Bull Call Spread - Strategies, Example, Advantages & Risks

A bull call spread is an options trading strategy that you can use when you anticipate a moderate rise in any asset price. Here is a detailed guide for your review.

What is a Bull Call Spread?

A bull call spread is a strategy for options trading that is used when you expect a moderate increase in the price of an asset. It works for moderately bullish markets, involving buying a call option with a lower strike price and then selling another call option with a higher strike price. They are both based on the same underlying asset and have the same expiry date. While this blueprint restricts the potential profit, it also limits potential losses. The maximum loss is thus capped at the net premium paid for the position.

So, you essentially buy a call option at a lower strike price (costing you a premium) and sell a call option at a higher strike price (earning you a premium). The premium you get from selling the higher strike call will lower the overall buying cost of the lower strike call. This results in a net debit paid to the trader.

Key Attributes of a Bull Call Spread

- Cost

The net premium paid will be lower than buying the call outright. This is because the premium from the sold call will offset a part of the cost. - Profit Potential

It is restricted to the difference between the two strike prices, subtracted from the net premiums paid. - Loss Potential

This is limited to the net premium paid. - Ideal For

Those investors who have a moderately bullish view, i.e. they anticipate an upside, but not dramatically (like a big rally).

Example:

- Buy a call at ₹100 strike (premium = ₹10)

- Sell a call at ₹120 strike (premium = ₹4)

- Net cost = ₹6

- Max profit: ₹14 (difference in strikes ₹20 – cost ₹6)

- Max loss: ₹6 (net premium paid)

Why Do Traders Use Bull Call Spread?

A bull call spread is used for the following reasons:

- Lower Costs

Buying a call option outright can be costly; by selling a higher strike call, the net premium paid can be reduced. - Risk Clarity

The maximum loss will be restricted to the net premium paid. Hence, it is safer in comparison to holding a stock or a naked call. - Defined Profits

While profits are capped, traders are more amenable to this approach, as they do not anticipate unlimited upside. What they expect is a moderate increase. - Moderately Bullish Scenarios

Bull call spreads are ideal when traders anticipate a rise in the index or stock (but not dramatically). If the rise falls within the strike range, then the bull call spread offers a decent risk-reward setup. - Improved Capital Usage

Limited risks and lower costs help traders manage capital more effectively compared to a single call or an outright asset purchase.

Structure of a Bull Call Spread

A bull call spread comprises two call options on the same underlying asset and with the same expiry date. However, the strike prices are different in this case, creating the following structure:

- Long Call (Lower Strike Price)

This involves buying a call option with a lower strike price, which gives you the right to purchase the asset at that price. It costs a premium. - Short Call (Higher Strike Price)

You will choose a call option with a higher price, obligating you to sell the asset at the strike price (in case the option is exercised). This earns you a premium.

Here are some other key aspects worth noting:

- Net Debit (Cost)

The premium you pay for a long call is partially offset by the premium you receive from the short call. - Risk/Reward Ratio

The maximum loss is the net premium paid, while the difference between the strike prices and the net premium paid is the maximum profit. The breakeven point is the sum of the lower strike price and net premium paid.

The bull call spread formula can be expressed as follows:

Buy 1 Call (lower strike) + Sell 1 Call (higher strike)

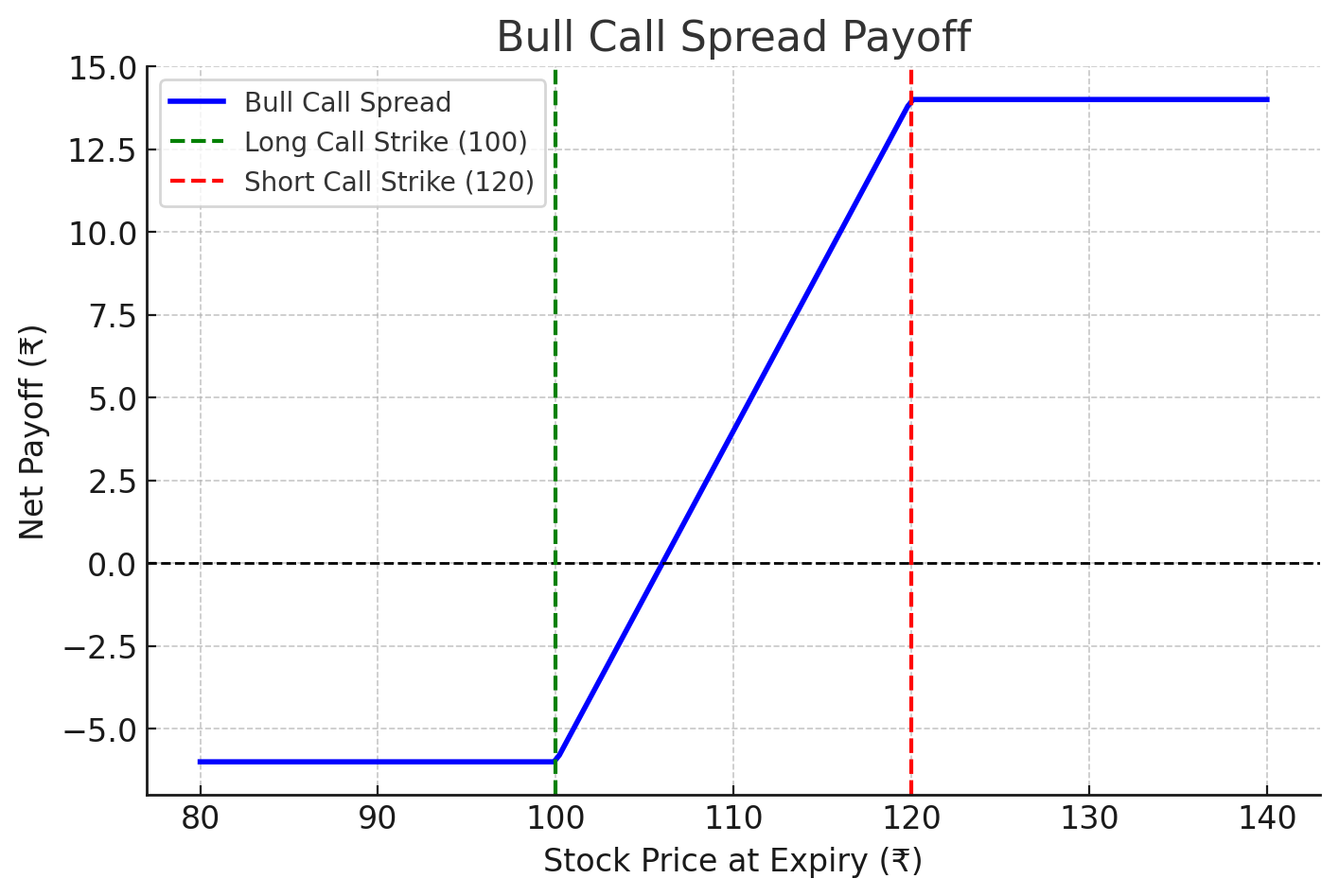

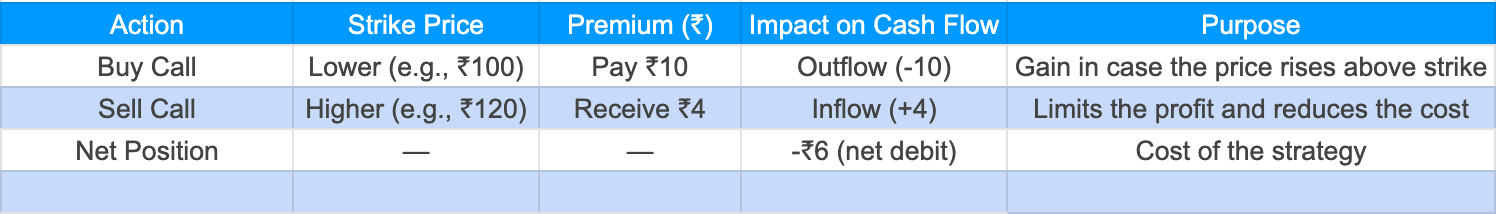

Here is an example of the structure in a table for your perusal -

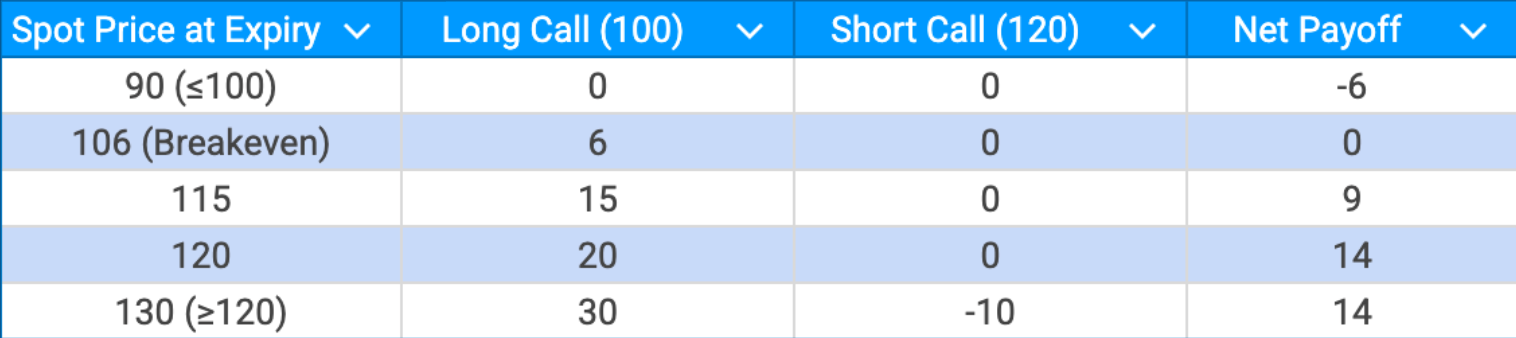

Payoff Possibilities:

- Maximum Profit = Difference in strikes – Net premium paid = (₹120 – ₹100) – ₹6 = ₹14

- Maximum Loss = Net premium paid = ₹6

- Breakeven Point = Lower strike + Net premium = ₹100 + ₹6 = ₹106

Main Payoff Attributes:

- Maximum Profit - When the underlying price at expiry is above/at the higher strike.

- Maximum Loss - When the underlying price is below/at the lower strike.

- Breakeven - The price at which the total loss or profit equates to zero.

- Payoff Shape - Limited upside (gains capped once the stock crosses a higher strike) or limited downside (maximum loss limited to the net premium paid).

- Best Scenario - Moderate stock rise (finishing above/at the higher strike).

Here is a simple example:

- Buy Call @ 100 (Premium = 10)

- Sell Call @ 120 (Premium = 4)

- Net Premium Paid = 6

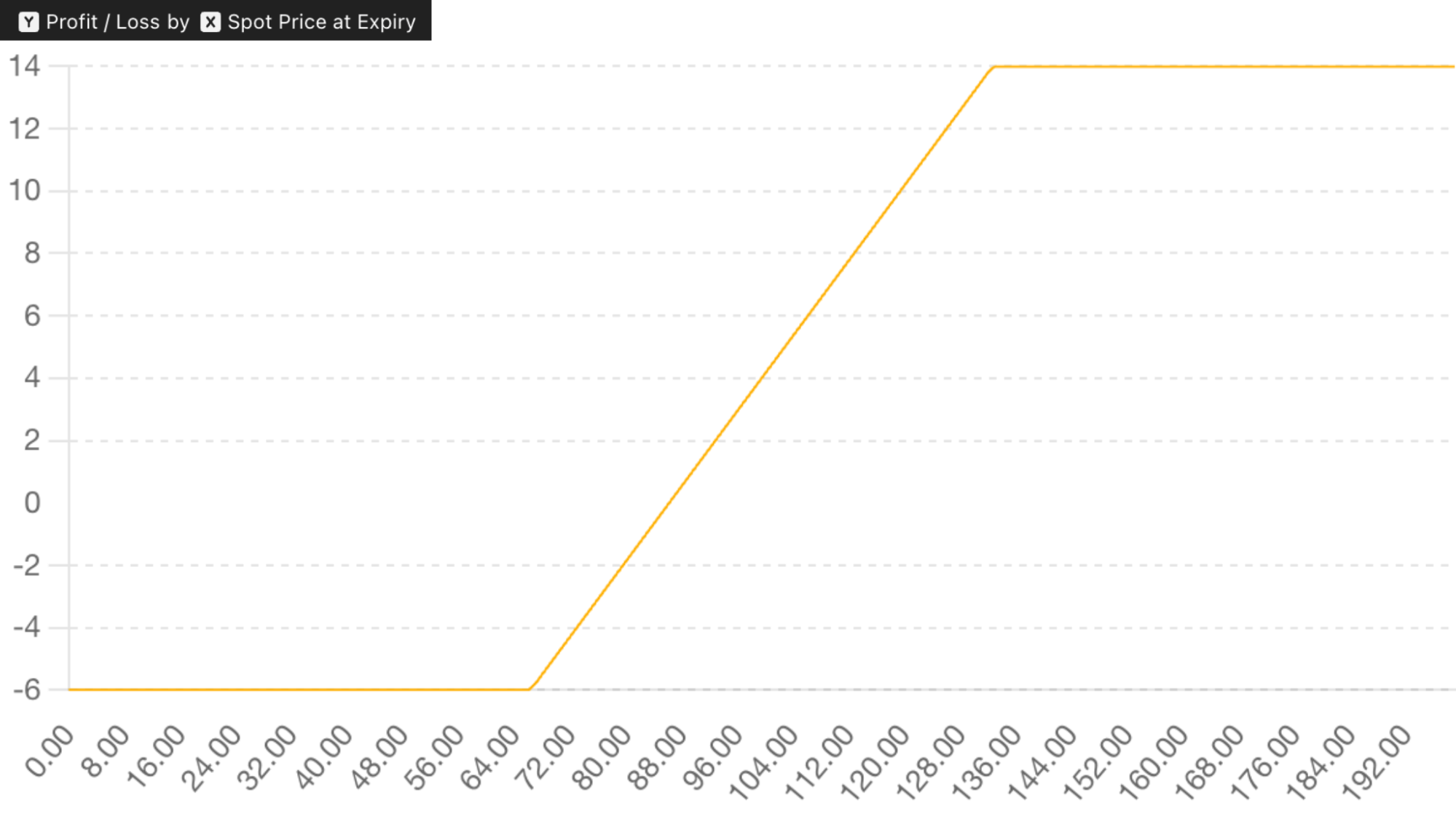

Summary:

- The loss is limited to the net premium paid (₹6 in our example).

- Profit rises as the spot price increases, but gets capped once it crosses the higher strike (₹120).

- The curve shows the breakeven point at ₹106, the maximum profit at ₹14, and the maximum loss at ₹6.

When NOT to Use a Bull Call Spread

Here’s when a bull call spread is not recommended:

- When you are uncertain or have bearish sentiments.

- When the short call caps profits in case you anticipate a large rally.

- If you want unlimited profit potential and higher liquidity.

Real-Life Scenarios Where Traders Often Use a Bull Call Spread

Here are some real-life situations where traders use bull call spreads:

- Earnings Announcements

Release of quarterly results by companies, where you anticipate a moderate increase in the stock without a massive rally. - Policy Announcements or Budget

You expect certain sectors, such as infrastructure and banking, to witness a moderate rise. - Commodity Price Movements

You expect demand for commodities like gold and crude oil to increase steadily without a significant spike. - Uptrends in Sectors Without Large Breakouts

When there’s an uptrend in any particular sector, with resistance at higher levels, a moderate uptrend can be achieved without incurring additional costs for a naked call in this scenario.

Comparison with Other Strategies

Here is a quick comparison of the bull call spread with some other common strategies.

|

Strategy |

Cost |

Risk |

Reward |

Best Use Case |

|

Long Call |

High (premium paid) |

Limited to premium |

Unlimited |

Very bullish, expect sharp upside |

|

Bull Call Spread |

Moderate (net premium paid, reduced by short call) |

Limited to net premium |

Limited (capped at strike difference – net cost) |

Moderately bullish, expect controlled upside |

|

Covered Call |

High (buy stock + sell call) |

Downside risk of stock (large) |

Limited (premium + capped upside) |

Slightly bullish/neutral, want income |

|

Bull Put Spread |

Moderate (net credit received) |

Limited (strike difference – net credit) |

Limited (net credit) |

Moderately bullish, benefit from time decay |

|

Stock Purchase |

Very high (buying full stock) |

Full downside risk |

Unlimited |

Strongly bullish, long-term holding |

Advanced Variations of Bull Call Spread

Some advanced variations of the bull call spread include:

-

Basic

You buy one call option and sell another of the same asset with a lower strike price for the sold call.

Example: Reliance Industries, before quarterly earnings.

- Stock @ ₹100.

- Analysts expect substantial numbers, leading to a moderate rally to ₹115-₹118.

Your Strategy:

- Buy 100 Call (₹10), Sell 120 Call (₹4).

- Net cost = ₹6.

Result:

- If the stock ends at ₹118, then the profit would be approximately ₹12 - ₹6 = ₹6.

- If it exceeds ₹120, it is capped at a maximum of ₹14.

- If earnings disappoint, then the maximum loss would be ₹6.

Why It is Used: It’s cost-effective and safe if you want to play earnings when the expectations are strong but not massive.

-

Ratio Call Spread (1:2)

You buy one call and sell multiple calls at a higher strike price. Alternatively, you buy two calls and sell one call at a higher strike.

Example: Infosys during the IT sector uncertainty.

- Stock @ ₹100.

- Traders think the stock may rise to ₹110–115, but it is unlikely to cross ₹120 (strong resistance).

Your Strategy:

- Buy 1 Call @100 (₹10).

- Sell 2 Calls @120 (₹4 each = ₹8).

- Net cost = ₹2.

Results:

- If the stock ends at ₹115, then the profit would be ~₹13.

- If the stock shoots to ₹130, losses begin (due to the extra short call).

Why It’s Used: You can bet affordably on a small rally.

Risk: Can be dangerous in case Infosys surprises the market with a big earnings beat.

-

Laddered Bull Call Spread

Extends the concept, involving buying calls at progressively higher strike prices. This creates multiple short calls at higher strikes.

Example: HDFC Bank before the RBI policy.

- Stock @ ₹100.

- Traders expect a slow rise, capped at ₹125.

Your Strategy:

- Buy 100 Call (₹10).

- Sell 115 Call (₹6).

- Sell 125 Call (₹3).

- Net cost = ₹1.

Results:

- If the stock ends between ₹115 and ₹125, it yields the best profits.

- If it rallies above 125, profits are capped, and then it may decline.

Why It’s Used: Ultra-affordable trades and ideal for range-bound rallies after major policy events.

-

Diagonal Bull Call Spread

You purchase a call option with one expiration date and then sell a call option with a different expiration date and/or a different strike price. This leads to the creation of a staggered position.

Example: Nifty 50 during the festive season.

- Nifty @ 20,000.

- Trader bullish for 2–3 months but sells short-dated calls to benefit from time decay.

Your Strategy:

- Buy long-dated 20,000 Call (exp: 3 months).

- Sell near-term 21,000 Call (exp: 1 month).

Results:

- Collects premium from short call repeatedly (if rolled).

- A long call ensures participation if the Nifty trends higher.

Why It’s Used: When you have a medium-term bullish view while earning income from short-dated calls.

-

Bull Call Spread + Protective Put (Synthetic Collar)

It’s a separate strategy for hedging that combines a protective put with a long stock position. This is meant to safeguard you from downside risks.

Example: Tata Motors ahead of EV policy announcement.

- Stock @ ₹100.

- Expect a positive outcome, but want protection if the policy disappoints.

Your Strategy:

- Bull Call Spread (Buy 100 Call @10, Sell 120 Call @4).

- Buy Protective Put @95 (₹5).

- Net cost = ₹11.

Results:

- If the stock rises above 120, the maximum profit is approximately ₹9 (capped).

- If the stock falls, the maximum loss is capped at ₹11 - (floor from the put).

Why It’s Used: To play the upside with some insurance against any sharp drop.

Impact of Time and Volatility

Time Decay and Volatility are two key aspects that traders should note while dealing with bull call spreads.

Time Decay Impact (Theta)

- Time value decay leads to options losing value as the expiration date approaches.

- So, the long call (lower strike) loses its value with time, and the short call (higher strike) also loses value, partly offsetting your loss.

- Time decay impacts the spread, although it is less than that of a naked long call.

- If the stock does not rise swiftly, the payoff decreases closer to the expiry date.

Key takeaway: Use a Bull Call Spread only when you anticipate a moderate rise, but not a slow move.

Volatility Impact (Vega)

- IV (implied volatility) enhances option premiums. This is because a higher IV equates to more uncertainty.

- Hence, the long call value increases when the IV rises, and the same is true for the short call, which reduces the benefit.

- The spread is less sensitive to volatility than a single long call. The breakeven is higher when there’s a higher IV before entry, although it costs more. Yet, a lower IV before entry means the strategy is cheaper and future drops in the IV will not pinch as much.

Key takeaway: Bull call spreads are not as dependent on volatility and smooth out the impact of Vega. It’s best to enter when the IV is at a moderate to low level (more affordable premiums), just before any known policy event.

Margin & Capital Requirements

Bull call spreads rely on net debit strategies, where you have to pay upfront premiums. Here, the capital required equates to the net premium paid.

Example:

- Buy 100 Call @ ₹10 (pay ₹10)

- Sell 120 Call @ ₹4 (receive ₹4)

- Net premium = ₹6 × lot size (say 100 shares = ₹600).

That’s the maximum risk that the broker will block.

Margin Requirement:

- For Long Call (Buy 100 Call):

- Full premium (₹10 × lot size) must be paid upfront.

- No extra margin is required since the risk is capped.

- For Short Call (Sell 120 Call):

- Typically, naked short calls need a high margin (since loss is unlimited).

- But here, risk is hedged by the long call at 100, so the margin is reduced.

- The broker/Exchange requires only the difference in premiums (net debit) plus a small buffer.

Why Margin is Low in Bull Call Spread

The margin is low in a bull call spread for the following reasons:

- Both the maximum profit and loss are defined, and the risks are limited.

- The margin requirement is minimal, as exchanges and brokers are aware of this attribute.

- Margin is the net premium plus a negligible buffer in most cases.

Tax Implications

Understanding the tax implications of the bull call spread strategy is important. Here are some key aspects worth noting:

|

Classification |

Profit Taxation |

Loss Treatment |

Compliance & Audit Requirements |

GST |

|

Options trading is taken as business income and not capital gains (non-speculative business income as per Section 43 (5)) |

Your profits are taken as your business income They are added to the total income and taxed as per the prevailing slab rate |

You can set it off against other business income It can be carried forward for 8 years against future business income |

Audit may apply (Section 44AB) if turnover crosses the prescribed limits or the trading volume is large Turnover in options equates to the absolute sum of positive and negative differences + premium received upon sale. |

Not applicable to trading derivatives Transaction and brokerage costs include GST. |

Example

Suppose you did a Bull Call Spread on Reliance:

- Net Premium Paid = ₹6,000

- Net Profit at expiry = ₹14,000

- Tax Treatment:

- ₹14,000 profit is added to your business income.

- Taxed at your applicable slab rate.

- Expenses such as brokerage, internet, and advisory fees can be deducted.

Market Example

Let’s assume a Nifty 50 Trading Strategy where a Broker has suggested a Bull Call Spread strategy for Nifty options contracts expiring on 21 August 2025.

Here are the details:

|

Parameter |

Value |

|

Underlying |

Nifty-50 index |

|

Date of recommendation |

14 August 2025 |

|

Expiry |

21 August 2025 |

|

Outlook |

Moderately bullish |

|

Buy Call Strike |

24,650 Call @ premium ~ ₹155-₹165 |

|

Sell Call Strike |

24,850 Call @ premium ~ ₹75-₹85 |

Risk-Reward, Break-even, Max Profit / Loss

From this setup, we can derive:

- Net Premium Paid = Premium paid for the 24,650 call minus premium received from selling the 24,850 call.

If we take the middle of the quoted ranges - - Max Loss = Net Premium Paid = ₹80 (if Nifty closes ≤ 24,650 at expiry).

- Max Profit = Difference in strikes minus net premium = (24,850 − 24,650) − 80 = 200 − 80 = ₹120.

- Breakeven Point = Lower Strike + Net Premium = 24,650 + 80 = ≈ 24,730. mint

- Possible Reward / Risk:

- If the Nifty moves above 24,850 by the expiry, you will receive the full profit of ₹120.

- If Nifty ends between 24,650 and 24,730, small or no profit/loss.

- If it stays below 24,650, there will be a loss of ₹80.

Why It Works

- Moderately Bullish View:

The assumption was that Nifty would move up somewhat, but maybe not strongly beyond 24,850. This spread caps the upside but reduces the cost. - Cost Control:

By selling the 24,850-call, the trader recovers some premium, which lowers the net cost from what a plain call at 24,650 would cost alone. - Defined Risk & Reward:

Max loss is known in advance (₹80), max gain is capped (₹120). This makes planning easier. - Margin & Capital Efficiency:

Because risk is limited, brokers will require less margin than for a naked call. (Though actual margin depends on broker policy & lot size.)

Potential Risks / What May Go Wrong

- If Nifty doesn’t rise above ~24,730 (breakeven), the trader loses.

- If the rise is too slow, time decay will erode the long call (especially as expiration approaches).

- Implied volatility falling may hurt the spread (the premium on a long call loses more if IV drops).