Belrise Industries Shares Jump Nearly 5% as Q4 Consolidated Net Profit Soars Over 5-Fold

Belrise Industries, the recently listed automotive components manufacturer, saw its share price surge by up to 4.64% on June 16, 2025, following the release of its March quarter earnings. The company reported a consolidated net profit of ₹110 crore for Q4FY25, a staggering 575% increase compared to ₹16 crore in the same period last year. Revenue for the quarter rose 49% year-on-year to ₹2,274 crore, up from ₹1,526 crore in Q4FY24. The stock is currently trading at ₹106.40.

Strong Operating Performance and Margin Expansion

Earnings before interest, taxes, depreciation, and amortisation (EBITDA) for the quarter stood at ₹276 crore, marking a 54.4% increase from ₹178.6 crore in the year-ago period. The company’s operating margin expanded to 12.13% from 11.7% a year earlier, reflecting improved operational efficiency and cost management. The robust earnings performance was driven by higher product sales and a growing international footprint, cementing Belrise Industries’ position among the top three players in India’s two-wheeler metal components segment.

IPO Success and Market Debut

Belrise Industries’ initial public offering (IPO), which closed in late May 2025, was subscribed 41.3 times, highlighting strong investor appetite for the stock. The ₹2,150-crore IPO had a price band of ₹85-90 per share. On its market debut on May 28, the stock listed at an 11% premium and closed with a gain of over 8% against the issue price. Since listing, the share price has remained buoyant, trading up to 19% above the IPO price as of June 16, 2025.

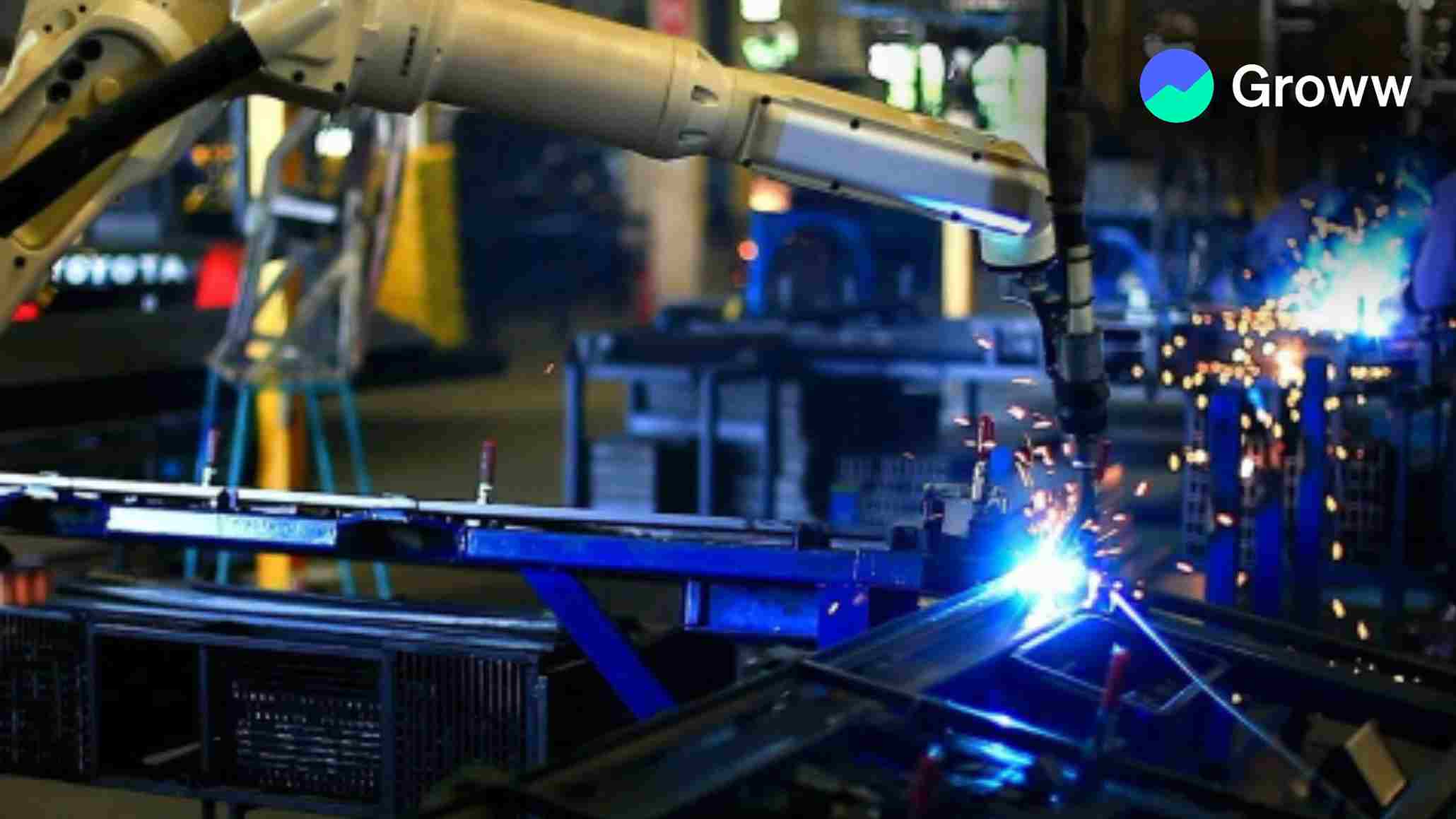

Diverse Client Base and Product Portfolio

Belrise Industries supplies safety-critical systems and engineering solutions for two-wheelers, three-wheelers, four-wheelers, commercial vehicles, and agricultural vehicles. The company maintains long-standing relationships with prominent multinational original equipment manufacturers (OEMs), including Bajaj Auto, Honda Motorcycle & Scooter India, Hero MotoCorp, Jaguar Land Rover, and Royal Enfield Motors. Its product range includes metal chassis systems, polymer components, suspension systems, body-in-white components, and exhaust systems.

Market Capitalisation and Investor Sentiment

As of June 16, 2025, Belrise Industries’ market capitalisation stands at approximately ₹9,100 crore. The stock’s price-to-book ratio is around 3.7, with a 52-week high of ₹108.25 and a low of ₹89.15. The company’s shares have shown notable resilience and momentum, outperforming broader indices since their market debut.

Financial Strength and Growth Outlook

Belrise Industries’ recent financials underscore its strong growth trajectory and operational resilience. The company has demonstrated consistent revenue growth over recent quarters, with Q4FY25 results marking a significant acceleration in profitability. The firm’s robust cash position and prudent financial management have also contributed to investor confidence. The company’s increased investment in capex-rising 86% year-on-year to ₹361.64 crore-reflects its commitment to expanding capacity and enhancing its product offerings.

Sectoral Context and Competitive Edge

The automotive components sector in India is witnessing robust demand, driven by rising vehicle production and increasing localisation efforts by OEMs. Belrise Industries’ diversified product portfolio and strong client relationships position it well to capitalise on these trends. The company’s focus on safety-critical systems and engineering solutions further differentiates it from peers, providing a competitive edge in both domestic and international markets.

Conclusion: A Standout Performer in the Auto Ancillary Space

Belrise Industries’ stellar Q4 results and strong market debut have firmly established it as a standout performer in India’s auto ancillary sector. The company’s ability to deliver robust revenue and profit growth, coupled with its diversified client base and expanding product portfolio, bodes well for its future prospects. Investors are likely to continue monitoring its execution on growth initiatives and its ability to maintain momentum in an evolving automotive landscape.

Disclaimer: This news is solely for educational purposes. The securities/investments quoted here are not recommendatory.

To read the RA disclaimer, please click here