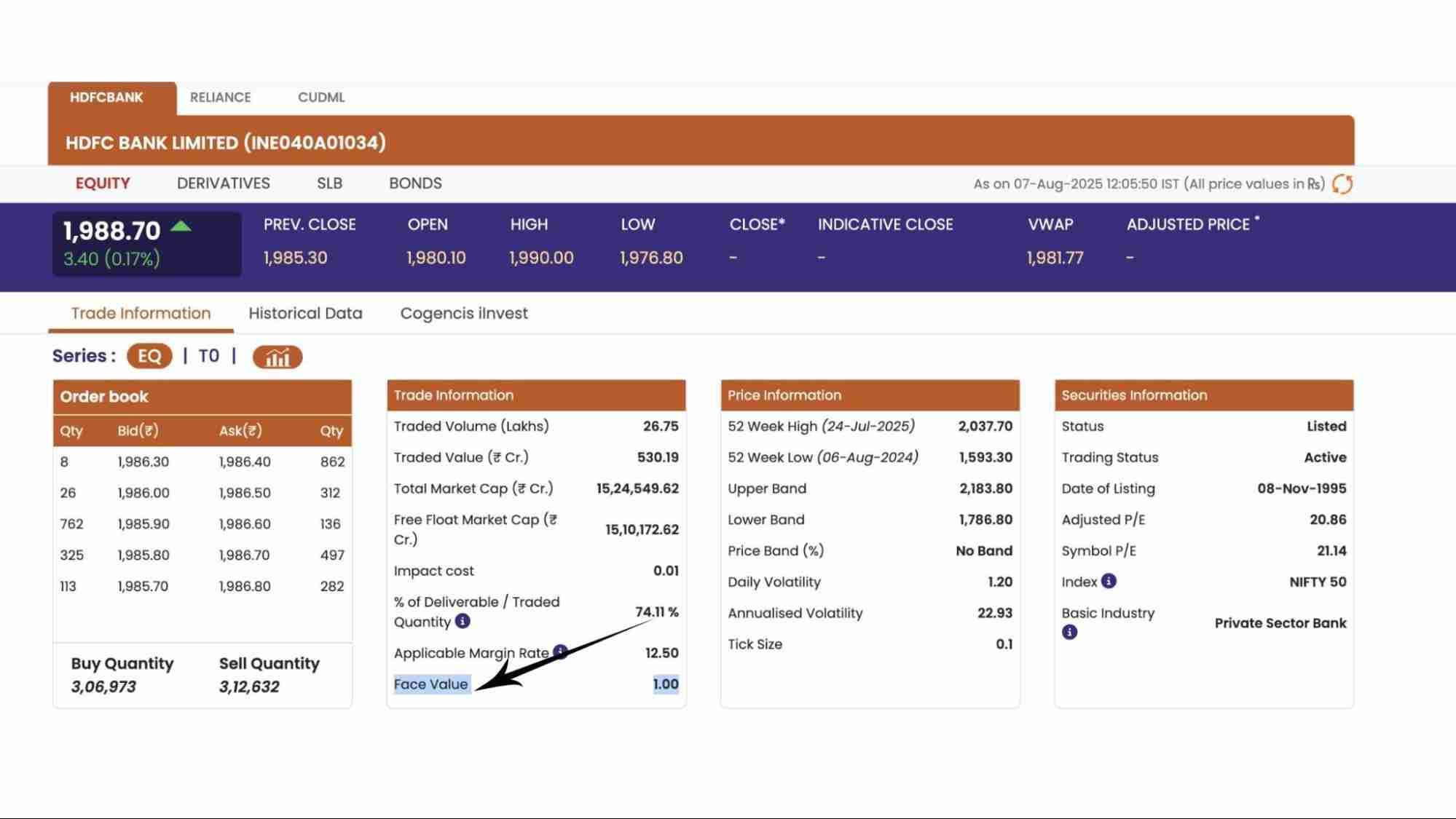

- Face Value: The face value printed on the physical certificate must match the company's current face value. To know this, visit the NSE/BSE website. Search for the company name (for instance, HDFC Bank) and look for the “face value”.

- Security Type: The type of security (e.g., equity, preference shares, etc.) should match what’s mentioned on the certificate.

- Number of Holders: The number of shareholders named on the certificate should match the number listed in the demat account. If the certificate is jointly held, the demat account must also be in the same joint names and order.

- Name Match: The name(s) on the certificate must exactly match the name(s) in the demat account. If there's a mismatch in spelling or order, you’ll need to provide a notarised affidavit explaining the difference.

|

Note: On July 2, 2025, SEBI launched a special 6-month re-lodgement window for investors who had submitted transfer deeds before April 1, 2019, but were initially rejected or not processed due to missing or deficient documents. The deadline for such re-lodgement was initially fixed as March 31, 2021, but the window is now open again from July 7, 2025, to January 6, 2026. |