New on Groww: Invest in Corporate Bond IPOs Seamlessly

Hello Investors,

Are you looking to diversify your portfolio with stable and predictable returns?

Then we have some good news for you.

We’re excited to introduce Bond IPOs on Groww —a seamless way for investors to explore and apply for corporate bonds directly through the app. With this new product, investing in corporate bonds is now as simple as investing in stocks or mutual funds.

So, are you ready to experience the thrill of placing your first bid before the crowd gets in?

This product gives you first-hand access to apply early, lock in attractive interest rates, and boost your chances of 100% allotment.

➡️What are Corporate Bonds?

Corporate Bonds are fixed-income debt instruments offered by organisations. When you invest in any corporate bond, you are essentially lending money to that organisation. In return, they agree to pay you interest at a fixed rate for a certain period and return the principal amount at maturity.

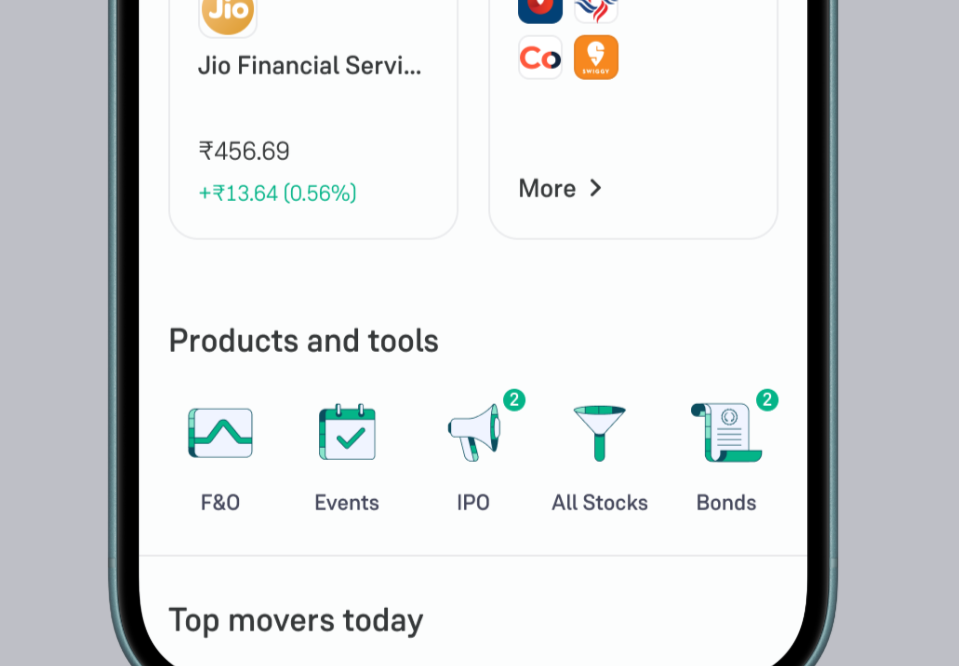

Groww users can now apply for the Bond IPOs directly from the app. From comparing bond series to previewing payout schedules and interest, it's all just a few taps away.

Let’s walk you through the key highlights and how to get started.

➡️Feature Highlights

✅ Discover Open Bond IPOs

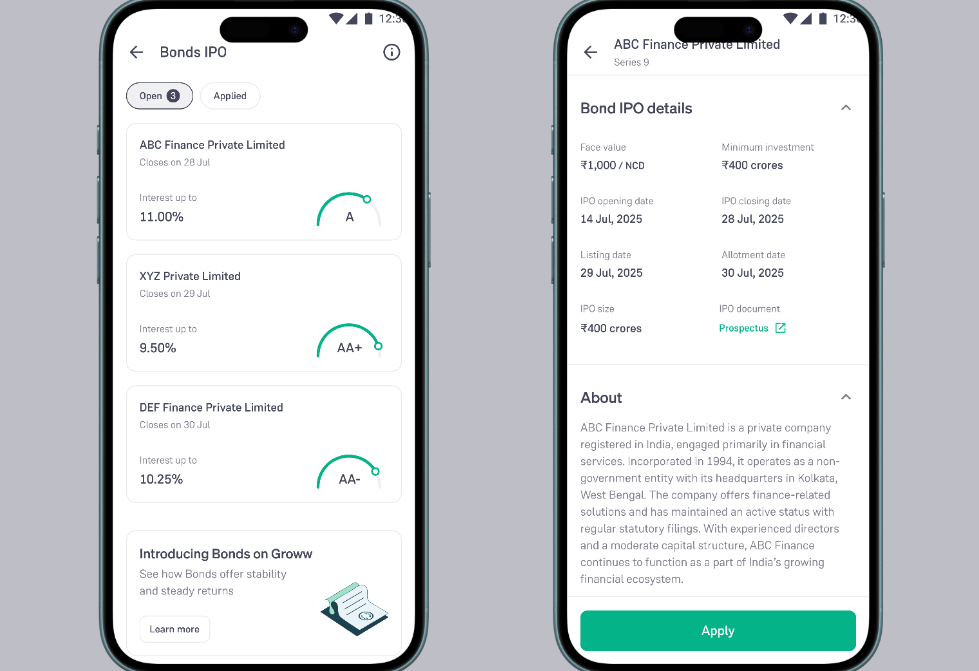

You can see all currently open Bond IPOs listed under the “Open” tab in the Bonds section.

✅ Check Key Details at a Glance

Each listing will show the following details:

- Interest rate and payout frequency.

- CRISIL rating and risk profile.

- Tenure and minimum investment amount.

- Opening and closing dates, allotment, and listing timelines.

✅ Compare Across Series

Every bond IPO comes with multiple series options : monthly payouts, annual payouts, cumulative returns, and more. Easily compare all series side-by-side and pick the one that suits your style.

✅ Apply Easily During Market Hours

You can apply with a minimum investment of ₹10,000 (₹1,000 per unit), and directly between 10:00 AM to 5:00 PM on market days. Allotments are made based on availability.

➡️How to Get Started with Bond IPOs?

- Head to the Bonds section on the Groww app.

- Explore available bond offerings through the “Open” tab.

- Review risk, interest rate, and tenure.

- Apply within market hours.

- Sit back, relax and wait for your returns.

➡️Why Consider Bond IPOs?

- Attractive Interest Rates.

- Predictable Returns.

- Lower Risk Than Equity.

- Regulated by SEBI.

- Fully digital process via the Groww app.

Still unsure or want to know more about the Bonds IPO? Scroll down to find a set of FAQs on Bonds in the app.

Explore Bonds on Groww today!

- Team Groww