Bonds

What is a Bond?

Bonds are fixed-income debt instruments issued by corporate and government entities to raise funds for various projects and activities.

How Do Bonds Work?

When you buy a bond, you're essentially lending money to the issuer (borrower).

In return, you (lender) will receive:

- Coupon Yield: Regular interest payments (coupon payments) at predetermined intervals may be monthly, semi-annual, annual, or yearly, depending on the bond’s terms.

- Yield to Maturity (YTM): Return of the bond’s face value or par value (the principal) at maturity.

In short, the bond is a form of loan wherein the lender (bondholder) lends funds to the issuer (borrower) in exchange for regular interest payments and return of the principal at maturity.

Characteristics of Bonds

Fixed Interest Payments

One of the bond's primary characteristics is that it pays the bondholder fixed interest, known as coupon payments. Depending on the specific bond's terms, these payments are made monthly, semiannually, quarterly, or annually.

Fixed interest payments provide investors with a predictable income stream. This makes bonds a popular investment choice for conservative investors seeking steady returns.

Maturity Date

The maturity date is the specific date on which the bond matures and the bond issuer repays the bond’s face value (principal) to the bondholder.

Bonds can have different maturities, ranging from

- Short-term (a few months to 5 years),

- Medium-term (5 to 10 years), or

- Long-term (10 years or more).

The maturity date determines the length of time the bondholder will receive interest payments and how long their investment will be locked in.

Credit Rating

Rating agencies (such as CRISIL, CARE, and ICRA) assign bonds credit ratings, which reflect the issuer’s creditworthiness and ability to pay the principal back.

Why Buy Bonds?

When most individuals think about investing, they either choose stocks or fixed deposits (FDs). While stock market investments have the potential for higher returns, they are more prone to market volatility. On the other hand, FD returns don’t even beat inflation post taxes.

That’s where bonds strike the perfect balance as they provide inflation-beating, predictable returns of around 8%-15% with less risk. Below are some reasons why bonds deserve to be a part of your portfolio.

-

Offers Predictable & Stable Income Stream

Debt instruments are generally considered safe-haven investments, especially when equity markets are volatile.

Though their returns are low compared to equity instruments, bonds are more predictable and stable. For example, before investing in a bond, investors know the monthly interest and YTM beforehand.

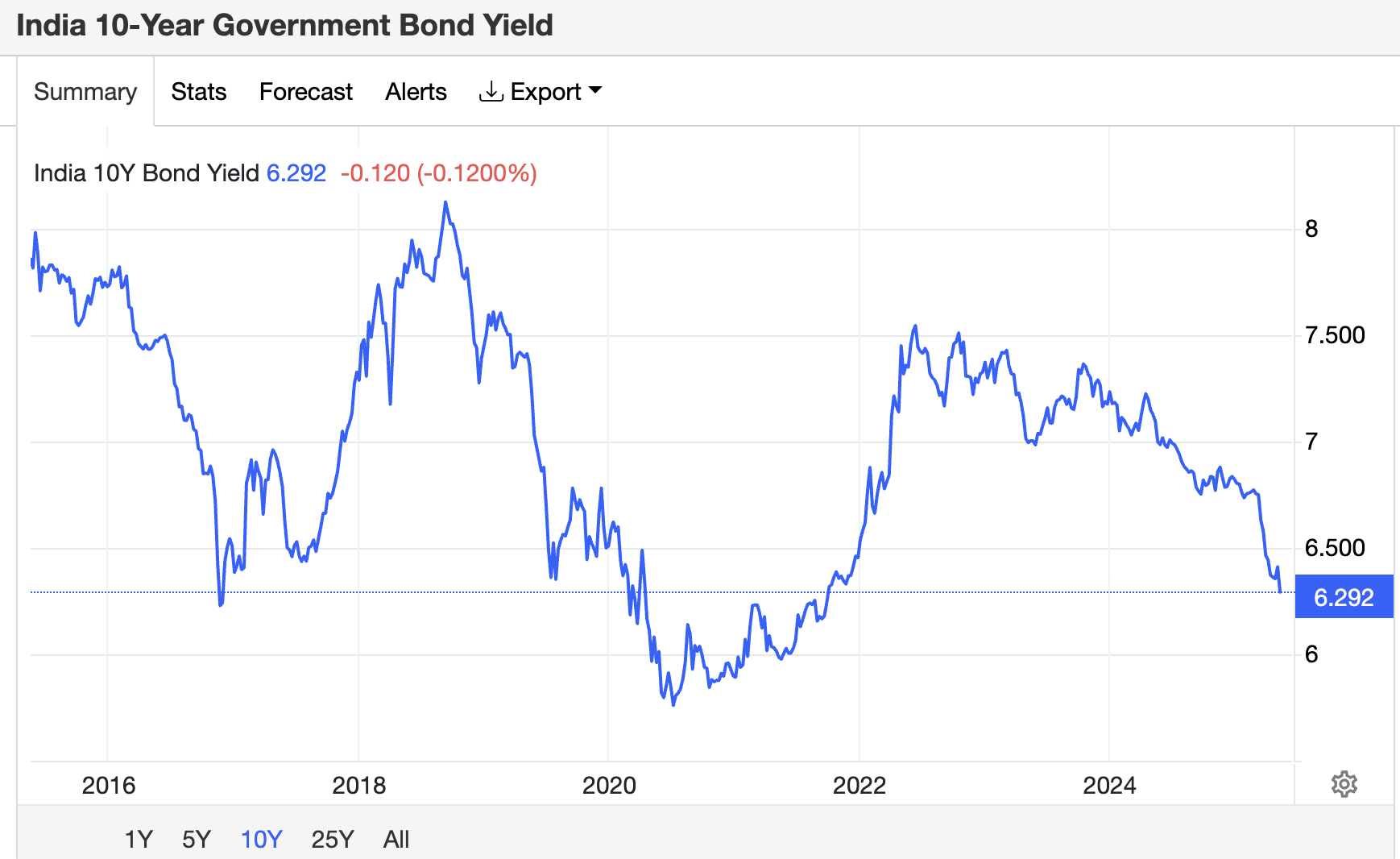

Also, Government bonds, which carry low default risk, have given consistent returns. A 10-year G-sec bond in India has yielded around 6.5%-8% over the past years.

-

Tax-Free Interest Returns

Government-backed entities such as NHAI, Rural Electrification Corporation, etc., issue Tax-free bonds. These bonds have a maturity period of 5-50 years, and the interest earned on them is tax-exempt under section 10(15) of the Income Tax Act.

Note: No tax-free bonds have been issued since 2016.

-

Diversification

Bonds tend to have a low correlation with equity markets. This means when stock markets drop, bonds perform better, or vice versa. So, it can be used for hedging.

List of Different Types of Bond Categories

As the name suggests, zero-coupon bonds do not pay coupon or interest payments to the bondholders. Instead, full face value is paid at maturity.

-

Fixed Rate Bonds

In fixed rate bonds, the coupon rate is fixed till the bond maturity.

-

Floating rate bonds

In floating rate bonds, interest rates are adjusted periodically based on a benchmark like the RBI repo rate.

-

Inflation-linked Bonds

Inflation-linked Bonds adjust interest payments and principal amounts against inflation.

-

Municipal Bonds

Issued by states, municipalities, cities, or local governments to fund public projects.

-

Callable Bonds

Callable bonds give the issuer the right to buy back the bonds before maturity.

-

Puttable Bonds

Puttable Bonds give investors the right to sell the bond back before maturity.

These bonds are issued by the central or state governments of India, such as Treasury Bills (T-bills), Cash Management Bills (CMBs), G-Secs, etc.

Corporate bonds are issued by private companies to raise capital and offer higher yields than government bonds.

Who Issues Bonds?

In India, bonds are issued by various entities, both public and private. Each type of issuer serves a different purpose and offers varying levels of risk and return.

-

Government of India

The Government of India (GoI) offers different types of bonds via the Reserve Bank of India (RBI), including -

-

- Treasury Bills (T-Bills): Short-term (91, 182, 364 days)

- Government Securities (G-Secs): Long-term (up to 40 years)

- Sovereign Gold Bonds (SGBs)

- Inflation-Indexed Bonds (IIBs)

- Floating Rate Bonds (FRBs)

-

Public Sector Undertakings (PSUs)

PSUs are government-owned companies with at least 51% of the GOI's stake. These include NTPC, NHAI, PFC, REC, IRFC, etc.

-

Municipal Corporations

These bonds are issued by Urban Local Bodies (ULBs) or Municipalities for water supply, sanitation, smart city projects, etc.

-

NBFCs (Non-Banking Financial Companies)/Banks

Private/public banks (HDFC Bank, SBI Bank) and NBFCs (Bajaj Housing Finance, Shree Ram Finance)

-

Corporations / Private Companies

Bonds issued by public and private companies are known as corporate bonds. These offer the highest returns of up to 13%. The best part is that if the bond is listed, you can even sell it before the maturity date.

-

State Governments

Individual State Governments in India issue State Development Loans (SDLs) to fund their fiscal deficit. These are similar to central government bonds and carry nearly the same risk profile.

What is Yield to Maturity (YTM)?

Yield to Maturity (YTM) is a metric used to evaluate the total return an investor can get if they hold the bond until it matures. This calculation uses a trial-and-error method since it involves solving a non-linear equation.

Advantages of Bonds

Investment in bonds is advantageous to investors in several ways. Due to the regular interest payments and principal returns, bonds have proved to be a stable investment option for investors averse to excessive risk in the market.

-

Stability

Bonds are long-term investment tools that accrue assured returns compared to other investment options. They provide a low-risk avenue to investors apprehensive of the volatility of equity returns.

-

Indentures

Bonds grant a legal guarantee that binds borrowers to return the principal amount to their creditors on time. They serve as financial contracts that contain details such as the par value, coupon rates, tenure, and credit ratings.

Companies that attract massive investments in their bonds are highly unlikely to default on interest payments due to their reputation in the securities market. Besides, bondholders precede shareholders in receiving debt repayment in the event of an entity’s bankruptcy.

-

Portfolio Diversification

Investors massively rely on investment in fixed-income debt instruments such as bonds to diversify their investment portfolio, as they offer superior risk-adjusted returns on investment. Consequently, portfolio diversification reduces the possibility of short-term losses due to increased allocation of investment funds to fixed-income resources instead of solely depending on equities.

Limitations of Bonds

Even though bonds are a low-risk investment option, they come with specific limitations that investors should be acquainted with. The disadvantages include -

-

Inflation’s Influence

Bonds are susceptible to inflation risks when the prevailing rate of inflation exceeds the coupon rate offered by issuers. Debt instruments that accrue fixed interest face risks of devaluation, too, due to the impact of inflation on the principal value invested.

-

Limited Liquidity

Bonds, although tradable, are mostly long-term investments with withdrawal restrictions on the investment amount. Shares precede bonds in terms of liquidity, as bonds are liable to several fees and penalties if creditors decide to withdraw their debt amount.

-

Lower Returns

Issuers offer coupon rates on bonds, which are usually lower than returns on stocks. Investors receive a consistent amount as interest over the tenure in a low-risk investment environment. However, returns are much lower than on other debt instruments.

Things to Consider Before Investing in Bonds

Investors have to consider the following factors before investing in secure and fixed-investment options such as bonds.

-

Investment Objectives

Investors have to take into account their return expectations on investment according to the nominal value, coupon rates and tenure of an entity’s bonds. They can further achieve stability of their investment portfolio by parking their funds in bonds.

-

Tenure of the Bond

Consideration of the tenure is essential when it comes to investment in these debt instruments. Bond interest rates are usually higher for the ones invested for a long term and can benefit investors with a steady interest income. Customers purchasing long-term bonds imply long term capital commitment through this debt instrument.

Contrarily, bonds of medium or short term offer better liquidity to investors and are thus suitable for meeting immediate as well as extended financial requirements.

-

Analyse Risk Factor

Investors should analyse a company's credit rating to find the best bonds in the market. High-yielding bonds are often offered by companies with high risk factors, as graded by credit rating agencies, and vice versa. Thus, the choice of a bond should also depend on an investor’s risk-taking capacity.

-

Be more careful with Callable Bonds

Callable Bonds give the issuer (borrower) the right to “call” or buy back the bonds before maturity. So, if you are investing in a callable bond, you must measure the possibility of companies retracting their bonds before the maturity period due to increasing market prices and falling interest rates.

Suitability of Investments in Bonds

Although there is no particular time to invest in bonds due to predominantly consistent interest cycles, investors who are risk-averse should consider bonds.

Individuals are met with several options while investing in bonds, as per their financial inclination. Investors inclined towards safe debt instruments should accumulate bonds from high-rated companies.

Additionally, investors who are willing to take market risks can find it financially beneficial to accumulate bonds from low-safety-rated companies for a higher rate of return on these fixed-income securities.

Features of a Bond in the Capital Market

It is the “nominal value of the bond” that the bondholder will receive at maturity. For instance, if a bond’s face value is ₹1,00,000, the maturity amount payable to the bondholder will be ₹1,00,000.

-

Issue Date

The day on which the bond issue is known as the issue date.

-

Coupon Rate

Coupon rate is the interest rate paid by the issuer as a percentage of the bond’s face value.

-

Maturity Date

The date on which the bond matures is known as the maturity date.

How Are Bond's Rated?

In India, bonds are rated by credit rating agencies (CRAs) to assess the issuer's creditworthiness and the likelihood of timely repayment of principal and interest.

|

Rating |

Degree of safety |

Credit Risk Description |

|

AAA |

Highest |

Highest credit quality, very low credit risk |

|

AA |

High |

High credit quality, low credit risk |

|

A |

Adequate |

Adequate credit quality, low credit risk |

|

BBB |

Moderate |

Moderate credit quality, moderate credit risk |

|

Risk of default |

||

|

BB |

Moderate |

Speculative grade, higher credit risk |

|

B |

High |

High default risk |

|

C |

Very High |

Very high default risk |

|

D |

In default |

In default or are expected to be in default soon |