Disclaimer: This news is solely for educational purposes.

Stocks

Invest in Stocks

Invest in stocks, ETFs, IPOs with fast orders. Track returns on your stock holdings and view real-time P&L on your positions.

F&O

Mutual Funds

Invest in Mutual Funds

Invest in direct mutual funds at zero charges via lump sump investments or SIPs

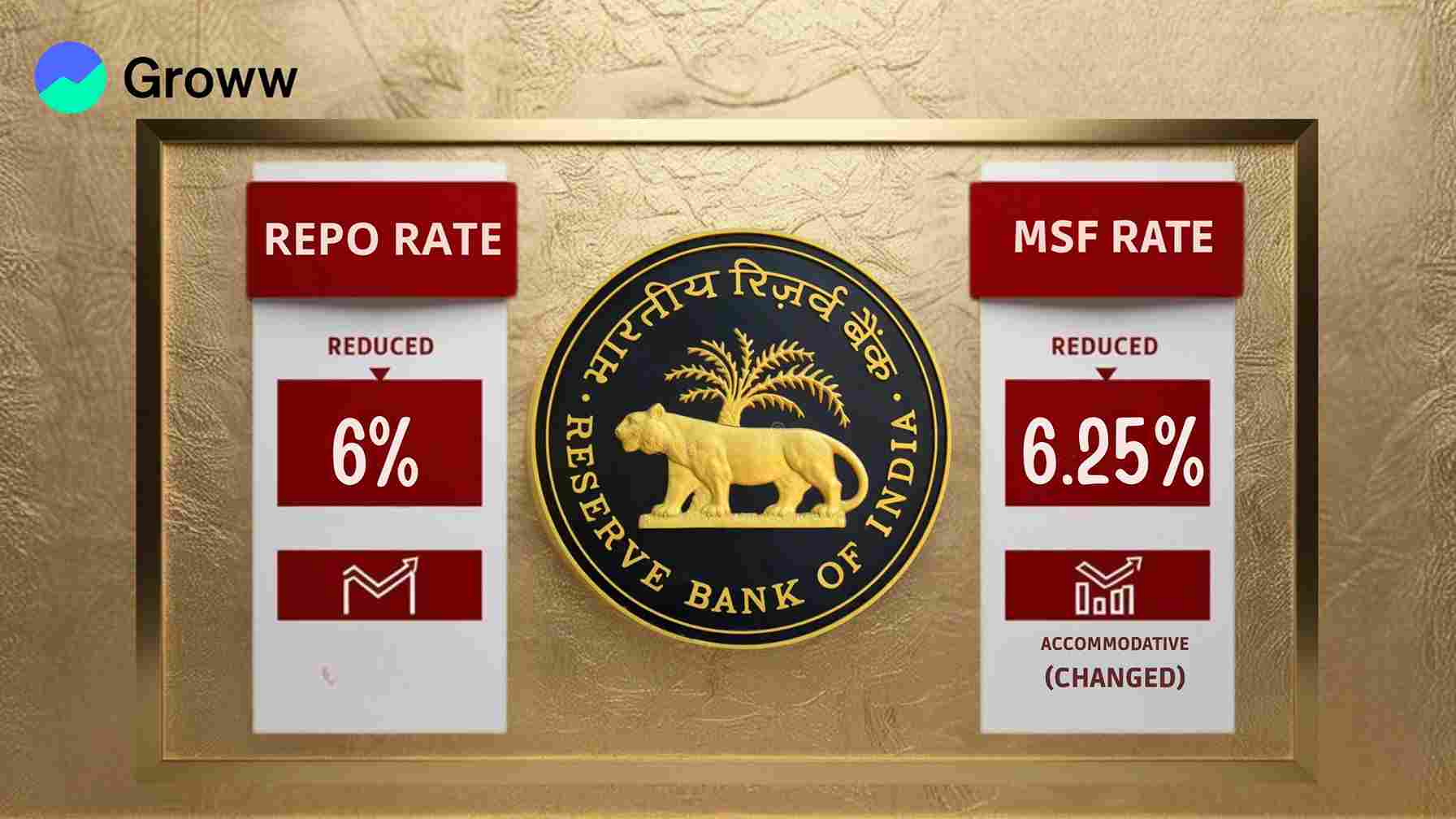

RBI Cuts Repo Rate to 6%, Shifts Stance to ‘Accommodative’ Amid Global Uncertainty

09 April 2025

3 min read

The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC), headed by Governor Sanjay Malhotra, has made its first bi-monthly monetary policy of the fiscal year 2025-26 by lowering the benchmark repo rate by 25 basis points to 6%. This was done by the rate-setting panel unanimously, which is in line with most economists and market participants' expectations. The MPC had started its three-day meetings on Monday and made the announcement today.

Along with the cut in the rate, the RBI has also reset the standing deposit facility (SDF) rate at 5.75%, while the marginal standing facility (MSF) rate and the bank rate will be 6.25%. This reset of rates in the liquidity adjustment facility (LAF) structure indicates the central bank's direction to regulate liquidity conditions in consonance with the new policy stance.

More importantly, Governor Malhotra declared a shift in the policy orientation from 'neutral' to 'accommodative'. This change suggests that, except for unexpected shocks, the MPC will mainly think about either continuing with the status quo or further rate reductions in its subsequent policy actions. This new stance marks the policymakers' increasing ease with the changing inflation path and allows room to support economic growth.

Macroeconomically, the RBI has reduced its FY26 inflation forecast to 4%, from its previous estimate of 4.2%. The revision is based on the slowdown in headline inflation during January and February 2025, and specifically the improvement in food inflation, along with the expectation of a normal monsoon. But the central bank is cautious of possible upside risks due to uncertainty in global markets and negative weather-related supply shocks.

At the same time, the RBI has lowered its real GDP growth forecast for FY26 to 6.5%, from its earlier estimate of 6.7%. The quarterly GDP growth forecasts in FY26 are: Q1: 6.5%, Q2: 6.7%, Q3: 6.6%, and Q4: 6.3%. Governor Malhotra pointed out that although investment activity has picked up and is likely to strengthen further, merchandise exports may run into headwinds because of global uncertainties.

The reduction in the repo rate comes amidst nervous global economic conditions. Governor Malhotra recognized the unusual uncertainties haunting the global economy, such as the effect of US President Donald Trump's retaliatory tariffs on the large economies. In spite of these external constraints, India's foreign exchange reserves are still strong at USD 676 billion as of April 4, giving import cover of 11 months.

Market response to the policy announcement was one of early falls, with the NIFTY and SENSEX opening down. The Indian rupee has also fallen against the US dollar. Yet the expected cut in the repo rate has been largely priced into market expectations.

Analysts expect this rate cut to translate into a cut in Equated Monthly Instalments (EMIs) for borrowers of loans, especially housing, which can spur housing demand and consumer confidence. But actually transmitting these rate cuts by banks into lending rates is still a main factor to watch out for.

In addition, Governor Malhotra signalled the central bank's plan to release detailed guidelines on gold loans to bring guidelines in line across different regulated institutions.

In the future, the RBI has hinted at the potential for additional policy rate reductions this year, subject to the changing macroeconomic environment and the lack of major shocks. The central bank will continue to monitor global developments and their potential impact on the Indian economy, maintaining an agile and decisive approach to policy formulation. This move towards a more accommodative stance underscores the RBI’s commitment to supporting growth while remaining vigilant on the inflation front in an increasingly uncertain global landscape.

All Topics