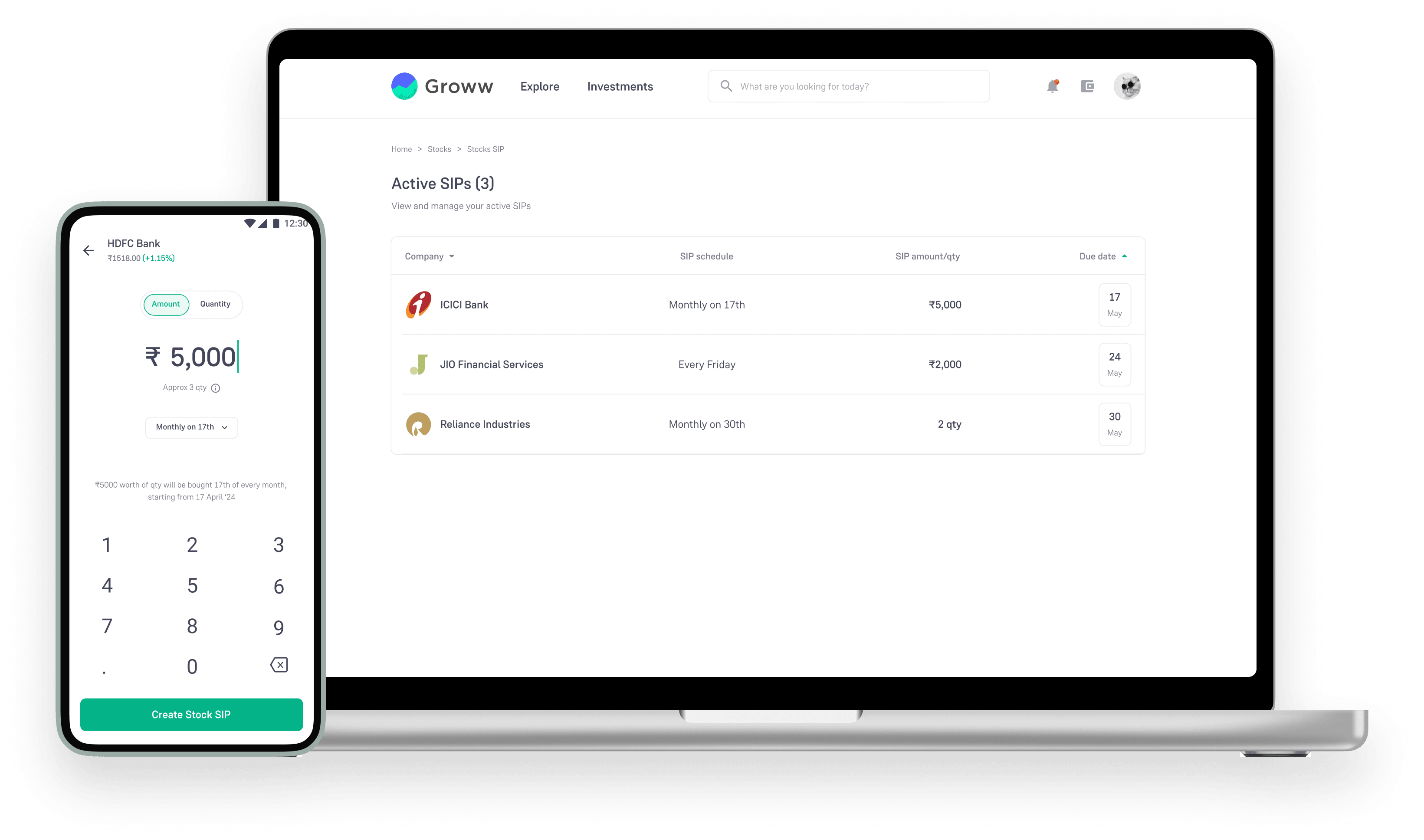

Automatically invest in

stocks and ETFs

Stock SIP helps investing in stocks and ETFs regularly—weekly or monthly. Beat market fluctuations and build wealth steadily.

Why Stock SIP?

about Groww

“If you are one of those who would like to take control of how you save, use Groww. It’s ridiculously easy portal. It took me 5 mins to set up and 10 mins to find the funds that suited my need and invest.”

“Groww.in was the platform where I first got onboard to MF and I would have to say, even for a beginner like me it made things quite easier to explore and invest. Groww actually helped me make better-informed decisions.”

“The experience with Groww has been lovely. Investing sounds extremely simple and non-scary to me now. Really smooth.”

in a minute

How is Stocks SIP Different from Mutual Funds SIP?

In a mutual fund SIP, the investment amount goes into a diversified portfolio of securities managed by the fund manager. Whereas, in case of Stocks SIP, investors can directly invest a fixed amount in a particular stock or few selected stocks.

Who is eligible to use Stock SIP?

Anyone with a trading and demat account with a registered stockbroker are eligible to invest in Stock SIP.

Which stocks are eligible for Stock SIP?

Stock SIP is available only in certain stocks approved by brokers, generally large-cap or liquid stocks, actively traded companies. Many brokers also extend SIP options to ETFs, so you can invest in them at regular intervals just like in stocks. You can see the list of eligible stocks directly on the Groww app once you set up your Stock SIP.

What is the minimum investment / minimum quantity for a Stock SIP?

The minimum investment in a Stock SIP will depend on the type of SIP you choose. For example, in an account based SIP you can start with as little as ₹500 per interval (cycle), where the shares allotted will depend on the stock price. However, for a quantity-based SIP you would need to buy a minimum of at least 1 share per interval wherein the actual investment amount will depend on the market price of that share. Here, a cycle refers to the frequency you select for your SIP such as weekly, monthly, or quarterly.

What is an Amount Based SIP?

An Amount-based SIP is a type of SIP where you decide a fixed amount (say ₹500 or ₹1,000) to invest in a stock at regular intervals (weekly, monthly, etc.). The number of shares you get will depend on the stock’s price at the time of investment. For example, if you invest ₹1,000 and the stock price is ₹500, you will get 2 shares. If the stock price rises to ₹1,000, you will get 1 share.

What is Quantity Based SIP?

A Quantity-based SIP is a type of SIP which allows you to buy a fixed number of shares of a stock at specific intervals of time (weekly, monthly, etc). If you set a SIP for 2 shares of a stock every month, the amount you invest will vary based on the market price of the stock. This means if the share price is ₹500, you will be investing ₹1,000 that month or if the share price increases to ₹600 you will be investing ₹1,200.

What is the e-mandate amount required for the stock SIP?

The e-mandate amount for a stock SIP is the maximum amount you set for deductions from your account for your SIP. It is not a fixed amount and can be based on your financial preferences. However, it should be higher than your desired SIP amount (e.g., a ₹1,000 SIP might require a ₹1,500 or ₹2,000 mandate limit).

What happens when my SIP amount exceeds the mandate amount?

If your Stock SIP amount is greater than the mandate amount, your bank will likely reject the transaction. Alternatively, they will send you an OTP and require additional authentication, which will result in missing out on the investment for this cycle. To avoid this either set a higher mandate amount or ensure sufficient funds are available in your bank account.

Is there a lock-in period for stock SIPs?

No, there is no lock-in period for stock SIPs. You can start, pause, or stop your Stock SIPs at any time.