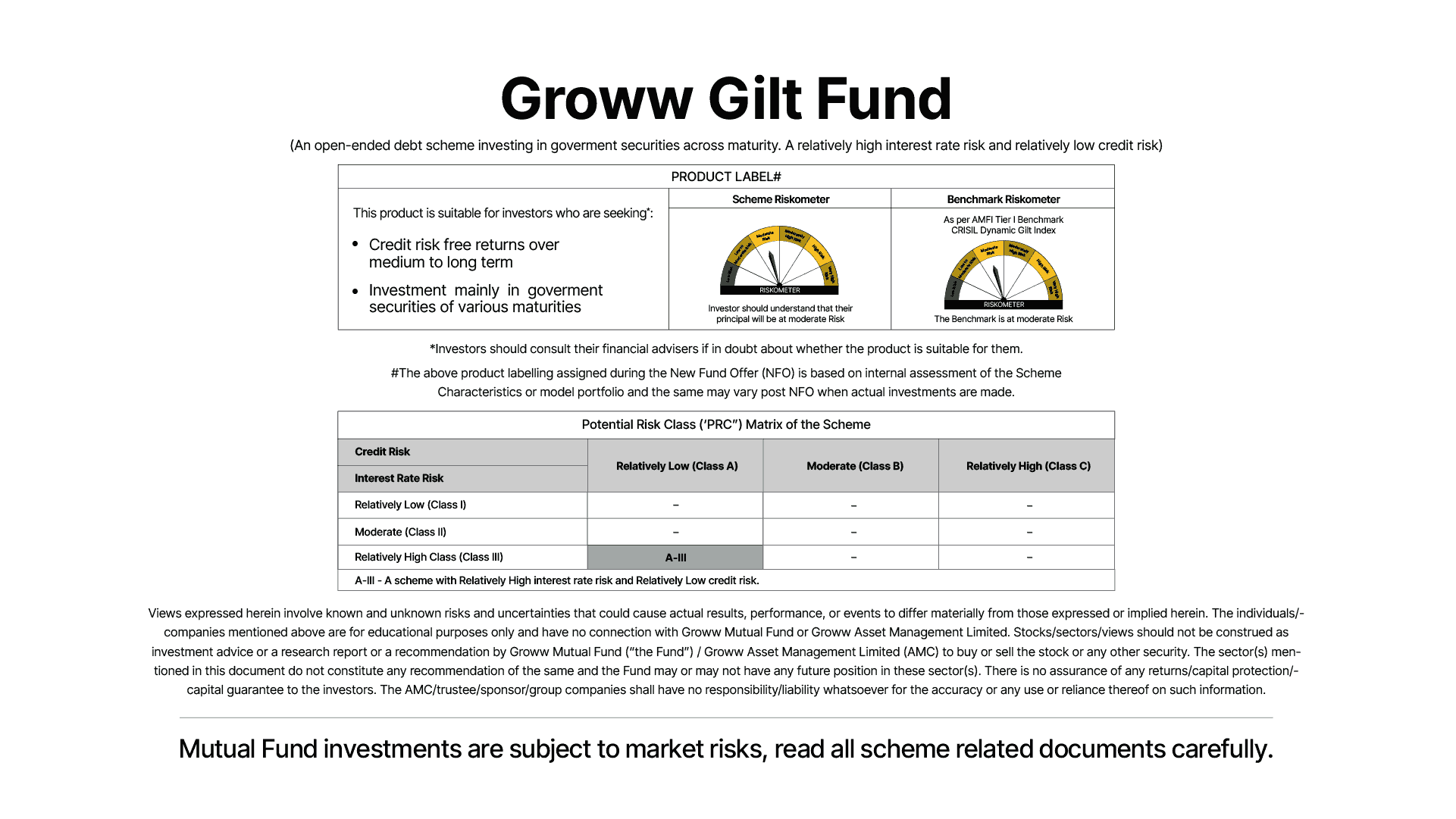

Invest in government securities with Groww Mutual Fund's latest offering: Groww Gilt Fund

Groww Mutual Fund has introduced the Groww Gilt Fund, which invests at least 80% of its total assets in government securities across maturities, to offer investors a way to potentially diversify their portfolios.

The NFO period for this scheme is from April 23 to May 7, 2025.

About Groww Gilt Fund

The Groww Gilt Fund is an open-ended debt scheme that seeks to limit credit risk exposure for investors while offering relatively low-risk returns through government-backed instruments.

Why consider the Groww Gilt Fund now?

Given the rapidly evolving macroeconomic environment, several factors may be influencing the appeal of government-backed securities for investors.

- Interest rates and economic adjustments: With potential economic slowdowns and shifting central bank policies, interest rates may continue to adjust—making government-backed securities a potentially more attractive fixed-income option. This environment could support growing interest in government debt instruments like those in the Groww Gilt Fund.1

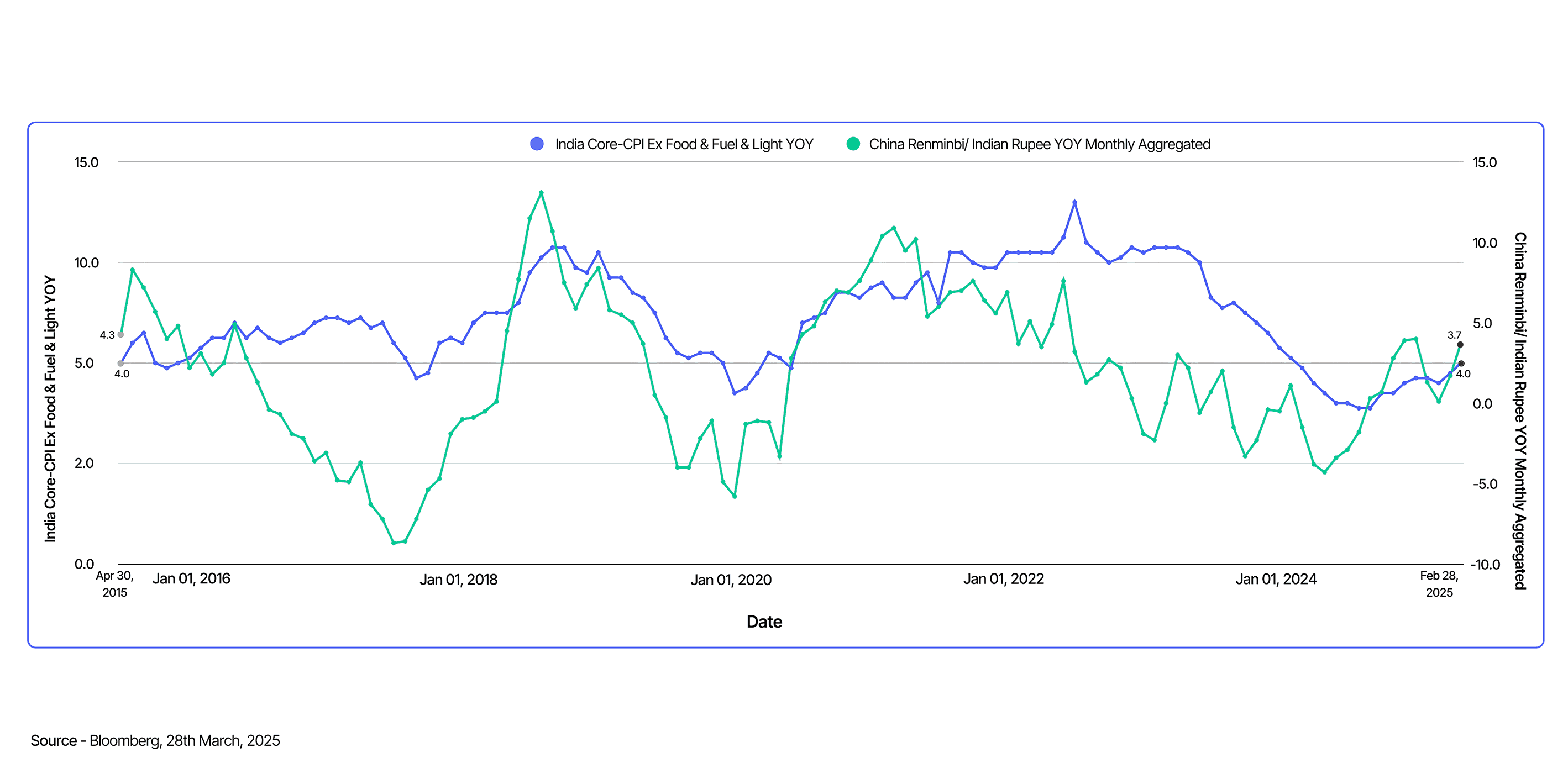

- A weakening Yuan and its impact on inflation: The weakening Chinese Yuan may ease import-driven inflation in India, creating a potentially favorable environment for government-backed debt, as lower inflation can make fixed-income investments more appealing.2

3. Improving Current Account Deficit (CAD): India's improving Current Account Deficit (CAD) indicates a relatively positive economic outlook, which may help lower risk premiums on government-backed debt. As fundamentals improve, government securities could offer potentially better returns with comparatively lower risk.2

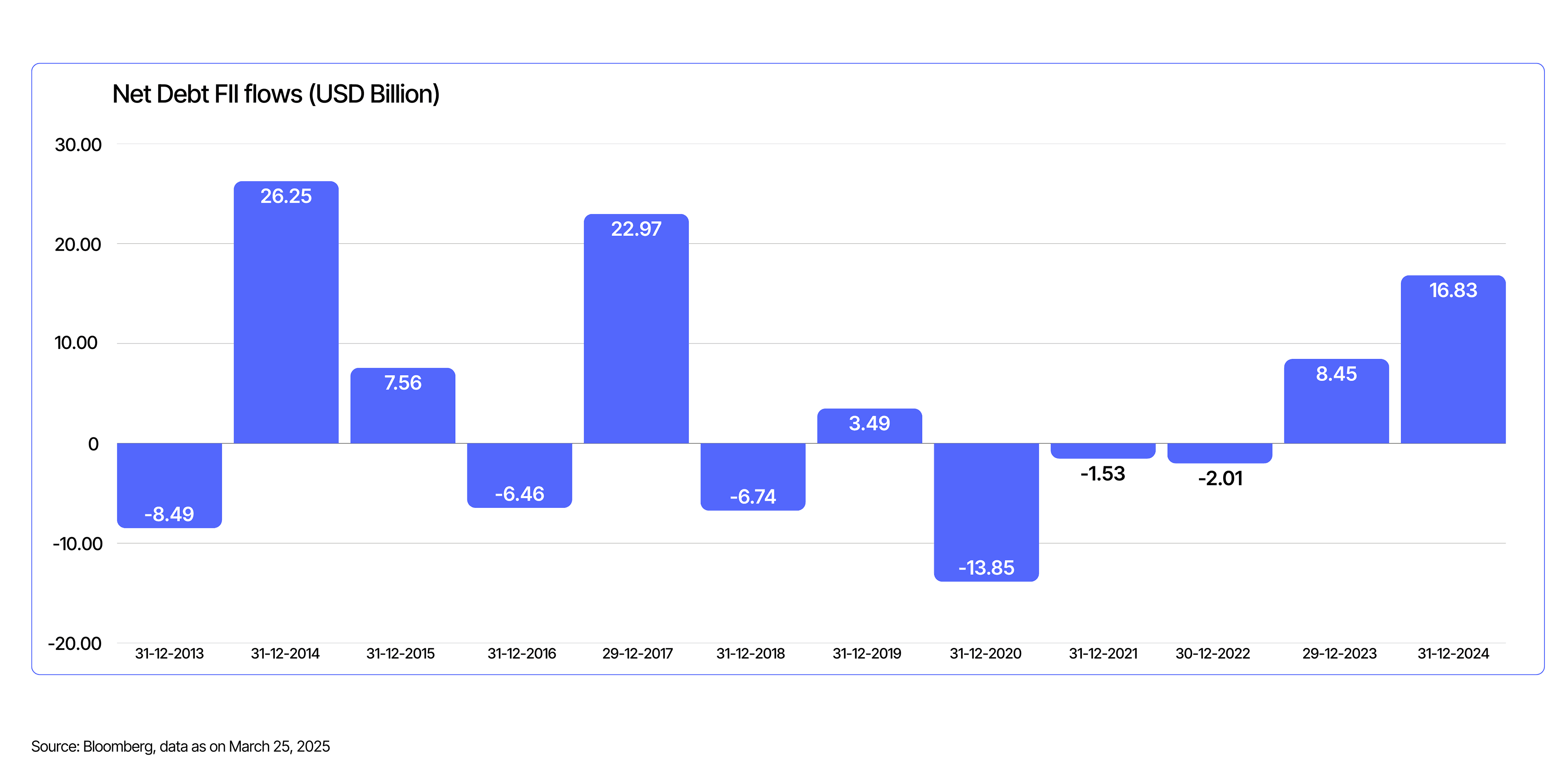

4. Foreign Institutional Investor (FII) debt flows: A potential increase in FII debt flows may boost demand for government-backed securities, which could lead to lower yields and potentially benefit investments in schemes like the Groww Gilt Fund.3

5. Inflation trends and economic conditions: Moderating inflation and lower energy prices could make government-backed debt more attractive, as lower inflation often increases the appeal of fixed-income investments.

Features of Groww Gilt Fund

- Government-backed investmentThe Groww Gilt Fund predominantly invests in government securities, which are considered low-risk. This offers investors exposure to relatively lower risk debt instruments available in the market.

- Diversification of portfolio The Groww Gilt Fund provides an opportunity to potentially diversify a portfolio with government-backed debt. This can help reduce overall portfolio risk, especially during periods of market uncertainty or economic shifts.

- Liquidity and growth potential Government securities are generally liquid, providing flexibility for investors to move in and out of positions as needed. The Groww Gilt Fund offers this flexibility, while also positioning investors for potential growth in a low interest rate environment.

The Groww Gilt Fund may be considered by investors seeking credit risk-free returns, opportunities for diversification through government-backed securities, and the potential to benefit from favorable macroeconomic trends.

The minimum investment amount for the scheme is ₹100 for SIP and ₹500 for lump sum, with no exit load, and it is managed by Mr. Kaustubh Sule.

Sources:

Source 1 - Bloomberg, data as on March 24, 2025

Source 2 - Bloomberg, March 28, 2025

Source 3 - Bloomberg, March 25, 2025

Source 4 - Capital Minds Flipbook March 2025, Bloomberg, March 28, 2025